Using PDF files online is simple with this PDF editor. You can fill in Form 706 Gs T here with no trouble. The tool is constantly upgraded by our staff, getting new awesome features and growing to be greater. This is what you'd need to do to begin:

Step 1: Access the PDF form in our editor by pressing the "Get Form Button" in the top section of this page.

Step 2: When you launch the online editor, you'll see the form prepared to be filled in. Aside from filling out different blank fields, you may also perform other sorts of actions with the PDF, specifically writing your own text, editing the initial textual content, adding graphics, signing the form, and more.

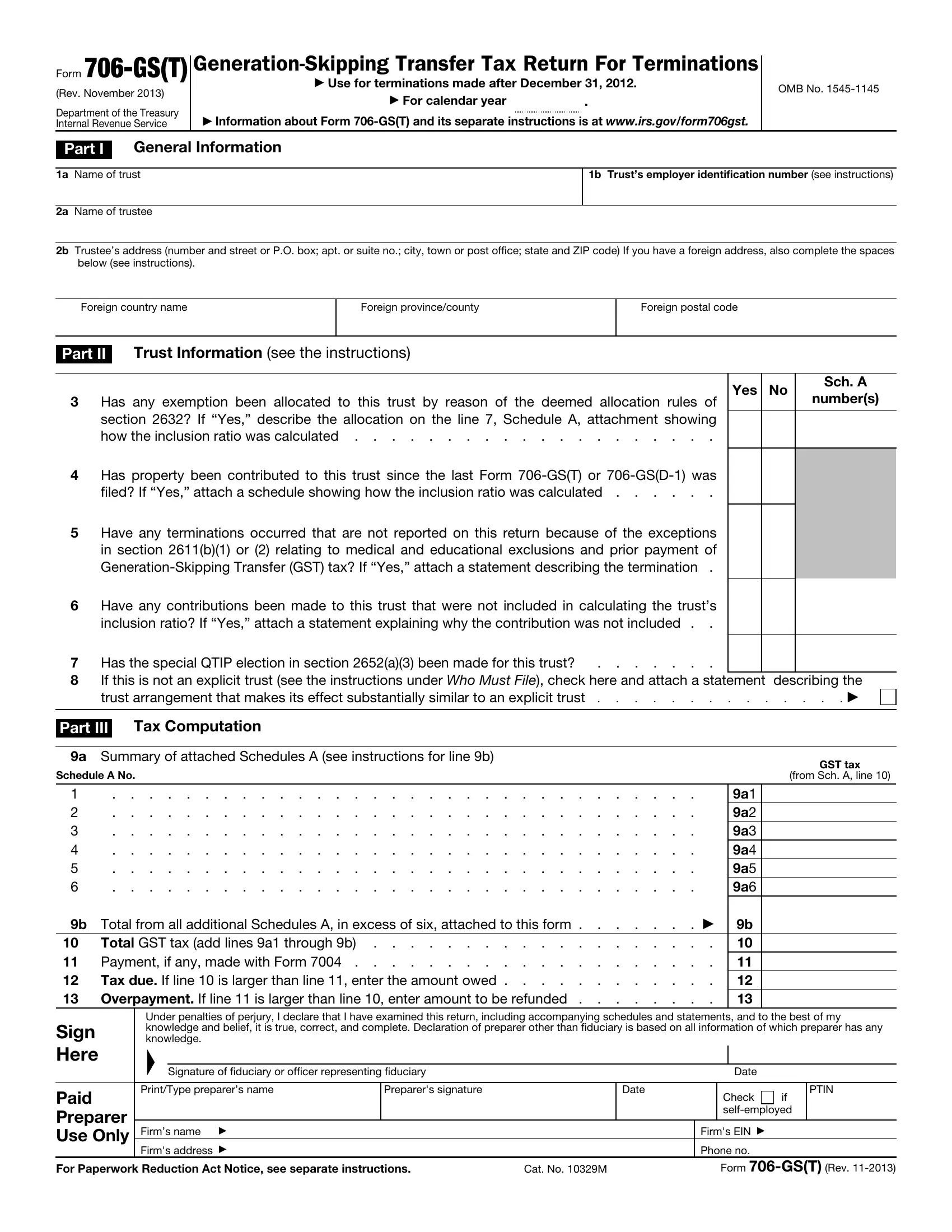

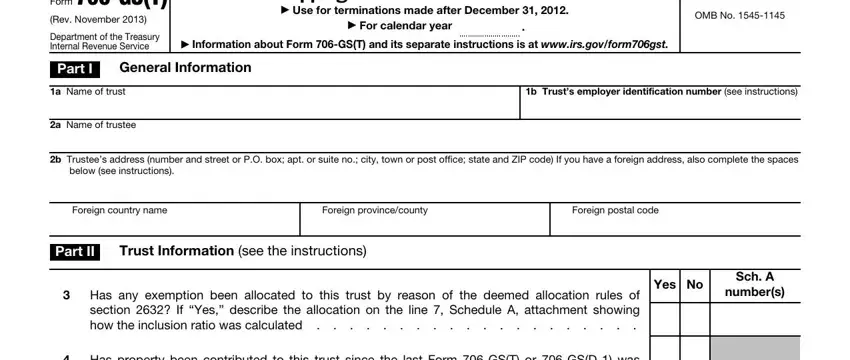

This form will need particular info to be typed in, so ensure you take your time to fill in what is requested:

1. Complete the Form 706 Gs T with a selection of necessary fields. Consider all of the required information and make sure nothing is forgotten!

