Should you desire to fill out form f656, you won't have to download and install any software - simply try our online tool. Our tool is consistently evolving to grant the best user experience achievable, and that's thanks to our resolve for constant enhancement and listening closely to user comments. To get started on your journey, consider these simple steps:

Step 1: Open the PDF form inside our tool by clicking the "Get Form Button" above on this webpage.

Step 2: The editor gives you the ability to modify PDF forms in a variety of ways. Transform it with your own text, adjust what's already in the PDF, and put in a signature - all at your disposal!

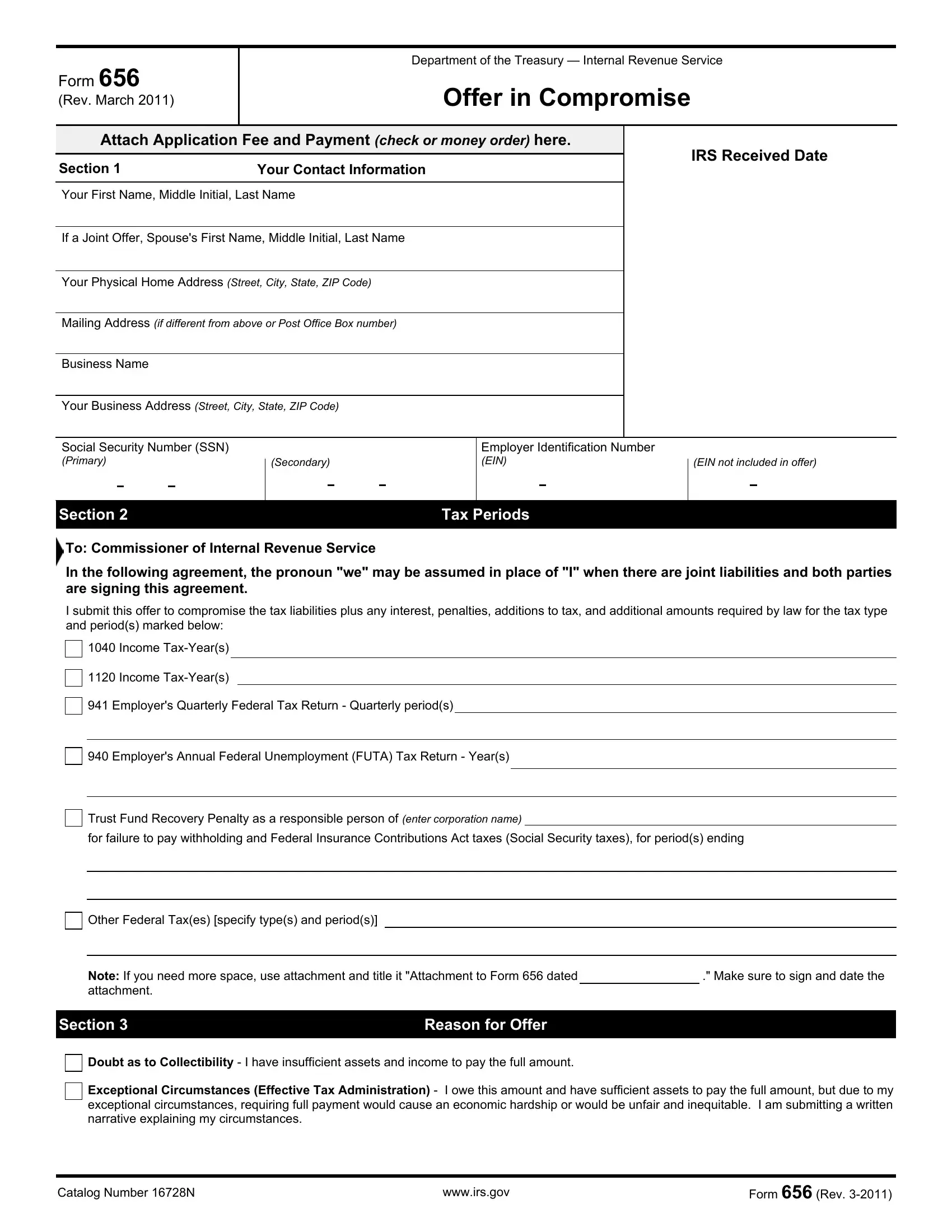

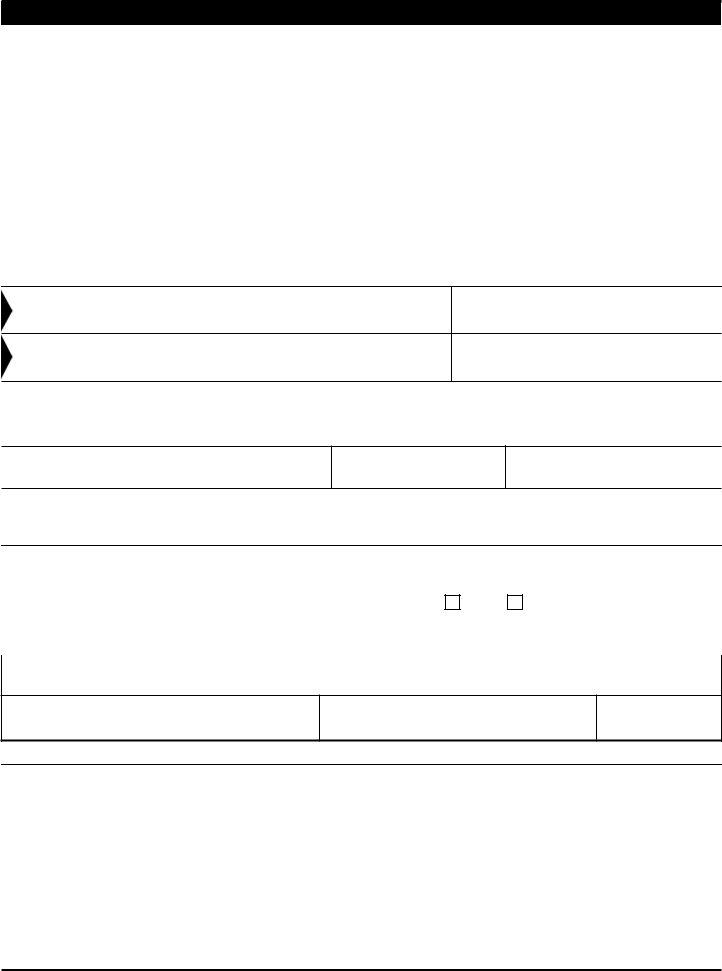

As for the blank fields of this specific form, here is what you need to know:

