Form 62A500 S1 is a document used to declare the value of assets held by an individual. The form is completed by individuals and organizations that are not subject to tax on their worldwide income. The form is also used to declare certain types of income and provides information on the ownership of assets. The form must be filed with the IRS every year, regardless of whether any changes have occurred since the last filing.

| Question | Answer |

|---|---|

| Form Name | Form 62A500 S1 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | 2012dealer 62a500 s1 11 11 form |

|

|

|

|

|

|

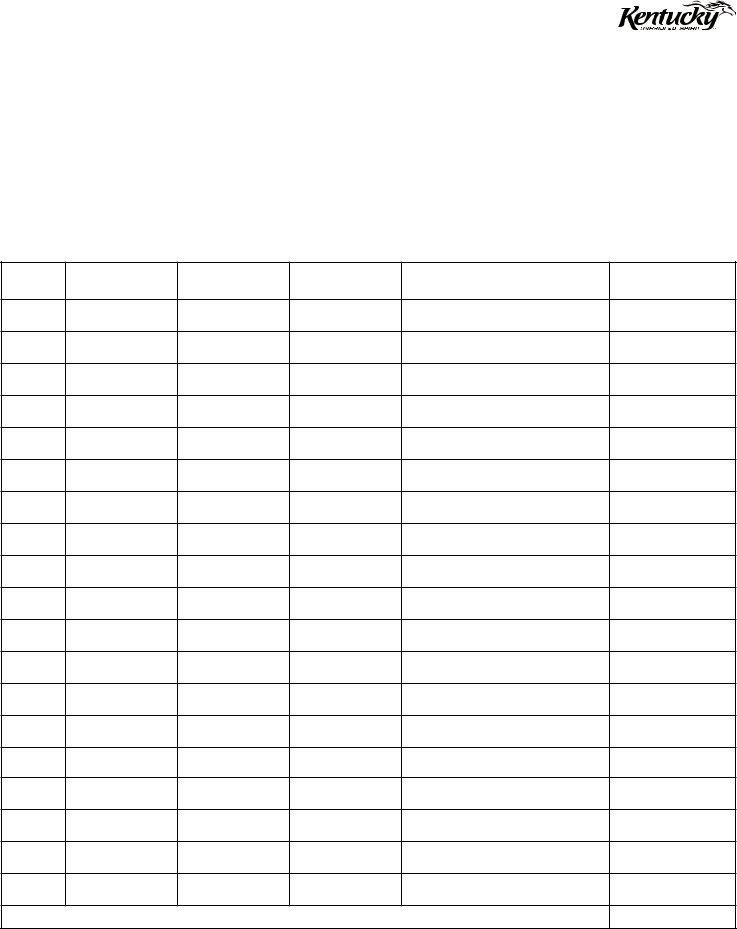

Page No. ______ |

||||

Commonwealth of Kentucky |

AUTOMOBILE DEALER'S INVENTORY LISTING FOR LINE 34 |

|

|

|||||||

DEPARTMENT OF REVENUE |

|

|

TANGIBLE PERSONAL PROPERTY TAX RETURN |

|

|

|

||||

Office of Property Valuation |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||

State Valuation Branch |

|

|

|

|

|

|

|

|

||

Fourth Floor, Station 32 |

|

|

|

Property Assessed January 1, 2012 |

|

|

|

|

||

501 High Street |

|

|

|

|

|

|

|

|

||

Frankfort, KY |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security No. or |

|

Name of Business |

|

|

|

|

||

|

|

Federal ID No. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Dealer |

|

Telephone Number |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

2nd SSN if joint return |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||

|

|

Mailing Address |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or Town |

State |

|

ZIP Code |

|

|

|

Property is located in |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property Location (Number and Street or Rural Route, City) |

|

|

|

|

|

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year

Make

Model

License Plate Number

(If Applicable)

Vehicle Identification Number

NADA

Total From This Page ➤