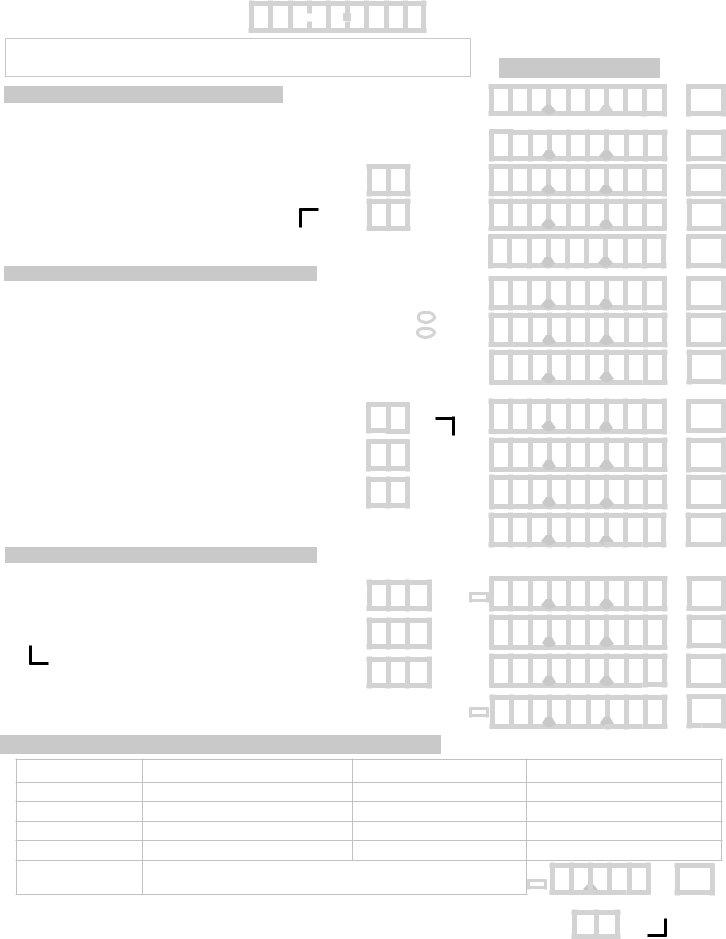

When residents of Virginia navigate their state tax obligations, the 2007 Virginia Schedule ADJ (Form 760-ADJ WEB) plays a pivotal role in ensuring their tax returns are accurate and reflective of their financial situation. This form addresses both additions to and subtractions from federal adjusted gross income, accounting for nuances like interest on obligations from other states, disability income, and various deductions that may not be accounted for in the federal tax return. Moreover, the form delves into adjustments for Virginia Adjusted Gross Income (VAGI), including considerations for low-income individuals or families who might qualify for tax credits, echoing the state's efforts to ease the tax burden on its financially vulnerable citizens. It also incorporates sections for voluntary contributions, signaling Virginia's encouragement for taxpayers to contribute to school foundations and other charitable causes. Understanding the intricacies of the 760-ADJ form is crucial for Virginians looking to accurately complete their state tax returns, potentially leading to beneficial adjustments to their taxable income and leveraging tax credits designed to assist them.

| Question | Answer |

|---|---|

| Form Name | Form 760 Adj Web |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Schedule ADJ virginia form 760 adj |

2007 Virginia Schedule ADJ |

Your Social Security Number |

||

- |

- |

||

(Form |

|||

|

|

||

Name(s) as shown on Virginia return |

|

|

|

whole dollars only

Additions to Federal Adjusted Gross Income |

|

1. Interest on obligations of other states, exempt from federal income tax but not from state tax |

1 |

2. Other additions to federal adjusted gross income |

|

|

2a. SPECIAL FIXED DATE CONFORMITY ADDITION - SEE INSTRUCTIONS |

2a |

|

|

Enter Code |

|

2b - 2c Refer to the Form 760 instruction book for Other Addition |

|

|

|

2b |

|

Codes |

|

|

|

2c |

|

3. Total Additions (add Lines 1 and 2a - 2c, enter here and on Form 760, Line 2) |

3 |

|

Subtractions from Federal Adjusted Gross Income

4.Income (interest, dividends or gains) from obligations or securities of the U.S. exempt