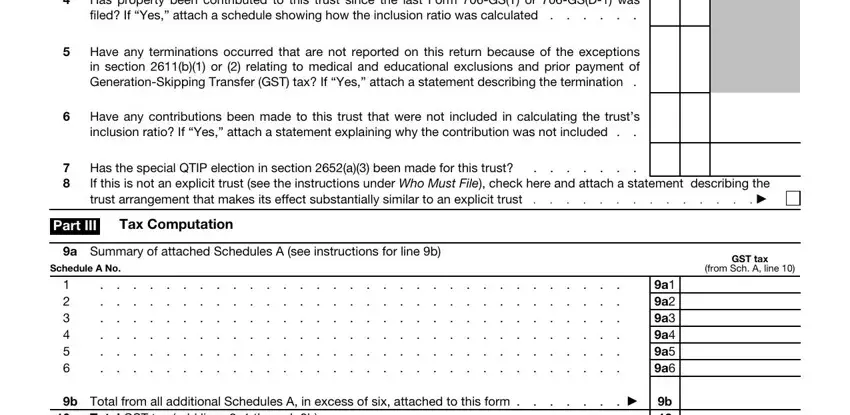

2. When this part is filled out, go to enter the relevant information in all these - Has property been contributed to, filed If Yes attach a schedule, Have any terminations occurred, Have any contributions been made, inclusion ratio If Yes attach a, Has the special QTIP election in, If this is not an explicit trust, Part III, Tax Computation, a Summary of attached Schedules A, Schedule A No, b Total from all additional, Total GST tax add lines a through, GST tax, and from Sch A line.

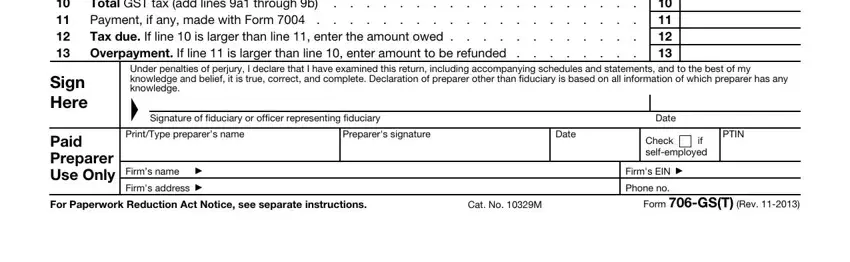

3. Within this step, examine b Total from all additional, Total GST tax add lines a through, Sign Here, Paid Preparer Use Only, Under penalties of perjury I, Signature of fiduciary or officer, PrintType preparers name, Preparers signature, Date, Firms name, Firms address, Date, Check if selfemployed, PTIN, and Firms EIN. Each one of these need to be taken care of with highest precision.

