Form 62A500 is a form used to request an exemption from paying Illinois income tax. This form can be used by individuals who meet certain qualifications,such as being a full-time student or being out of the country for an extended period of time. There are a number of other exemptions that can be claimed on this form, so it is important to review the qualifications carefully before filing. The deadline for submitting Form 62A500 is April 15th each year.

| Question | Answer |

|---|---|

| Form Name | Form 62A500 |

| Form Length | 32 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 8 min |

| Other names | kentucky personal property tax, kentucky personal property tax return 2021, kentucky 62a500, kentucky personal property |

COMMONWEALTH OF KENTUCKY

DEPARTMENT OF REVENUE

OFFICE OF PROPERTY VALUATION

DIVISION OF STATE VALUATION

62A500 (P)

2021

PERSONAL PROPERTY TAX FORMS

AND

INSTRUCTIONS

* * * * * * * * * * * * * * *

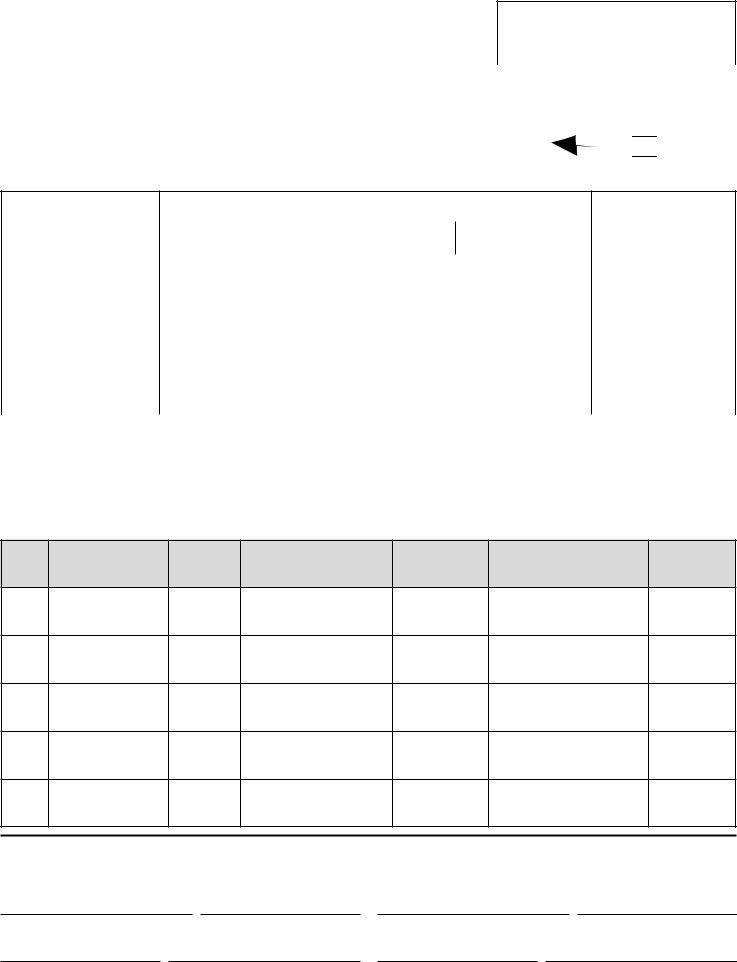

This packet contains forms and instructions for filing your 2021 tangible personal property tax return.

Please:

•File with the Property Valuation Administrator of the county of taxable situs (see pages 11 and 12) by May 17, 2021. All returns postmarked after May 17, 2021, will be assessed for the tax plus applicable penalties and interest by the Department of Revenue.

MAY 2021

S M T W T F S

1

2 3 4 5 6 7 8

910 11 12 13 14 15

1617 18 19 20 21 22

2324 25 26 27 28 29

3031

•THERE IS NO FILING EXTENSION PROVISION FOR TANGIBLE PERSONAL PROPERTY TAX RETURNS.

•Tangible personal property tax returns filed after May 17, 2021, will not be allowed a discount.

•Enter your Federal Employer Identification Number or Social Security on all returns, schedules, attachments and correspondence. It is recommended to use Federal Employer Identification Number (FEIN) if business has FEIN.

•Staple all pages of each return together.

•Sign all returns and list appropriate telephone numbers and an email address (if applicable).

•Returns not required to be filed per KRS 132.220(1)(b)(2) where the sum of all fair cash values is $1,000 or less for each address but are still filed will not be retained.

•DO NOT FILE personal property tax returns with the income tax return.

•DO NOT SEND PAYMENT WITH THE RETURN. Timely filed tangible returns will be billed no earlier than September 15 and are payable to the county sheriff. Returns filed after the due date are billed by the Division of State Valuation.

Should you have any questions regarding the tangible personal property tax returns, please do not hesitate to contact the Division of State Valuation at (502)

Kentucky Department of Revenue Mission Statement

As part of the Finance and Administration Cabinet, the mission of the Kentucky Department of Revenue is to administer tax laws, collect revenue, and provide services in a fair, courteous, and efficient manner for the benefit of the Commonwealth and its citizens.

* * * * * * * * * * * * *

The Kentucky Department of Revenue does not discriminate on the basis of race, color, national origin, sex, age, religion, disability, sexual orientation, gender identity, veteran status, genetic information or ancestry in employment or the provision of services.

INSTRUCTIONS

TANGIBLE PROPERTY TAX RETURNS

(REVENUE FORMS 62A500,

Definitions and General Instructions

The tangible personal property tax return includes instructions to assist taxpayers in preparing Revenue Forms 62A500,

•personal household goods used in the home;

•crops grown in the year which the assessment is made and in the hands of the producer;

•tangible personal property owned by institutions exempted under Section 170 of the Kentucky Constitution.

•returns for each address with a total sum of property with a reported fair cash value of one thousand dollars ($1,000) or less, per KRS 132.220(1)(b)(2).

The tangible return and instructions do not apply to real property, registered motor vehicles, apportioned vehicles or the following classes of property which should be reported to the Public Service Branch:

Report Commercial Aircraft on Form 61A206. Report Commercial Watercraft on Form 61A207.

Report Distilled Spirits in bonded warehouses on the Annual Report of Distilled Spirits in Bonded Warehouses, Form 61A508.

Report Public Service Companies on the Public Service Tax Return, Form 61A200.

Report Communications Service Providers and

Communications Service Providers and

•All telephone companies (including paging services)

•All cable television companies

•All Direct Broadcast Satellite (DBS) companies

•Wireless cable Direct Broadcast Companies

•Voice Over Internet Protocol (VOIP)

•Internet Protocol Television Service (IPTV)

Assessment

Situs of Tangible

Filing

•Kentucky does not allow consolidated and joint returns.

•File a tangible property tax return for each property location within Kentucky.

•The return must include the property location by street address and county. A post office box is not acceptable as the property address.

•File the return between January 1 and May 15. If May 15 falls on a weekend, the return is due the first business day following

May 15. Use the appropriate year form for the assessment date.

•Do not enclose the tangible return with the income tax return.

•File the return with the Property Valuation Administrator (PVA) in the county of taxable situs. See pages 11 and 12 for a complete listing of mailing addresses.

•THERE IS NO FILING EXTENSION FOR THIS RETURN.

Payment of Taxes— Do Not Send Payments With Your Return. The sheriff in each county mails the tax bills no earlier than September 15. Returns filed after the due date are billed by the

Division of State Valuation.

Classification of

Lessors and Lessees of Tangible Personal

Revenue Form

Property leased to Communications Service Providers and Multi- Channel Video Programming Service Providers under an operating lease must be reported on Form 62A500 by the lessor.

Tangible property leased to local governmental jurisdictions is exempt from state and local tax under the Governmental Leasing Act and no return is required. Tangible property leased to any other

Depreciable

assets are never fully depreciated and must be reported. Assets expensed with a useful life of greater than a year should also be reported on 62A500.

Manufacturing

1

shape or composition and ends when the product is ready for sale on the open market.

Manufacturing Machinery does not include the following:

•Activities preceding the introduction of the raw materials into the manufacturing process.

•Activities following the point at which the finished product is packaged and/ or ready for sale on the open market.

•Activities where the already manufactured product is merely being made more attractive or more convenient for the customer is not considered part of the manufacturing process.

Examples include engineering, maintenance, inspection, receiving, shipping, retail monograming/ embroidery, and quality control conducted independent from the manufacturing process.

