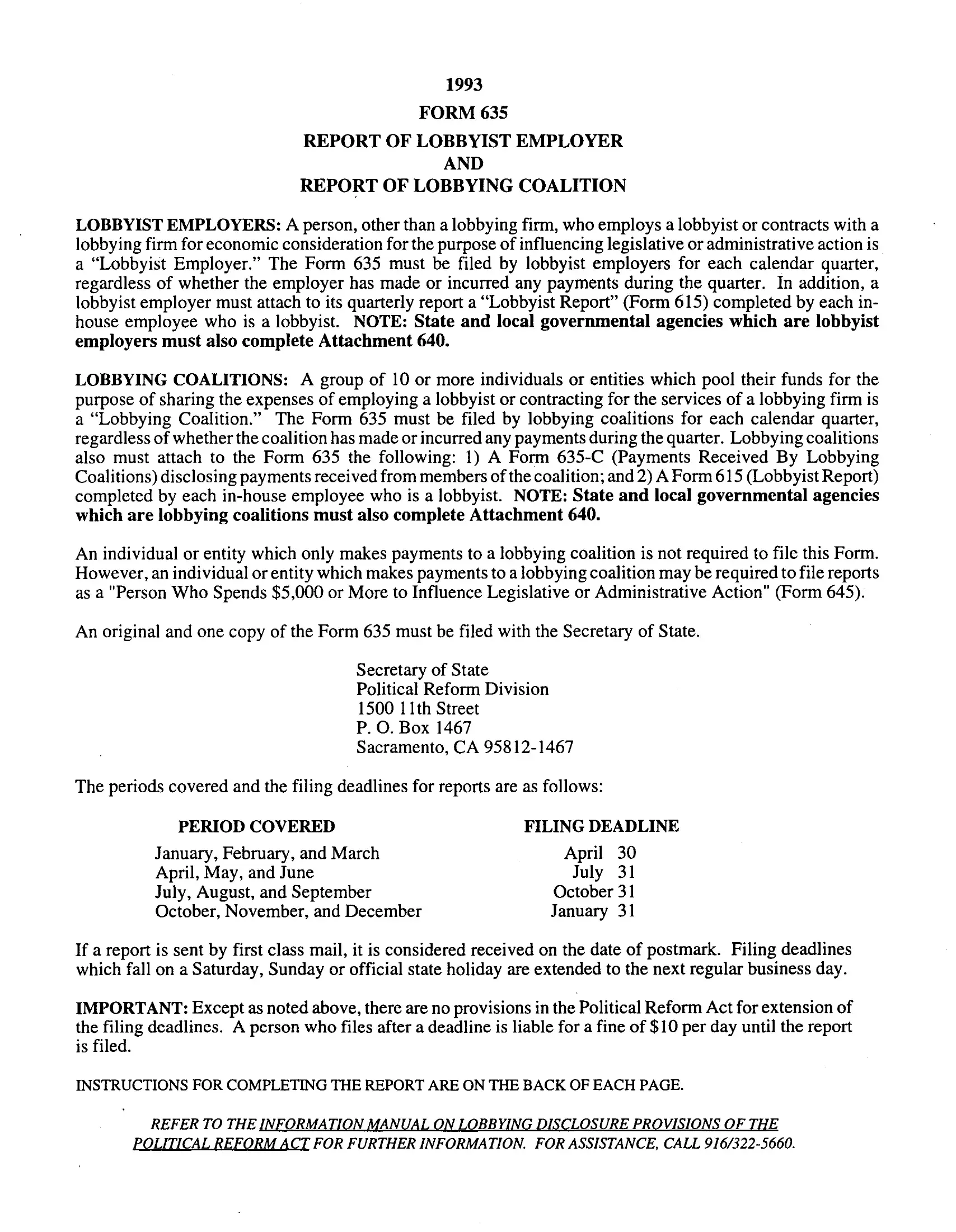

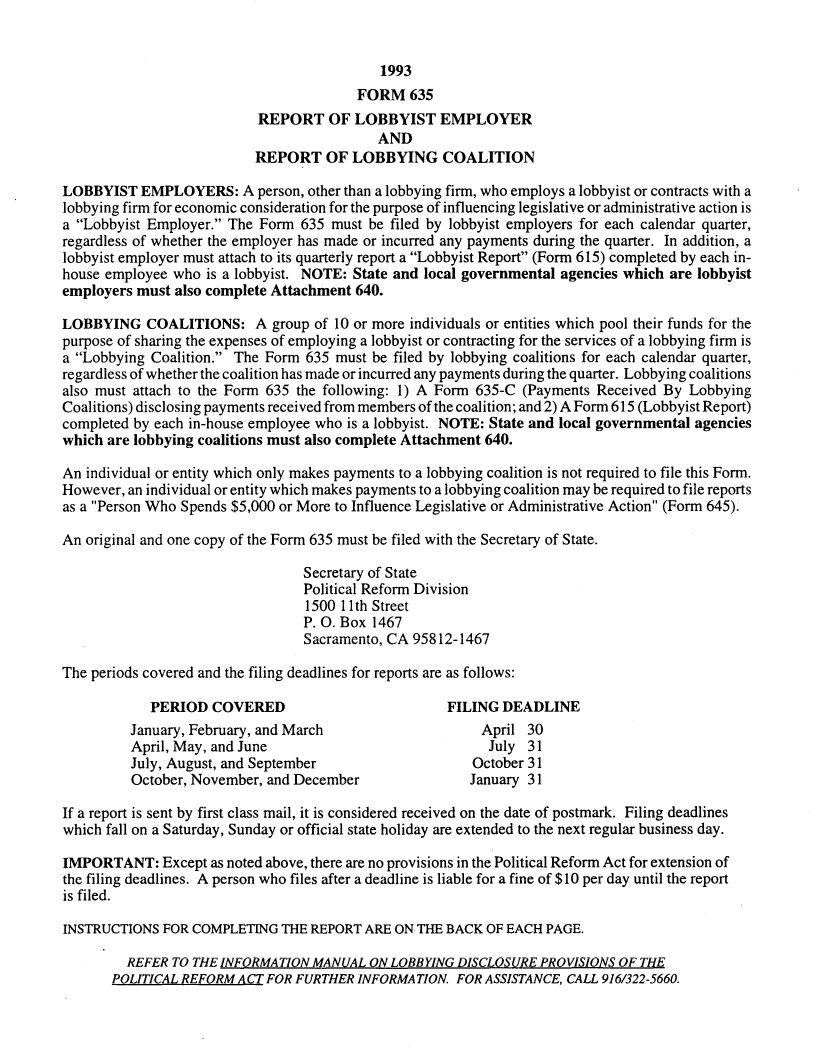

With the online PDF editor by FormsPal, you'll be able to fill in or modify eeedings right here. Our team is ceaselessly endeavoring to enhance the editor and help it become much better for people with its cutting-edge functions. Discover an ceaselessly progressive experience today - explore and find out new possibilities as you go! Starting is effortless! All you need to do is follow these easy steps directly below:

