With the online editor for PDFs by FormsPal, it is easy to fill out or alter 5471 here. FormsPal professional team is constantly working to develop the editor and ensure it is even faster for people with its cutting-edge functions. Uncover an constantly revolutionary experience today - check out and find out new opportunities as you go! All it takes is a couple of simple steps:

Step 1: Access the PDF file in our editor by pressing the "Get Form Button" above on this webpage.

Step 2: This tool will allow you to modify your PDF file in a range of ways. Improve it by writing customized text, correct original content, and place in a signature - all when it's needed!

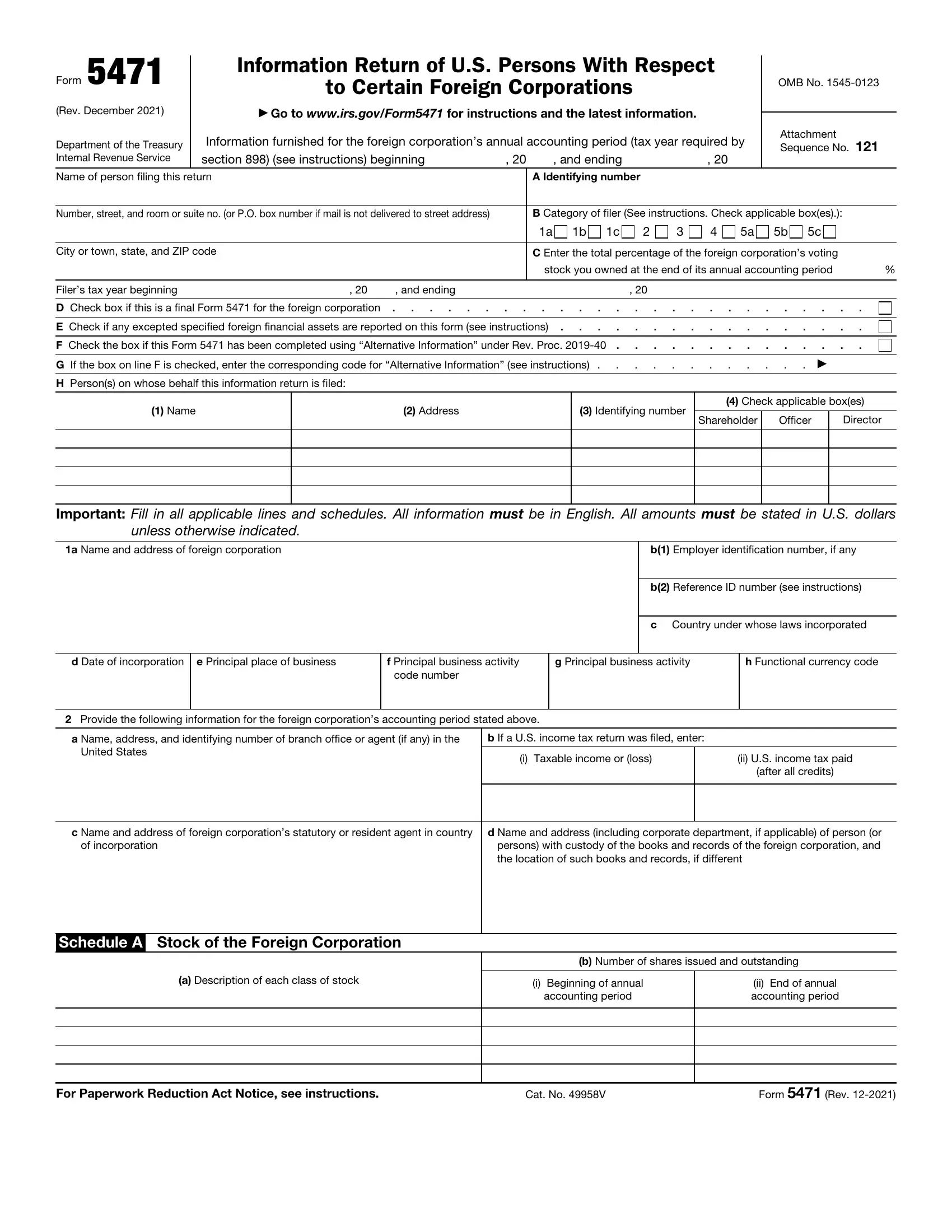

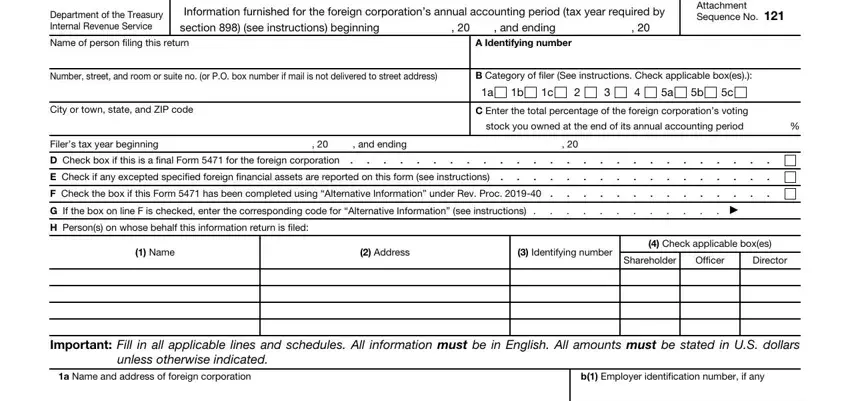

With regards to the fields of this specific form, here's what you want to do:

1. You will need to fill out the 5471 correctly, therefore be attentive while working with the segments comprising these blank fields:

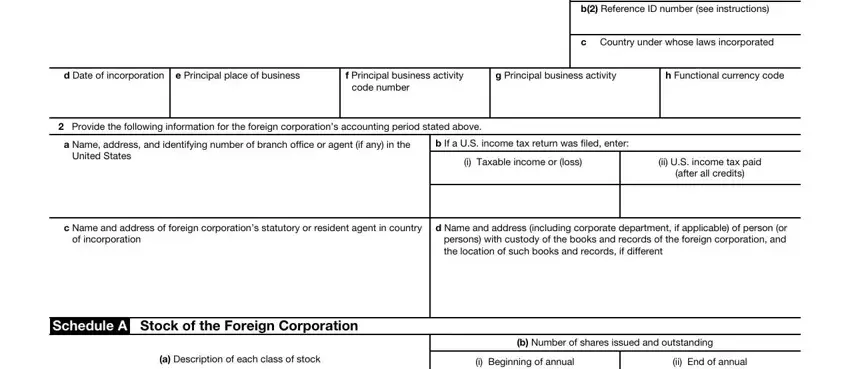

2. After filling in this step, go to the next stage and complete all required details in all these blanks - b Reference ID number see, c Country under whose laws, d Date of incorporation, e Principal place of business, f Principal business activity, g Principal business activity, h Functional currency code, code number, Provide the following information, a Name address and identifying, b If a US income tax return was, United States, i Taxable income or loss, ii US income tax paid, and after all credits.

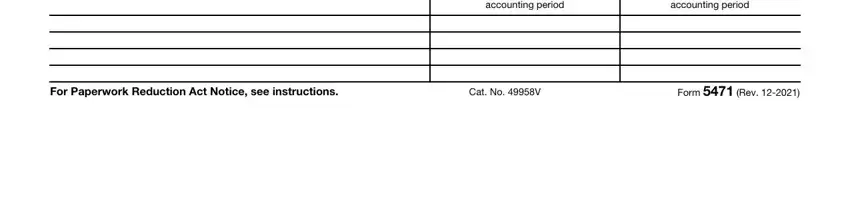

3. This third step is normally straightforward - fill out all the form fields in accounting period, ii End of annual accounting period, For Paperwork Reduction Act Notice, Cat No V, and Form Rev to conclude the current step.

Be extremely careful when filling out Form Rev and ii End of annual accounting period, as this is the part in which a lot of people make mistakes.