Automobile dealers must report all vehicles whether new, used, dealer assigned, titled, untitled, registered, or unregistered held for sale as motor vehicle inventory. All new vehicles are valued at the dealer’s cost and used vehicles are valued at the NADA clean trade- in value. Include a list of motor vehicles with the

Farming Equipment and

Foreign Trade

Pollution Control

Industrial Revenue

Rebuilds or Capitalized

costs and listed under two economic life classes on the tangible personal property tax return. The original cost of all assets is included in the year of acquisition in the appropriate class life. Any rebuild(s) capitalized for book or tax purposes are to be entered in the appropriate class life for the expected life of the rebuild. If a second rebuild occurs, the second rebuild is again included in age 1 of the appropriate class for the expected life of that rebuild. The first rebuild is then deleted from the original cost column and dropped from the valuation process.

Exceptions to the Fair Cash Value Computation

Taxable property inoperable and held for disposal as of the assessment date may be valued separately. List this property on Schedule C and include an affidavit explaining the circumstances and the basis for valuation. Such property is valued as follows:

•if component parts have been removed and the remainder is useless to the business, report the actual scrap or salvage value; or

•if a visual inspection confirms that useful life has not ended, the true value is the greater of its depreciated book value or the actual salvage value; or

•property sold on or before the due date of the return through a proven arm’s length transaction, is reported at the selling price.

Temporary idleness is not sufficient cause for separate valuation. This includes idleness attributed to seasonal operation or from repair or overhaul of equipment. Idled equipment no longer actually engaged in manufacturing is Schedule A property and subject to full local rates.

Listing and Valuing Tangible Personal Property

List depreciable property on Form 62A500, Schedule A or B, based on its economic life. To assist taxpayers in determining proper economic life classification a partial listing of North American

Industrial Classification System (NAICS) codes is included. Property descriptions frequently used in these specific industries are listed under each code. Most businesses have property falling into more than one economic life classification.

An asset listing of each item of property must be available to the Department of Revenue upon request. The asset listing should include original cost, acquisition date, make, model, serial number and/or other identification numbers.

Fair Cash Value Computation

The fair cash value computation begins with cost. Cost must include inbound freight,

tax credits, assembly and installation labor, material and expenses, and sales and use taxes. Premium pay and payroll taxes are included in labor costs. Costs are not reduced by trade- in allowances. Capitalize costs of major overhauls in the year in which they occur.

Cost should be net of additions, disposals and transfers occurring during the year. Multiply aggregate cost by the applicable conversion factor to determine reported value. The column totals represent the total original cost and total reported value of each class of property. Original cost totals must generally reconcile with the book cost. NOTE: Property written off the records, but

still physically on hand, must be included in the computation.

2

GENERAL INFORMATION

Revenue Form 62A500

Alternative Reporting Requirement

Tangible property should be reported using the composite factors, methods, and guidelines provided with Form 62A500.

If a taxpayer believes the composite factors in the return have overvalued or undervalued the property, the taxpayer may petition the Department of Revenue to accept an alternative reporting method. The taxpayer must file the return and affidavit of alternative valuation with the Division of State Valuation, not the local PVA, and check the alternative method valuation check box on page 1 of 62A500. The affidavit must include a proposed alternative valuation method, justification of the method chosen, detailed documentation, including, but not limited to: independent appraisals, actual production, and sales and usage reports, that support the proposed method. Accepting the alternative valuation method as filed in

order to expedite the processing of the return, does not affect the department’s right to eventually audit the return and the method used.

For valuation information or assistance in filing this return, contact the PVA in your county (see the addresses and telephone numbers in these instructions) or the Division of State Valuation at (502)

General

•Federal Employer Identification Number or Social Security Number; only use Social Security Number in absence of Federal Employer Identification Number.

•NAICS code that most closely identifies your business activity;

•type of business activity;

•tangible personal property listings in other Kentucky counties (check appropriate box);

•name and address of business;

•property location (street address);

•county where the property is physically located;

•organization type (check appropriate box); and

•taxpayer signature, email, and telephone number and the preparer’s (other than taxpayer) name and contact information at the bottom of Form 62A500, Schedule C.

Failure to properly complete the general information section may result in omitted property notices, subject to penalties and interest.

Instructions for Lines

Schedule A property includes, but is not limited to:

•business furniture and fixtures;

•professional trade tools and equipment;

•signs and billboards;

•drilling, mining and construction equipment;

•computers and related pheripheral equipment; and

•telephone, cable and cellular towers.

Schedule B property includes:

•qualifying commercial radio and television equipment;

•qualified pollution control facilities; and

•manufacturing machinery and computer equipment controlling the machinery; and

•radio and television towers.

Schedules A and B list six economic life classes. Property is classified by the expected economic life, not the depreciable life used for accelerated income tax purposes.

The age of property, whether purchased new or used, is determined as follows: property purchased in the year prior to the assessment date is age 1; purchases made 2 years prior are age 2; etc. Assets listed into Classes I, II and III, whose ages exceed the maximum age for each class (13 years), should be aggregated on “Age 13+” of the original cost column. Assets listed into Classes IV and V whose ages exceed the maximum age for each class (27 years) should be aggregated on “Age 27+” of the original cost column. As long as an asset is in use, it is valued using the appropriate factor as determined by its class and age. For Class VI assets whose age is greater than 27 years contact the State Valuation Branch for the appropriate factor.

Multiply the original cost by the conversion factor to arrive at the reported value. Add original costs for each class to determine the total original cost by class. Add reported values for each class to determine the total reported value by class. The column totals for original cost and reported value for each class of property are listed in the space provided for Schedule A and B property on Form 62A500, page 1. The grand total of original cost and reported value for all classes of property are summarized on lines 17 and 27.

All fully depreciated assets must continue to be reported, as long as they are on hand, in the manner described above.

The following describes the various property categories. Report these values on Form 62A500, page 1.

31Merchants

Attach a separate schedule for machinery and equipment reported as inventory.

Used Boats Held for Sale by a Licensed Boat

Qualified Heavy

32Manufacturers Finished

33Manufacturers Raw Materials

3

unmanufactured agricultural products. List raw materials not on

hand at the plant on line 35.

Manufacturers Goods in

34Motor Vehicles Held for Sale (Dealers Only)

Rental Vehicles of a Motor Vehicle Dealer are not considered as

Service department motor vehicles of a motor vehicle dealer along with personal use vehicles are not considered as

Salvage Titled Vehicles (Insurance Companies Only)

New Farm Machinery Held Under a Floor

New Boats and Marine Inventory (Dealers Only)

Nonferrous Metal located in a commodity warehouse and held on warrant is subject to a state rate only.

Biotechnology Products held in a warehouse for distribution by the manufacturer or affiliate are subject to a state rate only.

Recreational Vehicles, as defined by KRS 132.010, held for sale in a retailer’s inventory are subject to a state rate only.

35Goods Stored in Warehouse/Distribution

36Goods Stored in Warehouse/Distribution

Personal property placed in a warehouse or distribution center for purposes of further shipment to an

This property classification is exempted from state, county, school and city tax and may be subject to special district taxation.

37Unmanufactured Tobacco Products not at Manufacturers Plant nor in the Hands of the Grower or His

the year of assessment is exempt from taxation in that year. Such products still on hand as of January 1 of the following year would be taxable. This property is subject to a state property tax rate and a county/city tax rate.

38Other Unmanufactured Agricultural Products not at

Manufacturers Plant nor in the Hands of the Grower or His

39Unmanufactured Agricultural Products at Manufacturers Plant or in the Hands of the Grower or His

Industrial Revenue Bond

of value of the leasehold interest created through any private financing. Upon expiration of the bond, property is fully reportable on Schedules A and B at the appropriate age. The information necessary for calculation of taxable value of IRB property includes the following:

•the amount of the bond,

•the real property assessment,

•the personal property assessment,

•the life of the bond, and

•recipient of the property upon full amortization of the bond.

The valuation of industrial revenue bond personal property contemplates ownership upon full amortization of the bond issue. If the property converts to the private entity upon full amortization, the property is assessed higher as the bond ages and as the private enterprise assumes a greater leasehold interest.

The following example provides the basics of IRB property valuation:

Total industrial revenue bond value — $11,000,000

Real property valuation |

— |

$1,000,000 |

Life of the bond issue |

— |

20 Years |

The private entity receives the IRB property upon amortization of the issuance.

