In the world of estate planning and tax compliance, the Form 706GS(T), also known as the Generation-Skipping Transfer Tax Return for Terminations, plays a critical role for trustees and tax professionals. Revised in November 1992 by the Department of the Treasury's Internal Revenue Service, this form is tasked with the intricate job of documenting and calculating taxes due on certain transfers from trusts that skip a generation, bypassing the immediate heirs for later generations. It encompasses a wide array of information, from general trust details such as the name and taxpayer identification number of the trust and trustee's contact information, to more specific data regarding contributions, terminations, and the trust's tax computation. Trustees are required to meticulously report any changes in the trust's assets and any termination events that might impact the generation-skipping transfer (GST) tax liability. This includes determining whether any exemptions apply due to medical or educational exclusions or prior GST tax payments, as well as detailing contributions that do not affect the inclusion ratio, which is essential for calculating the trust's GST tax obligations. Additionally, the form delves into special elections available under tax law, such as the QTIP (Qualified Terminable Interest Property) election, and outlines the computation of GST tax payable or refundable for the year in question. With the requirement for accuracy under the threat of perjury, and the complexity of the instructions and schedules attached, completing Form 706GS(T) is a task that underscores the intricate dance between trusts and tax policy in the United States.

| Question | Answer |

|---|---|

| Form Name | Form 706Gs T |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | GST, form 1192, 9a1, Preparer |

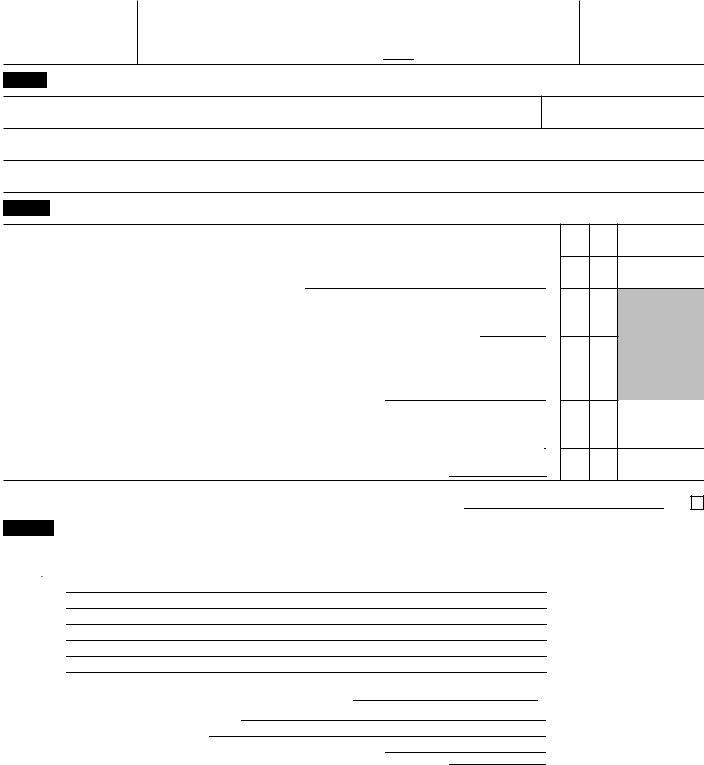

Form 7 0 6 GS(T)

(Rev. November 1992)

Department of the Treasury Internal Revenue Service

For Terminations

Calendar Year 19

OMB No.

Part I General Information

1a Name of trust

1b EIN of trust (see instructions)

2a Name of trustee

2b Trustee’s address (number and street or P.O. box; apt. or suite no.; city, town or post office; state and ZIP code)

Part II Trust Information (see instructions)

3Has any exemption been allocated to this trust by reason of the deemed allocation rules of section 2632 (b) and (c)? If “Yes,” describe the allocation on the line 7, Schedule A attachment showing how the inclusion ratio was calculated

4Has property been contributed to this trust since the last Form 706GS(T) or

5Have any terminations occurred that are not reported on this return because of the exceptions in section 2611(b)(1) or (2) relating to medical and educational exclusions and prior payment of GST tax? If “Yes,” attach a statement describing the termination

6Have any contributions been made to this trust that were not included in calculating the trust’s inclusion ratio? If “Yes,” attach a statement explaining why the contribution was not included

7 Has the special QTIP election in section 2652(a)(3) been made for this trust?

Yes No

Sch. A number(s)

