Handling PDF forms online is certainly super easy with this PDF editor. Anyone can fill out 8288 here and try out several other options we provide. FormsPal professional team is always working to improve the editor and insure that it is even easier for users with its many functions. Take your experience to the next level with continuously growing and exciting options we offer! Should you be seeking to get started, here's what it's going to take:

Step 1: Just press the "Get Form Button" in the top section of this webpage to launch our pdf editing tool. Here you will find everything that is necessary to fill out your document.

Step 2: This tool enables you to change almost all PDF files in many different ways. Transform it by writing personalized text, adjust what is originally in the PDF, and include a signature - all doable in no time!

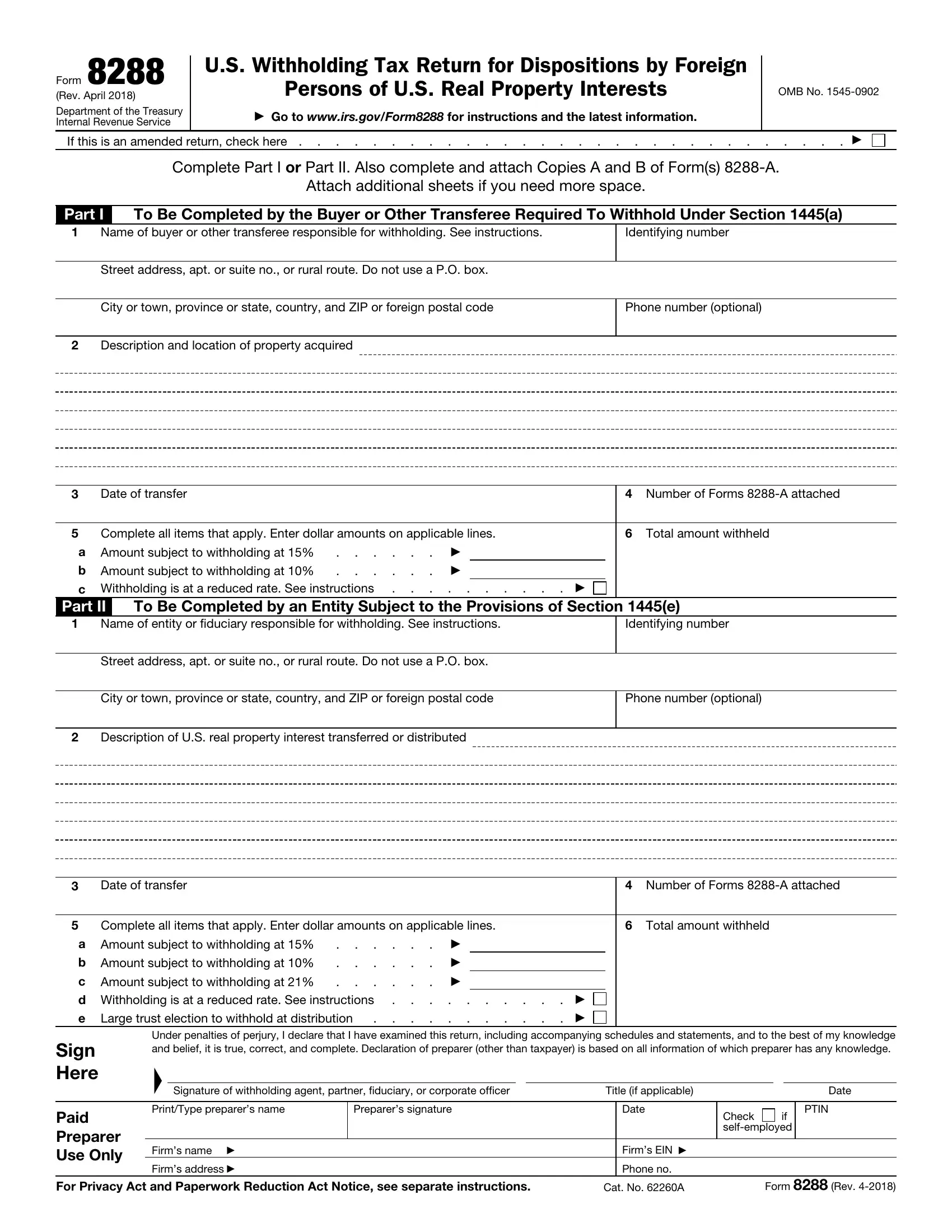

In an effort to finalize this document, be sure you provide the required details in each area:

