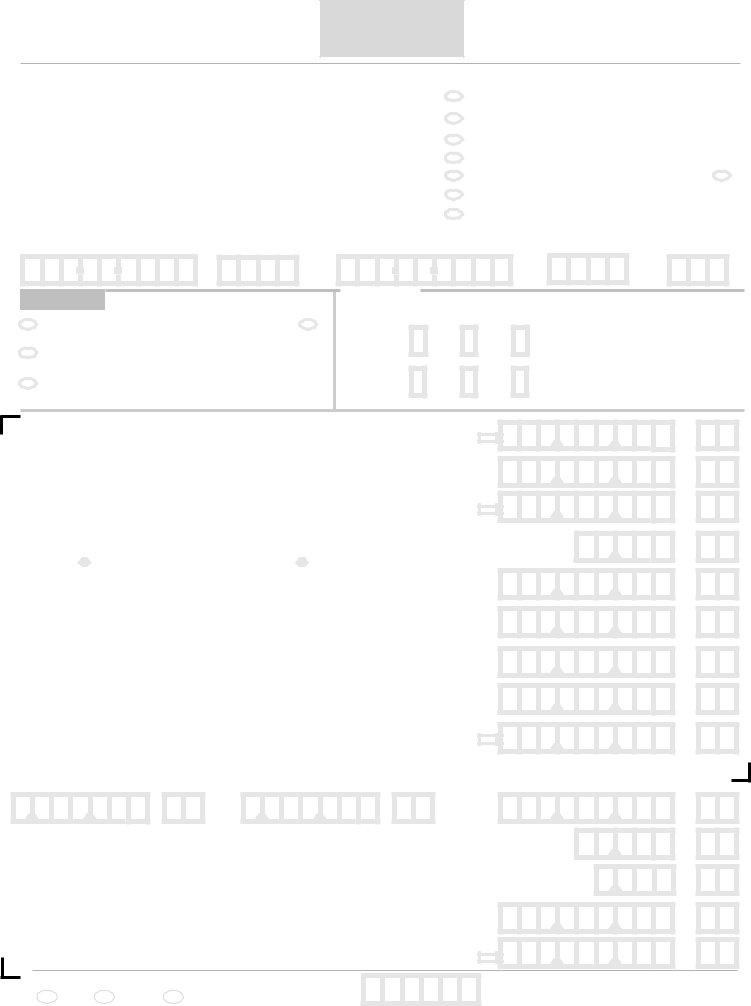

As the deadline of May 1, 2003, approaches, Virginia residents find themselves navigating the complexities of the 760 Web form for their individual income tax returns. This form, embodying both the convenience of digital submission and the meticulousness of financial documentation, requires filers to use black ink for clear legibility. Its structure, aimed at streamlining the filing process, encompasses various sections including personal information, filing status, income calculations, and deductions. Unique features such as the option for an accelerated refund request, the necessity to report any changes in filing status or address since the last filing, and the ability to amend returns due to net operating loss (NOL) or other adjustments make this form tailored to a wide range of taxpayer circumstances. Additionally, the form accommodates deductions for age, benefits received under the Social Security Act, and state income tax refunds, among other specifics. The inclusion of schedules for detailed adjustments and multiple opportunities to claim credits or deductions illustrates the form's comprehensive approach to individual tax reporting in Virginia. From the basic entries of personal identification and residence to the calculation of Virginia adjusted gross income and beyond, the 760 Web form encapsulates the intricate dance between taxpayer contributions and state fiscal requirements, all while encouraging accuracy and promptness in submission.

| Question | Answer |

|---|---|

| Form Name | Form 760 Web |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 2002, VAGI, ovals, W-2G |

IndividualIncomeTaxReturn

iFile

www.tax.state.va.us Fast. Easy. Secure.

