Dealing with the aftermath of a loved one's passing is a challenging time, filled with both emotional and administrative tasks that need to be completed. Among these tasks is the responsibility to handle the deceased's estate, which might include filing tax returns related to the estate. For individuals managing estates in Maine for decedents who passed away in the calendar year 2012, with gross estates and adjusted taxable gifts not exceeding $1,000,000, the Form 706ME-EZ serves as a critical document. This form, titled "Estate Tax Information Return for Lien Discharge," is designed to simplify the estate tax return process for smaller estates. It requests essential information about the decedent, the estate's value, and details concerning gifts exceeding annual exclusion limits. Importantly, the form is not just a means of reporting but also plays a role in the discharge of any estate tax lien. When the federal estate tax filing is not required but there's a need to clear a tax lien, this form provides a streamlined avenue. Additionally, it outlines the responsibilities of the personal representative, the necessity of including specific documents such as the decedent’s will, and instructions for completing associated worksheets. However, it's critical to note that if the federal gross estate plus adjusted taxable gifts exceed $1,000,000, or there's a requirement to file a federal Form 706, the estate cannot use Form 706ME-EZ and must instead file Maine Form 706ME, illustrating the specific eligibility criteria for utilizing this simplified process.

| Question | Answer |

|---|---|

| Form Name | Form 706Me Ez |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | maine estate discharge, maine estate discharge get, estate information return, 706me estate taxable form |

FORM

2012

MAINE REVENUE SERVICES

ESTATE TAX INFORMATION RETURN

FOR LIEN DISCHARGE

99

*1211000*

FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR 2012 WITH GROSS ESTATES PLUS ADJUSTED TAXABLE GIFTS OF NOT MORE THAN $1,000,000. FOR MORE INFORMATION, GO TO www.maine.gov/revenue/incomeestate/estate

STEP 1 |

If federal Form 706 is required to be fi led for the estate, use Form 706ME. |

Estate of:

First Name

- -

Social Security Number (SSN)

Domicile at Date of Death:

M.I. Last Name Date of Death:

MM

/

DD

/

YYYY

-

Estate EIN

Street Address

City/Town |

State |

ZIP Code |

County |

Personal Representative or Person in Possession of Decedent’s Property:

First Name |

M.I. Last Name |

- -

Personal Representative’s SSN

-

Telephone Number

-

-

Fax Number

-

Personal Representative’s Mailing Address

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_______________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

City/Town |

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

|

|

|

|

Email Address |

|||||

STEP 2 Authorization is granted to the representative listed below to receive copies of confidential tax information related to this return under 36 MRSA § 191 and to act as the estate’s representative before Maine Revenue Services.

Firm Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact Person: First Name |

|

|

M.I. Last Name |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact Person Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

City/Town |

|

|

|

|

|

|

State |

|

ZIP Code |

|

|

|

|

|

Telephone Number |

|

|

|

|

|

|

||||||||||||||||||||||||||||

___________________________________________________ |

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

STEP 3 Decedent’s Maine Residency Status (check one) |

|

|

|

|

|

|

|

Resident |

|

|

|

|

|

|

|

|

Nonresident |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

STEP 4 1. Did the decedent make any gifts in excess of the applicable annual exclusion from gift tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

after December 31, 1976? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

|

|

|

Yes |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

1a. If Yes, enter amount: $______________________ 1b. |

Were federal gift tax returns filed? |

|

|

|

|

|

|

|

|

1b. |

|

|

|

Yes |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

2. Marital Status of Decedent .... |

|

|

|

|

Married with surviving spouse |

|

|

|

Widow/Widower |

|

|

|

|

Single/Divorced |

||||||||||||||||||||||||||||||||||||

No

No

2a. If married/widow/widower, enter spouse’s name: __________________________________ |

and SSN |

|

3. Enter the amount from Worksheet, column B, line 12 (see instructions) |

3. |

$ |

-

,

-

,

.00

THE PERSONAL REPRESENTATIVE IS PERSONALLY LIABLE FOR ANY TAX DUE IF IT IS LATER DETERMINED THAT MAINE ESTATE TAX LIABILITY EXISTS.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements and to the best of my knowledge and belief they are true, correct and complete. Declaration of preparer is based on all information of which preparer has any knowledge.

______________________________________________________________________

Signature of Personal Representative

______________________________________________

Signature of Preparer other than Personal Representative |

Preparer’s SSN or PTIN |

____________

Date

____________

Date

__________________________ |

______________________________ |

( |

) |

____________________ |

|||

Firm’s Name (or preparer’s if |

Preparer’s Address |

Preparer’s Telephone Number |

|

INSTRUCTIONS

MAINE ESTATE TAX INFORMATION RETURN FOR LIEN DISCHARGE

IF THE FEDERAL GROSS ESTATE PLUS ADJUSTED TAXABLE GIFTS IS MORE THAN $1,000,000, OR IF A FEDERAL FORM 706 IS REQUIRED, YOU CANNOT USE FORM

Note: 1) The value of the decedent’s gross estate is the fair market value at date of death of all property, real or personal, tangible or intangible, wherever situated. Gross estate value is not the same as the probate estate value.

2)Adjusted taxable gifts is the total value of gifts made by the decedent after December 31, 1976 in excess of the annual exclusion from gift tax.

The following documents must be included with Form

•A copy of the decedent’s will.

•A copy of the Certifi cate of Discharge of Estate Tax Lien containing a description of the property.

•A copy of the appraisals or documentation of fair market value at the time of death. Provide a list and description of assets.

•A completed worksheet for Form

•A copy of federal Forms 709.

