masterfile can be filled out online with ease. Simply try FormsPal PDF tool to get it done right away. Our editor is consistently evolving to grant the best user experience achievable, and that is due to our dedication to constant development and listening closely to feedback from customers. For anyone who is seeking to get going, here is what it will take:

Step 1: Click on the "Get Form" button above. It will open up our tool so you can begin filling in your form.

Step 2: Once you start the PDF editor, you will see the document made ready to be filled out. Other than filling in different fields, it's also possible to do some other actions with the PDF, particularly putting on your own text, changing the initial text, inserting graphics, signing the document, and much more.

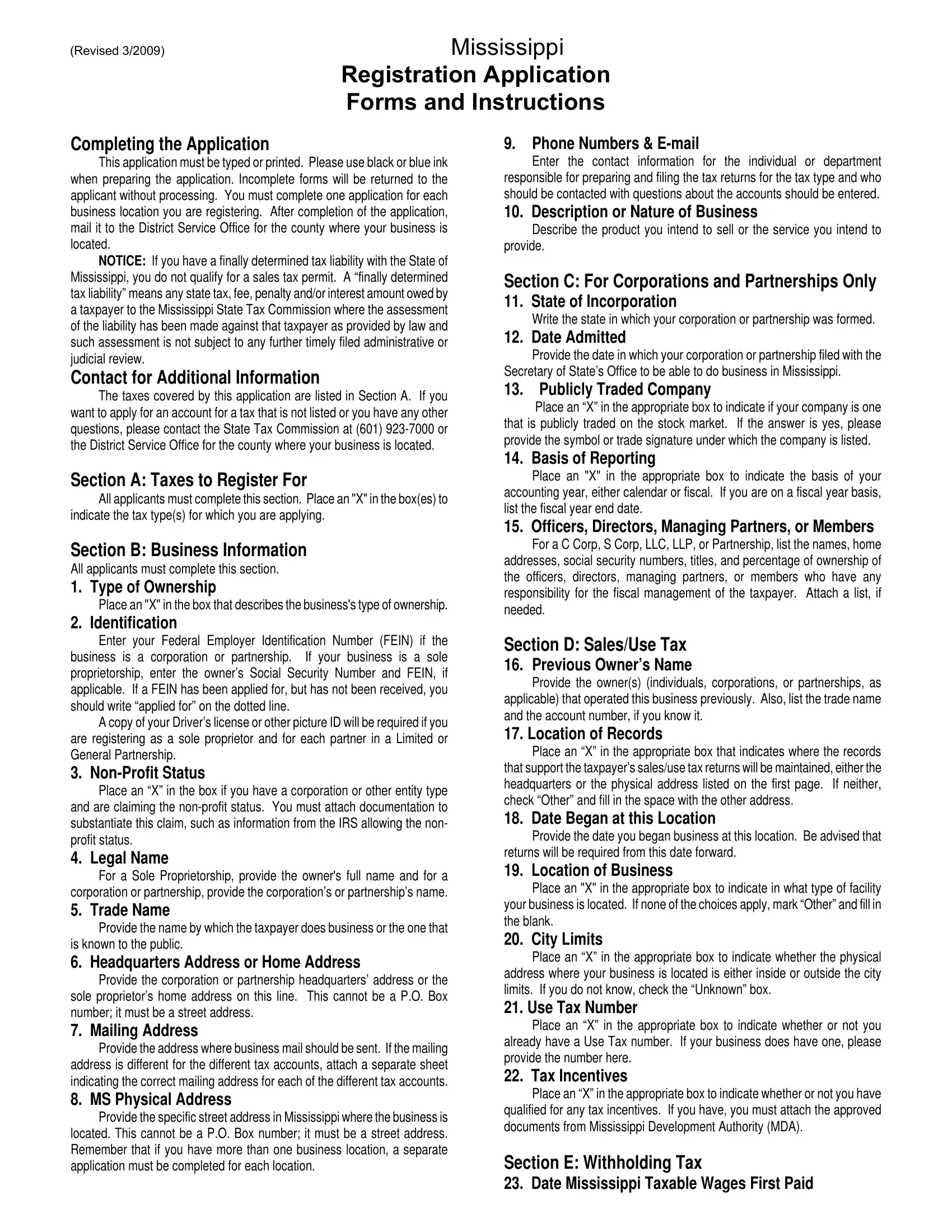

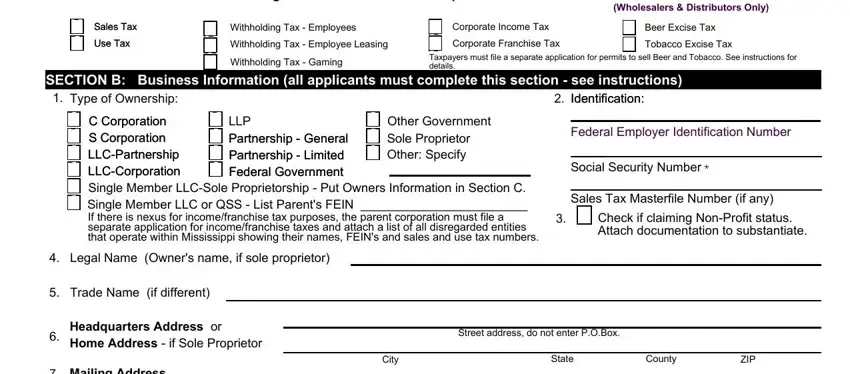

For you to complete this PDF form, ensure you provide the right information in each and every area:

1. While filling in the masterfile, ensure to complete all essential blanks within the relevant area. It will help to speed up the process, allowing for your information to be handled swiftly and properly.