*VA0760102888*

Your first name |

M.I. |

Last name |

Suffix |

|

Fill in all ovals that apply: |

|

|

|

|

|

|

|

Nameorfilingstatushaschangedsincelastfiling |

|

|

|

|

|

|

|

|

|

|

Spouse’s first name |

M.I. |

Last name |

Suffix |

|

Addresshaschangedsincelastfiling |

|

|

|

|

|

|||||

|

|

|

|

|

Virginiareturnwasnotfiledlastyear |

|

|

|

|

|

|

|

|

||

Present home address (number and street) |

|

|

AcceleratedRefundRequest |

|

|||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

City, town or post office and state |

|

Zip Code |

|

|

Dependent on another’s return and have unearned income |

|

|

|

|

|

|

|

Returnadjustedforfixeddateconformity |

|

|

|

|

|

|

|

|

|

|

Your Social Security Number |

First 4 letters of |

Spouse’s Social Security Number |

First 4 letters of |

Locality Code |

|

your last name |

spouse’s last name |

See instructions |

|||

|

|

- |

- |

- |

- |

Filing Status Fill in oval to indicate status

(1)Single. Did you claim federal head of household? Yes

(2)Married filing joint return (Enter spouse’s SSN above)

(3)Married filing separate return (Enter spouse’s SSN above)

Spouse’s Name________________________

Exemptions |

|

|

|

|

|

|

65 or over |

Blind |

|

You |

1 |

+ |

+ |

|

Spouse |

|

+ |

+ |

|

if filing |

|

|

||

|

|

|

|

|

joint return |

|

|

|

|

Dependents |

|

|

Total |

Use |

||||||||||

|

|

|

|

|

|

|

Exemptions |

Total |

||||||

+ |

|

|

|

|

|

|

= |

|

|

|

|

|

|

Exemptions |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

tocomplete |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Line11 |

|

|

1. |

Federal Adjusted Gross Income |

............................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|||||||||||||

|

|

|

|

|

|

|

|

(from federal return - NOTFEDERALTAXABLEINCOME) |

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||

VA |

|

2. |

.....................................................................Total Additions from attached Schedule ADJ, line 3 |

|

|

|

|

|

|

|

|

|

|

|

2 |

||||||||||||||||

|

|

|

|

|

|

|

(You must attach Schedule ADJ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

reporting |

|

3. |

Add lines 1 and 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

4. |

Deduction for age on Jan 1, 2003. Each filer age |

|

|||||||||||||||||||||||||||

withholdinghere. |

You |

|

|

|

|

|

|

|

|

|

|

|

|

|

+ Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

= |

4 |

||

|

|

|

|

, |

|

|

|

|

|

|

|

.00 |

|

|

|

|

, |

|

|

|

|

|

|

. 00 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

5. |

Social Security Act and equivalent Tier 1 Railroad Retirement Act benefits |

|

|

5 |

|||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

(reported as taxable on federal return) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Forms |

|

6. |

State Income Tax refund or overpayment credit (reported as income on federal return) |

.............. |

6 |

||||||||||||||||||||||||||

|

7. |

Subtractions from attached Schedule ADJ, line 7 |

|

|

|

|

|

|

|

|

|

|

|

|

7 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

STAPLE |

|

|

|

|

|

|

|

(You must attach Schedule ADJ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

8. |

Add lines 4, 5, 6, and 7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

||||||||||||

|

|

................................................................................................................ |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

9. |

Virginia Adjusted Gross Income (VAGI) - Subtract line 8 from line 3 |

|

|

9 |

|||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||

10.

10a. Total deductions - see instructions |

10b. State and Local Income Taxes claimed |

, |

, |

|

minus |

, |

, |

=n |

|

10 |

|||||

|

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm |

|||||

|

|

. |

|

|

. |

|

(YOU MUST USE ITEMIZED DEDUCTIONS IF YOU ITEMIZED ON YOUR FEDERAL RETURN)