Step 1: Hit the "Get Form" button in the top area of this page to access our editor.

Step 2: Once you start the tool, you will find the form prepared to be completed. In addition to filling out different fields, you might also do various other actions with the Document, such as putting on your own words, modifying the original text, adding illustrations or photos, placing your signature to the PDF, and a lot more.

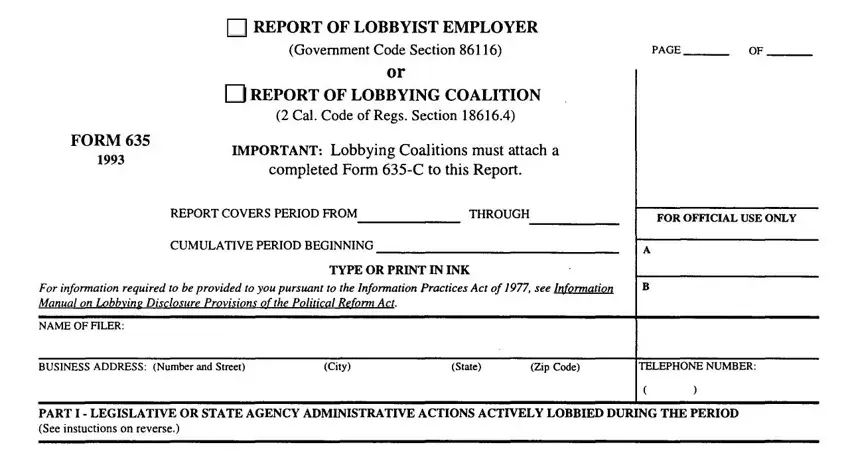

With regards to the blank fields of this particular document, this is what you want to do:

