form 741 can be completed online in no time. Simply try FormsPal PDF editor to complete the job fast. FormsPal expert team is relentlessly endeavoring to expand the tool and make it much better for clients with its many functions. Make use of present-day progressive prospects, and discover a trove of unique experiences! Getting underway is effortless! All you should do is stick to the next basic steps down below:

Step 1: Press the "Get Form" button in the top area of this webpage to open our editor.

Step 2: With our advanced PDF editing tool, you're able to accomplish more than merely fill in forms. Try all of the functions and make your forms seem high-quality with custom textual content added in, or modify the original input to perfection - all comes along with an ability to add almost any images and sign it off.

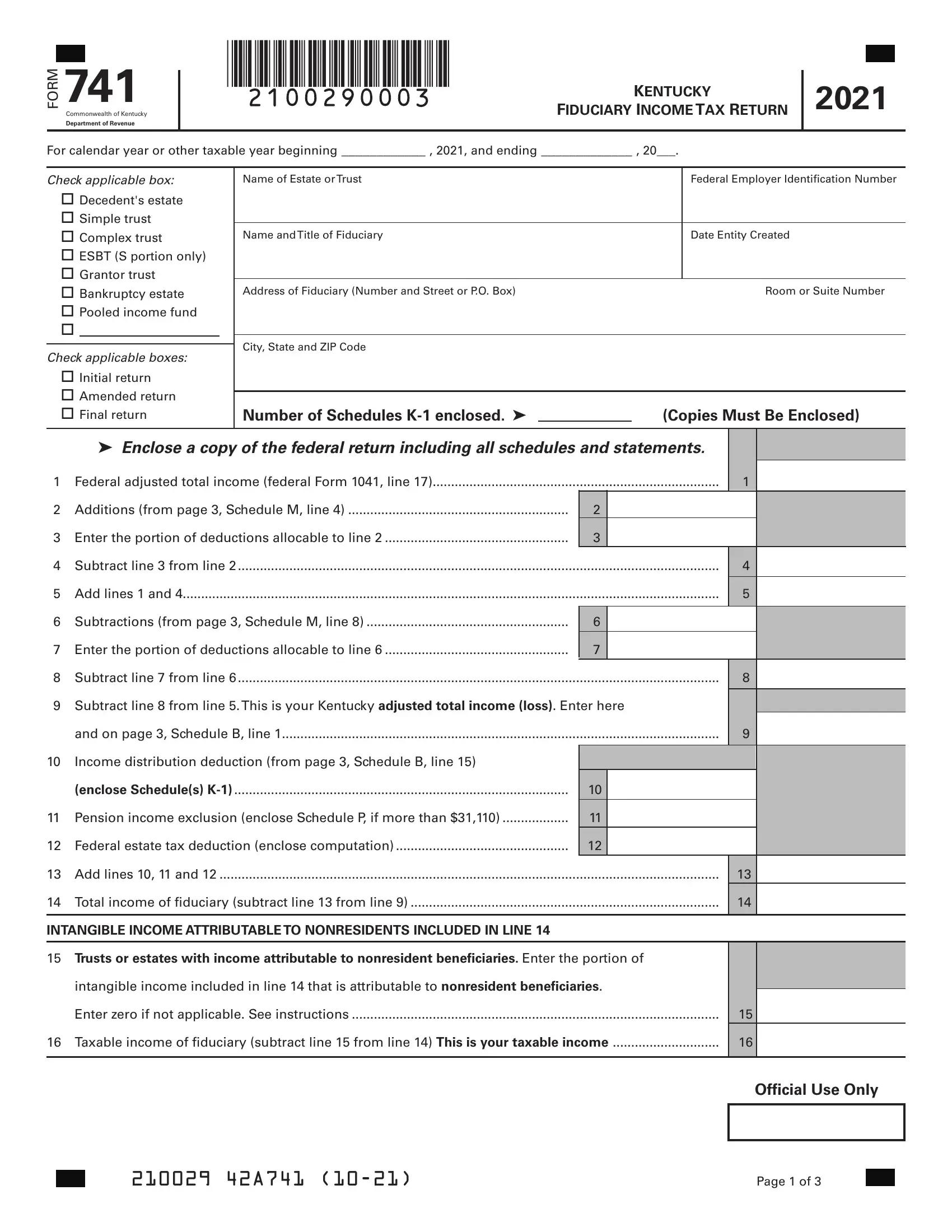

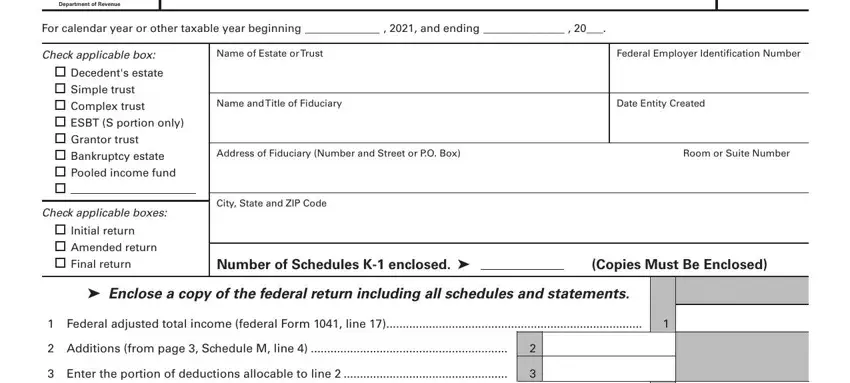

So as to finalize this PDF form, be sure to enter the information you need in every single blank field:

1. You will want to complete the form 741 accurately, hence take care when filling out the sections including these specific fields:

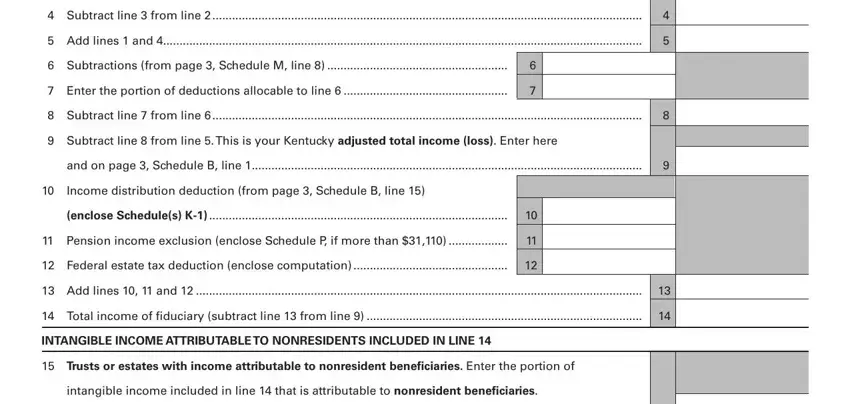

2. Given that the previous section is completed, it is time to put in the essential specifics in Subtract line from line, Add lines and, Subtractions from page Schedule, Enter the portion of deductions, Subtract line from line, Subtract line from line This is, and on page Schedule B line, Income distribution deduction from, enclose Schedules K, Pension income exclusion enclose, Federal estate tax deduction, Add lines and, Total income of fiduciary subtract, INTANGIBLE INCOME ATTRIBUTABLE TO, and Trusts or estates with income so that you can progress to the 3rd step.

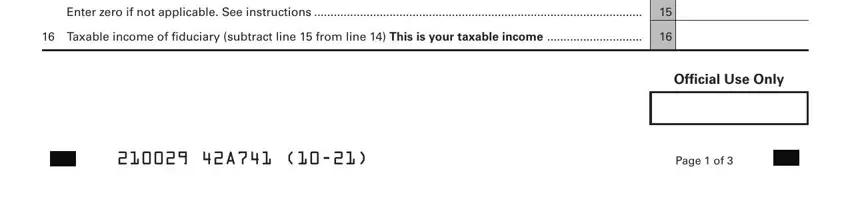

3. Within this stage, check out Enter zero if not applicable See, Taxable income of fiduciary, Page of, and Official Use Only. Every one of these will need to be filled in with greatest focus on detail.