|

here |

11. |

Exemptions. Multiply number of Total Exemptions claimed above by $800 |

11 |

|

|

|

|

|

STAPLE payment |

12. |

Child and Dependent Care Expenses. See Instructions |

12 |

|

|

Staple |

13. |

Add lines 10, 11 and 12 |

13 |

|

|

|||

|

|

14. |

Virginia Taxable Income - Subtract line 13 from line 9 |

14 |

LOSS |

|

|

|

|

n |

|

, |

, |

. |

|

|

|

|

|

|||

|

, |

, |

. |

|

n |

|

|

|

|||

LOSS |

|

|

|

|

|

|

, |

, |

. |

|

|

|

|

, |

. |

00 |

n n |

|

|

n |

|||

|

, |

, |

. |

|

n |

|

|

|

|||

|

, |

, |

. |

|

n |

|

|

|

|||

|

, |

, |

. |

|

n |

|

|

|

|||

|

, |

, |

. |

|

n |

|

|

|

|||

LOSS |

|

|

|

|

|

|

, |

, |

. |

|

|

|

, |

, |

. |

|

n |

|

|

|

|||

|

|

, |

. |

00 |

|

|

|

, |

. |

|

n |

|

, |

, |

. |

|

|

LOSS |

, |

, |

|

|

|

|

. |

|

|

LAR |

DLAR |

LTD $_______________ |

Office Use WB n

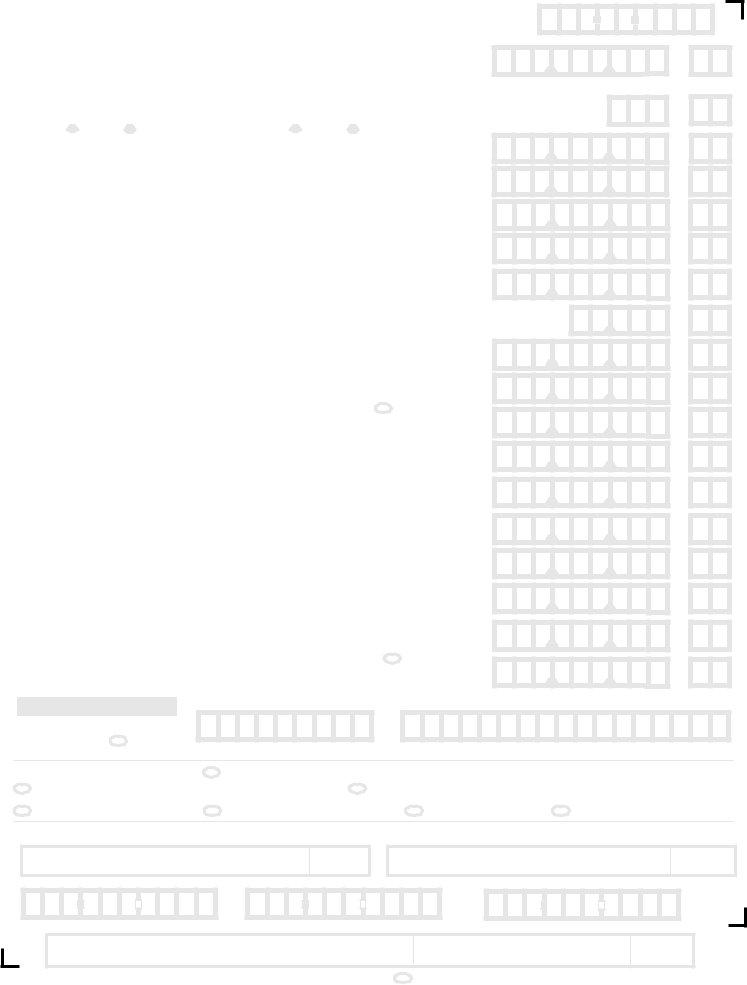

Form 760 - WEB |

*VA0760202888* |

|

Page 2 |

|

|

Year 2002 |

|

|

15. Amount of Tax (from Tax Table or Tax Rate Schedule) |

15 |

|

16. Spouse Tax Adjustment. For Filing Status 2 only. Enter VAGI in whole dollars below. See instructions.

|

|

|

|

|

16a - Enter Your VAGI below |

|

|

|

|

16b - Enter Spouse’s VAGI below |

|

|||||||||||||||||||||||||||||||||

LOSS |

|

|

|

|

, |

|

|

|

|

|

, |

|

|

|

|

|

|

.00 |

LOSS |

|

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

|

16 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Net Amount of Tax - Subtract line 16 from line 15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

||||||||||||||||||||||||||||

18. |

|

Virginia tax withheld for 2002. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