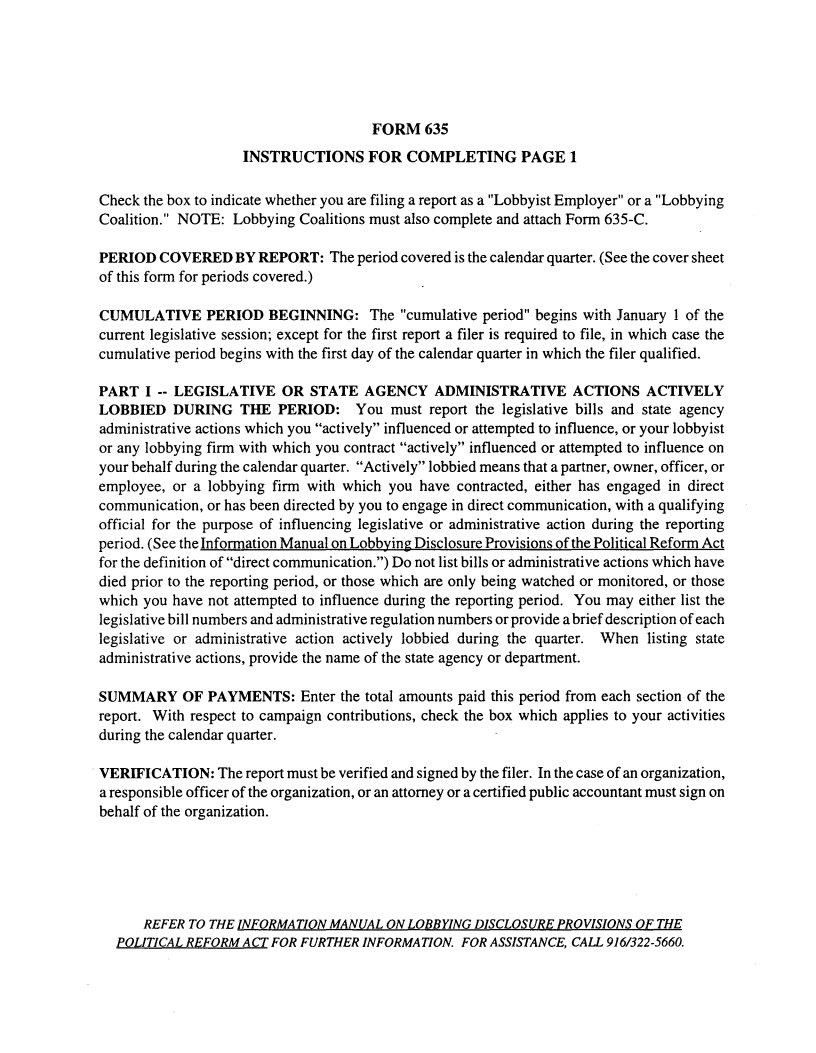

1. Whenever completing the eeedings, make certain to complete all of the needed blank fields in the relevant section. It will help to facilitate the process, enabling your details to be processed efficiently and properly.