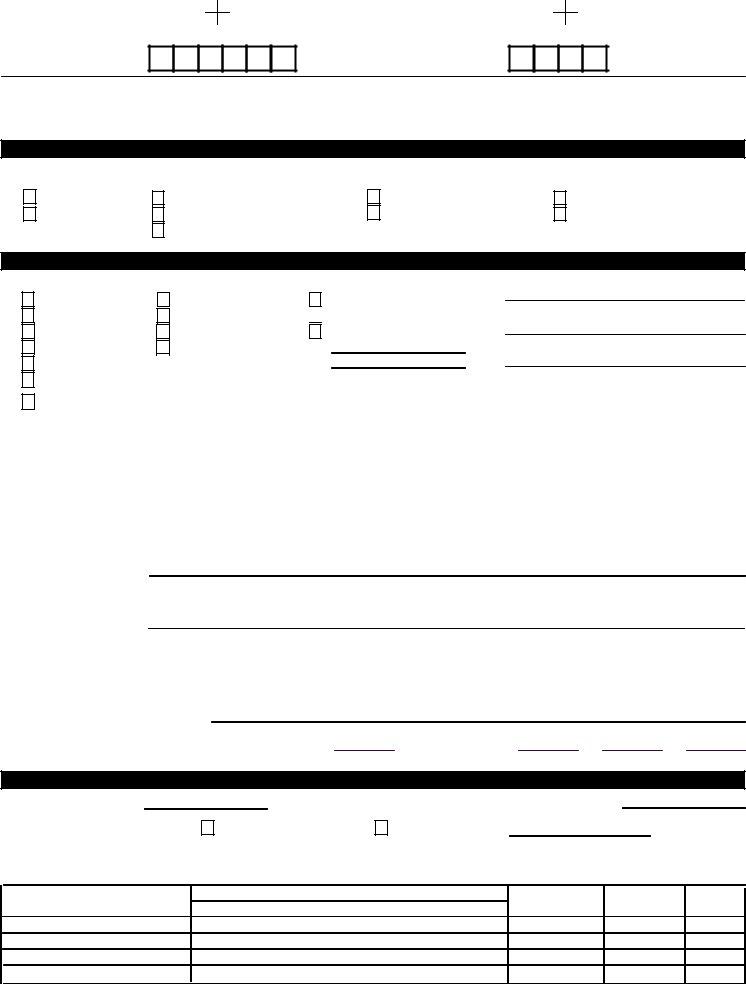

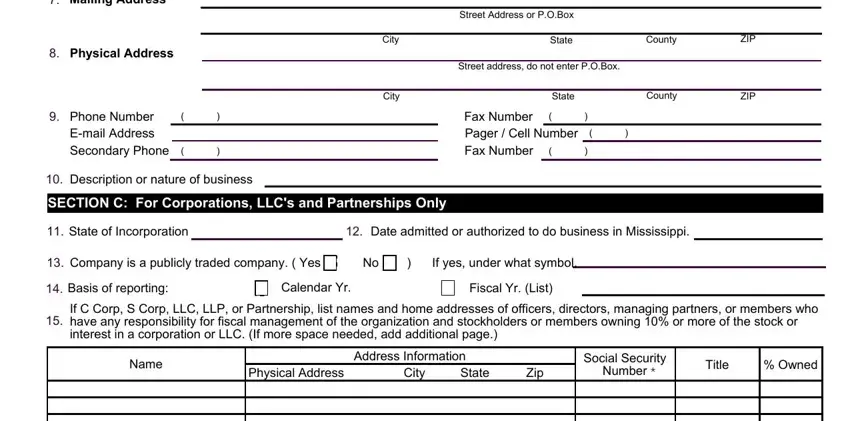

2. Given that the previous segment is done, you have to add the essential particulars in Mailing Address, Physical Address, Phone Number Email Address, Street Address or POBox, State, County, Street address do not enter POBox, State, County, City, City, ZIP, ZIP, Fax Number Pager Cell Number Fax, and Description or nature of business so you're able to proceed further.

3. Through this part, review This information will be used for, e and, ssss, and Disclosure Statement and Privacy. Each of these have to be completed with greatest precision.