Total industrial revenue bond |

$11,000,000 |

Less: Real property valuation |

( $ 1,000,000) |

Tangible personal property cost |

$10,000,000 |

All machinery purchased under the IRB must first be segregated and calculated as described for lines

Step 1: $10,000,000 X Economic Life Factor =

Reported Value

Step 2: Reported Value X Actual Property Age/20 (e.g., life of the IRB)

Step 3: Carry Step 2 result to Form 62A500, line 39.

Conversely, if the

Contact the Division of State Valuation at (502)

4

Qualifying Voluntary Environmental Remediation Property

50Livestock and Farm

60Other Tangible Personal

Schedule C on Form 62A500, line 60.

Schedule C property includes:

•inventory held by service industries;

•aircraft for hire (not reported on Form 61A200);

•

•U.S. Coast Guard documented watercraft used for commercial purposes (not reported on Form 61A207);

•materials, supplies and spare parts;

•investment properties such as coin, stamp, art or other collections;

•research libraries; and

•precious metals.

List aircraft for hire on the appropriate line on Schedule C at fair market value.

Materials, supplies and spare parts, normally expensed, must be segregated and valued separately. Any supplies included in inventory should be removed from the inventory value and reported on Schedule C. In all cases, list such property at original cost.

Supply items are valued at original cost in the amount on hand at

List the fair market value of all coin collections, stamp collections, art works, other collectibles and research libraries. List the number of ounces of all gold, silver, platinum and other precious metals. If the market value of a precious metal is known, list the value per ounce as of the preceding December 31 in the Value Per Ounce column. Multiply the number of ounces by the value per ounce to determine the total fair market value.

70Activated Foreign Trade

5

81Construction Work in Progress (Manufacturing Machinery) —

Machinery and equipment that eventually becomes part of the manufacturing process is classified as manufacturing machinery during the construction period. Report such property at original cost.

82Construction Work in Progress (Other Tangible Property) —

During the construction period, list all tangible property that does not become part of the manufacturing process on line 82. NOTE: Tangible property includes contractor’s building components.

90Recycling Machinery and

Revenue Form

Noncommercial Aircraft — List the serial number, federal registration number, make, year, model, size, power and value of all aircraft owned on January 1. Attach a separate sheet if necessary. Include additional information regarding avionics equipment, engine hours, condition and other documentation that may influence the aircraft value in the space provided. Do not list aircraft assessed as public service company property. List aircraft

used in the business of transporting persons or property for compensation or hire and not assessed as a public utility on Revenue Form 62A500, Schedule C. Taxation is based on the situs of the aircraft, on January 1st or the majority of the year, regardless of the owner’s residency.

Revenue Form

If on January 1 you have in your possession any consigned inventory that is held and not owned by you, you are required to complete this form and report the kind, nature, owner and value of all such inventory. If you are assuming the responsibility for the property taxes on the consigned inventory, you must report the value of such inventory on the tangible personal property tax return appropriate for your business activity. Consigned inventory must be valued using full absorption

LIFO deductions are not allowable. A separate return is required for each location at which consigned goods are located. File the return as an attachment to Revenue Form 62A500, this schedule is for informational purposes only.

Revenue Form

All persons and business entities who lease tangible personal property from others (e.g., lessees) are required to file the Lessee

Tangible Personal Property Tax Return, Revenue Form

Provide all information requested. List the name and address of the lessor and the related equipment information, including the type of equipment, year of manufacture, model, selling price new, gross annual rent, date of the lease, length of the lease and purchase price at the end of the lease. Attach a separate schedule if necessary.

Revenue Form

Documented Watercraft — Boats registered with the United States

Coast Guard, sitused in Kentucky, are subject to personal property taxes. These must be listed on the Tangible Personal Property Tax Return (Documented Watercraft), Revenue Form

January 1st, regardless of the owner’s residency.

Do not list any commercial watercraft on this return. Commercial watercraft includes federally documented watercraft used in transporting people and/or property for compensation or hire. The documented watercraft classification does not include

Amended Return Requirement

Taxpayers who discover an error was made on their personal property tax returns can file an amended return along with explanation of why the return is being amended and documentation to support the amended return. Form 62A500 needs to be completed with “AMENDED” written at the top of the form.

Amended returns resulting in a possible refund should be filed within 2 years from the date of payment in accordance with KRS 134.590 and should be accompanied by a refund request and/or application.

Refund requests should be accompanied by clear and concise documentation to support any changes from the original return filed. Documentation can include but not limited to fixed asset listings/ depreciation schedules and/or inventory records.

KRS 134.590 (2) No state government agency shall authorize a refund unless each taxpayer individually applies for a refund within two (2) years from the date the taxpayer paid the tax. Each claim or application for a refund shall be in writing and state the specific grounds upon which it is based.

6

Property Classification Guidelines

Property is classified by the expected economic life, not the

depreciable life used for accelerated income tax purposes. To assist taxpayers in determining proper economic life classification, a partial listing of the North American Industry Classification System (NAICS) codes follows. Property descriptions frequently used in these specific industries are listed under each code. Most businesses have property

falling into more than one economic life classification.

GENERAL BUSINESS ACTIVITIES |

CLASS |

General business purpose integrated computer systems and related |

|

peripheral equipment, such as computers, |

|

terminals, servers, printers, data entry equipment and |

|

I |

|

General administrative activities involving data handling equipment |

|

such as typewriters, calculators, adding and accounting machines, |

|

copiers and duplicating equipment, and fax machines. |

II |

General administrative activities involving the use of desks, file |

|

cabinets, communications equipment, security systems, and other |

|

office furniture, fixtures and equipment. |

III |

Only dozers, tractors, |

|

construction. |

IV |

NOTE: There is no single class for computers and related hardware used to control manufacturing processes.