from state income tax, but not from federal tax |

4 |

|

|

You |

|

5. Disability income reported as wages (or payments in lieu of wages) on |

|

|

|

Spouse |

|

your federal return |

5 |

|

6. Other subtractions as provided in instructions |

|

6a. SPECIAL FIXED DATE CONFORMITY SUBTRACTION - SEE INSTRUCTIONS |

6a |

, |

, |

. |

00 |

Enter Addition Amount

, |

, |

. |

00 |

, |

, |

. |

00 |

, |

, |

. |

00 |

, |

, |

. |

00 |

|

|||

|

|

|

|

, |

, |

. |

00 |

|

|||

|

|

|

|

, |

, |

. |

00 |

|

|||

|

|

|

, |

, |

. |

00 |

Enter Code |

|

|

6b - 6d Refer to the Form 760 instruction book for Other Subtraction |

|

|

|

6b |

|

Codes |

|

|

|

6c |

|

|

6d |

|

7. Total subtractions (add Lines 4, 5 and 6a - 6d, enter here and on Form 760, Line 7) |

7 |

|

Deductions from Virginia Adjusted Gross Income

Enter Subtraction Amount

, |

, |

. |

00 |

|

|||

|

|

|

, |

, |

. |

00 |

|

|||

|

|

|

|

, |

, |

. |

00 |

|

|||

|

|

|

, |

, |

. |

00 |

|

|||

|

|

|

8.Refer to the Form 760 instruction book for Deduction Codes

8a

8b

8c

9.Total Deductions (add Lines 8a - 8c, enter here and on Form 760, Line 12)

Enter Code |

Enter Deduction Amount |

LOSS |

|

|

00 |

, |

, |

. |

, |

, |

. |

00 |

|

|||

|

|

|

|

, |

, |

. |

00 |

|

|

|

||||

|

|

|

|

||

LOSS |

|

|

|

00 |

|

9 |

, |

, |

. |

||

|

|||||

|

|

|

Credit for Low Income Individuals or Virginia Earned Income Credit

|

Family VAGI |

Name |

Social Security Number |

Virginia Adjusted Gross Income (VAGI) |

|

|

You |

|

|

|

|

|

Spouse |

|

|

|

|

|

Dependent |

|

|

|

|

|

Dependent |

|

|

|

|

10. |

Total |

If more than 4 exemptions, attach schedule listing the name, SSN & VAGI. |

LOSS |

|

|

|

|

|

|||

|

|

Enter total Family VAGI here. |

|

, |

. |

|

|

|

|

|

|

11. Enter the total number of exemptions reported in the table above. Next, go to the Poverty Guideline Table shown |

● |

|

in the Form 760 instruction book for this Line to see if you qualify for this credit |

11 |

|

●

Continue with Line 12 on Page 2

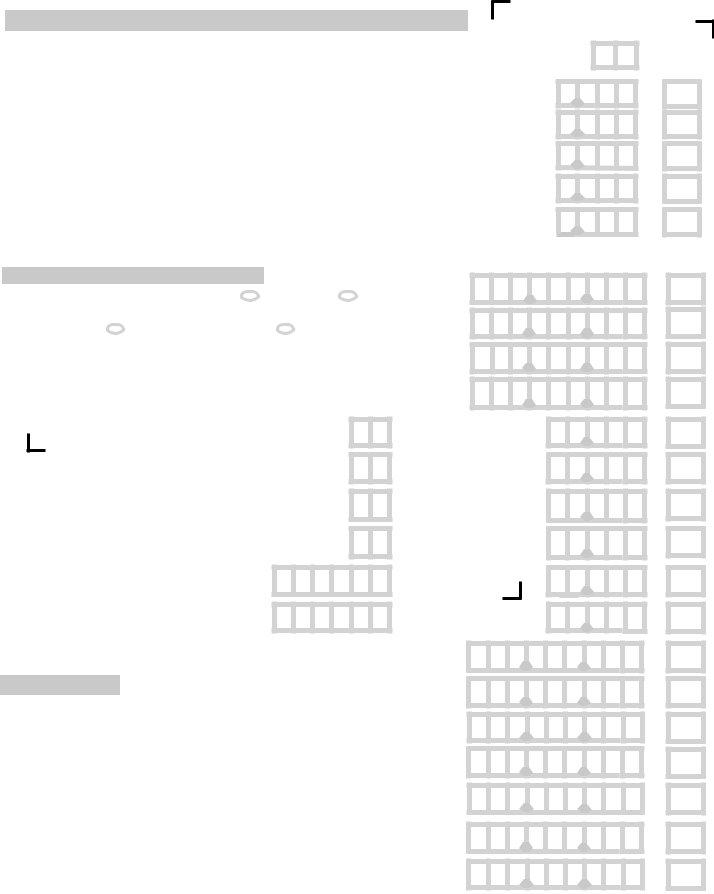

2007 Virginia Schedule ADJ WEB Page 2

|

|

|

Your Social Security Number |

|

||||||||||||||||

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit for Low Income Individuals or Virginia Earned Income Credit (Continued)