8If this is not an explicit trust (see instructions under Who Must File), check box and attach a statement describing the

|

trust arrangement that makes its effect substantially similar to an explicit trust |

|

|

▶ |

||||||

Part III |

Tax Computation |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||

9a |

Summary of attached Schedules A (see instructions for line 9b) |

|

|

Net GST tax |

||||||

|

|

|

|

|

|

|

|

|

|

|

Schedule A No. |

|

|

|

|

|

(from Sch. A, line 14) |

||||

1 |

|

|

|

|

|

|

|

|

9a1 |

|

2 |

|

|

|

|

|

|

|

|

9a2 |

|

3 |

|

|

|

|

|

|

|

|

9a3 |

|

4 |

|

|

|

|

|

|

|

|

9a4 |

|

5 |

|

|

|

|

|

|

|

|

9a5 |

|

6 |

|

|

|

|

|

|

|

|

9a6 |

|

9b |

Total from all additional Schedules A attached to this form |

▶ |

9b |

|

||||||

10 Total net GST tax (add lines |

|

10 |

|

|||||||

11 |

Payment made with Form 2758 |

|

11 |

|

||||||

12 TAX |

|

12 |

|

|||||||

13 |

|

13 |

|

|||||||

Please |

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge |

|||||||||

and belief, it is true, correct, and complete. Declaration of preparer other than fiduciary is based on all information of which preparer has any knowledge. |

||||||||||

Sign |

|

|

|

|

|

|

|

|

|

|

Here |

|

|

|

|

|

|

|

|

||

|

|

|

▶ Signature of fiduciary or other officer representing fiduciary |

|

|

Date |

||||

|

|

|

Preparer’s |

▶ |

|

|

Date |

|

|

|

Paid |

|

|

|

|

|

|

|

|||

|

|

signature |

|

|

|

|

|

|||

Preparer’s |

|

|

|

|

|

|

|

|

||

Firm’s name (or |

|

|

|

|

|

|||||

Use Only |

|

|

|

|

|

|||||

yours if |

|

|

|

|

|

|||||

▶ |

|

|

ZIP code |

|||||||

|

|

|

and address |

|

|

|

||||

For Paperwork Reduction Act Notice, see page 1 of the separate instructions to this form. |

Cat. No. 10329M |

Form 706GS(T) (Rev. |

||||||||

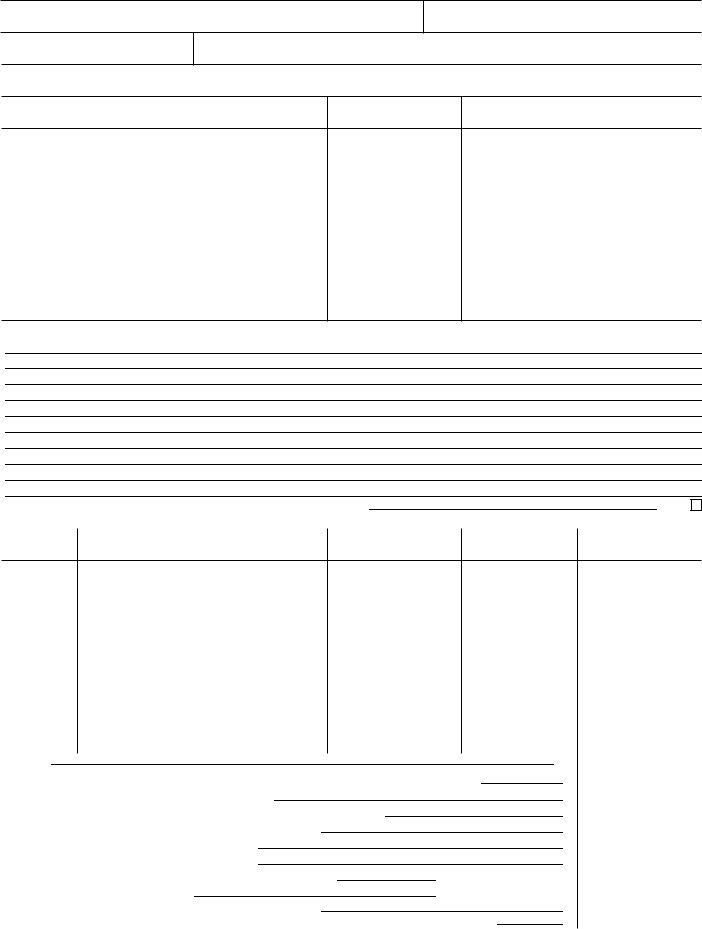

Form 706GS(T) |

Page 2 |

Name of trust

EIN of trust

Schedule A No.

Note: Make copies of this schedule before completing it if you will need more than one Schedule A.