NAICS |

Business |

|

Code |

Description |

Class |

AGRICULTURE, FORESTRY FISHING AND HUNTING

|

• |

Logging equipment |

III |

|

• Office furniture and equipment, fork lifts |

III |

|

|

• |

Harvesting equipment |

III |

|

• |

Grain bins |

III |

111000 |

Crop production (including greenhouse and floriculture) |

|

|

112900 |

Animal production (including breeding of cats and dogs) |

|

|

113000 |

Forestry and logging (including forest nurseries and |

|

|

114110 |

timber tracts) |

|

|

Fishing |

|

||

114210 |

Hunting and trapping |

|

|

|

|

MINING |

|

|

• Belting, continuous miner and roof driller |

I |

|

|

• Batteries, rockdusters, scoops and shuttle cars |

I |

|

|

• Below ground belt structure |

I |

|

|

• Office furniture and equipment, fork lifts |

III |

|

|

• Supply cars, underground locomotives, mine fans |

III |

|

|

• Electrical substations, personnel carriers |

III |

|

|

• Dozers, tractors, loaders, dump trucks, and highwall |

IV |

|

|

|

miners used in the mining business |

|

|

• Above ground belt structure |

V |

|

|

• Coal/mineral processing equipment (used to wash, |

VI |

|

|

|

size and crush) |

|

211110 |

• |

VI |

|

Oil and gas extraction |

|

||

212110 |

Coal mining |

|

|

212200 |

Metal ore mining |

|

|

212300 |

Nonmetallic mineral mining and quarrying |

|

|

|

|

CONSTRUCTION |

|

|

• Office furniture and equipment, fork lifts |

III |

|

|

• Barricades and warning signs |

III |

|

|

• Backhoe, unlicensed trailer and wagon |

III |

|

|

• Trenchers, boring machines, ditch diggers |

III |

|

|

• Dozers, tractors, |

IV |

|

|

• |

Pulverizers and mixers |

V |

|

• Cranes and mobile offices |

V |

|

233110 |

Land subdivision and land development |

|

|

233200 |

Residential building construction |

|

|

233300 |

Nonresidential building construction |

|

|

7

NAICS |

|

Business |

|

Code |

|

Description |

Class |

234100 |

Highway, street, bridge and tunnel construction |

|

|

235110 |

Plumbing, heating and |

|

|

235210 |

Painting and wall covering contractors |

|

|

235310 |

Electric contractors |

|

|

235400 |

Masonry, drywall, insulation and tile contractors |

|

|

235500 |

Carpentry and floor contractors |

|

|

235610 |

Roofing, siding and sheet metal contractors |

|

|

235710 |

Concrete contractors |

|

|

235810 |

Water well drilling contractors |

|

|

|

|

MANUFACTURING |

|

|

• Special tools (including jigs, molds, die cavities) |

I |

|

|

• |

Laser cutters |

II |

|

• |

Production Fork lifts |

III |

|

• Small drill presses and small hydraulic presses |

III |

|

|

• Heavy equipment (presses, casting machines) |

VI |

|

|

• |

VI |

|

|

|

Food Manufacturing |

|

|

• Juice extractors, peelers and corers, cutters |

III |

|

|

• Potato chip fryers, slicers and related equipment |

III |

|

|

• |

Palletizer, carts, flaking trays |

V |

|

• Dryer, steel bins, extruder, centrifuge MDL, blender |

V |

|

|

• |

Cranes |

V |

311110 |

Animal food manufacturing |

|

|

311200 |

Grain and oilseed milling |

|

|

311300 |

Sugar and confectionery product mfg. |

|

|

311400 |

Fruit and vegetable preserving and specialty food |

|

|

311500 |

Dairy product mfg. |

|

|

311610 |

Animal slaughtering and processing |

|

|

311710 |

Seafood product preparation and packaging |

|

|

311800 |

Bakeries and tortilla mfg. |

|

|

311900 |

Other food mfg. (including coffee, tea, flavoring and |

|

|

|

seasonings) |

|

|

|

|

Beverage and Tobacco Manufacturing |

|

|

• Casing, control and measuring instruments |

III |

|

|

• Brewing, blend and dispersion equipment |

III |

|

|

• Drying and flavor machines |

V |

|

|

• Fermentation, sterilization equipment and system |

VI |

|

312100 |

Beverages (including breweries, wineries and distilleries) |

|

|

312200 |

Tobacco mfg. |

|

|

|

|

Apparel, Textile Mills and Textile Product Mills |

|

|

• Cleaning and micro dust extracting machines |

III |

|

|

• Laser cutter, microprocessor control equipment |

III |

|

|

• Boarding, dryers, knitting machines |

III |

|

|

• Textile mill equipment, except knitwear |

V |

|

|

• Carding, combing and roving machinery |

V |

|

|

• |

Sewing machine, cutter, spreader, tacker |

V |

313000 |

Textile mills |

|

|

314000 |

Textile product mills |

|

|

315100 |

Apparel knitting mills |

|

|

315210 |

Cut and sew apparel contractors |

|

|

315990 |

Apparel accessories and other apparel mfg. |

|

|

|

|

Leather and Allied Product Manufacturing |

|

|

• Storage racks and maintenance equipment |

V |

|

|

• Sewing machine, cutter, spreader, tacker |

V |

|

|

• Assets used in tanning and currying |

V |

|

316110 |

Leather and hide tanning and finishing |

|

|

316210 |

Footwear mfg. (including leather, rubber and plastics) |

|

|

316990 |

Other leather and allied product mfg. |

|

|

|

|

Wood Products Manufacturing |

|

|

• |

III |

|

|

• Sanders, clamps and dust collectors |

III |

|

|

• Chippers, grinders and lathes |

V |

|

|

• Cutting, drying and wood presses |

V |

|

321110 |

Sawmills and wood preservation |

|

|

321210 |

Veneer, plywood and engineered wood product mfg. |

|

|

321900 |

Other wood product mfg. |

|

|

* Above ground tanks >30,000 gallons are considered real property and should not be reported on this return.