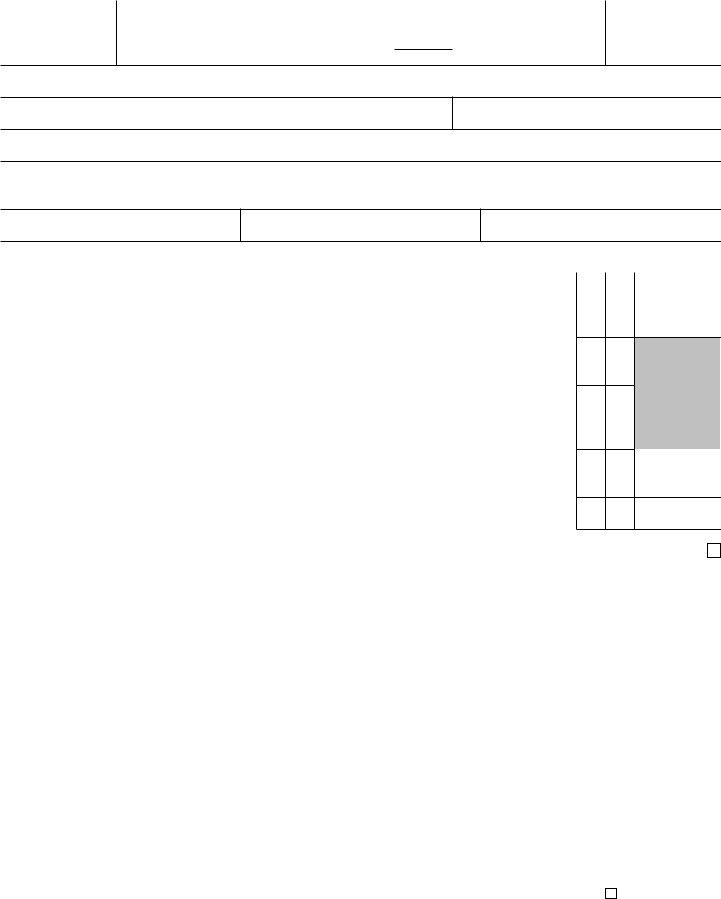

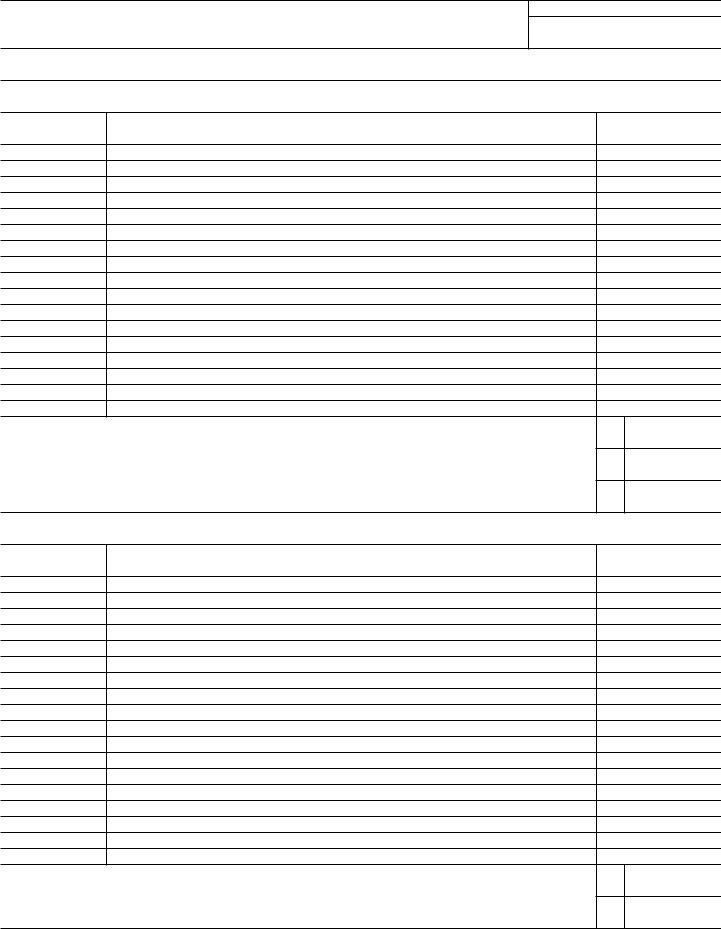

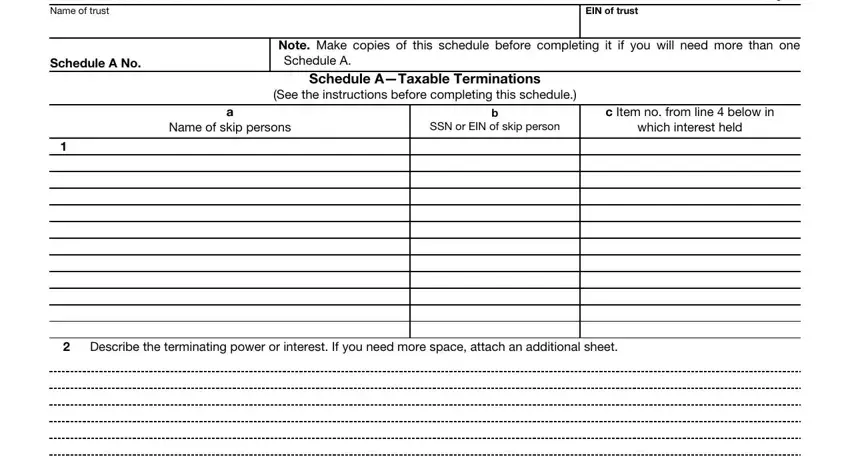

4. Filling out Form GST Rev, Name of trust, Schedule A No, EIN of trust, Page, Note Make copies of this schedule, Schedule ATaxable Terminations, See the instructions before, c Item no from line below in, Name of skip persons, SSN or EIN of skip person, which interest held, and Describe the terminating power or is vital in the fourth section - don't forget to devote some time and fill in each and every blank area!

A lot of people generally make some errors while completing Schedule A No in this part. Ensure you read again what you type in here.

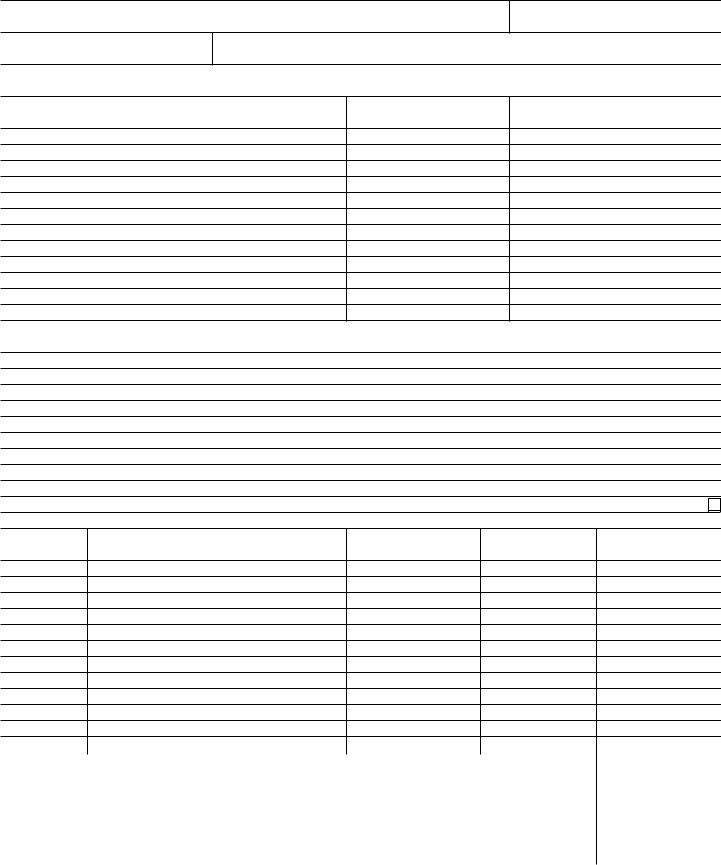

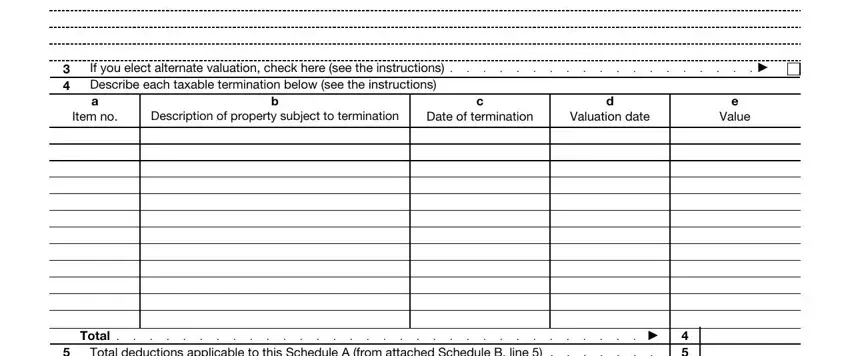

5. To conclude your document, the particular section includes a number of extra fields. Filling in If you elect alternate valuation, Describe each taxable, Item no, Description of property subject to, Date of termination, Valuation date, Value, Total, Total deductions applicable to, and Maximum federal estate tax will wrap up the process and you will be done in the blink of an eye!

Step 3: Right after you've reread the details provided, click "Done" to complete your form at FormsPal. Obtain your Form 706 Gs T the instant you register at FormsPal for a 7-day free trial. Instantly get access to the pdf in your personal account, along with any modifications and changes automatically synced! When you work with FormsPal, you can easily complete documents without the need to be concerned about information incidents or entries getting distributed. Our secure system helps to ensure that your private information is stored safe.