Should you desire to fill out kentucky 62a044 exoneration, you won't need to download and install any kind of programs - just try using our PDF editor. To make our editor better and less complicated to work with, we continuously develop new features, taking into consideration feedback coming from our users. Getting underway is simple! All you need to do is stick to the next basic steps below:

Step 1: First, open the editor by pressing the "Get Form Button" above on this site.

Step 2: With our state-of-the-art PDF file editor, it's possible to do more than merely fill in blank fields. Express yourself and make your docs seem professional with custom textual content added in, or adjust the file's original content to excellence - all comes with an ability to insert your own photos and sign it off.

This form will need some specific information; to ensure correctness, don't hesitate to take into account the subsequent tips:

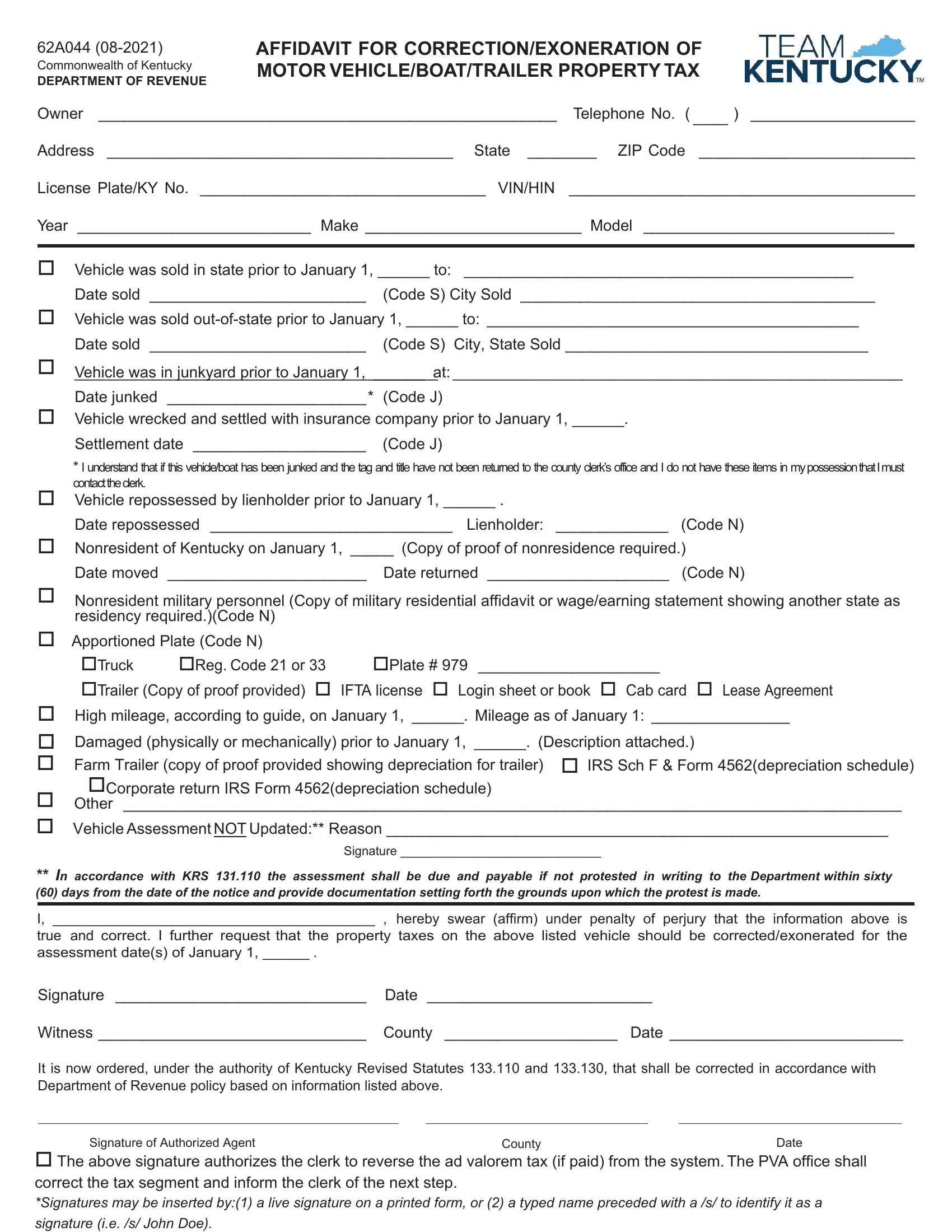

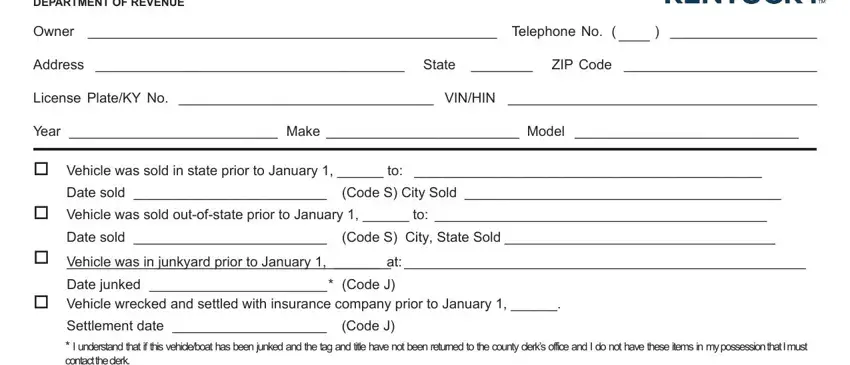

1. The kentucky 62a044 exoneration usually requires specific information to be typed in. Be sure the subsequent blanks are completed:

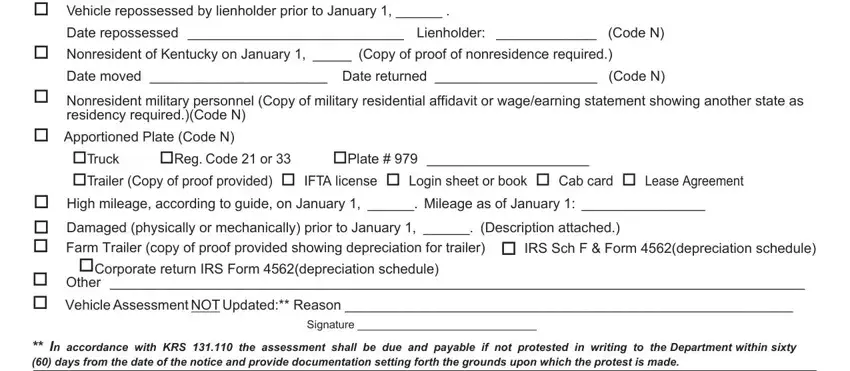

