Working with PDF forms online is definitely very simple with this PDF editor. Anyone can fill out preprinted here effortlessly. The tool is continually improved by us, receiving useful functions and growing to be greater. Here's what you will want to do to get going:

Step 1: Open the PDF file in our tool by clicking on the "Get Form Button" in the top area of this page.

Step 2: With our advanced PDF editor, you'll be able to accomplish more than just complete blanks. Try all the functions and make your forms look high-quality with custom textual content added, or modify the file's original content to excellence - all that supported by an ability to insert any images and sign it off.

It is straightforward to fill out the document adhering to this detailed tutorial! Here's what you need to do:

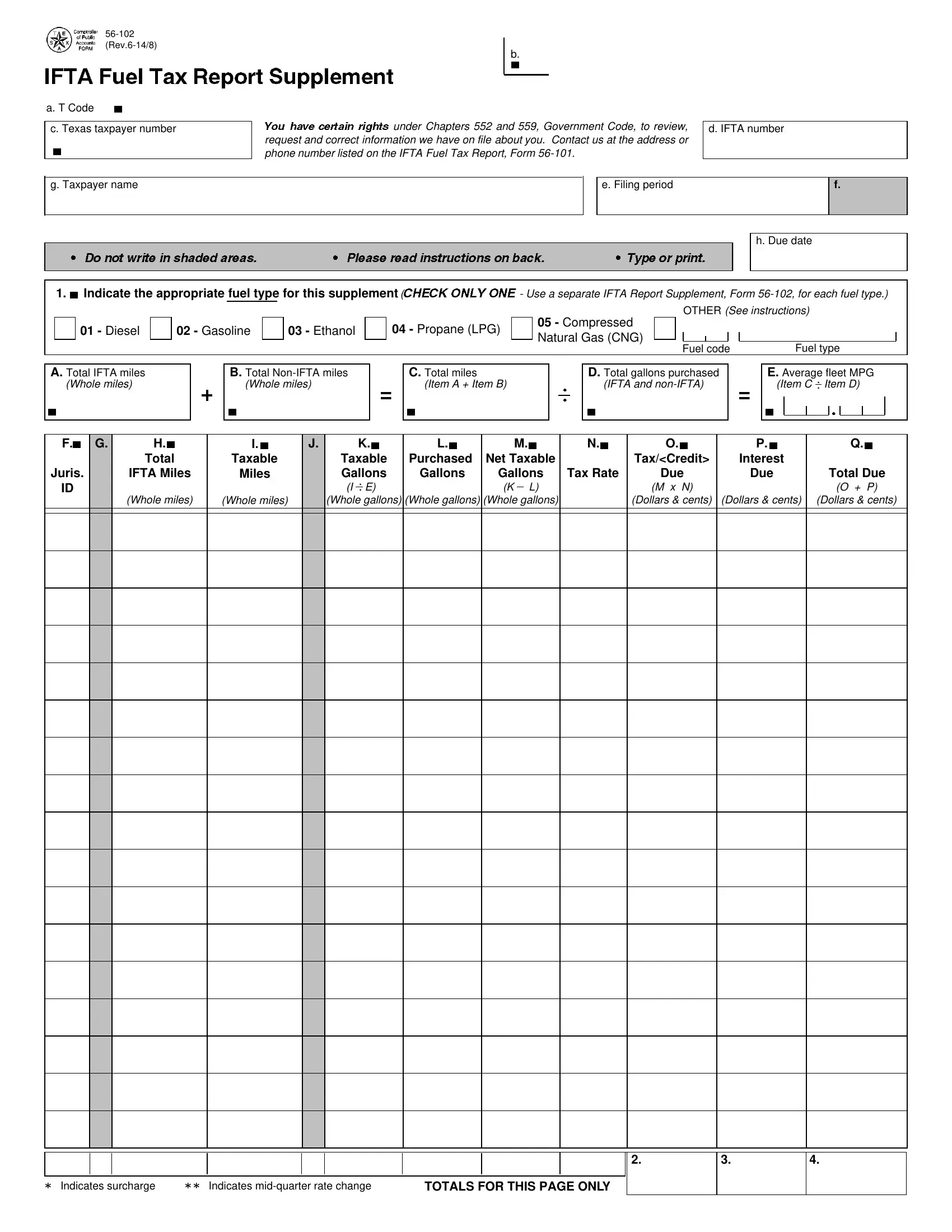

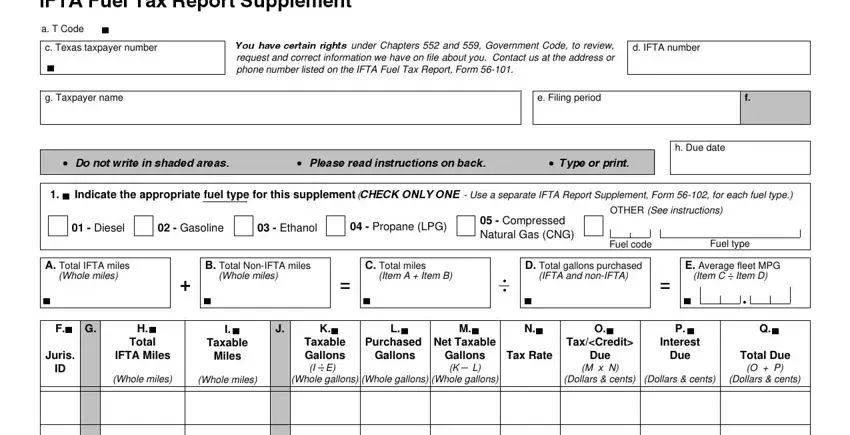

1. While filling out the preprinted, make certain to incorporate all important blank fields in its relevant section. This will help speed up the process, allowing for your details to be processed quickly and correctly.

2. Once the last segment is done, you need to put in the needed specifics in in order to move on further.