12. If you qualify, enter the number of personal exemptions reported on your Form 760 |

12 |

13. |

Multiply Line 12 by $300. Enter the result on Line 13 and proceed to Line 14. If you do not qualify |

|

|

|

|

|

||||

|

for the Tax Credit for Low Income Individuals but claimed an Earned Income Credit on your federal |

, |

. |

|

00 |

|

||||

|

return, enter $0 and proceed to Line 14 |

|

|

13 |

|

|

||||

|

|

|

|

|

|

|

|

|||

14. |

Enter the amount of Earned Income Credit claimed on your federal return. If you did not claim an |

|

|

|

|

● |

||||

|

Earned Income Credit on your federal return, enter $0 |

14 |

, |

. |

|

00 |

||||

|

|

|

|

|

|

|

|

00 |

|

|

15. |

Multiply Line 14 by 20% (.20) |

|

|

15 |

, |

. |

|

|

||

|

|

|

|

|

|

|

||||

16. |

Enter the greater of Line 13 or Line 15 above |

|

|

16 |

, |

. |

|

00 |

|

|

17. |

Compare the amount on Line 16 above to the amount of tax on Line 17 of Form 760 and enter the |

|

|

|

00 |

|

||||

|

lesser of the two amounts here and on Line 21 of Form 760. This is your credit amount |

17 |

, |

. |

|

|

||||

Adjustments and Voluntary Contributions |

|

|

|

|

|

|

00 |

|

||

18. |

Addition to tax. Fill in oval if addition came from: |

Form 760C |

Form 760F .... |

18 |

, |

, |

. |

|

||

19. |

Penalty |

|

|

|

|

, |

, |

|

00 |

|

|

Late Filing Penalty |

|

Extension Penalty |

19 |

. |

|

||||

|

|

|

|

|||||||

|

|

|

|

|

|

|||||

20. |

Interest (interest accrued on the tax you owe) |

......................................................................... |

|

20 |

, |

, |

. |

00 |

|

|

21. |

Consumer’s Use Tax |

|

|

21 |

, |

, |

. |

00 |

|

|

22. |

Voluntary Contributions from Overpaid Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

22a |

|

|

|

, |

. |

00 |

|

23. |

Other Voluntary Contributions |

|

22b |

|

|

|

, |

. |

00 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

23a |

|

|

|

, |

. |

00 |

|

|

|

|

23b |

|

|

|

, |

. |

00 |

|

|

If contributing to a School Foundation, |

23c |

|

|

|

, |

. |

00 |

|

|

|

enter the code for the foundation(s) and the |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

contribution amount(s) in boxes 23c - 23d. |

|

|

|

|

|

|

|

|

|

|

If contributing to more than 2 school |

23d |

|

|

|

|

|

00 |

|

|

|

foundations, see Form 760 instructions |

|

|

|

, |

. |

|

|||

|

book. |

|

|

|

|

|

|

|

|

|

24. |

Total Adjustments (add Lines 18, 19, 20, 21, |

24 |

, |

, |

. |

00 |

|

|||

Amended Return |

|

|

|

|

, |

, |

. |

00 |

|

|

25. |

Amount paid with original return, plus additional tax paid after it was filed |

|

25 |

|

||||||

|

|

|

|

|

||||||

26. |

Add Line 25 from above and Line 24 from Form 760 and enter here |

26 |

, |

, |

. |

00 |

|

|||

27. |

Overpayment, if any, as shown on original return or as previously adjusted |

27 |

, |

, |

. |

00 |

|

|||

28. |

Subtract Line 27 from Line 26 |

|

|

28 |

, |

, |

. |

00 |

|

|

29. |

If Line 28 above is less than Line 17, Form 760, |

|

|

|

|

|

|

00 |

|

|

|

subtract Line 28 above from Line 17, Form 760. |

This is the Tax You Owe |

29 |

, |

, |

. |

|

|||

30. |

Refund. If Line 17, Form 760 is less than Line 28 above, |

|

|

|

|

|

00 |

|

||

|

subtract Line 17, Form 760 from Line 28 above. This is the Tax You Overpaid |

.................... |

30 |

, |

, |

. |

|

|||

2601050 07/07