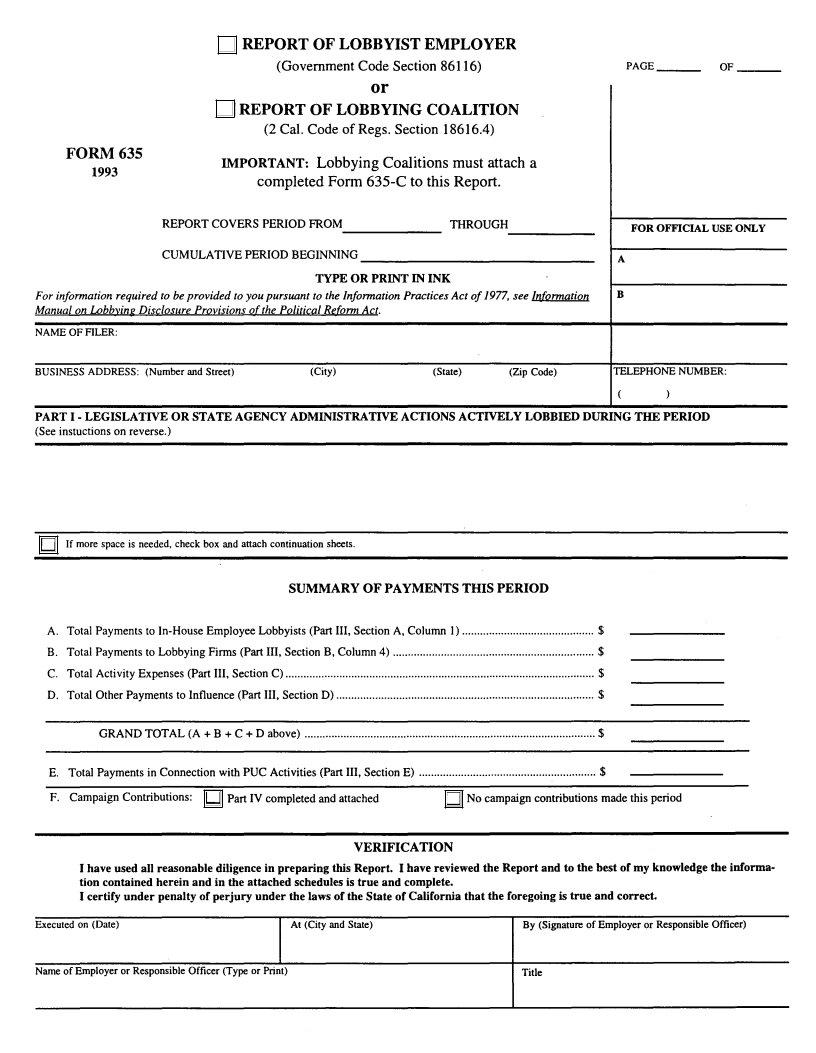

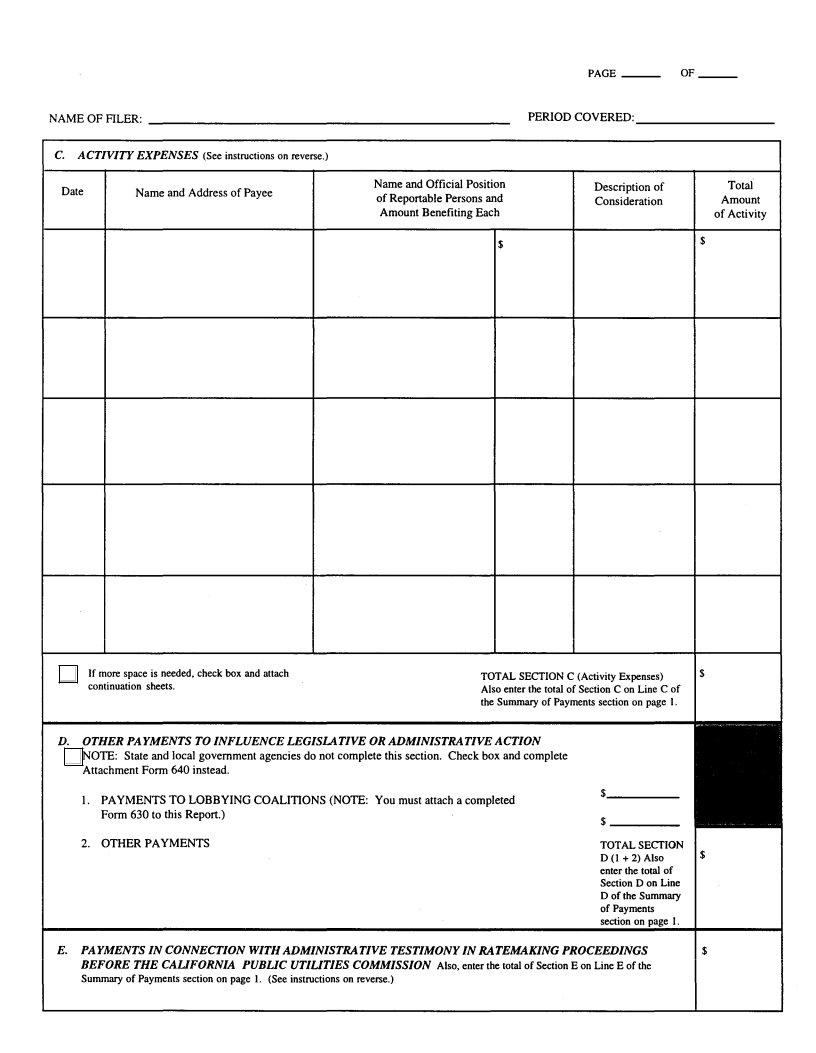

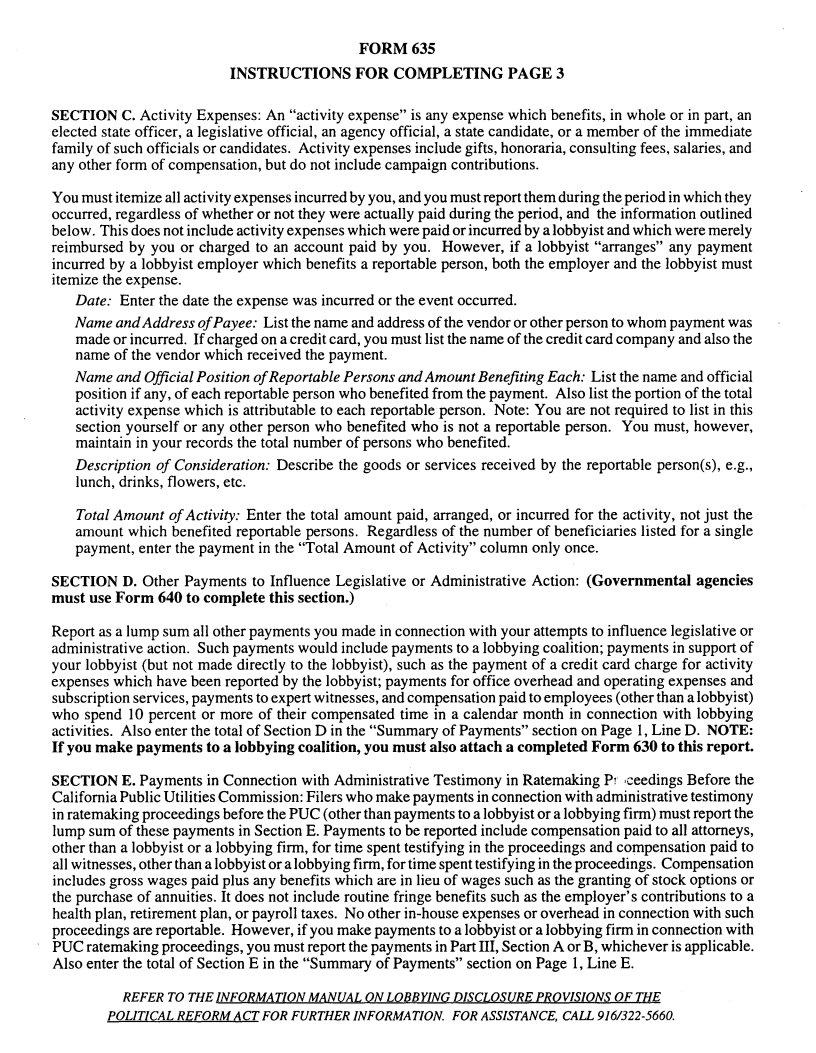

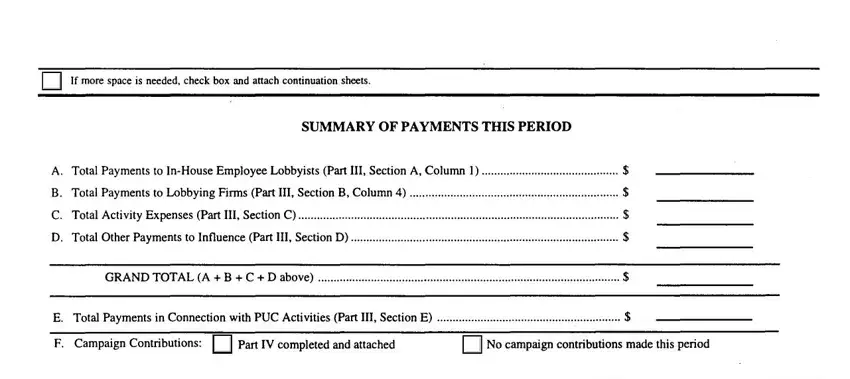

2. Right after this array of blanks is filled out, go on to enter the relevant information in these - D If more space is needed check, SUMMARY OF PAYMENTS THIS PERIOD, A Total Payments to InHouse, B Total Payments to Lobbying Firms, C Total Activity Expenses Part III, D Total Other Payments to, GRAND TOTAL A B C above, E Total Payments in Connection, and D No campaign contributions made.

