Dealing with PDF documents online is always very simple with our PDF tool. Anyone can fill in Form 5500 Schedule A here without trouble. The editor is consistently maintained by us, receiving cool features and growing to be greater. All it requires is a couple of simple steps:

Step 1: Click on the "Get Form" button at the top of this page to access our tool.

Step 2: After you launch the PDF editor, you'll notice the document ready to be filled out. In addition to filling in various fields, you may as well perform some other actions with the file, including writing your own textual content, editing the initial text, inserting graphics, placing your signature to the PDF, and a lot more.

This PDF will need specific details to be filled out, so make sure to take your time to type in exactly what is asked:

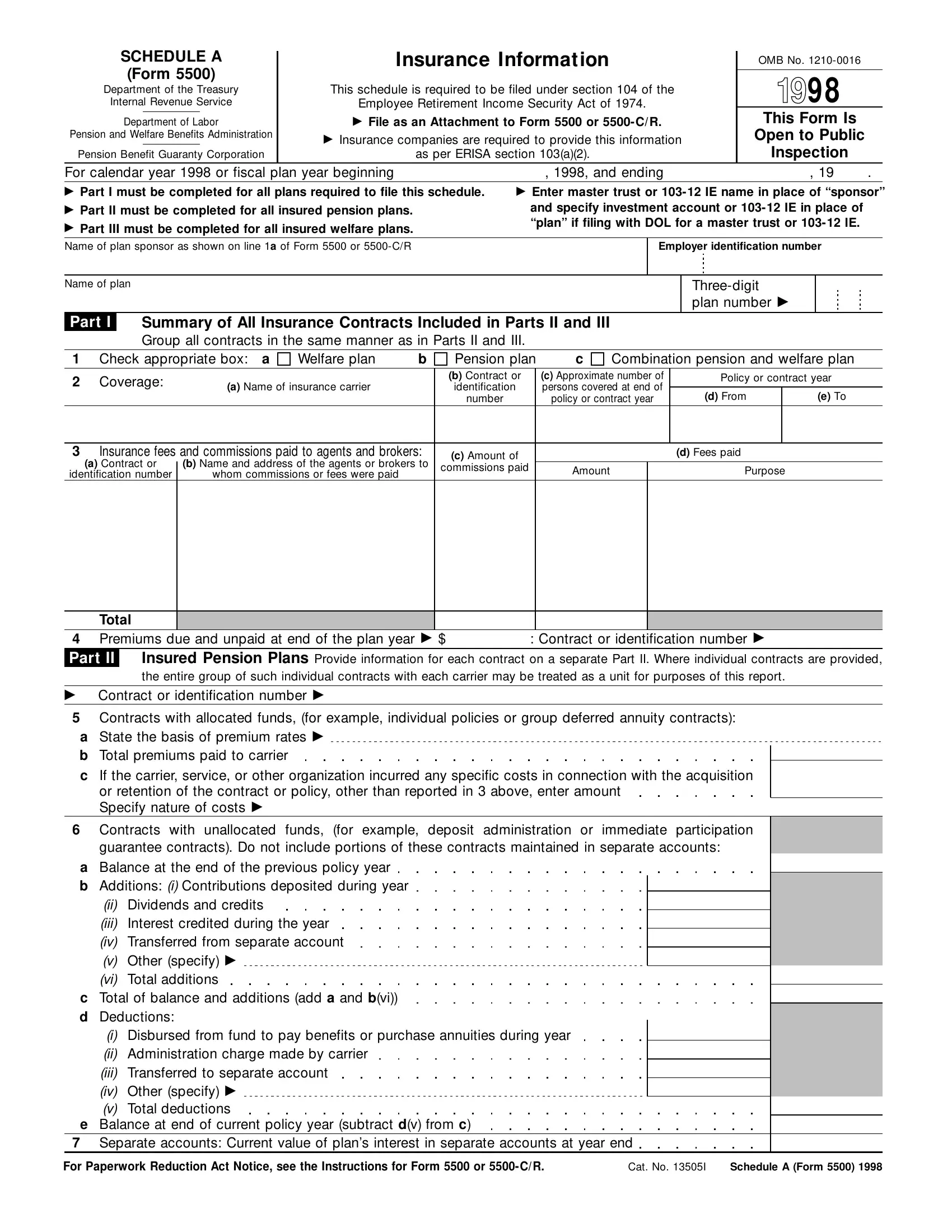

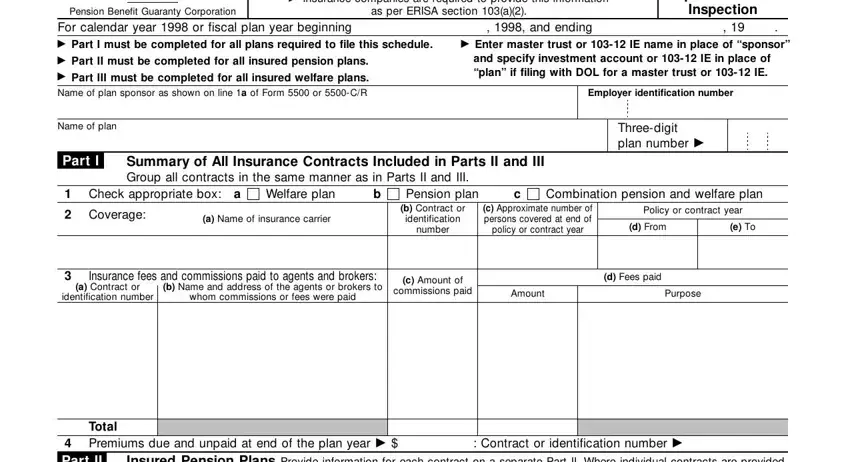

