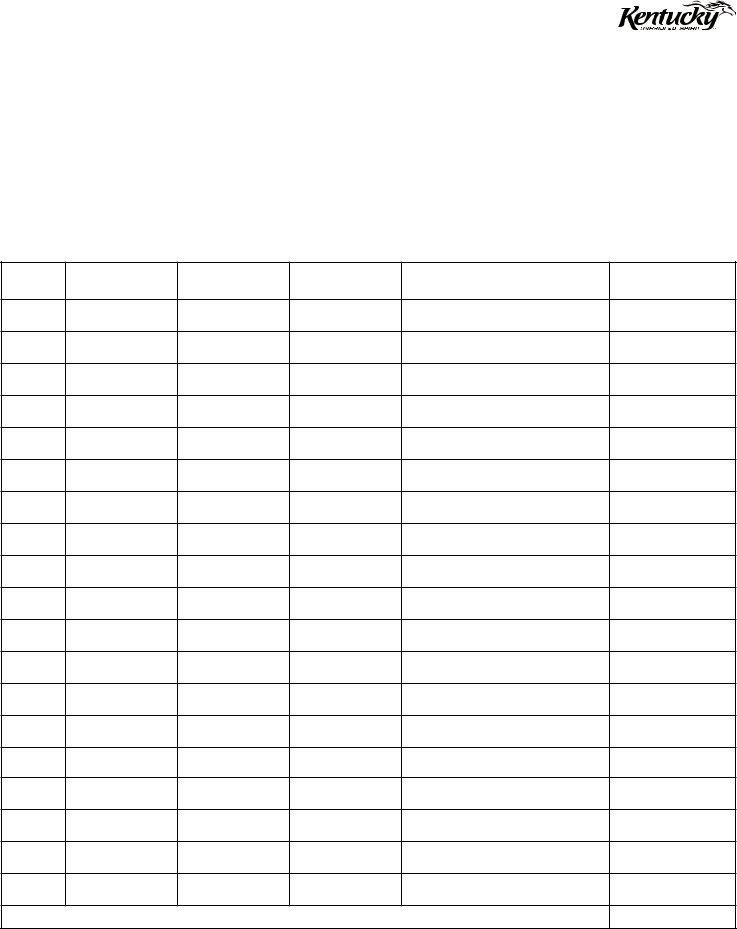

In the realm of automobile dealership operations within Kentucky, the 62A500 S1 form emerges as a pivotal document, intertwining the spheres of taxation and vehicle inventory management. Crafted by the Commonwealth of Kentucky's Department of Revenue, specifically under the Office of Property Valuation and the State Valuation Branch, this form serves as an Automobile Dealer's Inventory Listing for Line 34 on the Tangible Personal Property Tax Return. With a focus on the accurate assessment of property for the tax year beginning January 1, 2012, it mandates dealers to furnish detailed listings of their vehicle inventories. This encompasses a comprehensive array of information, including the business or social security number, Federal ID, dealer's name, contact details, and the physical location where the inventory is held, alongside a meticulous record of each vehicle—spanning year, make, model, license plate number (if applicable), vehicle identification number, and the NADA trade-in value. This requirement not only aids in the precise valuation of a dealership's tangible personal property for tax purposes but also ensures a clear and transparent record-keeping process that aligns with Kentucky's regulatory and fiscal standards.

| Question | Answer |

|---|---|

| Form Name | Form 62A500 S1 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | 2012dealer 62a500 s1 11 11 form |

|

|

|

|

|

|

Page No. ______ |

||||

Commonwealth of Kentucky |

AUTOMOBILE DEALER'S INVENTORY LISTING FOR LINE 34 |

|

|

|||||||

DEPARTMENT OF REVENUE |

|

|

TANGIBLE PERSONAL PROPERTY TAX RETURN |

|

|

|

||||

Office of Property Valuation |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||

State Valuation Branch |

|

|

|

|

|

|

|

|

||

Fourth Floor, Station 32 |

|

|

|

Property Assessed January 1, 2012 |

|

|

|

|

||

501 High Street |

|

|

|

|

|

|

|

|

||

Frankfort, KY |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security No. or |

|

Name of Business |

|

|

|

|

||

|

|

Federal ID No. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Dealer |

|

Telephone Number |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

2nd SSN if joint return |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||

|

|

Mailing Address |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or Town |

State |

|

ZIP Code |

|

|

|

Property is located in |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property Location (Number and Street or Rural Route, City) |

|

|

|

|

|

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year

Make

Model

License Plate Number

(If Applicable)

Vehicle Identification Number

NADA

Total From This Page ➤