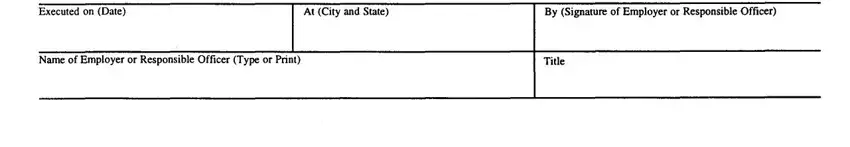

3. Completing Executed on Date, At City and State, By Signature of Employer or, Name of Employer or Responsible, and Title is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Always be extremely attentive when completing At City and State and Name of Employer or Responsible, as this is where most people make some mistakes.

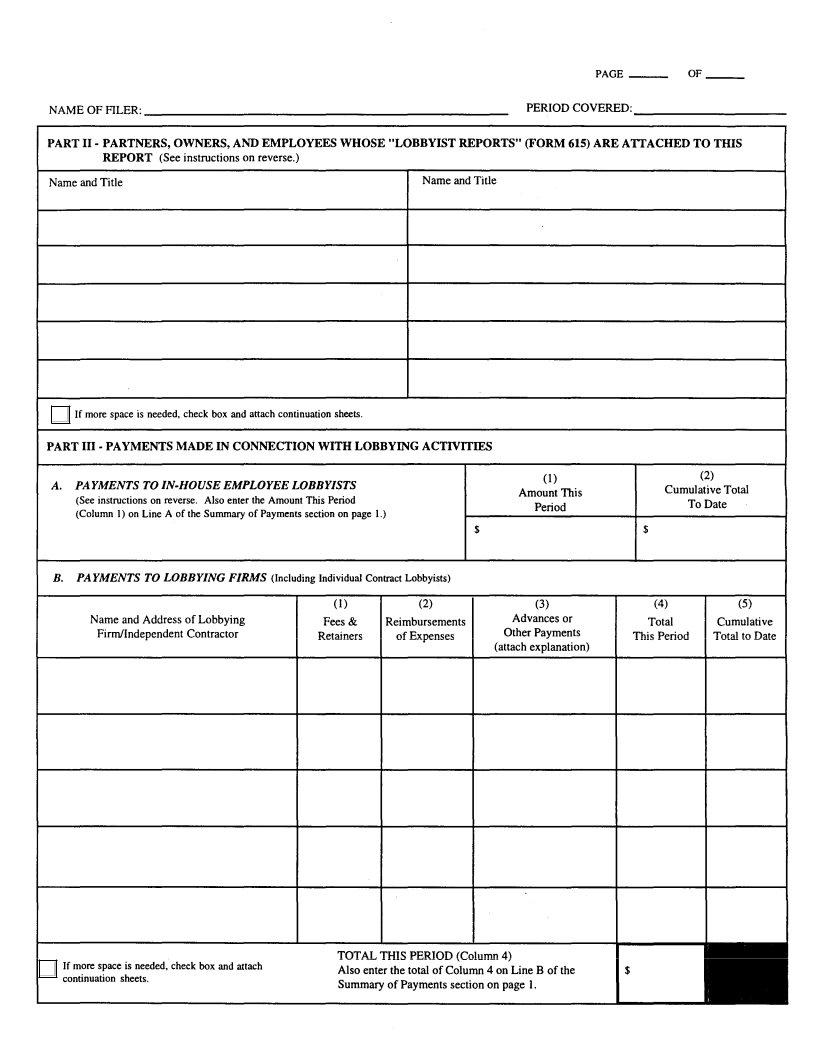

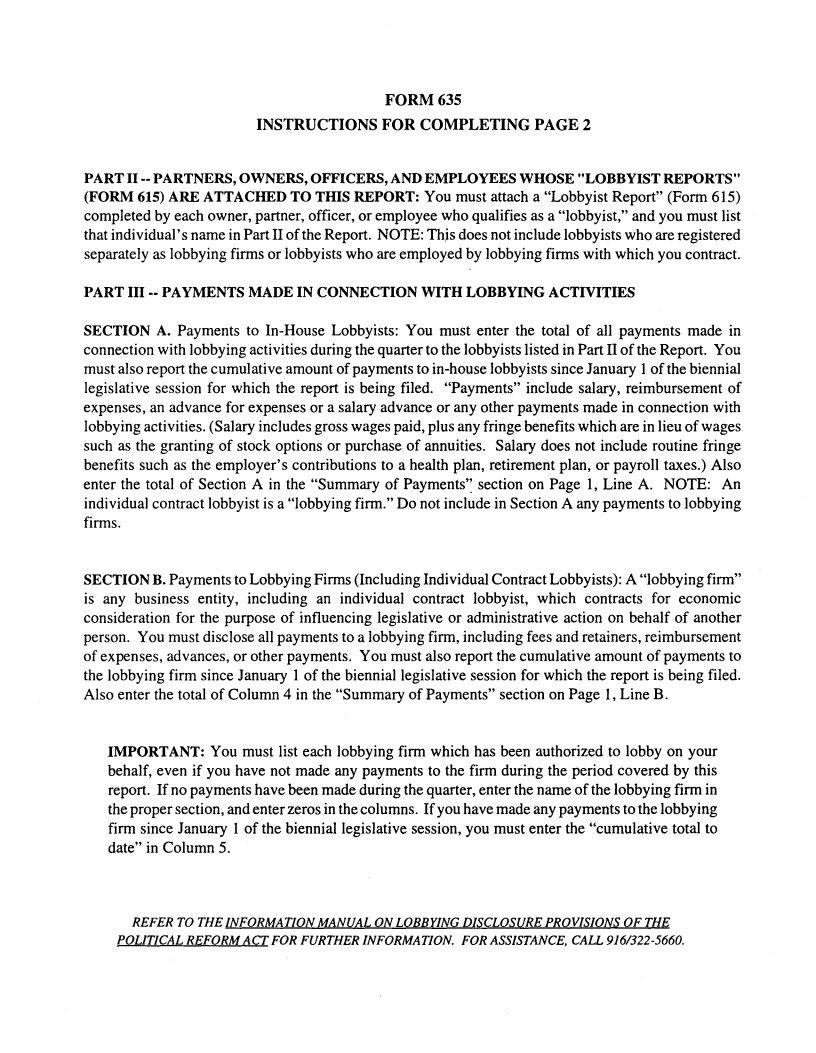

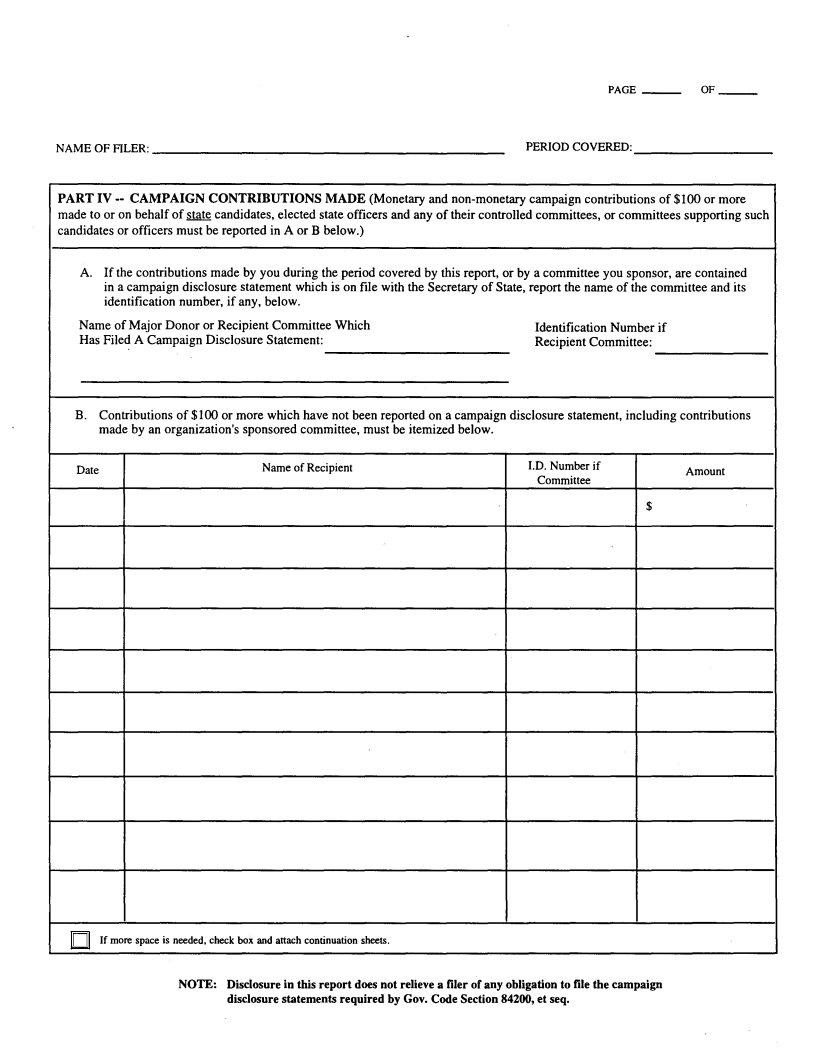

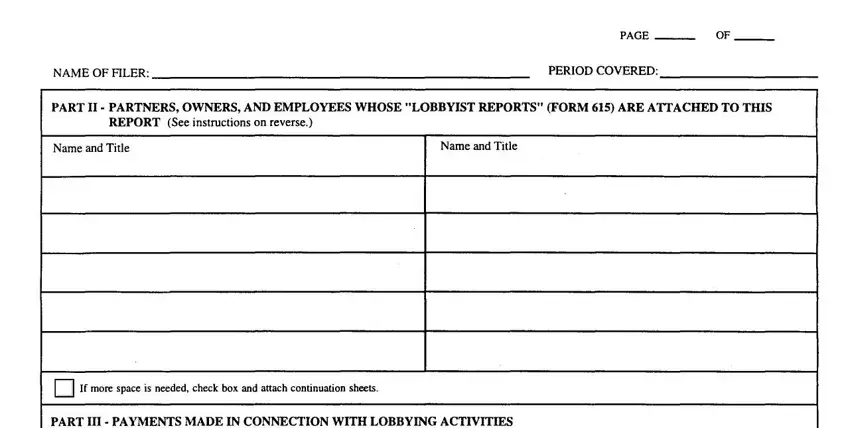

