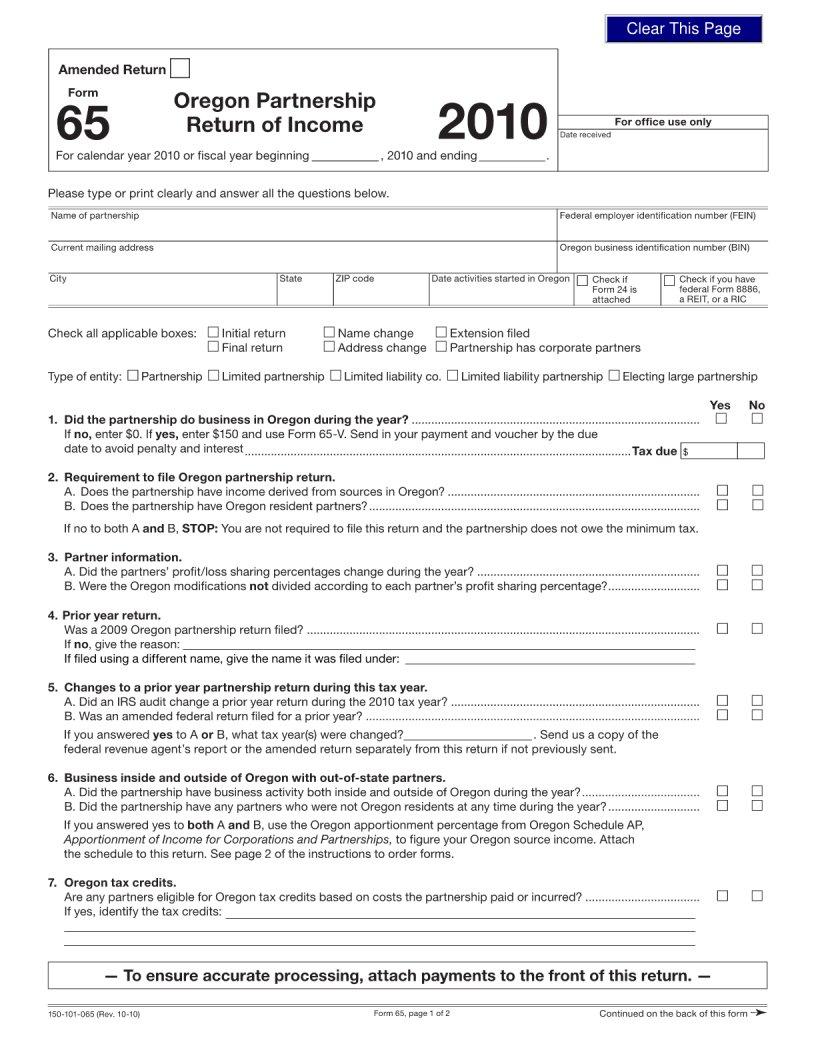

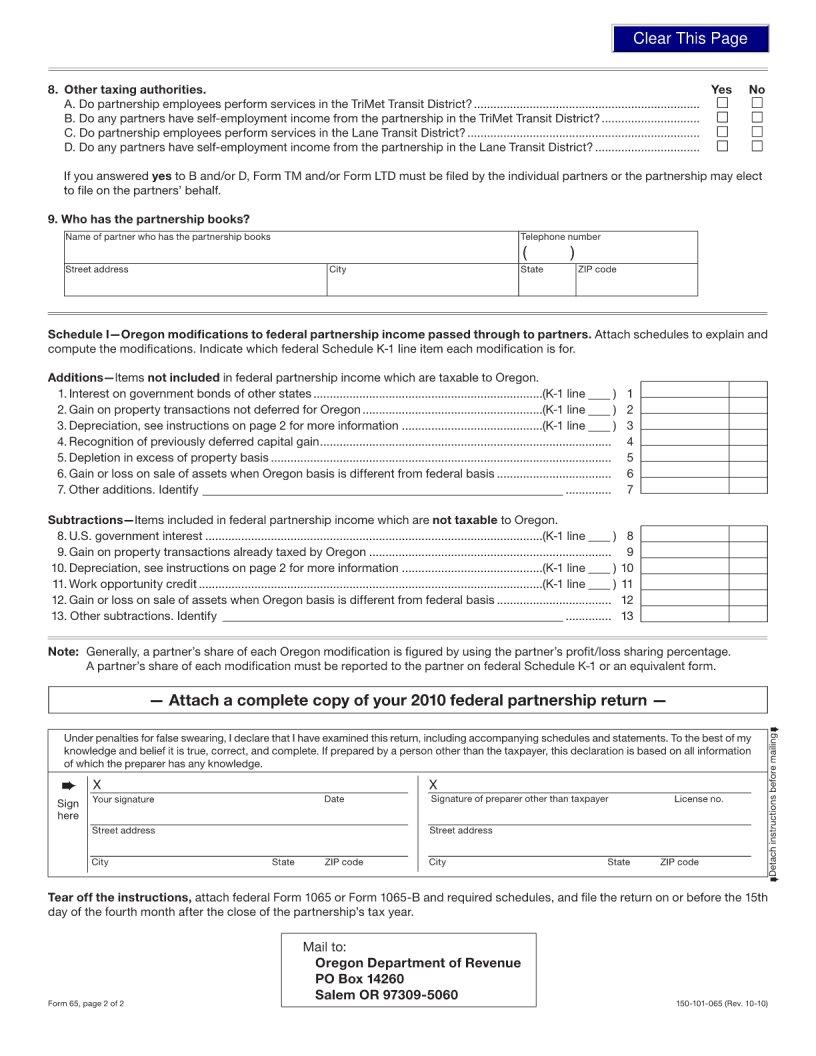

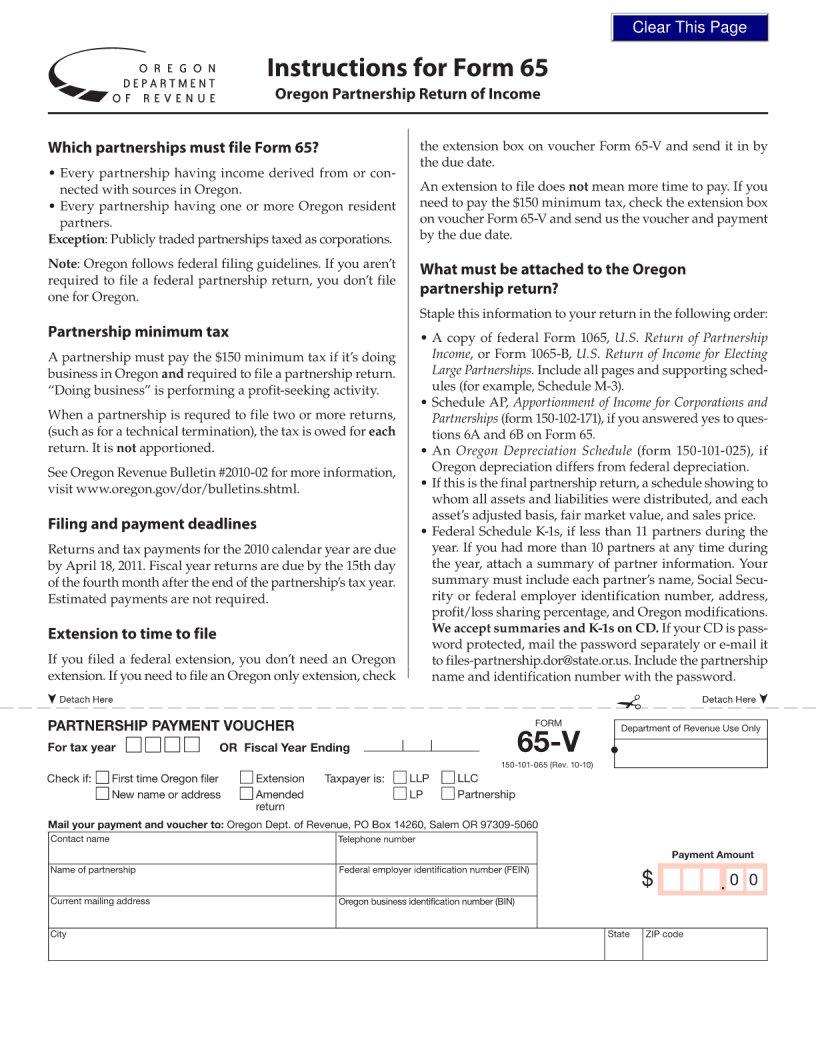

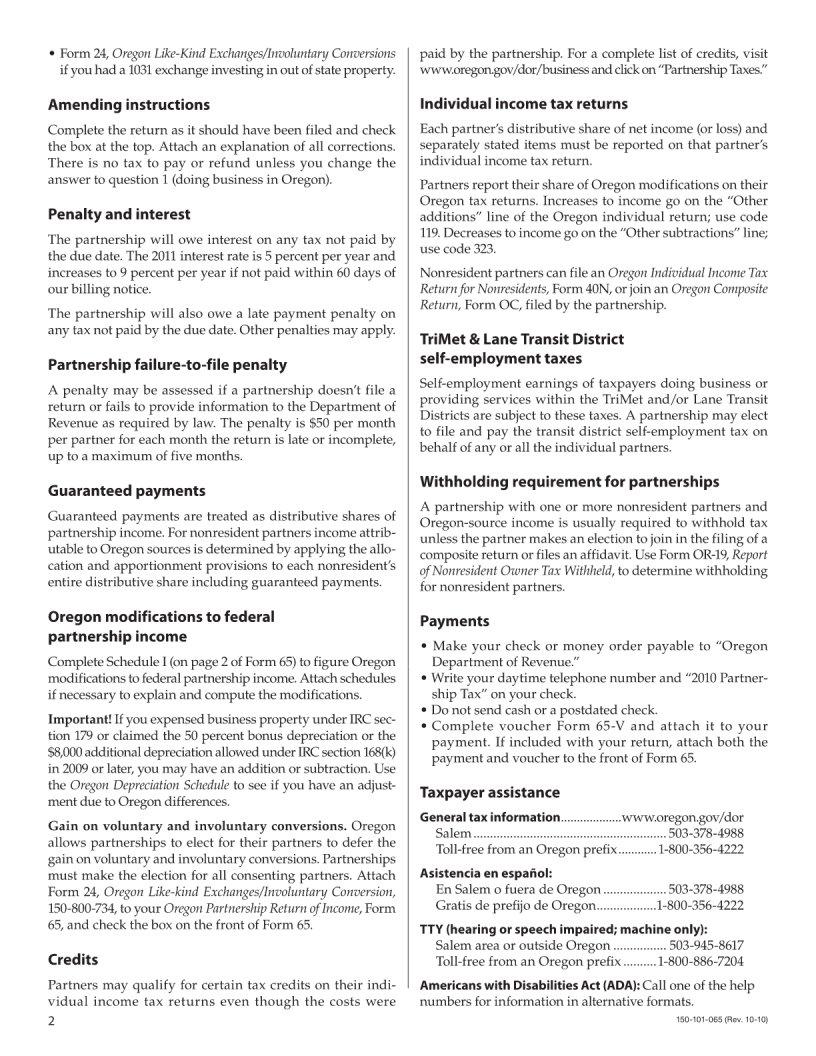

Embarking on the journey of understanding legal documents can often be daunting, especially when it comes to those pivotal in the realm of tax compliance and business operations. Among such critical documents is the 65 Oregon form, a cornerstone for entities navigating the complexities of reporting and tax obligations in the state of Oregon. This form serves multiple purposes, facilitating a clear pathway for businesses to declare their income, deductions, and credits in alignment with state regulations. It's designed to ensure transparency and compliance, enabling entities to effectively communicate their financial activities within a given fiscal year. As businesses endeavor to fulfill their tax responsibilities, the 65 Oregon form emerges as a vital tool, streamlining the process of maintaining fiscal discipline and adherence to state laws. Understanding its structure, requirements, and the nuances of its completion can profoundly impact a business's ability to operate within the legal frameworks, making a thorough comprehension of this document indispensable for entrepreneurs and financial professionals alike.

| Question | Answer |

|---|---|

| Form Name | Form 65 Oregon |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | 15th, oregon form 65, apportionment, 2011 |