You may complete Recordkeeping easily with the help of our PDF editor online. Our tool is continually developing to deliver the best user experience attainable, and that's thanks to our resolve for constant enhancement and listening closely to customer comments. To get the ball rolling, take these easy steps:

Step 1: Access the PDF doc inside our tool by hitting the "Get Form Button" in the top part of this page.

Step 2: This tool allows you to change PDF files in a variety of ways. Enhance it by including personalized text, adjust what's already in the PDF, and include a signature - all close at hand!

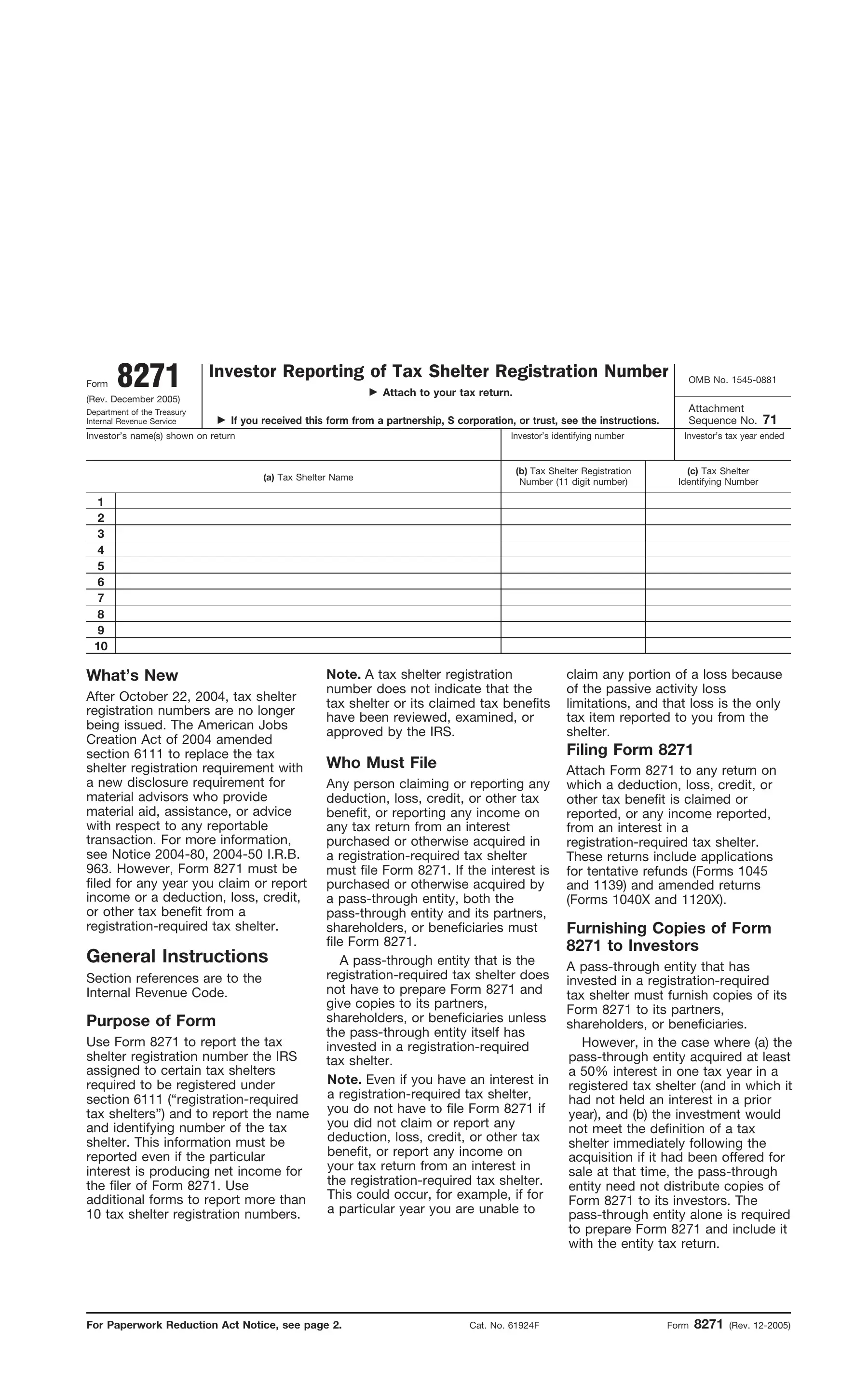

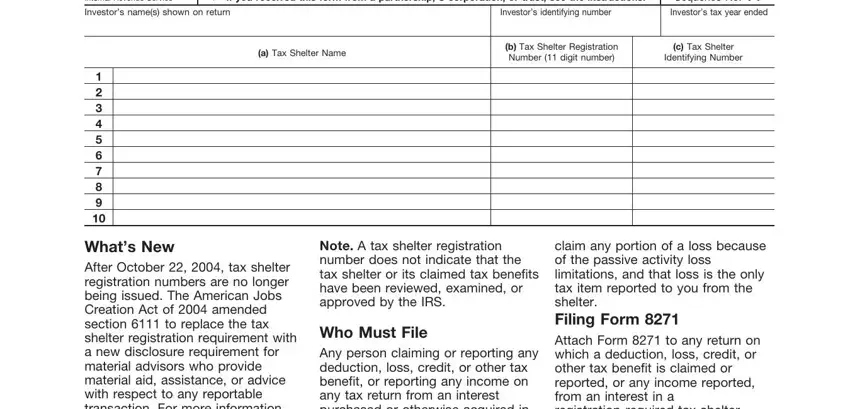

This form will need you to provide some specific information; in order to guarantee accuracy, take the time to adhere to the following steps:

1. You'll want to complete the Recordkeeping correctly, therefore be careful when filling out the parts comprising these blank fields:

Step 3: After you've glanced through the details in the fields, simply click "Done" to finalize your FormsPal process. Go for a 7-day free trial subscription at FormsPal and gain instant access to Recordkeeping - download or edit inside your personal cabinet. FormsPal is focused on the confidentiality of all our users; we make sure all personal information going through our system remains protected.