Interest on Deferred Tax

Generally, you must pay interest on the deferred tax related to any obligation that arises during a tax year from the disposition of property under the installment method if:

•The property had a sales price over $150,000, and

•The aggregate balance of all nondealer installment obligations arising during, and outstanding at the close of, the tax year is more than $5 million.

You must pay interest in subsequent years if installment obligations that originally required interest to be paid are still outstanding at the close of a tax year.

The interest rules do not apply to dispositions of:

•Farm property,

•Personal use property by an individual,

•Real property before 1988, or

•Personal property before 1989.

See section 453(l) for more information on the sale of timeshares and residential lots under the installment method.

How to report the interest. The interest is not figured on Form 6252. See Pub. 537 for details on how to report the interest.

Additional Information

See Pub. 537 for additional information, including details about reductions in selling price, the single sale of several assets, like-kind exchanges, dispositions of installment obligations, and repossessions.

Specific Instructions

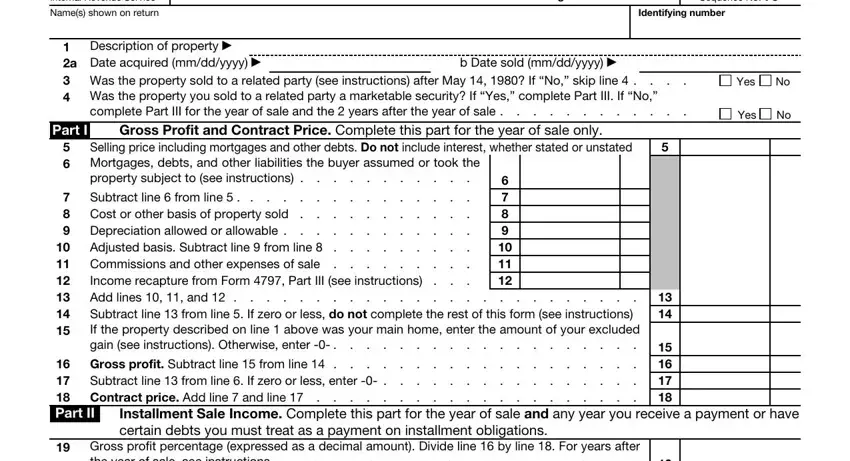

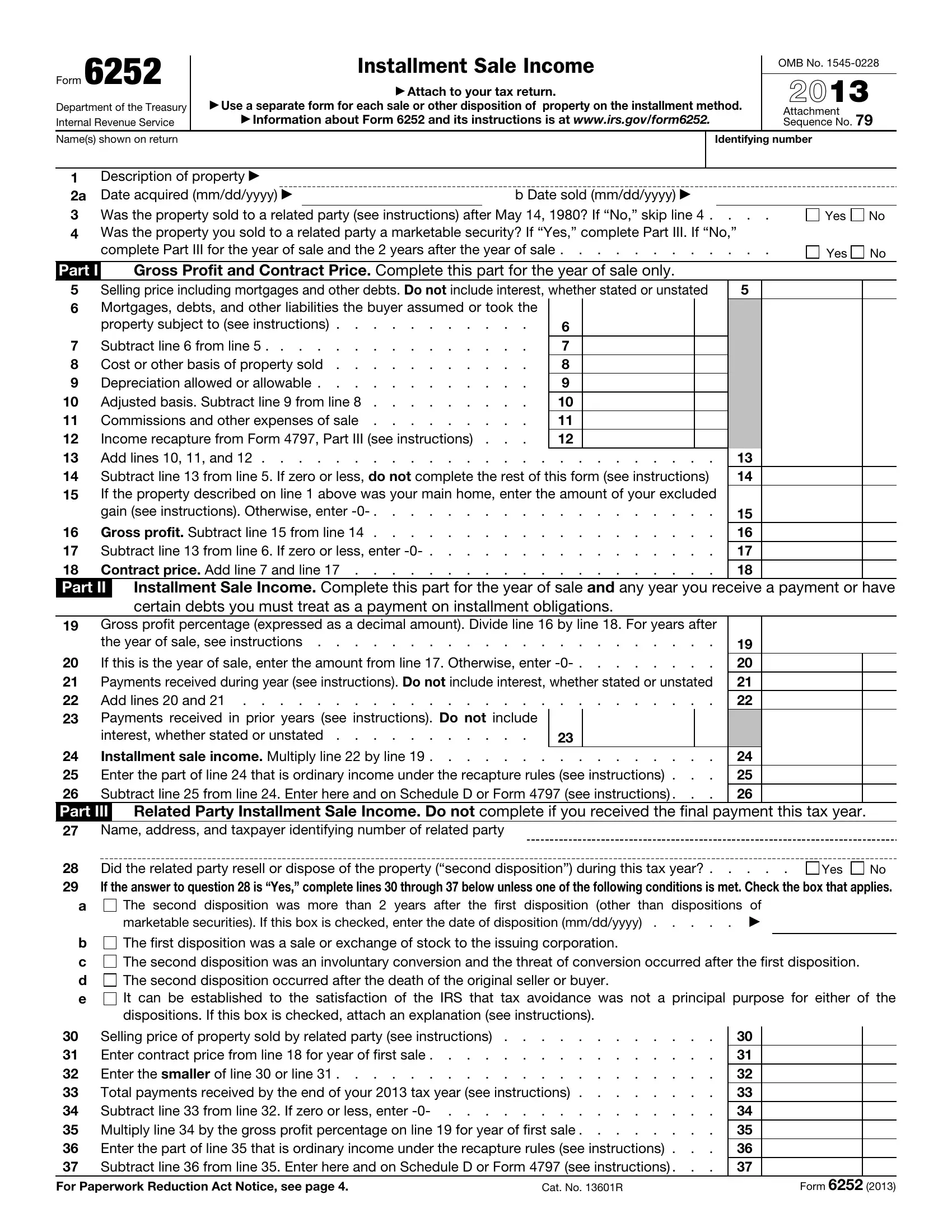

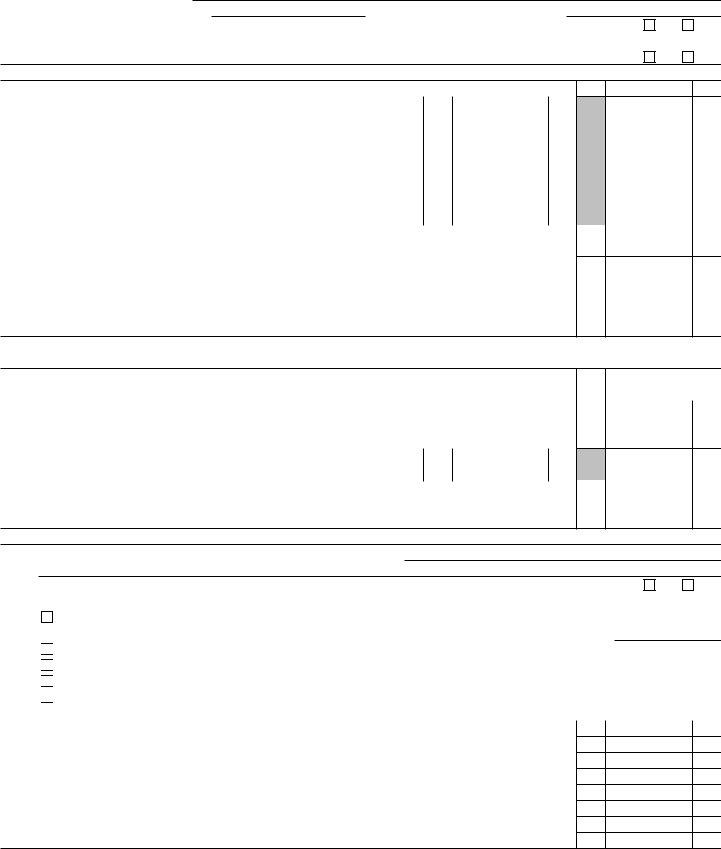

Part I—Gross Profit and Contract Price

Line 5

Enter the total of any money, face amount of the installment obligation, and the FMV of other property or services that you received or will receive in exchange for the property sold. Include on line 5 any existing mortgage or other debt the buyer assumed or took the property subject to. Do not include stated interest, unstated interest, any amount recomputed or recharacterized as interest, or original issue discount.

If there is no stated maximum selling price, such as in a contingent payment sale, attach a schedule showing the computation of gain. Enter the taxable part of the payment on line 24 and also on line 35 if Part III applies. See Temporary Regulations section 15A.453-1.

