With the help of the online editor for PDFs by FormsPal, you're able to complete or alter irs 6198 here and now. Our editor is continually evolving to present the best user experience achievable, and that is due to our dedication to continual enhancement and listening closely to user comments. Should you be seeking to start, here's what it requires:

Step 1: First of all, access the pdf tool by pressing the "Get Form Button" in the top section of this site.

Step 2: The editor enables you to work with your PDF file in a range of ways. Modify it by adding customized text, correct what's originally in the PDF, and put in a signature - all readily available!

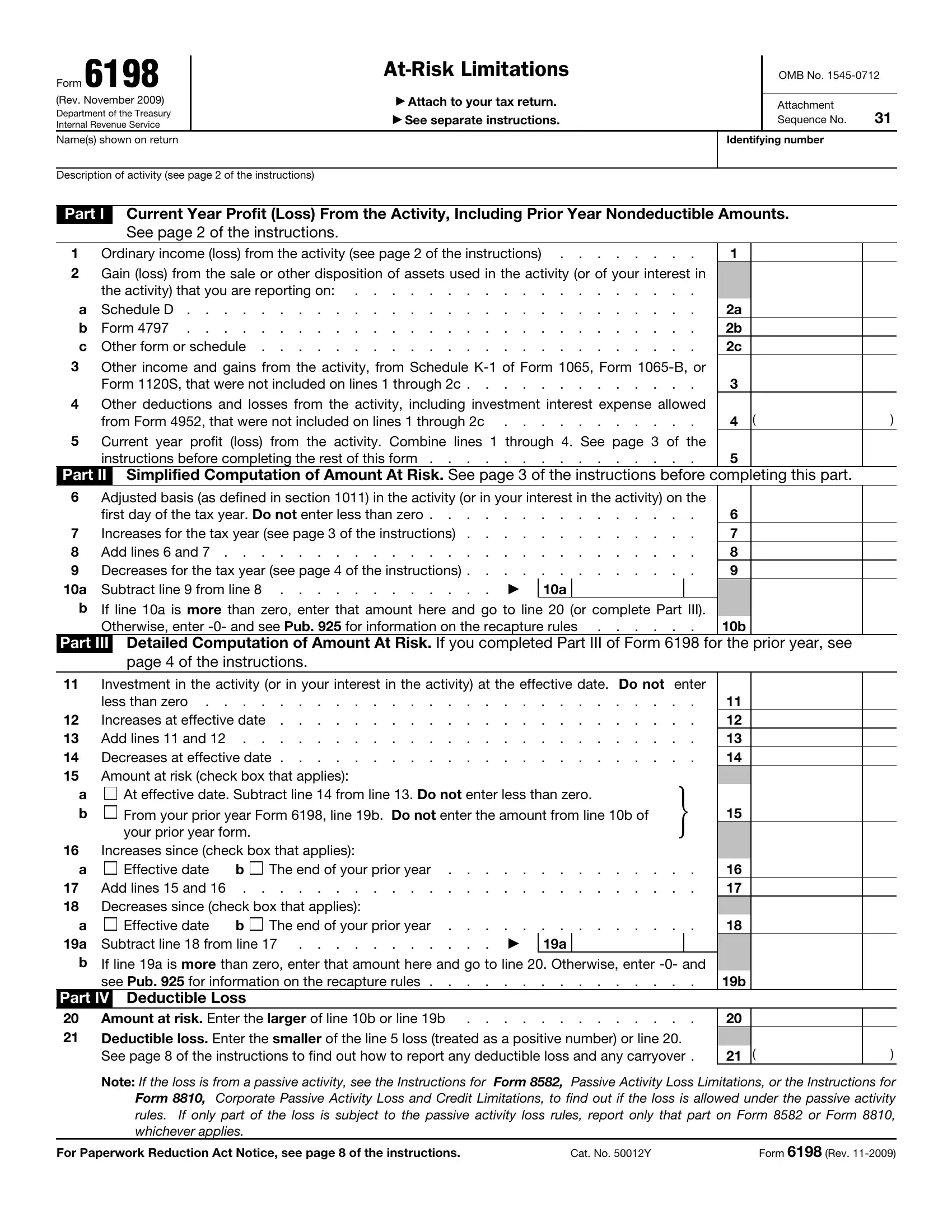

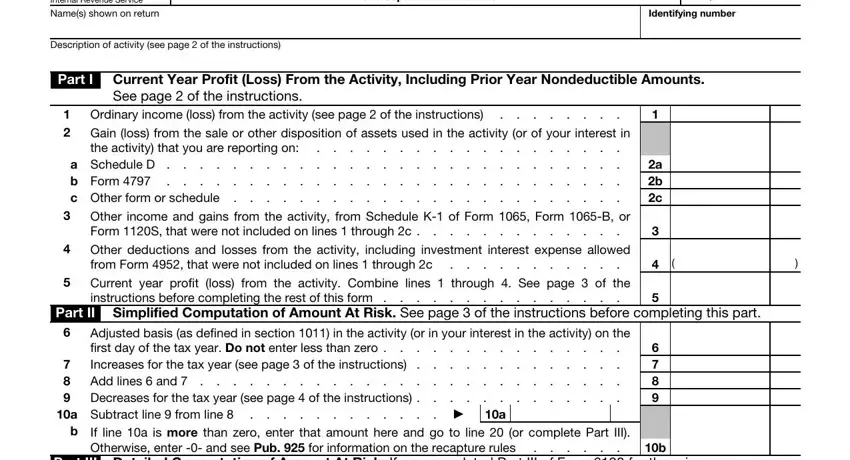

In an effort to finalize this PDF document, ensure you provide the required details in each and every blank field:

1. The irs 6198 necessitates specific details to be typed in. Be sure the subsequent blank fields are filled out:

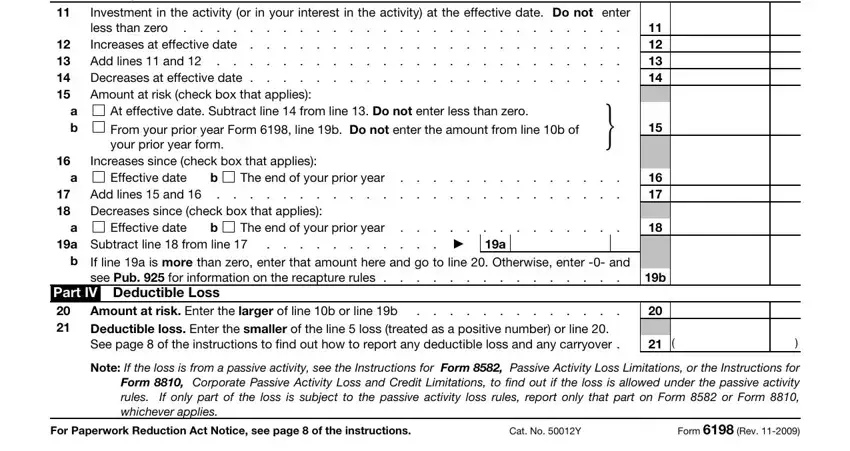

2. After finishing the previous part, go on to the next part and fill out all required particulars in all these blanks - page of the instructions, a b, Investment in the activity or in, At effective date Subtract line, From your prior year Form line b, Increases since check box that, Effective date, Add lines and Decreases since, The end of your prior year, Effective date, a Subtract line from line, The end of your prior year, b If line a is more than zero, see Pub for information on the, and Part IV Deductible Loss.

Those who work with this document often get some things incorrect when filling in see Pub for information on the in this area. Ensure you re-examine everything you type in right here.

Step 3: Ensure your details are accurate and then press "Done" to conclude the project. Get hold of the irs 6198 after you subscribe to a free trial. Readily use the pdf inside your FormsPal account page, together with any modifications and changes all synced! FormsPal guarantees your information confidentiality by having a protected method that in no way records or shares any kind of sensitive information involved in the process. Be assured knowing your docs are kept confidential when you use our tools!