1. The form f656 usually requires certain details to be typed in. Be sure the subsequent fields are completed:

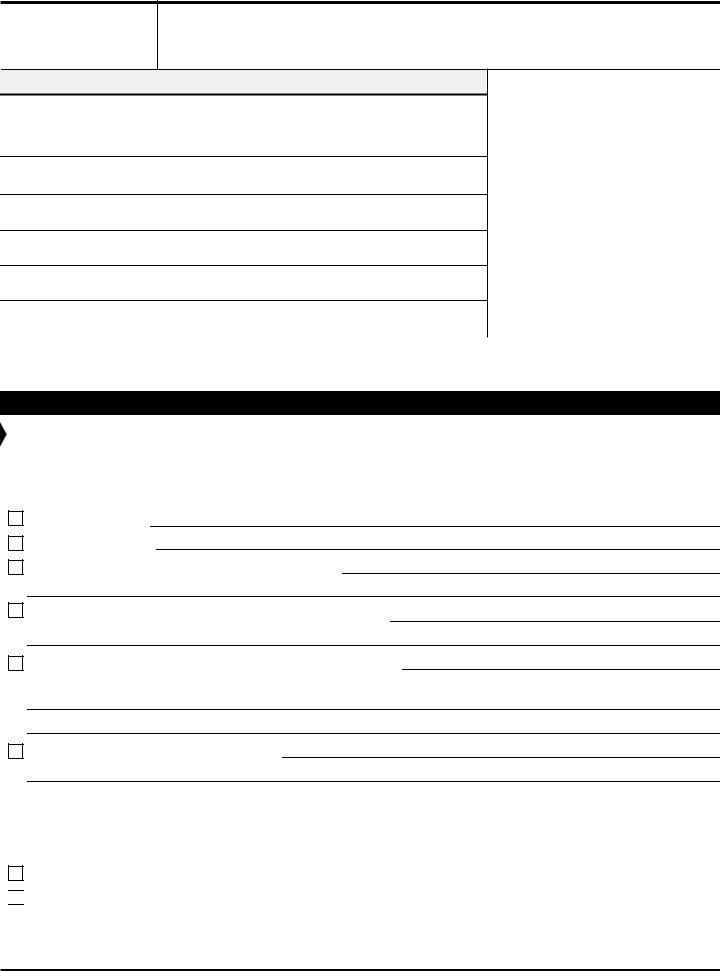

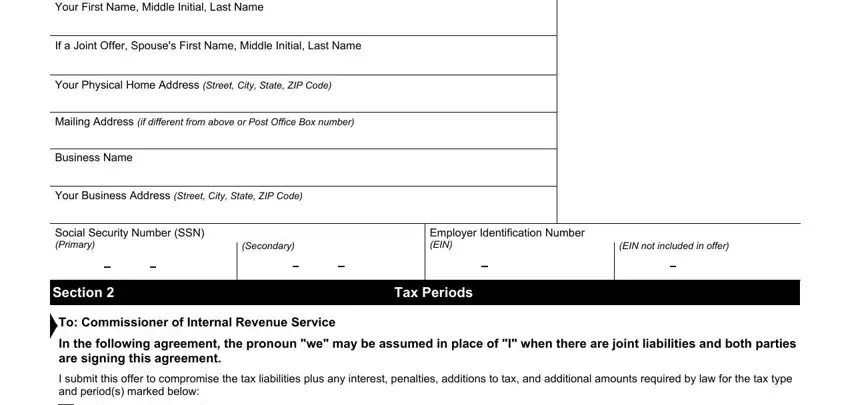

2. The subsequent stage would be to fill out these particular fields: Income TaxYears, Income TaxYears, Employers Quarterly Federal Tax, Employers Annual Federal, Trust Fund Recovery Penalty as a, for failure to pay withholding and, Other Federal Taxes specify types, Note If you need more space use, Make sure to sign and date the, Section, Reason for Offer, Doubt as to Collectibility I have, and Exceptional Circumstances.

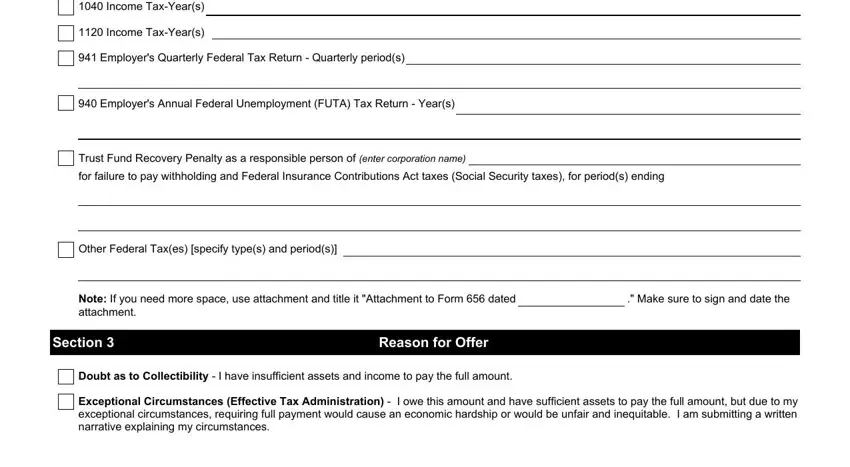

3. Completing Explanation of Circumstances Add, Section, Low Income Certification, Do you qualify for LowIncome, Check here if you qualify for, Size of family unit, contiguous states and DC, Hawaii, and Alaska is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

It is easy to get it wrong while filling out your Check here if you qualify for, and so make sure that you look again before you decide to finalize the form.

