2020 ca form 590 can be completed online without difficulty. Just use FormsPal PDF editor to complete the task promptly. The tool is constantly improved by us, acquiring useful functions and turning out to be greater. Getting underway is simple! What you need to do is stick to the next simple steps down below:

Step 1: Open the PDF in our editor by clicking on the "Get Form Button" at the top of this page.

Step 2: With our online PDF editor, you could do more than just complete blank form fields. Try all the features and make your forms appear faultless with custom textual content incorporated, or modify the file's original input to perfection - all comes with the capability to add any photos and sign the PDF off.

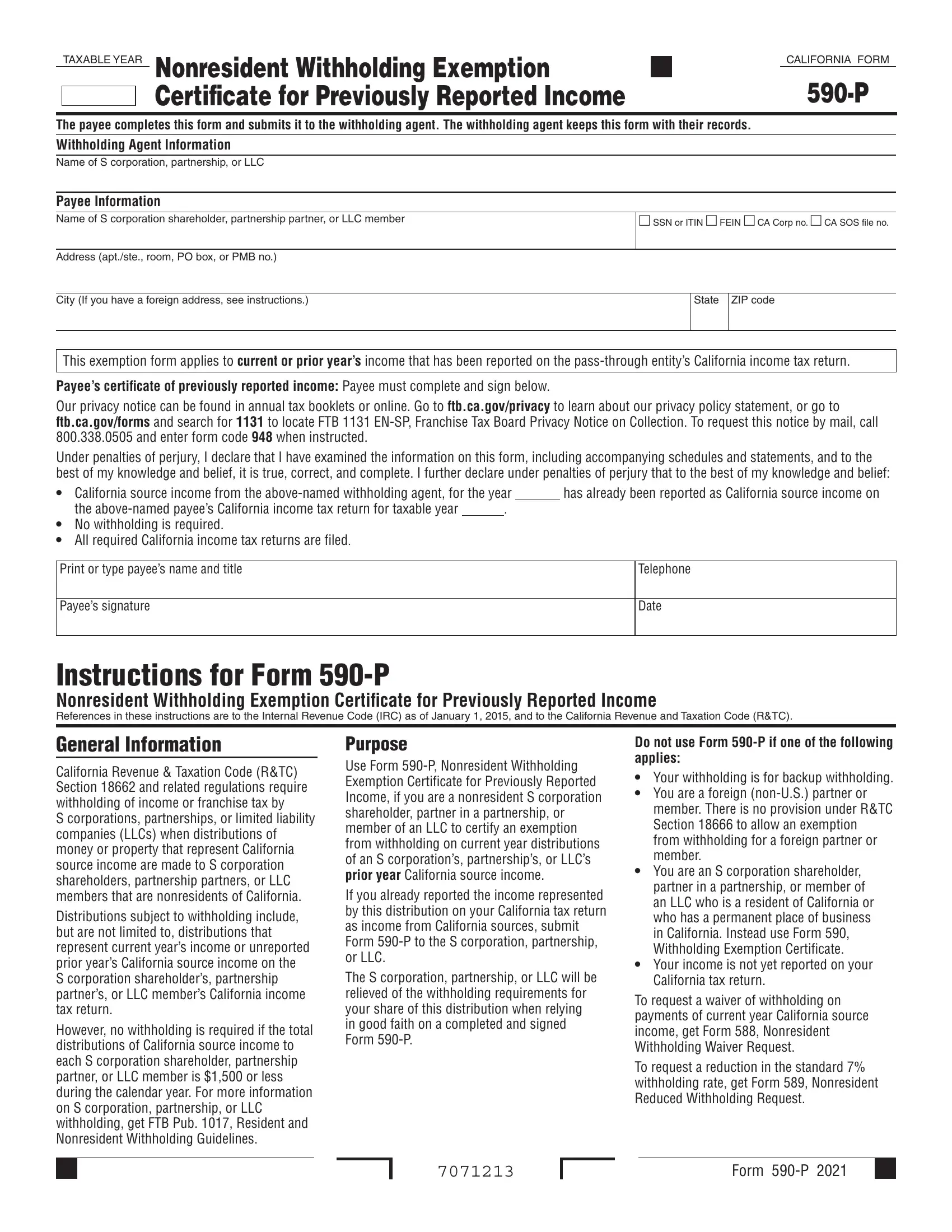

This form requires specific details to be filled out, hence you should definitely take your time to type in exactly what is asked:

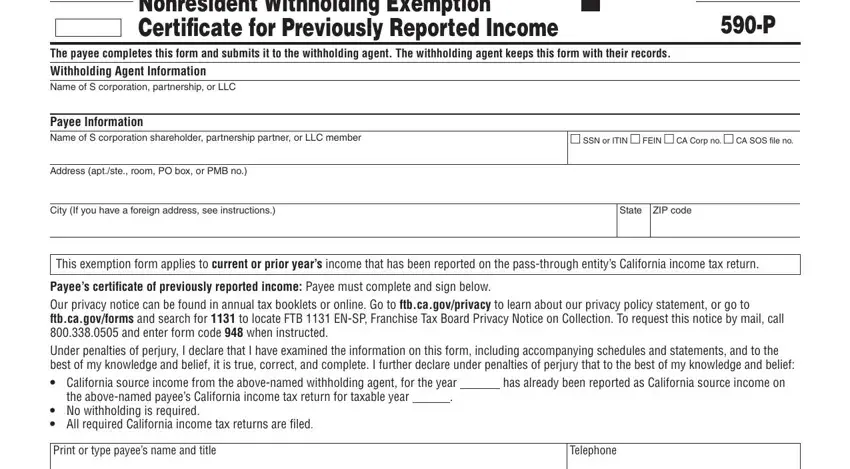

1. It is critical to fill out the 2020 ca form 590 properly, therefore be attentive while working with the sections including all of these blanks:

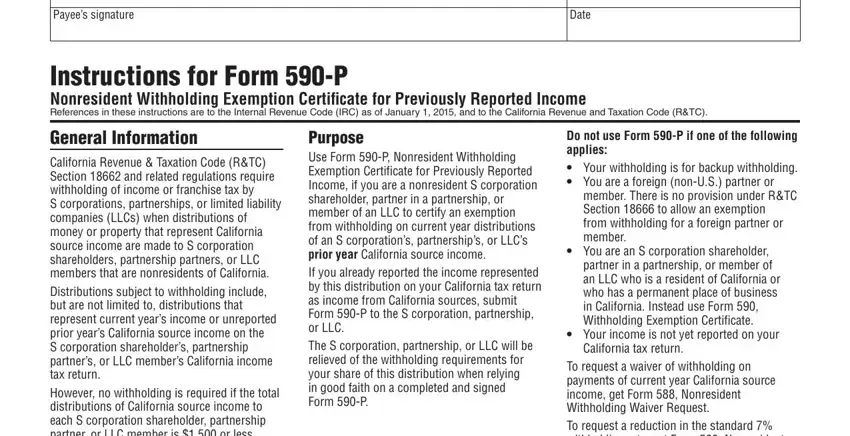

2. Right after filling in the last step, head on to the subsequent step and fill in all required details in all these blanks - Payees signature, Date, Instructions for Form P, General Information California, Purpose Use Form P Nonresident, Do not use Form P if one of the, member There is no provision under, You are an S corporation, Your income is not yet reported, California tax return, and To request a waiver of withholding.

Always be really careful when filling in Purpose Use Form P Nonresident and You are an S corporation, as this is where a lot of people make errors.

Step 3: Revise everything you've typed into the blank fields and hit the "Done" button. Join FormsPal today and instantly obtain 2020 ca form 590, all set for downloading. Every last edit you make is conveniently preserved , enabling you to change the file at a later point if needed. At FormsPal, we do our utmost to be sure that all of your information is stored private.