2. Just after the first part is filled out, proceed to type in the relevant details in all these - Settlement date I understand, Vehicle repossessed by lienholder, Date repossessed Lienholder Code, Nonresident of Kentucky on, Date moved Date returned Code N, Nonresident military personnel, residency requiredCode N, Apportioned Plate Code N, Truck Reg Code or Plate, High mileage according to guide, Farm Trailer copy of proof, IRS Sch F Form depreciation, Corporate return IRS Form, Other Vehicle Assessment NOT, and Signature.

Those who work with this PDF often make some errors when filling in Apportioned Plate Code N in this area. You need to revise everything you type in here.

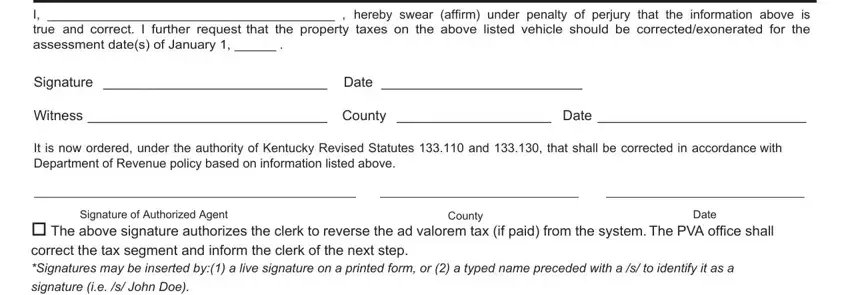

3. In this part, check out In accordance with KRS the, Signature Date, Witness County Date, It is now ordered under the, Signature of Authorized Agent, County, Date, and The above signature authorizes. All of these should be completed with greatest accuracy.

Step 3: Look through the details you've typed into the blanks and press the "Done" button. After creating a7-day free trial account here, you will be able to download kentucky 62a044 exoneration or email it right away. The PDF file will also be available from your personal cabinet with your each modification. At FormsPal.com, we strive to be sure that all of your details are maintained protected.