When using the online PDF editor by FormsPal, you may fill out or modify Issuer here. The editor is continually upgraded by us, acquiring handy features and growing to be better. To begin your journey, go through these simple steps:

Step 1: Press the orange "Get Form" button above. It will open up our editor so you could begin filling in your form.

Step 2: The tool will give you the capability to customize PDF forms in a range of ways. Enhance it by adding any text, correct what's originally in the document, and put in a signature - all when you need it!

This PDF form will involve some specific information; in order to guarantee correctness, please make sure to take into account the following guidelines:

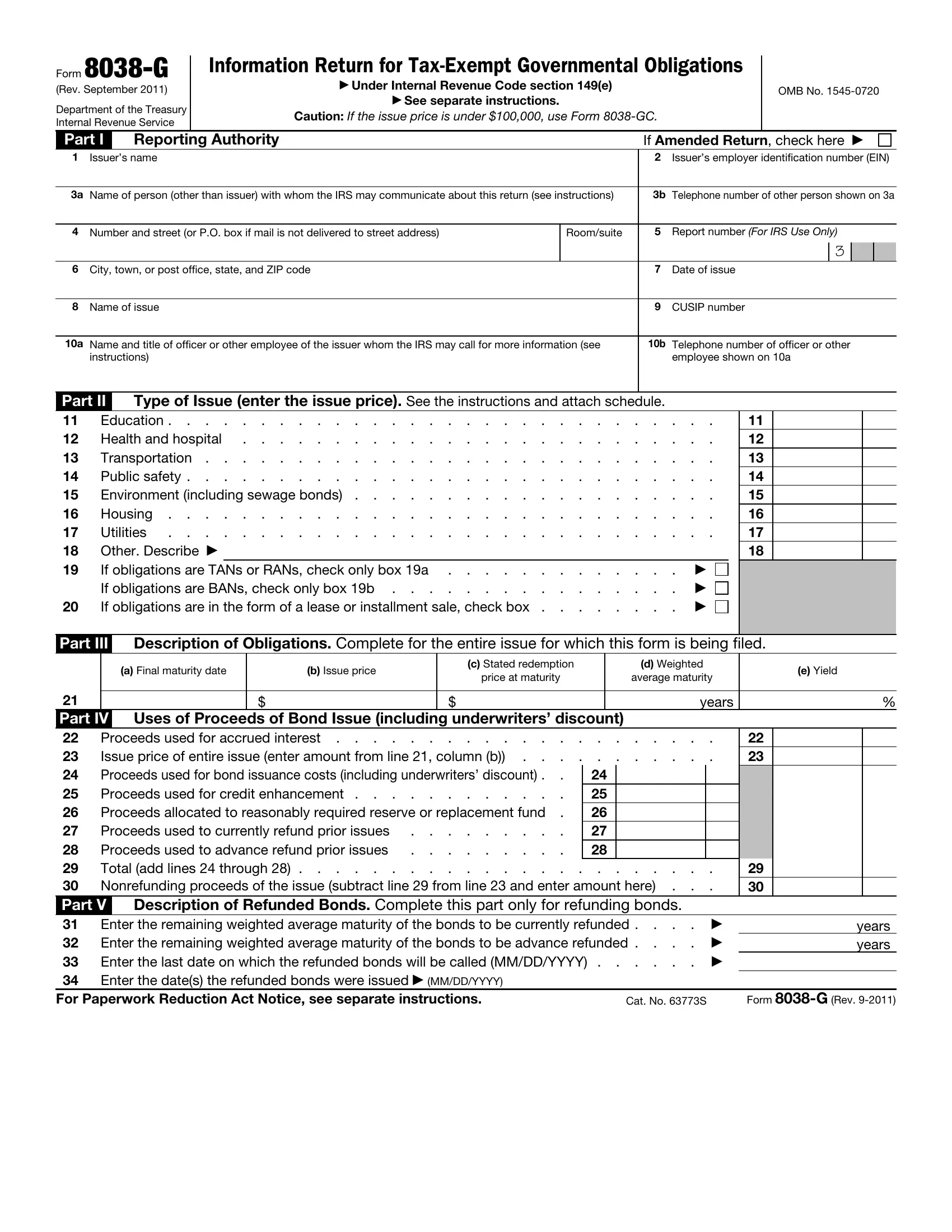

1. To start with, while filling in the Issuer, start out with the part that features the subsequent blank fields:

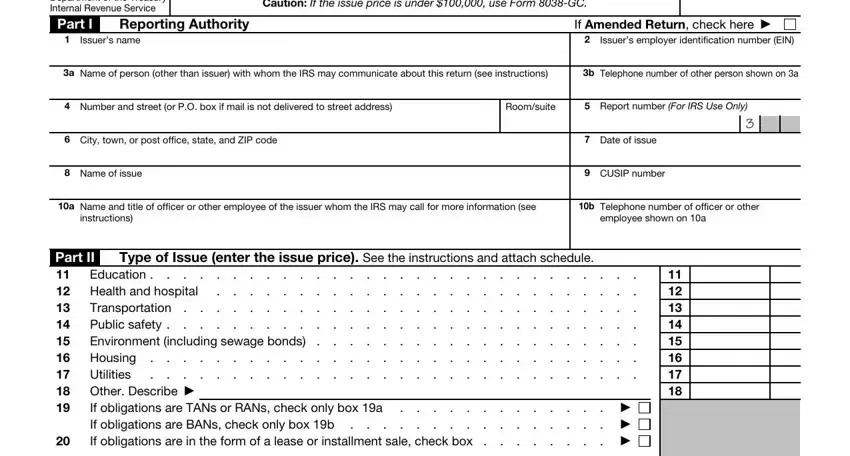

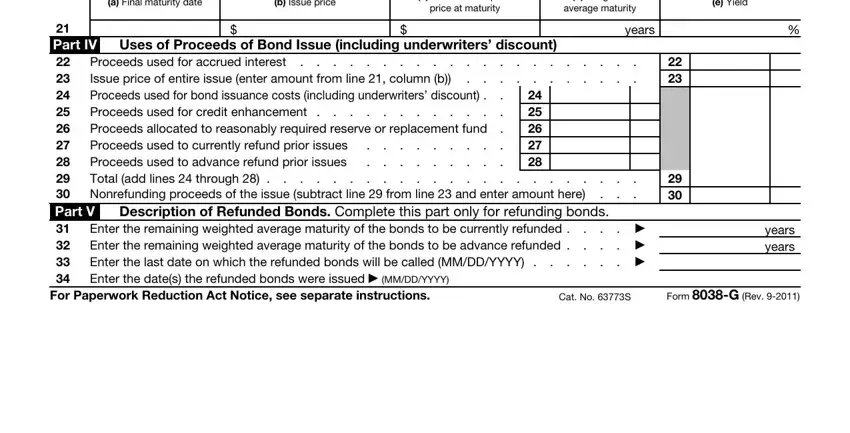

2. After the last part is complete, you're ready to include the necessary particulars in a Final maturity date, b Issue price, c Stated redemption, price at maturity, d Weighted, average maturity, e Yield, Uses of Proceeds of Bond Issue, Proceeds used for accrued interest, Part IV Nonrefunding, Description of Refunded Bonds, Enter the remaining weighted, years, years years, and For Paperwork Reduction Act Notice so you can go further.

A lot of people frequently make mistakes when completing Part IV Nonrefunding in this section. Ensure you read twice everything you type in right here.