NAICS |

|

Business |

|

Code |

|

Description |

Class |

|

|

Paper, Printing and Related Support Activities |

|

|

• Bailer, shredder, selectronic imaging |

III |

|

|

• Collating, folding, labeling machines |

III |

|

|

• Feeders, binders and trimmer |

V |

|

|

• |

V |

|

|

• Presses and assets used in pulps mfg. |

VI |

|

322100 |

Pulp, paper and paperboard mills |

|

|

322200 |

Converted paper product mfg. |

|

|

323100 |

Printing and related support activities |

|

|

|

|

Petroleum and Coal Products Manufacturing |

|

|

• Fork lifts, scissor lifts and aerial lifts |

III |

|

|

• Trenchers, boring machines, ditch diggers |

III |

|

324110 |

Petroleum refineries (including integrated) |

|

|

324120 |

Asphalt paving, roofing and saturated materials mfg. |

|

|

324190 |

Other petroleum and coal products mfg. |

|

|

|

|

Chemical Manufacturing |

|

|

• Gas chromatograph, spectrometer, GLC, HPLC |

III |

|

|

• Injection and |

III |

|

|

• Dryer, belt, kiln, mills |

V |

|

|

• Mixing and blending equipment |

V |

|

325100 |

Basic chemical mfg. |

|

|

325200 |

Resin, synthetic rubber and artificial and synthetic fibers |

|

|

325300 |

Pesticide, fertilizer and other agricultural chemical mfg. |

|

|

325410 |

Pharmaceutical and medicine mfg. |

|

|

325500 |

Paint coating and adhesive mfg. |

|

|

325600 |

Soap, cleaning compound and toilet preparation mfg. |

|

|

325900 |

Other chemical product mfg. |

|

|

|

|

Plastics and Rubber Products Manufacturing |

|

|

• Mandrels, lasts, pallets, patterns, rings and |

I |

|

|

|

insert plates |

|

|

• |

Injection molding machine |

III |

|

• Packers, sealers, labelers and label dispensers |

III |

|

|

• Storage racks and maintenance equipment |

V |

|

|

• Extruders, kneaders, mixing mills, dryers |

V |

|

|

• Baling presses and separators |

V |

|

326100 |

Plastics product mfg. |

|

|

326200 |

Rubber product mfg. |

|

|

|

|

Nonmetallic Mineral Product Manufacturing |

|

|

• Fork lifts, scissor lifts and aerial lifts |

III |

|

|

• Stone grinders and polishers |

V |

|

|

• Gang saws, block cutter and diamond wire machines |

V |

|

|

• Production of flat, blown, or pressed products |

VI |

|

|

• All other equipment used in glass and lime mfg. |

VI |

|

327100 |

Clay product and refractory mfg. |

|

|

327210 |

Glass and glass product mfg. |

|

|

327300 |

Cement and concrete product mfg. |

|

|

327400 |

Lime and gypsum product mfg. |

|

|

327900 |

Other nonmetallic mineral product mfg. |

|

|

|

|

Primary Metal Manufacturing |

|

|

• Assets used in the smelting and refining |

VI |

|

|

• |

Rolls, mandrels, refractories |

VI |

|

• |

VI |

|

331110 |

Iron and steel mills and ferroalloy mfg. |

|

|

331310 |

Alumna and aluminum production and processing |

|

|

331500 |

Foundries |

|

|

NAICS |

Business |

|

Code |

Description |

Class |

|

Fabricated Metal Products Manufacturing |

|

• |

Welders and torches |

III |

• |

Storage racks and powder booths |

V |

• |

Holding furnace, wire baskets |

V |

• |

Grinders, lathes, saws, shears and cutters |

V |

• |

Bar feeders, bending and lapping machines |

V |

• |

Extruders and stamping machines |

VI |

• |

Presses, casting machines |

VI |

332000 Fabricate metal product mfg.

332110 Forging and stamping

332510 Hardware mfg.

332700 Machine shops; screw, nut and bolt mfg.

332810 Coating, engraving, heat treating and allied activities

332900 Other fabricated metal product mfg.

Machinery Manufacturing

• |

Forklifts |

III |

• |

Storage racks and powder booths, conveyors |

V |

• |

Presses, casting machines |

VI |

333000 Machinery mfg.

333100 Agriculture and construction machinery mfg.

333200 Industrial machinery mfg.

333310 Commercial and service industry machinery

333410

333610 Engine, turbine and power transmission equipment

333900 Other general purpose machinery mfg.

Computer and Electronic Product Manufacturing

|

• |

Forklifts |

III |

|

• |

Drilling, grinding and tapping machines |

V |

|

• |

Storage racks and powder booths, conveyors |

V |

334110 |

Computer and peripheral equipment mfg. |

|

|

334200 |

Communications equipment mfg. |

|

|

334310 |

Audio and video equipment mfg. |

|

|

334410 |

Semiconductor and other electronic component mfg. |

|

|

334500 |

Electromedical and control instruments mfg. |

|

|

334610 |

Magnetic and optical media mfg. |

|

|

|

Electrical Equipment and Appliance Manufacturing |

|

|

|

• Coil and material handling equipment |

III |

|

|

• |

Drilling, grinding and tapping machines |

V |

|

• Gear cutting, forming and finishing machines |

V |

|

|

• |

Power presses, press brakes and shears |

V |

335000 |

Electrical equipment mfg. |

|

|

335200 |

Household appliance mfg. |

|

|

335900 |

Other electrical equipment and component mfg. |

|

|

|

|

Transportation Equipment Manufacturing |

|

|

• |

Forklifts |

III |

|

• |

Paint booths, conveyors |

V |

|

• |

Presses, |

VI |

336100 |

Motor vehicle mfg. |

|

|

336210 |

Motor vehicle body and trailer mfg. |

|

|

336300 |

Motor vehicle parts mfg. |

|

|

336410 |

Aerospace product and parts mfg. |

|

|

336510 |

Railroad rolling stock mfg. |

|

|

336610 |

Ship and boat building |

|

|

336990 |

Other transportation equipment mfg. |

|

|

|

|

Furniture and Related Product Manufacturing |

|

|

• |

III |

|

|

• |

Sanders, clamps and dust collectors |

III |

|

• |

Chippers and grinders, lathes |

V |

|

• |

Cutting and wood presses |

V |

337000 |

Furniture and related product mfg. |

|

|

|

|

Miscellaneous Manufacturing |

|

|

• |

Laser cutters |

II |

|

• Office furniture and equipment, fork lifts |

III |

|

|

• |

Welders and torches |

III |

|

• |

Storage racks and maintenance equipment |

V |

|

• |

Heavy equipment |

VI |

|

• |

Presses and casting machines |

VI |

339110 |

Medical equipment and supplies mfg. |

|

|

8

NAICS |

Business |

|

Code |

Description |

Class |

WHOLESALE AND RETAIL TRADE

• Cash registers, fork lifts |

III |

|

• |

Photography and developing equipment |

III |

• |

Retail shelving |

III |

• |

Small freezers |

III |

• Office furniture and equipment |

III |

|

• |

Racks and maintenance equipment |

V |

• |

Walk in coolers |

V |

• |

Above ground tanks < = 30,000 gallons * |

VI |

421000 Durable Goods

422000

441000 Motor vehicle and parts dealer

442000 Furniture and home furnishing stores

443000 Electronic and appliance stores

444200 Building material and other supplies

445000 Food and beverage stores

446000 Health and personal care stores

447100 Gasoline stations

448000 Clothing and accessories stores

451000 Sporting goods, hobby, book and music stores

454000 General merchandise stores

TRANSPORTATION AND WAREHOUSING

|

• Fork lifts, packaging equipment |

III |

|

• Drum lifts, pallet turners, steel shelving, |

V |

|

shrink wrap, conveyors |

|

481000 |

Air transportation |

|

484200 |

Specialized freight trucking |

|

493100 |

Warehouse and storage |

|

|

|

INFORMATION SERVICES |

|

|

• |

I |

|

|

• |

Modulator, mutiplexer, oscilliscope |

II |

|

• |

Antennas |

III |

|

• |

Cables, wire, droplines |

III |

|

• |

Tower |

VI |

|

|

|

|

511000 |

Publishing industries |

|

|

512100 |

Motion picture and video industries |

|

|

512200 |

Sound recording industries |

|

|

513000 |

Broadcasting and telecommunications |

|

|

514100 |

Information services |

|

|

514210 |

Data processing services |

|

|

|

|

FINANCE AND INSURANCE |

|

|

• Office furniture and equipment |

III |

|

522000 |

Credit intermediation and related activities |

|

|

524000 |

Insurance agents, brokers and related activities |

|

|

|

|

RENTAL AND LEASING |

|

|

• Electronics, video tapes, DVDs and formal wear |

I |

|

|

• |

Linen and uniforms |

I |

|

• |

Consigned display fixtures |

II |

|

• Household appliances and furniture |

II |

|

|

• |

Coin operated machines |

II |

|

• Lawn and garden equipment |

II |

|

|

• Bottled water and dispensers |

II |

|

|

• Heavy equipment (see “Construction” on page 7) |

|

|

532210 |

Electronics and appliance rental |

|

|

532220 |

Formal wear and costume rental |

|

|

532230 |

Video tape and Disc rental |

|

|

532310 |

General rental centers |

|

|

532400 |

Equipment rental and leasing (use appropriate classification |

|

|

from applicable industries)

*Above ground tanks >30,000 gallons are considered real property and should not be reported on this return.