18a. |

Your Virginia withholding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18a |

||||||||||||||||

|

|

|

|

18b. |

Spouse’s Virginia withholding (filing status 2 only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18b |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

19. |

|

|

Estimated Tax Paid for tax year 2002 (from Form 760ES) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

(include overpayment credited from tax year 2001) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

20. Extension Payments (from Form 760E) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

||||||||||||||||||||||||||||

21. |

Tax Credit for Low Income Individuals from attached Schedule ADJ, line 12 |

21 |

||||||||||||||||||||||||||||||||||||||||||

22. |

Credit for Tax Paid to Another State from attached Schedule ADJ, line 19 |

..................................... |

|

|

|

|

|

|

22 |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

(You must attach Schedule ADJ and a copy of the other state’s return) |

|

||||||||||||||||||||||||||||||||||||

23. |

Other Credits from attached Schedule CR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

( If claiming Political Contribution only - fill in oval - see instructions) |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

24. |

Add lines 18a, 18b and 19 through 23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

||||||||||||||||||||||||||||

|

|

|

|

|

|

If you are filing an Amended Return, stop here and GO TO line 27 of Schedule ADJ |

|

|||||||||||||||||||||||||||||||||||||

25. |

If line 24 is less than line 17, subtract line 24 from line 17. This is the Tax You Owe |

25 |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

Skip to line 28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

26. |

If line 17 is less than line 24, subtract line 17 from line 24. This is Your Tax Overpayment |

26 |

||||||||||||||||||||||||||||||||||||||||||

27. |

Amount of overpayment you want credited to next year’s estimated tax |

|

|

|

|

|

|

|

27 |

|||||||||||||||||||||||||||||||||||

28. |

Adjustments and Voluntary Contributions from attached Schedule ADJ, line 26 |

28 |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

(You must attach Schedule ADJ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

29. |

Add line 27 and line 28 |

.................................................................................................................. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

||||||||||||||

30. |

If you owe tax on line 25, add lines 25 and 29. OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

If line 26 is less than line 29, subtract line 26 from line 29. |

AMOUNT YOU OWE |

30 |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

CREDIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Φ CARD |

|

FILL IN OVAL IF PAYMENT BY CREDIT CARD - SEE INSTRUCTIONS |

|

||||||||||||||||||||||||||||||||||||

31. |

If line 26 is greater than line 29, subtract line 29 from line 26. YOUR REFUND |

31 |

||||||||||||||||||||||||||||||||||||||||||

YourSSN

|

- |

- |

|

, |

, |

. |

|

|

|

. |

n n |

|

|

n |

|

|

|

|

|

, |

, |

. |

|

, |

, |

. |

n |

|

|||

, |

, |

. |

n |

|

|||

, |

, |

. |

n |

|

|||

, |

, |

. |

n |

|

|

, . |

n |

|

|

|

, |

, . |

n |

|

||

, |

, . |

n |

|

||

, |

, . |

|

, |

, . |

4 |

, |

, . |

4 |

, |

, . |

4 |

, |

, . |

4 |

, |

, . |

|

, |

, |

. |

4 |

|

|

|

nn |

, |

, |

. |

4 |

DirectDepositInformation

Please indicate type of account Checking Savings

Your bank’s routing transit number

nn

Your bank account number

Fillinallovalsthatapply: |

I authorize the Dept. of Taxation to discuss my return with my preparer. |

|

|

Qualifying farmer, fisherman or merchant seaman |

Schedule C filed with your federal return - Attach a copy of Schedule C |

||

Coalfield credit earned |

Primary taxpayer deceased |

Spouse deceased |

Overseas on due date |

nn

I (We), the undersigned, declare under penalty of law that I (we) have examined this return and to the best of my (our) knowledge, it is a true, correct and complete return.

Your Signature

Date

Spouse’s Signature

Date

Your business phone number |

Home phone number |

Spouse’s business phone number |

|

|

|

|

|

nn |

- |

- |

- |

- |

- |

- |

Preparer’s Name (please print)

Phone Number

Date

SEEINSTRUCTIONSFORADDRESSTOMAILYOURRETURN |

Fillinovalifreturnwascompletedbyapaidpreparer |