1. To get started, when filling in the Form 5500 Schedule A, beging with the area with the subsequent fields:

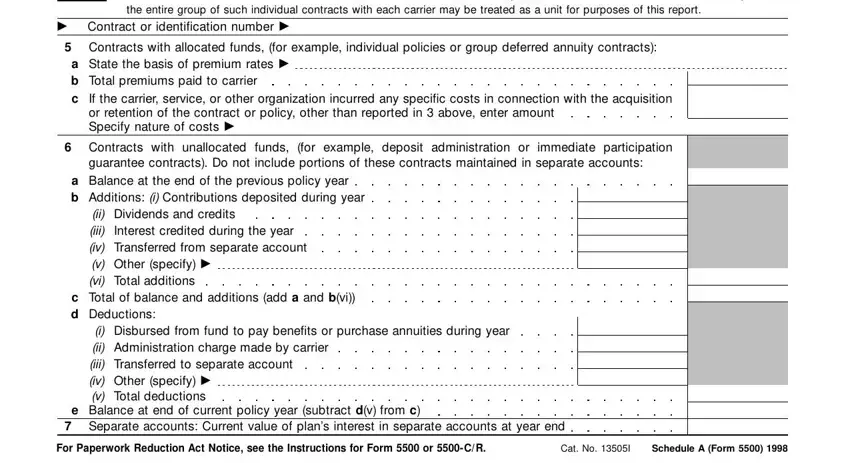

2. Once your current task is complete, take the next step – fill out all of these fields - Part II, Insured Pension Plans Provide, Contract or identification number, Contracts with allocated funds, a State the basis of premium rates, or retention of the contract or, Contracts with unallocated funds, guarantee contracts Do not include, a Balance at the end of the, ii iii iv v vi, Dividends and credits Interest, c Total of balance and additions, i ii iii iv v, Disbursed from fund to pay, and e Balance at end of current policy with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be extremely mindful while filling in guarantee contracts Do not include and a State the basis of premium rates, as this is the section where many people make a few mistakes.