9

NAICS |

Business |

|

Code |

Description |

Class |

PROFESSIONAL, SCIENTIFIC

AND TECHNICAL SERVICES

• Computers and prewritten software |

I |

|

• |

Chromatographs and spectrometers |

III |

• Film processor, enlarger, print washer, film dryer |

III |

|

• |

Medical and law libraries |

III |

541100 Legal services

541211 Office of certified public accountant

541310 Architectural and engineering services

541380 Testing laboratories

541400 Specialized design services

541510 Computer systems design services

541800 Advertising and related services

541920 Photographic services

541940 Veterinary services

ADMIN AND SUPPORT AND

WASTE MANAGEMENT SERVICES

• |

Waste and trash containers |

III |

• |

Compactors and recycling equipment |

V |

561300 Employment services

561430 Business service centers (includes copy shops)

561440 Collection agencies

561500 Travel arrangement and reservation services

561710 Exterminating and pest control services

562000 Waste management and remediation services

HEALTH CARE AND SOCIAL SERVICES

|

• Magnetic Resonance Imaging (MRI) |

I |

|

• Other high technology medical equipment |

II |

|

• |

III |

|

• Dental lathes, trimmers and instruments |

III |

|

• Sterilizers and |

III |

621100 |

Office of physicians |

|

621210 |

Office of dentists |

|

621300 |

Offices of other health care practitioners |

|

621400 |

Outpatient care centers |

|

621510 |

Medical and diagnostic laboratories |

|

622000 |

Hospitals |

|

624000 |

Social assistance services |

|

ART, ENTERTAINMENT AND RECREATION

|

• Billiard table, automatic pinsetters, time recorder |

III |

|

and scorekeeper |

|

|

• Amusements, rides, booths and other attraction equipment |

V |

711100 |

Performing arts companies |

|

711510 |

Independent artists, writers and performers |

|

712100 |

Museums, historical sites and similar institutions |

|

713100 |

Amusement parks and arcades |

|

ACCOMMODATION AND FOOD SERVICES

• Glassware, silverware and slicer |

III |

|

• Laundry washer and dryers |

III |

|

• |

Beverage dispensers |

III |

• Small freezers, fryers, grills and microwaves |

III |

|

• |

Beds |

III |

• |

Small freezers |

III |

• |

Ovens |

V |

• |

Safes |

V |

• |

Walk in coolers |

V |

721110 Travel accommodation

721210 RV parks and recreational camps

721310 Rooming and boarding houses

722110

722300 Special food services (contractors and caterers)

722410 Drinking places (alcoholic beverages)

NAICS |

Business |

|

Code |

Description |

Class |

OTHER SERVICES

|

• Dry cleaning machine, laundry machine, presser |

III |

|

• Film processor, enlarger, print washer, film dryer |

III |

|

• Body lifter, refrigerator, mausoleum lift, embalming table |

III |

|

• Steel chair, dryer, hand tool set |

III |

|

• Tanning beds and booths |

III |

|

• Automotive, diagnostic and machining equipment |

III |

|

• Hoists, disk lathes |

V |

|

Repair and Maintenance |

|

811110 |

Automotive mechanical and electrical repair |

|

811120 |

Automotive body, paint and glass repair |

|

811310 |

Commercial and industrial equipment repair |

|

811410 |

Appliance repair and maintenance |

|

811420 |

Reupholstery and furniture repair |

|

811430 |

Footwear and leather goods repair |

|

|

Personal and Laundry Services |

|

812111 |

Barber shops |

|

812112 |

Beauty salons |

|

812113 |

Nail salons |

|

812210 |

Funeral homes and funeral services |

|

812220 |

Cemeteries and crematories |

|

812310 |

|

|

812320 |

|

|

812330 |

Linen and uniform supply |

|

812910 |

Pet care (except veterinary) services |

|

812920 |

|

|

812930 |

Parking lots and garages |

|

10

|

|

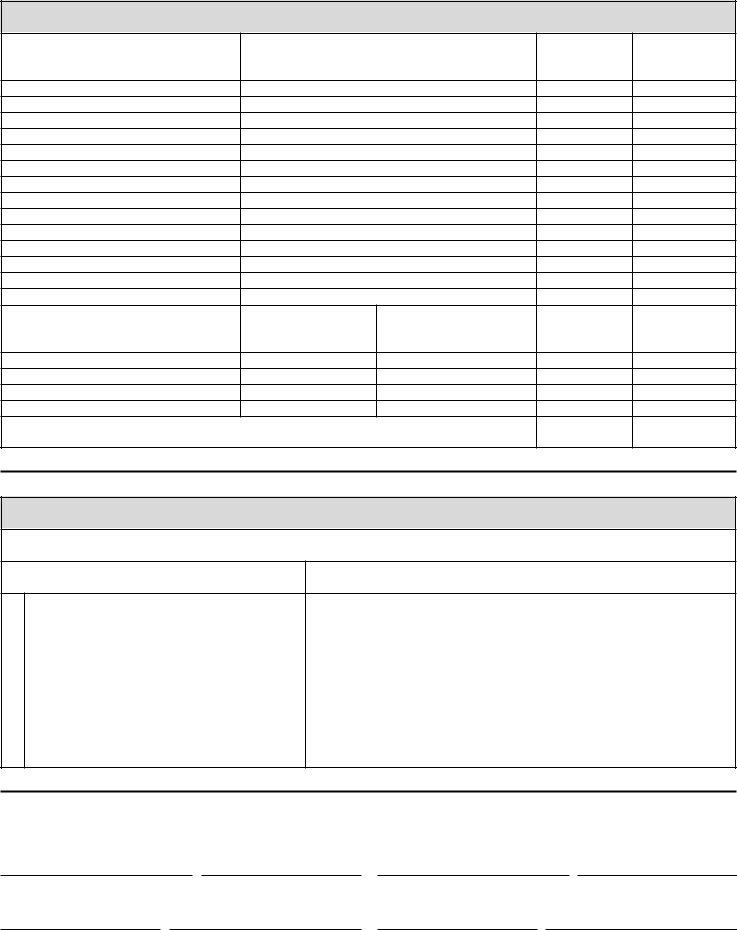

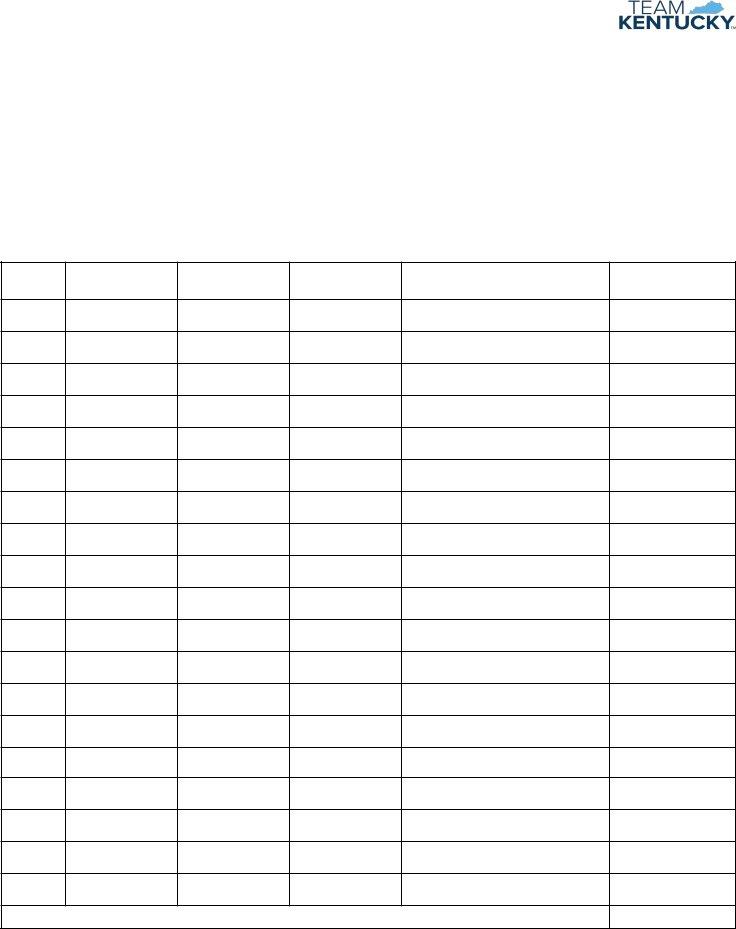

COUNTY PVA PHONE NUMBERS AND ADDRESSES |

|

|

||

County |

|

|

|

|

|

|

Code |

County |

Phone Number |

Address |

City |

ZIP Code |

|

001 |

Adair |

(270) |

424 |

Public Square, Suite 2 |

Columbia |

42728 |

002 |

Allen |

(270) |

P.O. Box 397 |

Scottsville |

42164 |

|

003 |

Anderson |

(502) |

101 |

Ollie Bowen Court |

Lawrenceburg |

40342 |

004 |

Ballard |

(270) |

P.O. Box 267 |

Wickliffe |

42087 |

|

005 |

Barren |

(270) |

P.O. Box 1836 |

Glasgow |

42142 |

|

006 |

Bath |

(606) |

P.O. Box 688 |

Owingsville |

40360 |

|

007 |

Bell |

(606) |

P.O. Box 255 |

Pineville |

40977 |

|

008 |

Boone |

(859) |

P.O. Box 388 |

Burlington |

41005 |

|

009 |

Bourbon |

(859) |

Courthouse, Room 15, 301 Main Street |

Paris |

40361 |

|

010 |

Boyd |

(606) |

P.O. Box 434 |

Catlettsburg |

41129 |

|

011 |

Boyle |

(859) |

Courthouse, 321 West Main Street, Room 127 |

Danville |

40422 |

|

012 |

Bracken |

(606) |

P.O. Box 310 |

Brooksville |

41004 |

|

013 |

Breathitt |

(606) |

1137 Main Street, Courthouse, Suite 302 |

Jackson |

41339 |

|

014 |

Breckinridge |

(270) |

P.O. Box 516 |

Hardinsburg |

40143 |

|

015 |

Bullitt |

(502) |

P.O. Box 681 |

Shepherdsville |

40165 |

|

016 |

Butler |

(270) |

P.O. Box 538 |

Morgantown |

42261 |

|

017 |

Caldwell |

(270) |

100 |

E. Market St., Courthouse, Room 28 |

Princeton |

42445 |

018 |

Calloway |

(270) |

P.O. Box 547 |

Murray |

42071 |

|

019 |

Campbell |

(859) |

1098 Monmouth Street, Room 329 |

Newport |

41071 |

|

020 |

Carlisle |

(270) |

P.O. Box 206 |

Bardwell |

42023 |

|

021 |

Carroll |

(502) |

Courthouse, 440 Main Street |

Carrollton |

41008 |

|

022 |

Carter |

(606) |

Courthouse, Room 214, 300 W. Main St. |