As to this field and next field, make sure that you review things in this section. The two of these are thought to be the most significant ones in this document.

3. The following segment is all about Indicates surcharge, Indicates midquarter rate change, and TOTALS FOR THIS PAGE ONLY - type in all these fields.

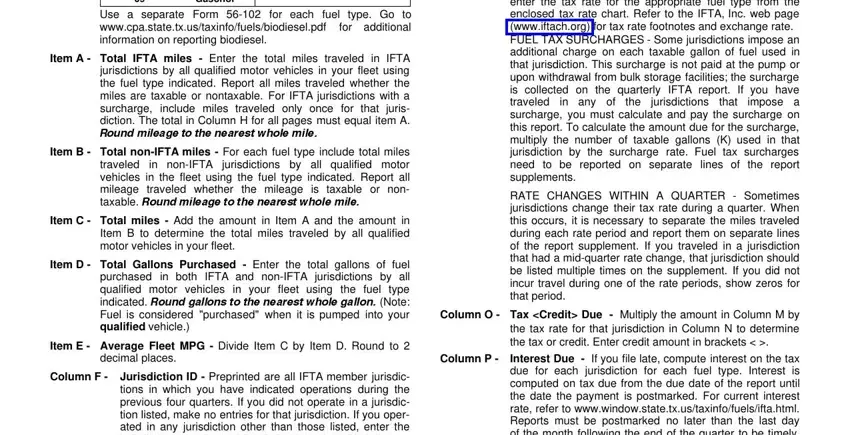

4. The next part comes next with all of the following blank fields to consider: Item A, Gasohol, Use a separate Form for each fuel, Total IFTA miles Enter the total, Item B Total nonIFTA miles For, Item C Total miles Add the, Item D Total Gallons Purchased, Item E Average Fleet MPG Divide, Column N Tax Rate The tax rate, jurisdictions, that, in any of, the, RATE CHANGES WITHIN A QUARTER, and Column O Tax Credit Due Multiply.

Step 3: After proofreading your completed blanks, click "Done" and you are done and dusted! After starting afree trial account with us, it will be possible to download preprinted or send it through email promptly. The PDF file will also be available through your personal account menu with your changes. We do not sell or share any details you provide whenever dealing with forms at FormsPal.