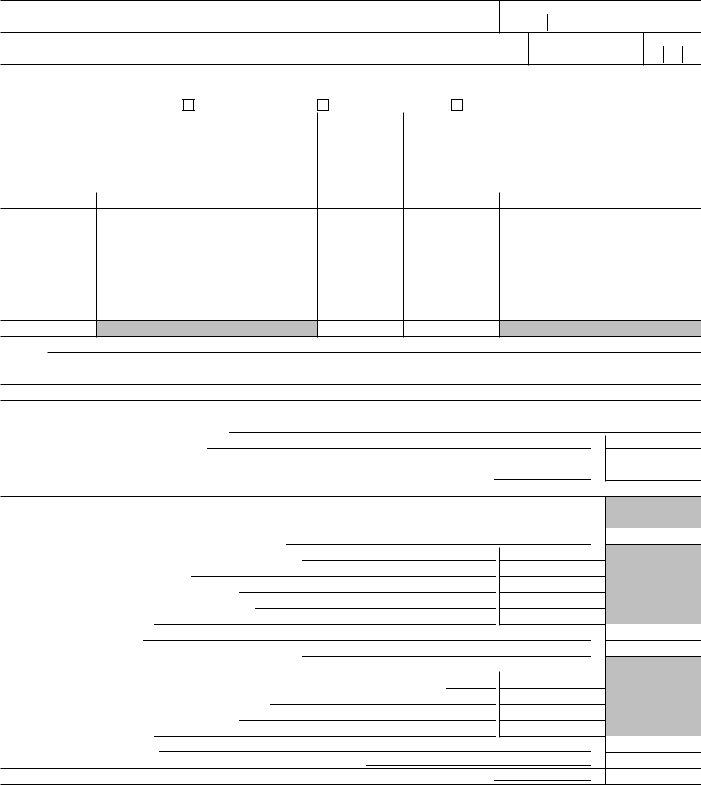

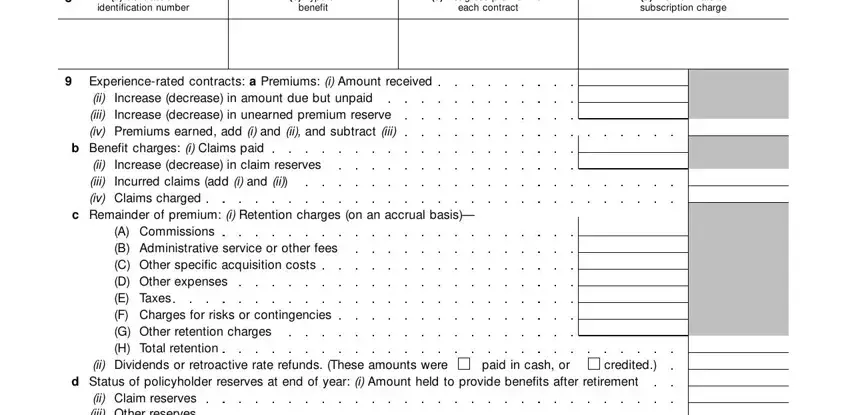

3. In this particular step, examine a Contract or, identification number, b Type of, benefit, c List gross premium for, each contract, d Premium rate or subscription, Increase decrease in amount due, Experiencerated contracts a, Increase decrease in claim, Commissions Administrative service, A B C D E F G H Dividends or, paid in cash or, credited, and d Status of policyholder reserves. All of these should be filled out with utmost accuracy.

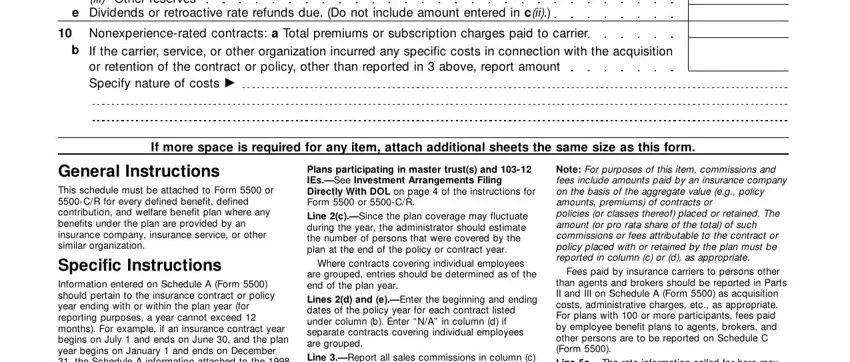

4. It's time to complete this next part! Here you will get all these ii iii, Claim reserves Other reserves, e Dividends or retroactive rate, Nonexperiencerated contracts a, If the carrier service or other, If more space is required for any, General Instructions This schedule, Plans participating in master, Where contracts covering, are grouped entries should be, Note For purposes of this item, Fees paid by insurance carriers to, and than agents and brokers should be blanks to complete.

Step 3: Before finalizing your document, make certain that all form fields were filled in correctly. Once you determine that it is correct, click “Done." Sign up with FormsPal now and easily obtain Form 5500 Schedule A, ready for download. Every single edit you make is handily kept , letting you edit the document later on as required. FormsPal guarantees your data confidentiality by using a protected system that in no way records or distributes any kind of sensitive information used in the file. Rest assured knowing your docs are kept confidential whenever you use our editor!