Grayson |

41143 |

|

023 |

Casey |

(606) |

P.O. Box 38 |

Liberty |

42539 |

|

024 |

Christian |

(270) |

P.O. Box 96 |

Hopkinsville |

42241 |

|

025 |

Clark |

(859) |

Courthouse, 34 South Main Street |

Winchester |

40391 |

|

026 |

Clay |

(606) |

102 |

Richmond Road, Suite 200 |

Manchester |

40962 |

027 |

Clinton |

(606) |

100 |

S. Cross St., Courthouse, Room 217 |

Albany |

42602 |

028 |

Crittenden |

(270) |

Courthouse, 107 South Main Street, Suite 108 |

Marion |

42064 |

|

029 |

Cumberland |

(270) |

P.O. Box 431 |

Burkesville |

42717 |

|

030 |

Daviess |

(270) |

Courthouse, Room 102, 212 St. Ann Street |

Owensboro |

42303 |

|

031 |

Edmonson |

(270) |

P.O. Box 37 |

Brownsville |

||

032 |

Elliott |

(606) |

P.O. Box 690 |

Sandy Hook |

41171 |

|

033 |

Estill |

(606) |

Courthouse, Room 104, 130 Main Street |

Irvine |

40336 |

|

034 |

Fayette |

(859) |

101 |

E. Vine St., Suite 600 |

Lexington |

40507 |

035 |

Fleming |

(606) |

100 |

Court Square, Room B110 |

Flemingsburg |

41041 |

036 |

Floyd |

(606) |

149 |

South Central Avenue, Room 5 |

Prestonsburg |

41653 |

037 |

Franklin |

(502) |

313 W. Main Street, Courthouse Annex, Room 209 |

Frankfort |

40601 |

|

038 |

Fulton |

(270) |

2216 Myron Cory Drive, Suite 2 |

Hickman |

42050 |

|

039 |

Gallatin |

(859) |

P.O. Box 470 |

Warsaw |

41095 |

|

040 |

Garrard |

(859) |

Courthouse, 7 Public Square, Suite 2 |

Lancaster |

40444 |

|

041 |

Grant |

(859) |

Courthouse, 101 North Main St., Room 15 |

Williamstown |

41097 |

|

042 |

Graves |

(270) |

101 |

E. South Street, Courthouse Annex, Suite 5 |

Mayfield |

42066 |

043 |

Grayson |

(270) |

10 Public Square |

Leitchfield |

42754 |

|

044 |

Green |

(270) |

103 |

South First Street |

Greensburg |

42743 |

045 |

Greenup |

(606) |

301 |

Main St., Courthouse Box 4 |

Greenup |

41144 |

046 |

Hancock |

(270) |

P.O. Box 523 |

Hawesville |

42348 |

|

047 |

Hardin |

(270) |

P.O. Box 70 |

Elizabethtown |

42702 |

|

048 |

Harlan |

(606) |

P.O. Box 209 |

Harlan |

40831 |

|

049 |

Harrison |

(859) |

111 |

South Main Street, Suite 101 |

Cynthiana |

41031 |

050 |

Hart |

(270) |

P.O. Box 566 |

Munfordville |

42765 |

|

051 |

Henderson |

(270) |

P.O. Box 2003 |

Henderson |

||

052 |

Henry |

(502) |

P.O. Box 11 |

New Castle |

40050 |

|

053 |

Hickman |

(270) |

110 |

E Clay, Courthouse, Suite F |

Clinton |

42031 |

054 |

Hopkins |

(270) |

25 E Center Street |

Madisonville |

||

055 |

Jackson |

(606) |

P.O. Box 249 |

McKee |

40447 |

|

056 |

Jefferson |

(502) |

Glassworks Building, 815 West Market St., Ste. 400 |

Louisville |

||

057 |

Jessamine |

(859) |

P.O. Box 530 |

Nicholasville |

40340 |

|

058 |

Johnson |

(606) |

230 |

Court Street, Courthouse, Suite 229 |

Paintsville |

41240 |

059 |

Kenton |

(859) |

1840 Simon Kenton Way, Ste. 3300 |

Covington |

41011 |

|

060 |

Knott |

(606) |

P.O. Box 1021 |

Hindman |

41822 |

|

061 |

Knox |

(606) |

P.O. Box 1509 |

Barbourville |

40906 |

|

062 |

Larue |

(270) |

209 West High Street, Courthouse, Suite 1 |

Hodgenville |

42748 |

|

063 |

Laurel |

(606) |

Room 127, 101 South Main Street |

London |

40741 |

|

11

|

|

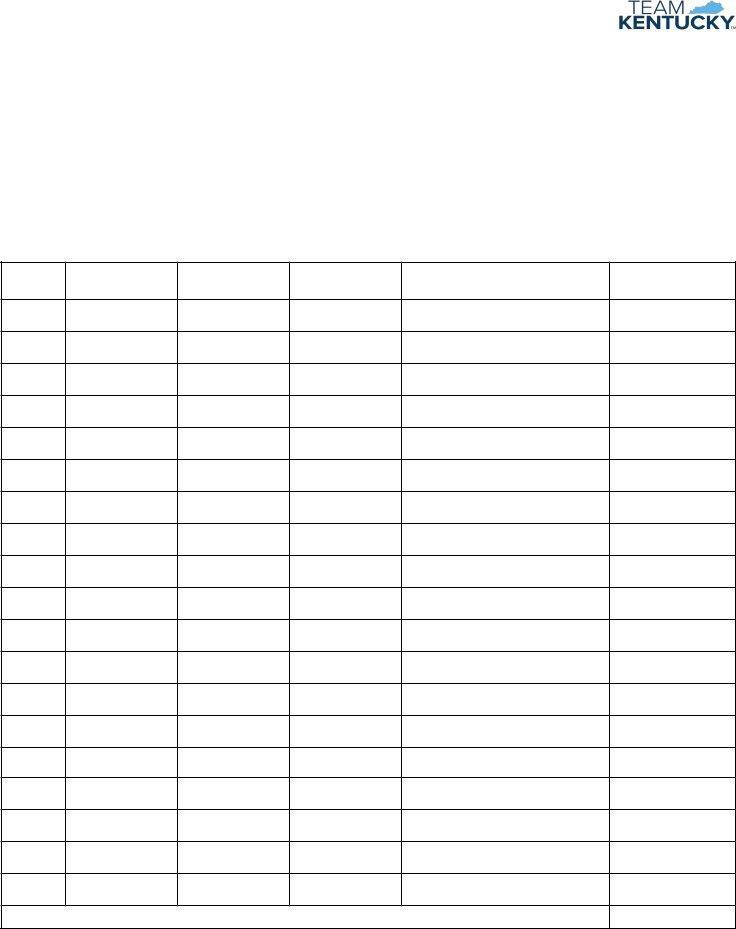

COUNTY PVA PHONE NUMBERS AND ADDRESSES |

|

|

||

|

|

|

|

Continued |

|

|

County |

|

|

|

|

|

|

Code |

County |

Phone Number |

Address |

City |

ZIP Code |

|

064 |

Lawrence |

(606) |

Courthouse, 122 S. Main Cross Street |

Louisa |

41230 |

|

065 |

Lee |

(606) |

P.O. Box 1008 |

Beattyville |

41311 |

|

066 |

Leslie |

(606) |

P.O. Box 1891 |

Hyden |

41749 |

|

067 |

Letcher |

(606) |

156 |

Main Street, Suite 105 |

Whitesburg |

41858 |

068 |

Lewis |

(606) |

112 |

Second Street, Suite 101 |

Vanceburg |

41179 |

069 |

Lincoln |

(606) |

201 |

East Main Street, Suite 2 |

Stanford |

40484 |

070 |

Livingston |

(270) |

P.O. Box 77 |

Smithland |

42081 |

|

071 |

Logan |

(270) |

P.O. Box 307 |

Russellville |

42276 |

|

072 |

Lyon |

(270) |

P.O. Box 148 |

Eddyville |

42038 |

|

073 |

McCracken |

(270) |

621 Washington Street |

Paducah |

42003 |

|

074 |

McCreary |

(606) |

P.O. Box 609 |

Whitley City |

42653 |

|

075 |

McLean |

(270) |

P.O. Box 246 |

Calhoun |

42327 |

|

076 |

Madison |

(859) |

135 W. Irvine Street, Suite 103 |

Richmond |

||

077 |

Magoffin |

(606) |

P.O. Box 107 |

Salyersville |

41465 |

|

078 |

Marion |

(270) |

223 |

N. Spalding Avenue, Suite 202 |

Lebanon |

40033 |

079 |

Marshall |

(270) |

1101 Main Street |

Benton |

42025 |

|

080 |

Martin |

(606) |

P.O. Box 341 |

Inez |

41224 |

|

081 |

Mason |

(606) |

220 |

1/2 Sutton Street |

Maysville |

41056 |

082 |

Meade |

(270) |

516 |

Hillcrest Drive, Suite 3 |

Brandenburg |

40108 |

083 |

Menifee |

(606) |

P.O. Box 36 |

Frenchburg |

40322 |

|

084 |

Mercer |

(859) |

P.O. Box 244 |

Harrodsburg |

40330 |

|

085 |

Metcalfe |

(270) |

P.O. Box 939 |

Edmonton |

42129 |

|

086 |

Monroe |

(270) |

200 |

N. Main St., Suite A |

Tompkinsville |

|

087 |

Montgomery |

(859) |

44 W. Main Street, Courthouse Annex, Suite E |

Mt. Sterling |

40353 |

|

088 |

Morgan |

(606) |

P.O. Box 57 |

West Liberty |

41472 |

|

089 |

Muhlenberg |

(270) |

P.O. Box 546 |

Greenville |

42345 |

|

090 |

Nelson |

(502) |

113 |

East Stephen Foster Avenue |

Bardstown |

40004 |

091 |

Nicholas |

(859) |

P.O. Box 2 |

Carlisle |

40311 |