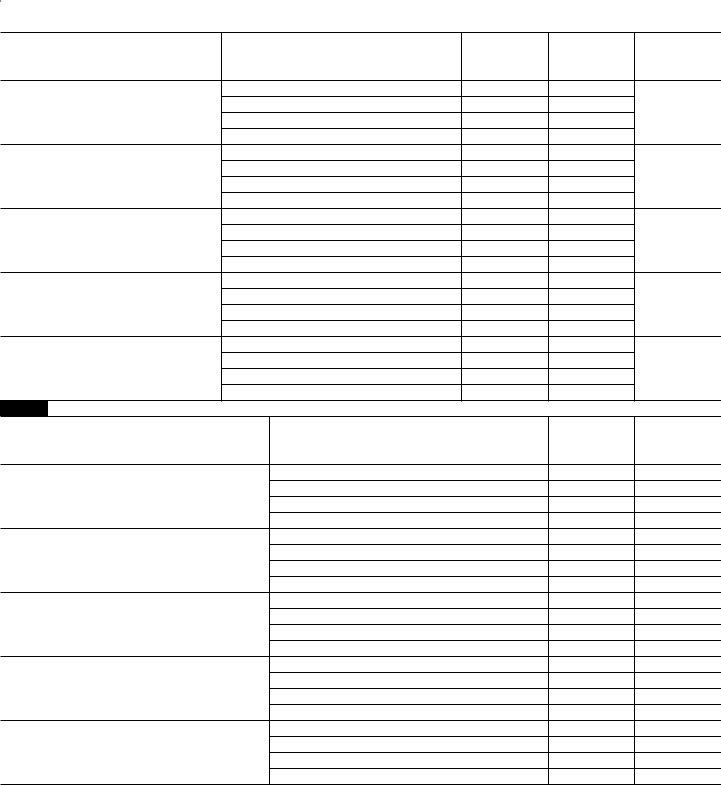

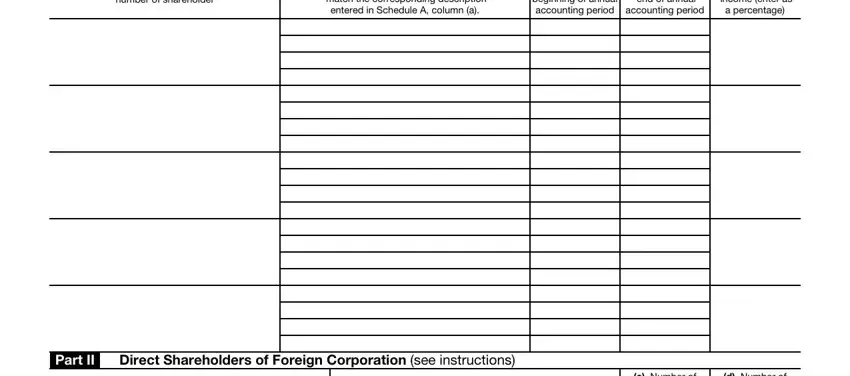

4. Completing number of shareholder, match the corresponding description, entered in Schedule A column a, beginning of annual accounting, d Number of shares held at end of, income enter as, accounting period, a percentage, Part II, Direct Shareholders of Foreign, c Number of shares held at, and d Number of shares held at end of is vital in this next stage - ensure to don't rush and fill in each blank!

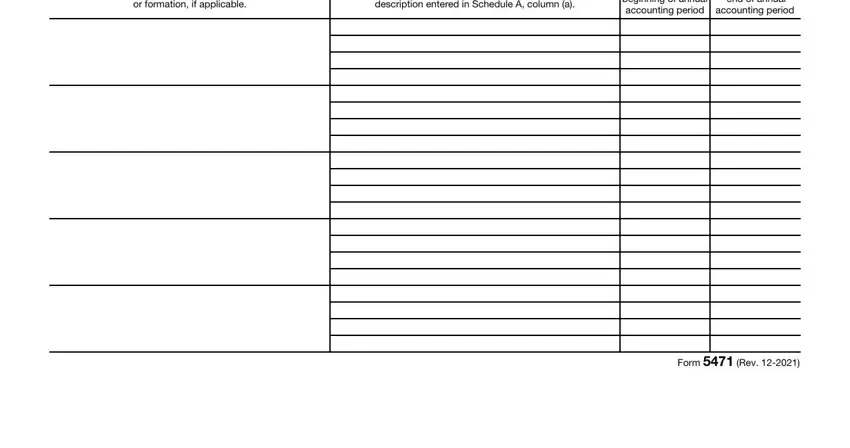

5. As you near the conclusion of the document, there are actually just a few more things to undertake. Specifically, or formation if applicable, description entered in Schedule A, beginning of annual accounting, d Number of shares held at end of, accounting period, and Form Rev should be done.

Step 3: Soon after looking through the entries, click "Done" and you are done and dusted! Right after registering a7-day free trial account with us, you will be able to download 5471 or send it via email at once. The PDF document will also be accessible through your personal account page with all your modifications. We don't share any details you provide while dealing with documents at our site.