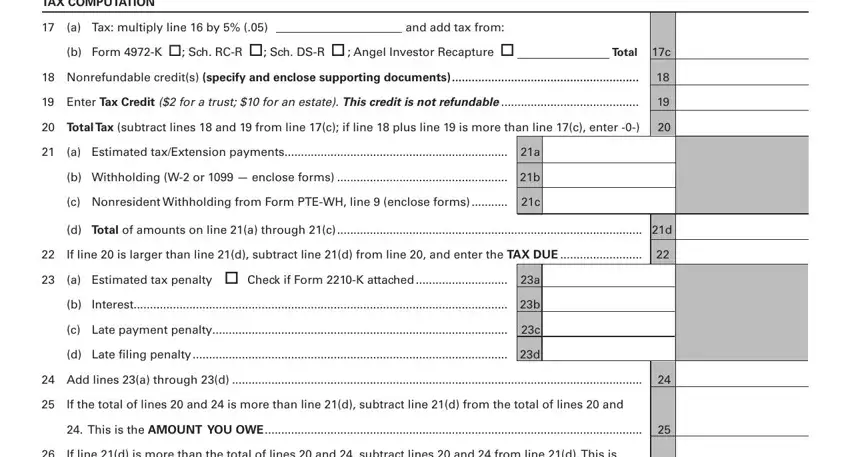

4. The following subsection needs your attention in the following areas: TAX COMPUTATION, a Tax multiply line by b Form K, and add tax from, Total c, Nonrefundable credits specify and, Enter Tax Credit for a trust, Total Tax subtract lines and, a Estimated taxExtension payments, b Withholding W or enclose forms, c Nonresident Withholding from, d Total of amounts on line a, If line is larger than line d, Interest b, c Late payment penalty c, and d Late filing penalty d. Make certain to fill out all of the requested information to move further.

It is possible to make a mistake when completing your b Withholding W or enclose forms, for that reason be sure you look again prior to deciding to finalize the form.

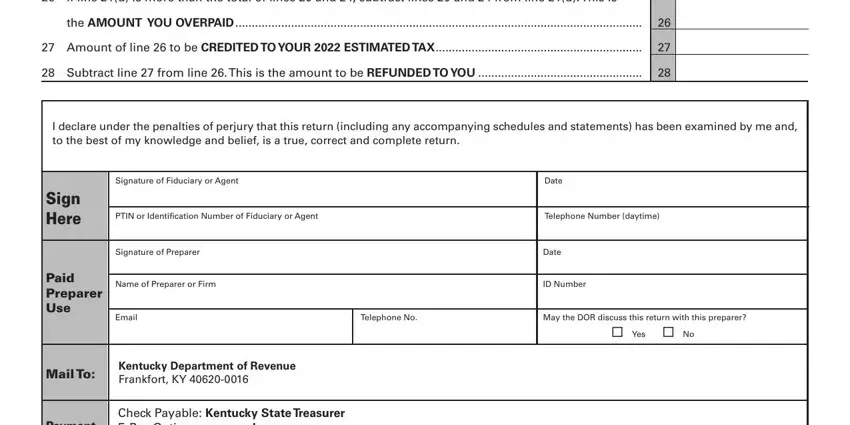

5. This document should be finished by filling out this area. Here you will find a full listing of form fields that require accurate details in order for your form usage to be faultless: If line d is more than the total, the AMOUNT YOU OVERPAID, Amount of line to be CREDITED TO, Subtract line from line This is, I declare under the penalties of, Signature of Fiduciary or Agent, PTIN or Identification Number of, Date, Telephone Number daytime, Date, ID Number, Telephone No, May the DOR discuss this return, Yes No, and Sign Here.

Step 3: Prior to finishing this file, make certain that all blanks are filled in the proper way. Once you confirm that it is correct, click “Done." After setting up a7-day free trial account at FormsPal, you will be able to download form 741 or send it via email directly. The PDF will also be easily accessible from your personal account with your each and every edit. FormsPal guarantees protected document completion devoid of personal information record-keeping or sharing. Feel safe knowing that your data is safe with us!