Schedule

(See instructions before completing this schedule.)

|

a |

1 |

Name of skip person(s) |

b

SSN or EIN

c Item number from line 4 below in which interest held

2Describe in this space the terminating power or interest. If you need more space, attach an additional sheet.

3 |

If you elect alternate valuation, check here (see instructions) |

|

▶ |

||

4 |

Describe each taxable termination below (see instructions) |

|

|

||

|

a |

b |

c |

d |

e |

Item number |

Description of property subject to termination |

Date of termination |

Valuation date |

Value |

|

1

|

Total |

|

|

▶ |

4 |

|

|

5 |

Total deductions applicable to this Schedule A (from attached Schedule B, line 5) |

|

5 |

|

|||

6 |

Taxable amount (subtract line 5 from line 4) |

|

|

|

6 |

|

|

7 |

Inclusion ratio (attach separate schedule showing computation) |

|

|

|

7 |

|

|

8 |

Maximium Federal estate tax rate (see instructions) |

|

|

|

8 |

% |

|

9 |

Applicable rate (multiply line 7 by line 8) |

|

|

|

9 |

|

|

10 |

Gross GST tax (multiply line 6 by line 9) |

|

|

|

10 |

|

|

11 |

Creditable state GST tax, if any (attach credit evidence) |

11 |

|

|

|

|

|

12 |

Multiply line 10 by 5% (.05) |

|

12 |

|

|

|

|

13 |

Allowable credit (enter the lesser of line 11 or line 12) |

|

|

|

13 |

|

|

14 |

Net GST tax (subtract line 13 from line 10) (enter here and on line 9, Part III, page 1) |

|

14 |

|

|||

Schedule A (Form 706GS(T))

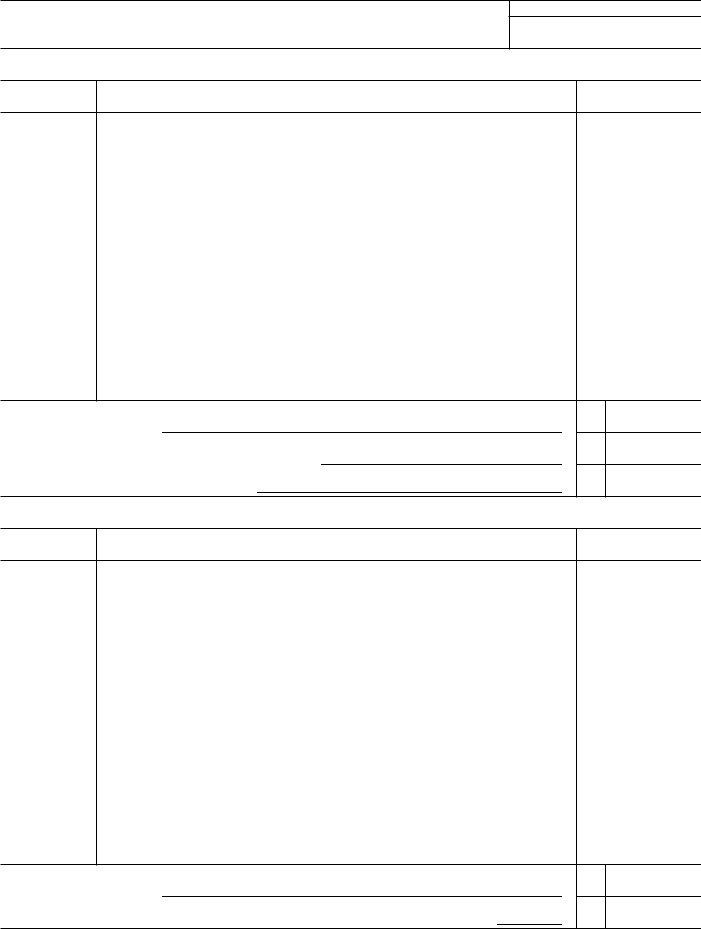

Form 706GS(T) |

Page 3 |

Name of trust

Schedule A No. ▶

EIN of trust

Schedule

(Section 2622(b)) (Enter only items related to the entire trust; see instructions)

a

Item number

1

b

Description

c

Amount

1Total of Schedule B(1)

2Percentage allocated to corresponding Schedule A

3 Net deduction (multiply line 1 by line 2)

1

2

3

%

Schedule

(Section 2622(b)) (Enter only items related solely to terminations appearing on corresponding Schedule A; see instructions)

a

Item number

1

b

Description

c

Amount

4Total of Schedule B(2)

5

4

5

Schedules B(1) and B(2) (Form 706GS(T))