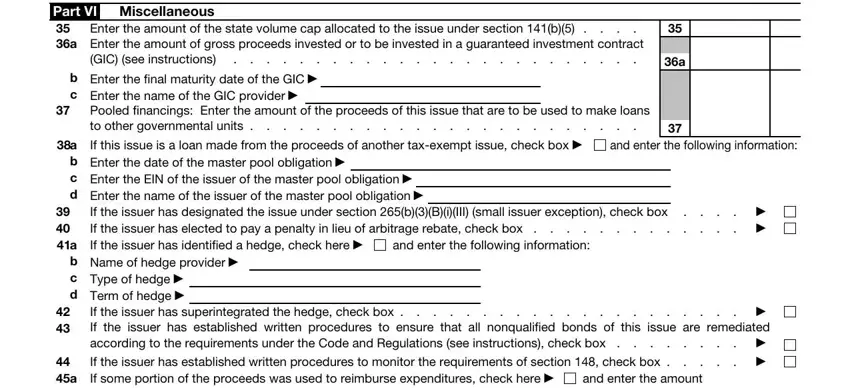

3. This stage is normally hassle-free - fill in all of the blanks in Page, Part VI Miscellaneous a Enter, Enter the amount of the state, GIC see instructions, b Enter the final maturity date of, Pooled financings Enter the amount, a If this issue is a loan made, and enter the following information, b Enter the date of the master, If the issuer has designated the, a If the issuer has identified, and enter the following, b Name of hedge provider c Type, If the issuer has superintegrated, and If the issuer has established to complete this part.

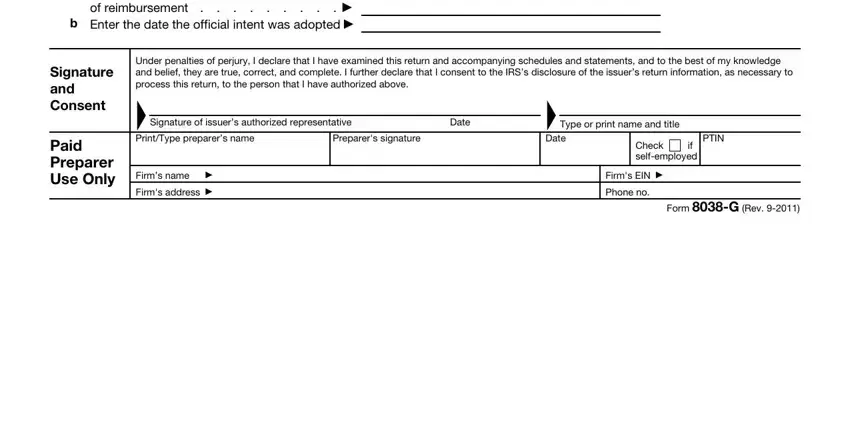

4. Filling in of reimbursement, b Enter the date the official, Signature and Consent, Paid Preparer Use Only, Under penalties of perjury I, Signature of issuers authorized, Date, Type or print name and title, PrintType preparers name, Preparers signature, Date, Firms name, Firms address, PTIN, and Check if selfemployed is key in this next stage - always don't rush and fill out every field!

Step 3: Be certain that the details are correct and then simply click "Done" to proceed further. Right after getting a7-day free trial account with us, it will be possible to download Issuer or send it through email immediately. The form will also be at your disposal via your personal account with your changes. FormsPal is committed to the confidentiality of our users; we make sure that all information coming through our system is kept confidential.