The intricate complexity of navigating the tax implications for corporations operating within U.S. possessions is encapsulated in the Form 5735, a crucial document issued by the Department of the Treasury and the Internal Revenue Service. This form, aimed at computing the Possessions Corporation Tax Credit under Sections 936 and 30A, requires detailed information about the corporation’s gross income, derived from its operations in various U.S. possessions, and the active conduct of its trade or business therein. With compliance dates stretching back to 1997, this form serves as a testament to the longstanding fiscal policies and incentives designed to stimulate economic activities in these territories. It breaks down the income categories meticulously, setting precise thresholds for eligibility based on the source and nature of the earnings, thus distinguishing between income from active business endeavors and qualified possession source investment income. Furthermore, this form navigates corporations through the computation of taxable income from possessions, emphasizing deductions, adjustments, and the intricate calculation of the tax credit itself, both under the percentage limitation and the economic-activity limitation pathways. The subsequent sections are focused on detailing the deduction for possession income taxes, offering a choice between percentage limitation for reduced credit or utilizing the economic-activity limitation in collaboration with the profit split method. Finally, it encompasses a summary from Schedule P to highlight the sales of possession products under various income methods and business presence tests, underscoring the comprehensive nature of Form 5735 in facilitating corporate tax compliance within U.S. possessions.

| Question | Answer |

|---|---|

| Form Name | Form 5735 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | possession 1981 online, 10a, OMB, Ratable |

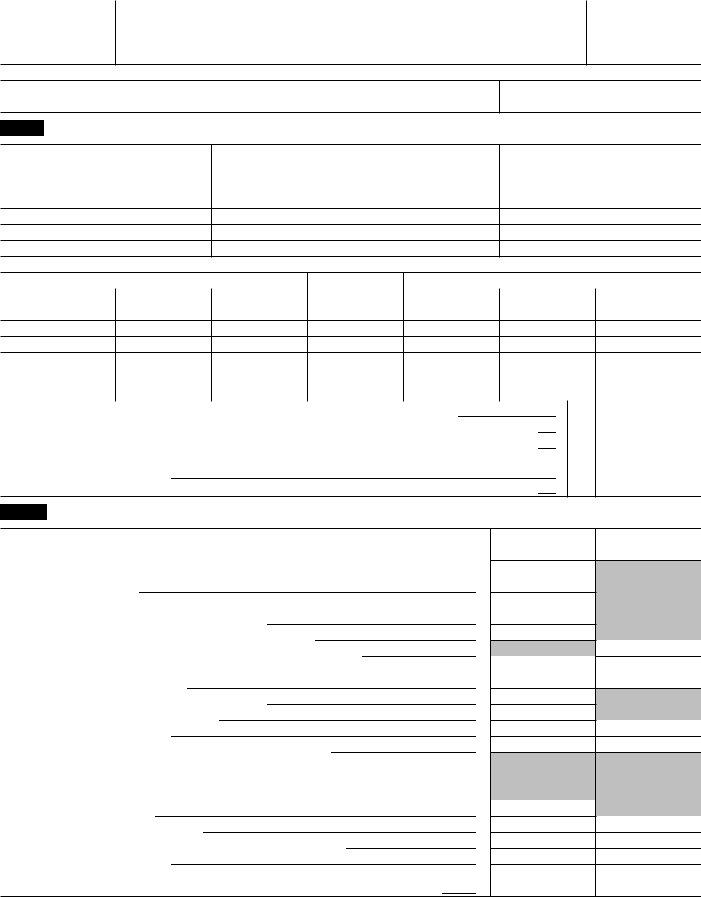

Form 5 7 3 5

(Rev. January 1997)

Department of the Treasury Internal Revenue Service

Possessions Corporation Tax Credit

(Under Sections 9 3 6 and 3 0 A)

▶See separate instructions.

▶Attach to the corporation’s tax return.

OMB No.

For calendar year 19 |

, or other tax year beginning |

, 19 |

, and ending |

, 19 |

. |

Name

Employer identification number

Part I Gross Income in Applicable Period (See instructions.)