SPECIFIC LINE INSTRUCTIONS

Step 1 Enter all required information. Failure to fully complete Step 4 |

|

|

|

|

|

||||

|

this section will delay the processing of the return. If a |

|

Line 1 On line 1a, enter the value of gifts in excess of the |

||||||

|

personal representative has not been appointed, every |

|

|||||||

|

|

|

applicable annual exclusion from gift tax made by |

||||||

|

person in possession of any property of the decedent is |

|

|

||||||

|

|

|

the decedent. On line 1b, indicate if any federal |

||||||

|

considered a personal representative and must be listed |

|

|

||||||

|

|

|

gift tax returns were filed by or on behalf of the |

||||||

|

as a personal representative on the return that is filed |

|

|

||||||

|

|

|

decedent. |

|

|

||||

|

for the estate. A personal representative can also be |

|

|

|

|

||||

|

|

|

|

|

|

|

|||

|

known as an executor. If there is more than one personal |

|

Line 3 Enter the gross value of the estate from column B, |

||||||

|

representative, fill in the information for one and attach a |

|

|

line 12 of the worksheet below. If column B, line |

|||||

|

schedule listing all personal representatives. |

|

|

12 is more than $1,000,000, you cannot use Form |

|||||

Step 2 This section must be completed if you choose to have |

|

|

|||||||

|

|

|

|

|

|

||||

|

copies of confidential tax information sent to anyone other |

SIGNATURE: A personal representative of the decedent is |

|||||||

|

than the personal representative. |

|

|

required to sign this return. |

Failure to do so will |

||||

Step 3 Check the appropriate box for the decedent’s residency |

|

|

result in the return being rejected, further delaying |

||||||

|

|

its processing. |

|

|

|||||

|

status at the time of death. See Maine Rule 807 at www. |

|

|

|

|

||||

|

|

|

|

|

|

|

|||

|

maine.gov/revenue/rules. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

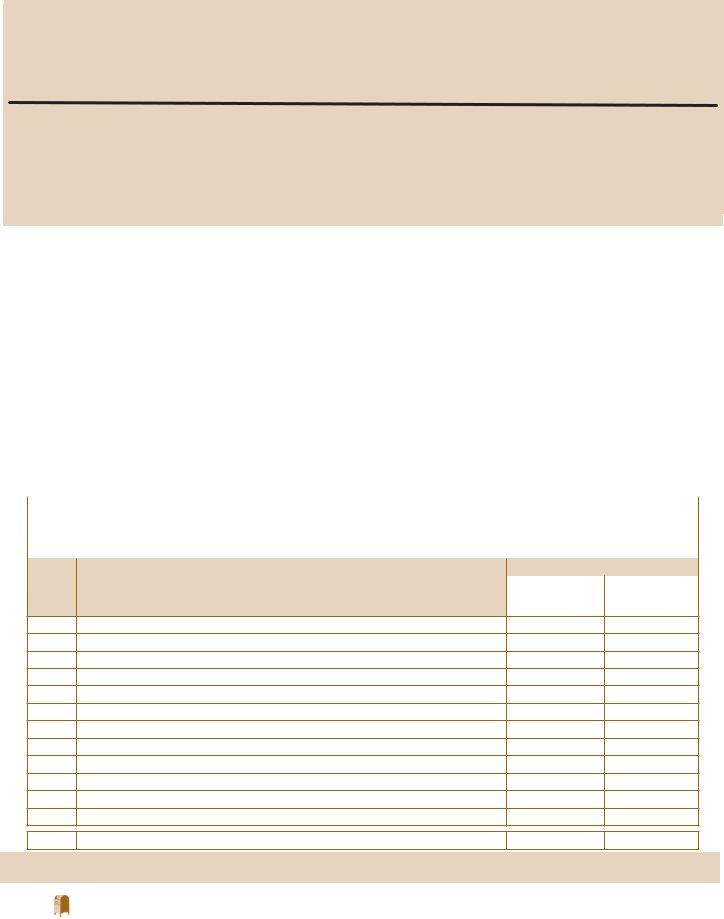

Worksheet for |

|

|

Name __________________________________ |

|||

|

|

This worksheet must be completed or Form |

|

|

|||||

|

|

(Attach a detailed description of all assets, including the fair market value of |

|

|

|

|

|

|

|

|

each) For more information, to to www.maine.gov/revenue/incomeestate/guidance |

|

Social Security Number ______/_____/______ |

||||||

|

|

|

and select “Maine Estate Tax Guidance Document .” |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value |

||

|

Line |

|

|

|

|

|

|

|

|

|

|

Gross Estate |

|

|

|

Column A |

Column B |

||

|

Number |

|

|

|

|||||

|

|

|

|

Taxable by |

Federal Gross |

||||

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

Maine |

Estate |

|

1Real Estate (Please include Real Estate Documentation of Value)

2Stocks and Bonds

3Mortgages, Notes and Cash

4Insurance on the Decedent’s Life (attach Form(s) 712)

5Jointly Owned Property

6Other Miscellaneous Property

7Transfers During Decedent’s Life ( include revocable trust(s))

8Powers of Appointment

9Annuities/Retirement Assets

10Trusts or

11Taxable Portion of Gifts Shown on page 1, line 1a

12Total Gross Estate (add lines 1 through 11 and enter the total from column B on page 1, line 3)

13

Marital Deduction

If the estate contains Maine elective property, Form 706ME must be filed. For more information on Maine QTIP property and Maine elective property, see www.maine.gov/revenue/incomeestate/estate/.

|

MAINE REVENUE SERVICES |

|

MAIL RETURN TO: |

P.O. BOX 1064 |

|

|

AUGUSTA, ME |

Rev. 08/11 |

Page 2