If you're a business owner in California, you're responsible for filing Form 560 - the Corporation Tax Return. This return is used to report your income and pay taxes on it. Filing this form is essential for any business operating in the state, so make sure you're aware of all the requirements and deadlines. The information on this form can be complex, so if you're unsure about anything, consult with an accountant or tax specialist. Filing Form 560 can be daunting, but it's necessary if you want to stay compliant with California tax laws. Make sure you do your research and file on time!

| Question | Answer |

|---|---|

| Form Name | Form 560 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | Signatory, 2005, notifying, Andhra |

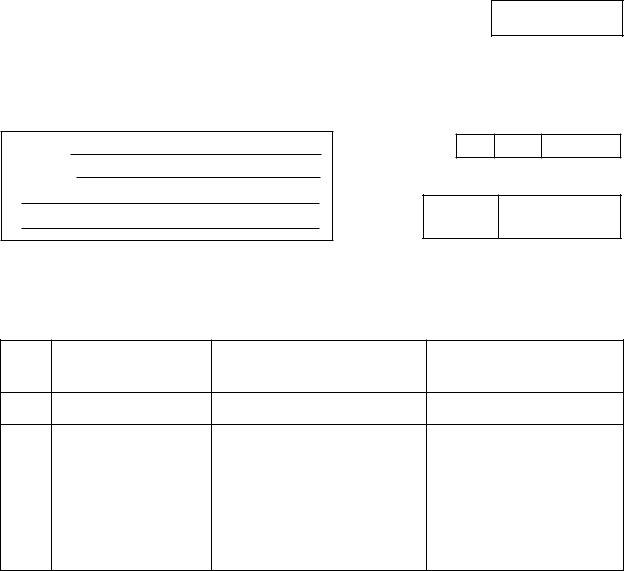

NOMINATION OF RESPONSIBLE PERSON

[ See Rule 63 (1) & (3) ]

FORM 560

Declaration notifying persons authorised to sign any return /document/

Statements and to receive notices, orders, etc., under the Andhra Pradesh

Value Added Tax Act 2005

To

Date Month Year

Name :

Address:

TIN/GRN

I/We __________________________________________ being Proprietor / Managing Partner /

Managing Director etc., do hereby authorise the following persons(s) to sign any return / documents / statements and to receive notices orders etc., under the Andhra Pradesh Value Added Tax Act 2005

Sl.No.

Name of the Person

Status and relationship

of the person to the dealer

Specimen signature of the person named in Col.(2)

1.

2.

3.

4.

Signature of the Dealer(s)/Authorised Signatory

I/We _________________________________ accept the above responsibility.

Signature of the person(s) authorised