|

092 |

Ohio |

(270) |

P.O. Box 187 |

Hartford |

42347 |

|

093 |

Oldham |

(502) |

110 W. Jefferson St. |

LaGrange |

40031 |

|

094 |

Owen |

(502) |

Courthouse, 100 N. Thomas St., Room 6 |

Owenton |

40359 |

|

095 |

Owsley |

(606) |

P.O. Box 337 |

Booneville |

41314 |

|

096 |

Pendleton |

(859) |

233 |

Main Street, Courthouse Room 2 |

Falmouth |

41040 |

097 |

Perry |

(606) |

481 |

Main Street, Suite 201 |

Hazard |

41701 |

098 |

Pike |

(606) |

146 |

Main Street, Suite 303 |

Pikeville |

41501 |

099 |

Powell |

(606) |

P.O. Box 277 |

Stanton |

40380 |

|

100 |

Pulaski |

(606) |

P.O. Box 110 |

Somerset |

42502 |

|

101 |

Robertson |

(606) |

P.O. Box 216 |

Mt. Olivet |

41064 |

|

102 |

Rockcastle |

(606) |

P.O. Box 977 |

Mt. Vernon |

40456 |

|

103 |

Rowan |

(606) |

Courthouse, 600 W. Main, Ste. 118 |

Morehead |

40351 |

|

104 |

Russell |

(270) |

410 |

Monument Square, Ste. 106 |

Jamestown |

42629 |

105 |

Scott |

(502) |

101 |

East Main Street, Courthouse, Ste. 206 |

Georgetown |

40324 |

106 |

Shelby |

(502) |

501 Washington Street |

Shelbyville |

40065 |

|

107 |

Simpson |

(270) |

P.O. Box 424 |

Franklin |

42135 |

|

108 |

Spencer |

(502) |

P.O. Box 425 |

Taylorsville |

40071 |

|

109 |

Taylor |

(270) |

203 |

N. Court St., Courthouse, Ste. 6 |

Campbellsville |

42718 |

110 |

Todd |

(270) |

P.O. Box 593 |

Elkton |

42220 |

|

111 |

Trigg |

(270) |

P.O. Box 1776 |

Cadiz |

42211 |

|

112 |

Trimble |

(502) |

P.O. Box 131 |

Bedford |

40006 |

|

113 |

Union |

(270) |

P.O. Box 177 |

Morganfield |

42437 |

|

114 |

Warren |

(270) |

P.O. Box 1269 |

Bowling Green |

||

115 |

Washington |

(859) |

120 |

E. Main |

Springfield |

40069 |

116 |

Wayne |

(606) |

55 N. Main St., Ste. 107 |

Monticello |

42633 |

|

117 |

Webster |

(270) |

P.O. Box 88 |

Dixon |

||

118 |

Whitley |

(606) |

P.O. Box 462 |

Williamsburg |

40769 |

|

119 |

Wolfe |

(606) |

P.O. Box 155 |

Campton |

41301 |

|

120 |

Woodford |

(859) |

Courthouse, Room 108, 103 Main Street |

Versailles |

40383 |

|

KENTUCKY DEPARTMENT OF REVENUE

OFFICE OF PROPERTY VALUATION

501 High Street, Station 32

Frankfort, KY

12

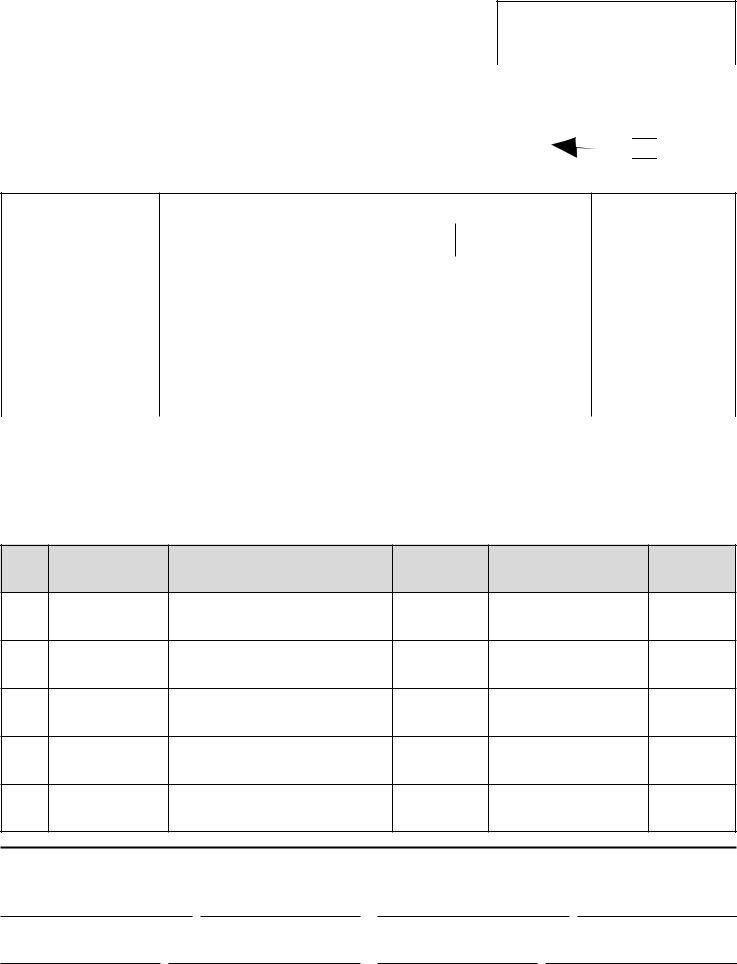

62A500 |

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR OFFICIAL USE ONLY |

|

|

||||||||||||||||||||||

Commonwealth of Kentucky |

|

|

|

|

|

|

TANGIBLE PERSONAL |

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

County Code |

|

|

|

Locator Number |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

DEPARTMENT OF REVENUE |

|

PROPERTY TAX RETURN |

|

|

T __ __ __ / __ __ __ __ __ |

|||||||||||||||||||||||||||||||||||

Station 32 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Due Date: |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Property Assessed January 1, 2021 |

|

|

|

|

|

|

|

|

|

MAY 2021 |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monday |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S M T W T F S |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

May 17, 2021 |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Forms filed on or before due date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

See pages 11 and 12 for a complete |

File the return with the PVA in the county of taxable situs. |

|

|

|

|

|

|

|

|

|

|

2 |

3 |

4 |

5 |

6 |

7 |

8 |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

9 |

|

10 |

|

11 |

12 |

13 |

14 |

15 |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

list of mailing addresses. |

|

|

|

|

There is no filing extension for this return. |

|

|

|

|

|

|

|

|

16 |

17 |

18 |

19 |

20 21 22 |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

|

24 |

25 26 27 28 29 |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

31 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Check applicable box and write in |

Name of Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Organization |

|

|

|

|

Type |

|||||||||||||||||||

|

Federal ID No. or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual |

|

|

|

1 |

||||||||||||

|

Social Security No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

Name of Taxpayer(s) |

|

|

|

|

|

|

Telephone Number |

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

Joint |

|

2 |

||||||||||

|

2nd SSN if joint return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partnership/LLP |

|

3 |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Corp./ |

|

|

||||||||||||||||

NAICS |

|

|

|

|

|

|

|

|

|

City or Town |

|

|

|

State |

|

|

|

ZIP Code |

|

4 |

||||||||||||||||||||

CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LLC |

|

|

|

|

|

||||||

|

Type of Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

Property Location (Number and Street or Rural Route, City)(Must List) REQUIRED |

|

|

|

|

|

Foreign Corp./ |

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LLC |

|

|

|

|

|

5 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Check if applicable |

|

|

|

|

Yes |

Property is Located in |

County |

|

For Official Use Only |

|

|

6 |

||||||||||||||||||||||||||||

Tangible in other KY counties? |

|

|

|

|

|

|

District Code |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Alternative valuation? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Type Return |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Final Return? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|