In the realm of distilled spirits' taxation and regulatory compliance within Kentucky, the 61A508 Schedule 5 form emerges as a critical document. Anchored by the Commonwealth of Kentucky's Department of Revenue, specifically under the auspices of the Office of Property Valuation and its Public Service Branch, this form plays a vital role in ensuring that the fair cash values of case goods stored in warehouses are meticulously reported and assessed as of January 1st of the reporting year. These goods are categorized into those not intended for out-of-state shipment, aligning with the stipulations of KRS 132.099, and those earmarked for such distribution. The form requires a thorough enumeration of these items' quantity, measured in 45-50 gallon barrel equivalents, alongside their fair cash value. The figures presented in Schedule 5 must correspond precisely with the details provided in Parts III (A & B) of the Annual Report of Distilled Spirits in Warehouse, signifying the form’s critical role in the accurate financial accounting and regulatory compliance of distilled spirits within the state. This rigorous documentation process underscores Kentucky's commitment to maintaining an orderly and transparent taxation system for distilled spirits, reflecting broader efforts to uphold fiscal responsibility and regulatory compliance within the industry.

| Question | Answer |

|---|---|

| Form Name | Form 61A508 S5 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | 61A508S5 s5 application kentucky form |

|

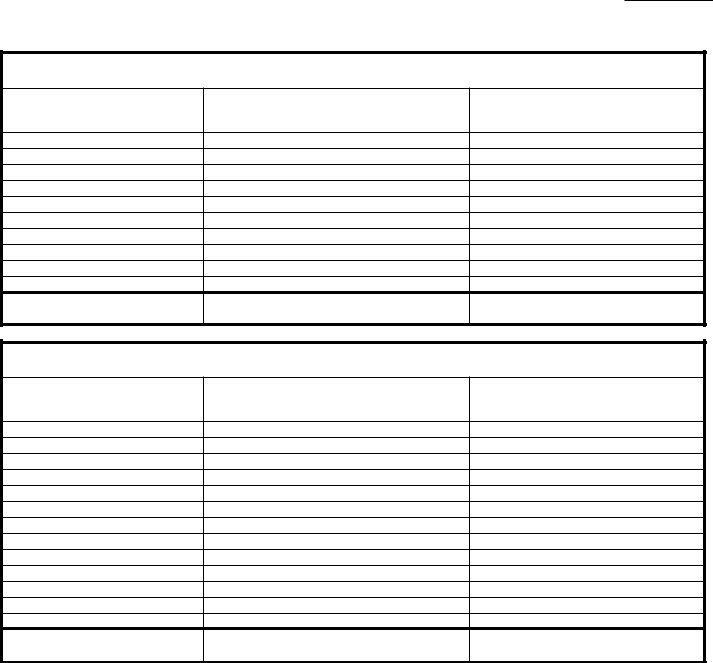

||

Commonwealth of Kentucky |

SCHEDULE 5 |

|

DEPARTMENT OF REVENUE |

||

|

Office of Property Valuation Public Service Branch

501 High Street, Fourth Floor Station 32

Frankfort, Kentucky 40620 (502)

Name __________________________________________ |

DSP # _________________ |

as of January 1, ________ |

|

Fair cash values of Case Goods summarized on Form 61A508 Part III (A & B), Annual Report of Distilled Spirits in Warehouse as of January 1, ________ . These totals must agree with items listed under Part III (A & B) of Form

61A508.

Part III A, Goods not held for shipment

Item

Quantity

(In

Fair Cash Value

TOTALS

Part III B, Goods held for shipment

Item

Quantity

(In

Fair Cash Value

TOTALS