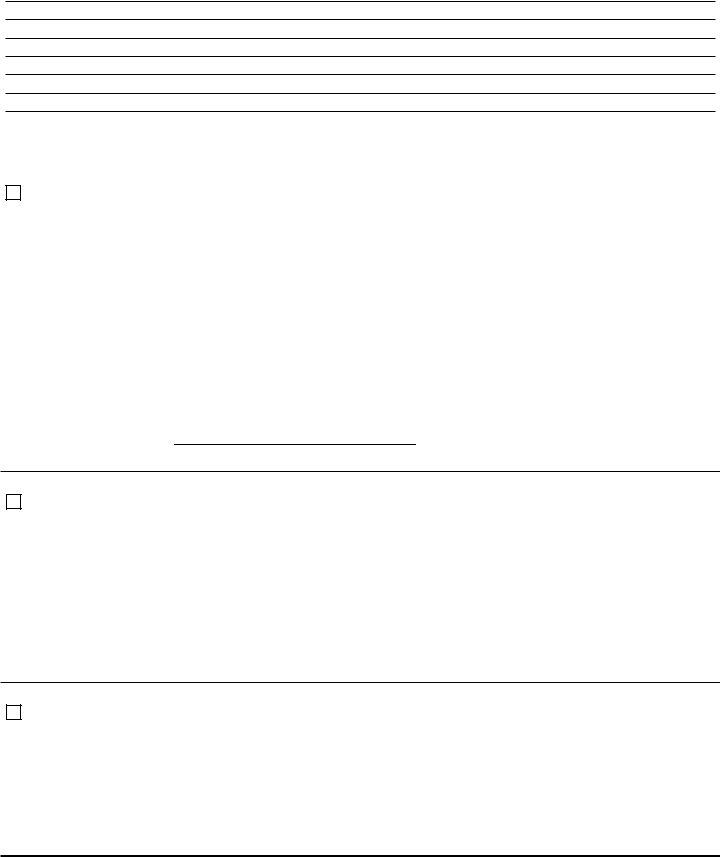

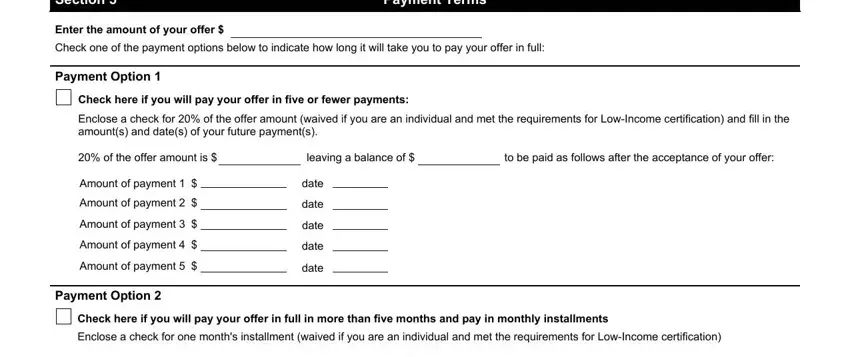

4. Now proceed to this next portion! Here you've got all these Section, Enter the amount of your offer, Payment Terms, Check one of the payment options, Payment Option, Check here if you will pay your, Enclose a check for of the offer, of the offer amount is, leaving a balance of, to be paid as follows after the, Amount of payment, Amount of payment, Amount of payment, Amount of payment, and Amount of payment form blanks to complete.

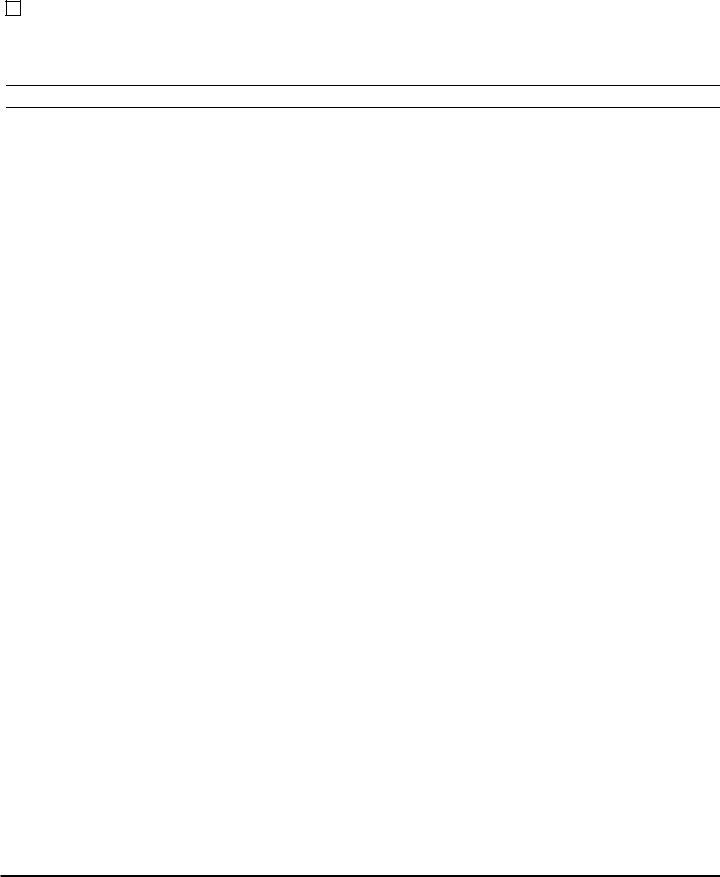

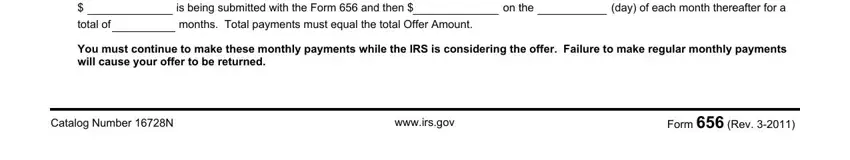

5. This document should be concluded by filling out this part. Below you will see a detailed set of blanks that must be completed with accurate details in order for your document submission to be faultless: total of, is being submitted with the Form, on the, day of each month thereafter for a, months Total payments must equal, You must continue to make these, Catalog Number N, wwwirsgov, and Form Rev.

Step 3: As soon as you've glanced through the details you given, press "Done" to conclude your form. Grab your form f656 after you sign up for a 7-day free trial. Readily use the pdf form inside your FormsPal account page, along with any edits and changes automatically synced! Whenever you work with FormsPal, you're able to fill out forms without needing to worry about database leaks or data entries being shared. Our protected software helps to ensure that your personal data is maintained safe.