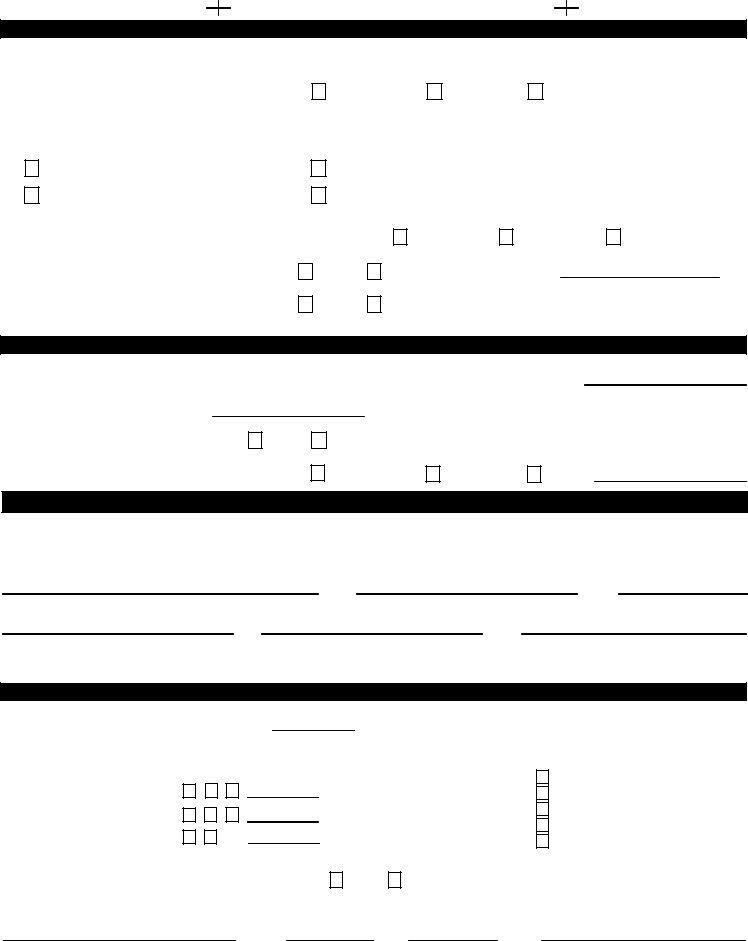

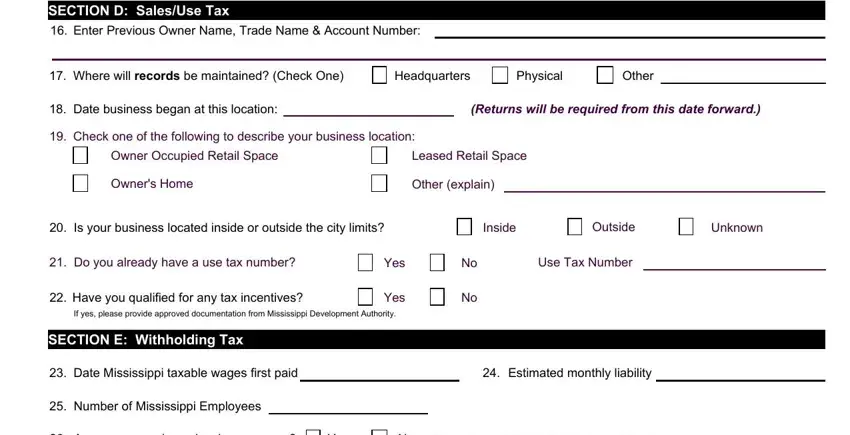

4. This next section requires some additional information. Ensure you complete all the necessary fields - SECTION D SalesUse Tax Enter, Where will records be maintained, Headquarters, Physical, Other, Date business began at this, Returns will be required from this, Check one of the following to, Owner Occupied Retail Space, Owners Home, Leased Retail Space, Other explain, Is your business located inside or, Inside, and Outside - to proceed further in your process!

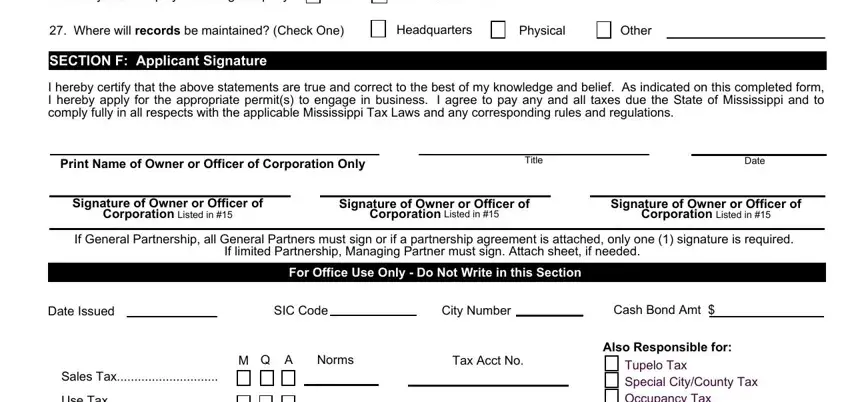

5. The form has to be finished by filling out this part. Below you'll find a full list of fields that require specific details to allow your document submission to be accomplished: Are you an employee leasing company, Yes, If yes contact your District, Where will records be maintained, Headquarters, Physical, Other, SECTION F Applicant Signature, I hereby certify that the above, Print Name of Owner or Officer of, Title, Date, Signature of Owner or Officer of, Corporation Listed in, and Signature of Owner or Officer of.

When it comes to Title and Signature of Owner or Officer of, be sure you don't make any mistakes here. These are the key fields in this form.

Step 3: Immediately after taking another look at the completed blanks, click "Done" and you are good to go! Find your masterfile the instant you subscribe to a 7-day free trial. Immediately view the pdf file from your FormsPal account, along with any edits and adjustments conveniently kept! At FormsPal, we aim to be sure that your details are stored protected.