Line 6

Enter only mortgages or other debts the buyer assumed from the seller or took the property subject to. Do not include new mortgages the buyer gets from a bank, the seller, or other sources.

Line 8

Enter the original cost and other expenses you incurred in buying the property. Add the cost of improvements, etc., and subtract any casualty losses and any of the following credits previously allowed with respect to the property.

•Nonbusiness energy property credit.

•Residential energy efficient property credit.

•Adoption credit.

•District of Columbia first-time homebuyer credit.

•Disabled access credit.

•New markets credit.

•Credit for employer-provided childcare facilities and services.

•Energy efficient home credit.

•Alternative motor vehicle credit.

•Alternative fuel vehicle refueling property credit.

•Qualified railroad track maintenance credit.

•Enhanced oil recovery credit.

•Qualified plug-in electric drive motor vehicle credit.

•Qualified plug-in electric vehicle credit.

•Qualified electric vehicle credit.

For additional information, see Pub. 551, Basis of Assets.

Line 9

Enter all depreciation or amortization you deducted or were allowed to deduct from the date of purchase until the date of sale. Adjust the depreciation or amortization amount by adding any of the following deductions previously taken with respect to the property.

•Section 179 expense.

•Commercial revitalization deduction.

•Deduction for clean-fuel vehicles and refueling property.

•Deductions claimed under sections 190 and 193.

•Deductions claimed under section 1253(d)(2) and (3) (as in effect before enactment of P.L. 103-66).

•Basis reduction to investment credit property.

Subtract the following recapture amounts and credits previously allowed with respect to the property.

•Section 179 or 280F.

•Clean-fuel vehicles and refueling property.

•Investment credit amount.

•Credit for employer-provided childcare facilities and services.

•Alternative motor vehicle credit.

•Alternative fuel vehicle refueling property credit.

•Qualified plug-in electric drive motor vehicle credit.

•Qualified plug-in electric vehicle credit.

•Qualified electric vehicle credit.

Line 11

Enter sales commissions, advertising expenses, attorney and legal fees, etc., incurred to sell the property.

Line 12

Any ordinary income recapture under section 1245 or 1250 (including sections 179 and 291) is fully taxable in the year of sale even if no payments were received. To figure the recapture amount, complete Form 4797, Part III. The ordinary income recapture is the amount on line 31 of Form 4797. Enter it on line 12 of Form 6252 and also on line 13 of Form 4797. Do not enter any gain for this property on line 32 of Form 4797. If you used Form 4797 only to figure the recapture amount on line 12 of Form 6252, enter “N/A” on line 32 of Form 4797. Partnerships and S corporations and their partners and shareholders, see the Instructions for Form 4797.

Line 14

Do not file Form 6252 if line 14 is zero or less. Instead, report the entire sale on Form 4797, Form 8949, or the Schedule D for your tax return.

Line 15

If the property described on line 1 was your main home, you may be able to exclude part or all of your gain. See Pub. 523, Selling Your Home, for details.

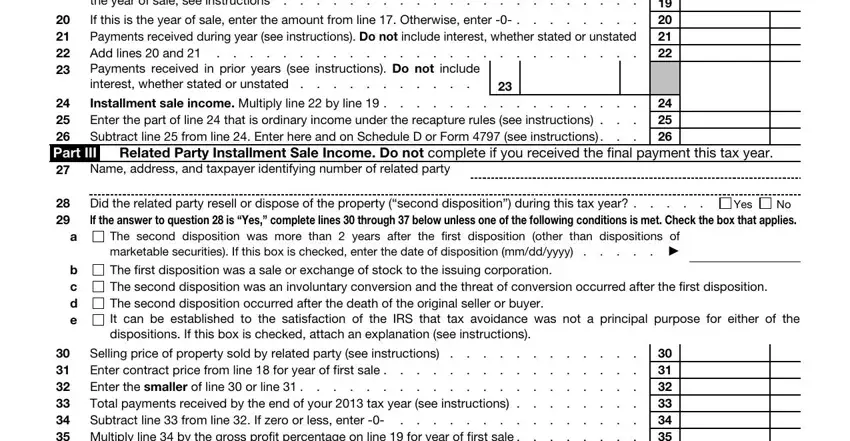

Part II—Installment Sale Income

Line 19

Enter the gross profit percentage (expressed as a decimal amount) determined for the year of sale even if you did not file Form 6252 for that year.