Tax year (Use a separate line for each tax year ending with or within your applicable period. Start with the earliest such tax year.)

(a) |

(b) |

Beginning |

Ending |

|

|

(c)

Name of U.S. possession in which trade or

business was actively conducted

Periods in which trade or business was actively

conducted in a U.S. possession (Dates are

inclusive)

(d) |

(e) |

From |

To |

|

|

Gross income during periods shown in columns (d) and (e)

Gross income from the active conduct of a trade or business in a U.S. possession |

(i) |

|

All other gross income |

|

|||

Gross qualified |

|

|

|||||

|

|

|

|

|

|

||

(f) |

(g) |

(h) |

(j) |

(k) |

(l) |

||

possession source |

|||||||

From sources in U.S. |

From all other sources |

From sources in |

investment income |

From sources in U.S. |

From all other sources |

From sources in the |

|

possessions |

outside the U.S. |

the U.S. |

(QPSII) (see instructions) |

possessions |

outside the U.S. |

U.S. |

|

Totals |

|

|

|

1 |

Total gross income in applicable period (add totals of columns (f) through (l)) |

1 |

|

2 |

Gross income in applicable period from sources in U.S. possessions (add total of columns (f), (i), and (j)) |

2 |

|

3 |

Divide line 2 by line 1 (If less than 80% , stop here. The possessions tax credit is not allowed) |

3 |

|

4Gross income from the active conduct of a trade or business in a U.S. possession (total of

columns (f), (g), and (h)) |

4 |

5 Divide line 4 by line 1 (If less than 75% , stop here. The possessions tax credit is not allowed) |

5 |

Part II |

Computation of Taxable Income From Possession Sources (See instructions.) |

|

When completing Part II, do not take into account any deduction for possession income taxes. |

||

|

6Qualified gross income in current year:

a From sources outside the U.S. from the active conduct of a trade or business in a U.S. possession

bFrom sources outside the U.S. from the sale or exchange of substantially all assets used in a possessions trade or business

cTotal active business income. Add lines 6a and 6b

dEnter gross qualified possession source investment income

7a Amounts received in the U.S

bIntangible property income (sec. 936(h)(2)) c Other intangible property income

d Add lines 7a, 7b, and 7c

e Subtract line 7d, column A from line 6c, column A. % Subtract line 7d, column B from line 6d, column B.

8Applicable deductions a Cost sharing amount

b Definitely allocable deductions

c Ratable part of other deductions not definitely allocable d Add lines 8a, 8b, and 8c

A

Active Business

Income

B

Gross QPSII (see instructions)