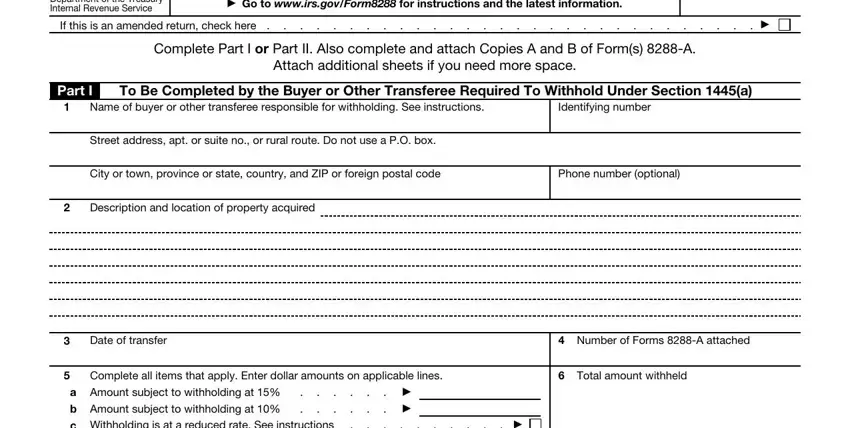

1. Start completing the 8288 with a group of necessary blank fields. Gather all the necessary information and be sure absolutely nothing is forgotten!

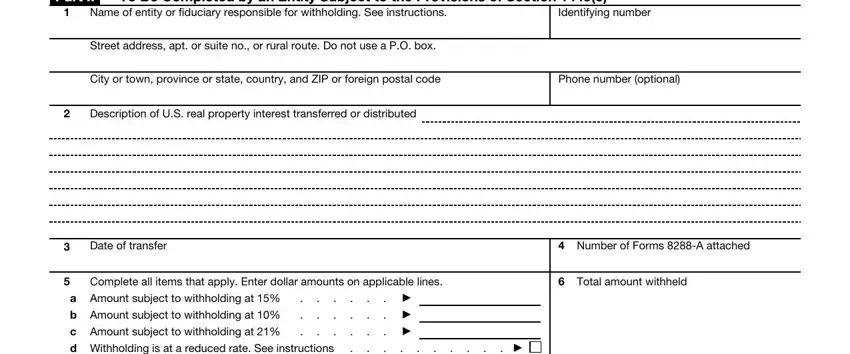

2. Immediately after this selection of blank fields is completed, go on to type in the relevant details in these - Part II, To Be Completed by an Entity, Name of entity or fiduciary, Identifying number, Street address apt or suite no or, City or town province or state, Phone number optional, Description of US real property, Date of transfer, Number of Forms A attached, Complete all items that apply, Total amount withheld, a Amount subject to withholding at, b Amount subject to withholding at, and c Amount subject to withholding at.

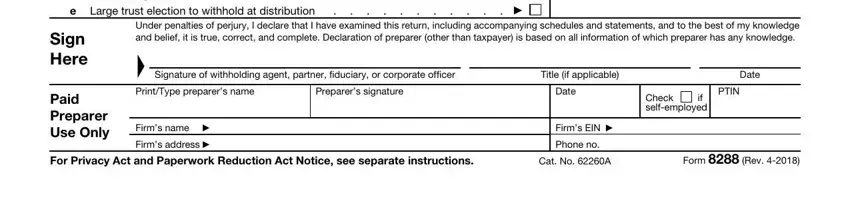

3. Your next stage will be straightforward - fill in every one of the form fields in d Withholding is at a reduced rate, Large trust election to withhold, Sign Here, Paid Preparer Use Only, Under penalties of perjury I, Signature of withholding agent, PrintType preparers name, Preparers signature, Firms name, Firms address, Title if applicable, Date, Date, PTIN, and Check if selfemployed to complete this process.

Regarding PrintType preparers name and Date, make certain you double-check them in this current part. These two are definitely the key fields in this file.

Step 3: Ensure that your information is correct and then just click "Done" to continue further. Create a free trial option at FormsPal and acquire instant access to 8288 - download, email, or edit inside your personal cabinet. FormsPal offers risk-free form tools devoid of personal data record-keeping or sharing. Feel at ease knowing that your data is secure here!