4. To move forward, this step involves completing a couple of form blanks. Included in these are NAME OF FILER, PERIOD COVERED, PART II PARTNERS OWNERS AND, REPORT See instructions on reverse, Name and Title, Name and Title, PAGE OF, D If more space is needed check, and PART III PAYMENTS MADE IN, which are integral to moving forward with this particular PDF.

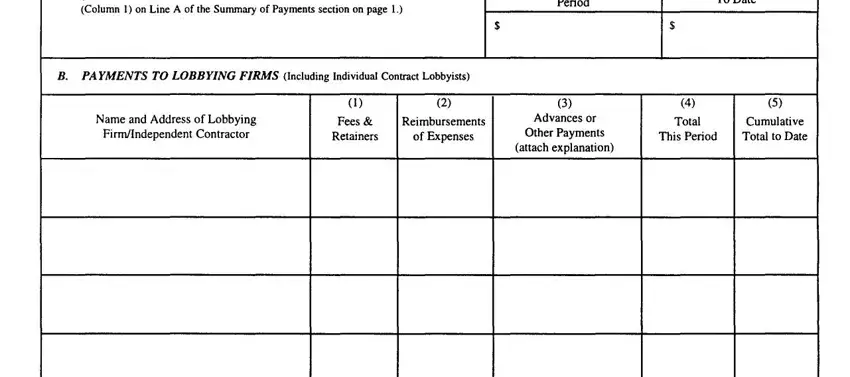

5. When you reach the conclusion of this form, there are a few extra requirements that need to be met. Specifically, A PAYMENTS TO INHOUSE EMPLOYEE, Period, To Date, B PAYMENTS TO LOBBYING FIRMS, Name and Address of Lobbying, FirmIndependent Contractor, Fees, Reimbursements, Retainers, of Expenses, Advances or, Other Payments, attach explanation, Total, and This Period should be done.

Step 3: Reread everything you have entered into the blanks and then hit the "Done" button. Go for a free trial account at FormsPal and obtain instant access to eeedings - downloadable, emailable, and editable from your personal account. We don't share or sell any information you provide while dealing with forms at FormsPal.