9 Qualified taxable income before adjustments. Subtract line 8d from line 7e

For Paperwork Reduction Act Notice, see page 1 of separate instructions. |

Cat. No. 12090G |

Form 5735 (Rev. |

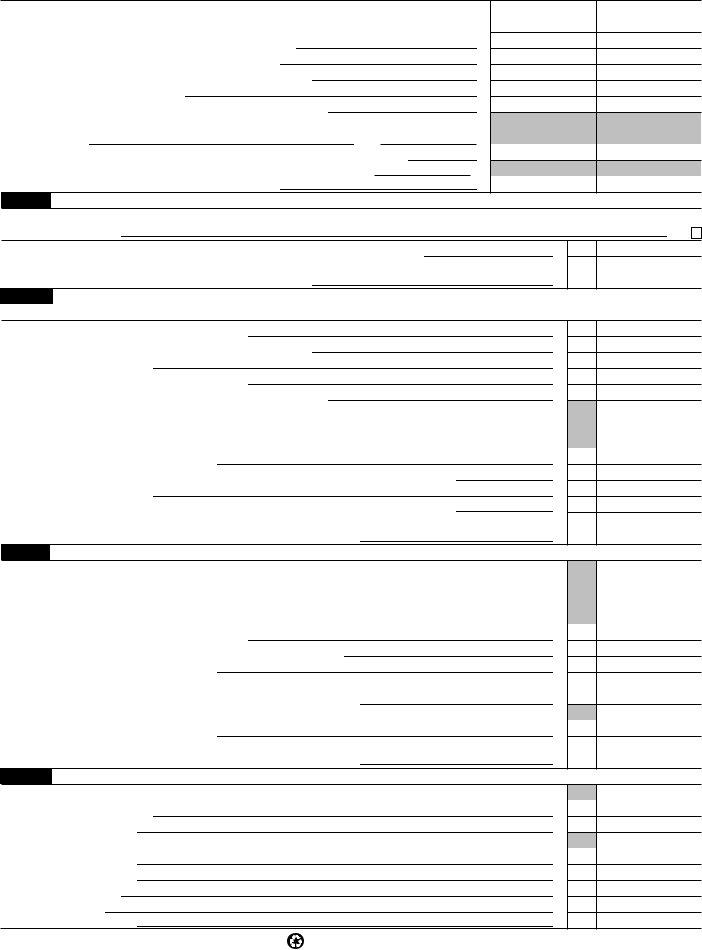

Form 5735 (Rev. |

Page 2 |

|

|

|

|

Part II |

Computation of Taxable Income From Possession Sources (continued) |

|

10Adjustments

aCurrent year losses from nonqualified sources b Recapture of prior year overall foreign losses

c Income against which foreign tax credit is claimed d Add lines 10a through 10c

11Qualified taxable income. Subtract line 10d from line 9

12Total taxable income from all sources (enter taxable income from the corporation’s

tax return) |

▶ |

13For each column, divide line 11 by line 12. Enter result as a decimal

14Total U.S. income tax against which possessions credit is allowed ▶

15For each column, multiply line 14 by line 13

A

Active Business

Income

B

Gross QPSII (see instructions)

Part III Computation of Possessions Credit Using the Percentage Limitation (See instructions.)

If the corporation elects to claim a reduced credit under section 936(a)(4)(B), check here and complete Part III. Skip Part IV and

go to Part V, line 28 |

▶ |

16Multiply line 15, column A, by the applicable percentage for the tax year

17Possessions credit. Add line 15, column B, and line 16. Enter here and on Form 1120, Schedule J, line 4b, or the appropriate line of other returns

16

17

Part IV Computation of Possessions Credit Using the Economic- Activity Limitation of Section 936 or 30A

(See instructions.)

18Enter 60% of qualified compensation

19Enter applicable portion of depreciation deductions

20Add lines 18 and 19

21Subtract line 20 from line 15, Column A

22Divide line 21 by line 14. Enter the result as a decimal

Note: If the corporation used the profit split method, skip lines 23 and 24. Enter the amount from line 20 on line 25. Complete the rest of Part IV and go to Part V, line 32. If the corporation did not use the profit split method, complete lines 23 through 27; skip Part V and go to Part VI.

23Enter possession income taxes

24Possession taxes allocable to nonsheltered income. Multiply line 23 by line 22

25Add lines 20 and 24

26

27Possessions credit. Add line 15, column B, and line 26. Enter the result here and on Form 1120, Schedule J, line 4b, or the appropriate line of other returns

18

19

20

21

22

23

24

25

26

27

Part V Computation of Deduction For Possession Income Taxes (See instructions.)

Note: Complete Part V only if the corporation is electing the percentage limitation (reduced credit), or the corporation is using the

Corporations Using Percentage Limitation (Reduced Credit)

28Subtract line 16 from line 15, Column A

29Divide line 28 by line 14. Enter the result as a decimal

30Enter possession income taxes

31Deduction for possession income taxes. Multiply line 30 by line 29. Include the result on Form 1120, page 1, line 17, or the applicable line of other returns

Corporations Using the Economic- Activity Limitation and the Profit Split Method

32Enter possession income taxes

33Deduction for possession income taxes. Multiply line 32 by line 22. Include the result on Form 1120, page 1, line 17, or the applicable line of other returns

28

29

30

31

32

33

Part VI Summary From Schedule P (Form 5735) (See instructions.)

34Enter the total sales of possession products to which each income method applies: a Cost sharing method

b Profit split method

35Enter the total sales of possession products that qualify under each business presence test: a Direct labor test

b

e None of the above

34a

34b

35a

35b

35c

35d

35e