Not many tasks are easier than filling in documents using the PDF editor. There isn't much you should do to change the Beneficiarys document - just adopt these measures in the next order:

Step 1: Choose the button "Get Form Here".

Step 2: You can now edit the Beneficiarys. You may use our multifunctional toolbar to include, erase, and adjust the text of the form.

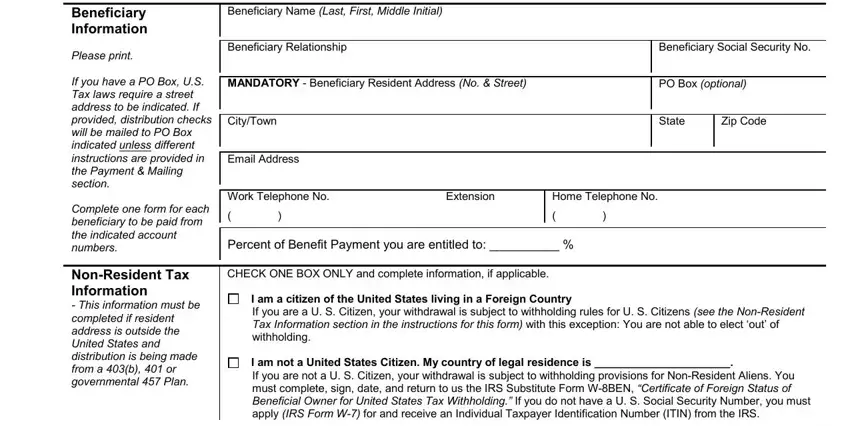

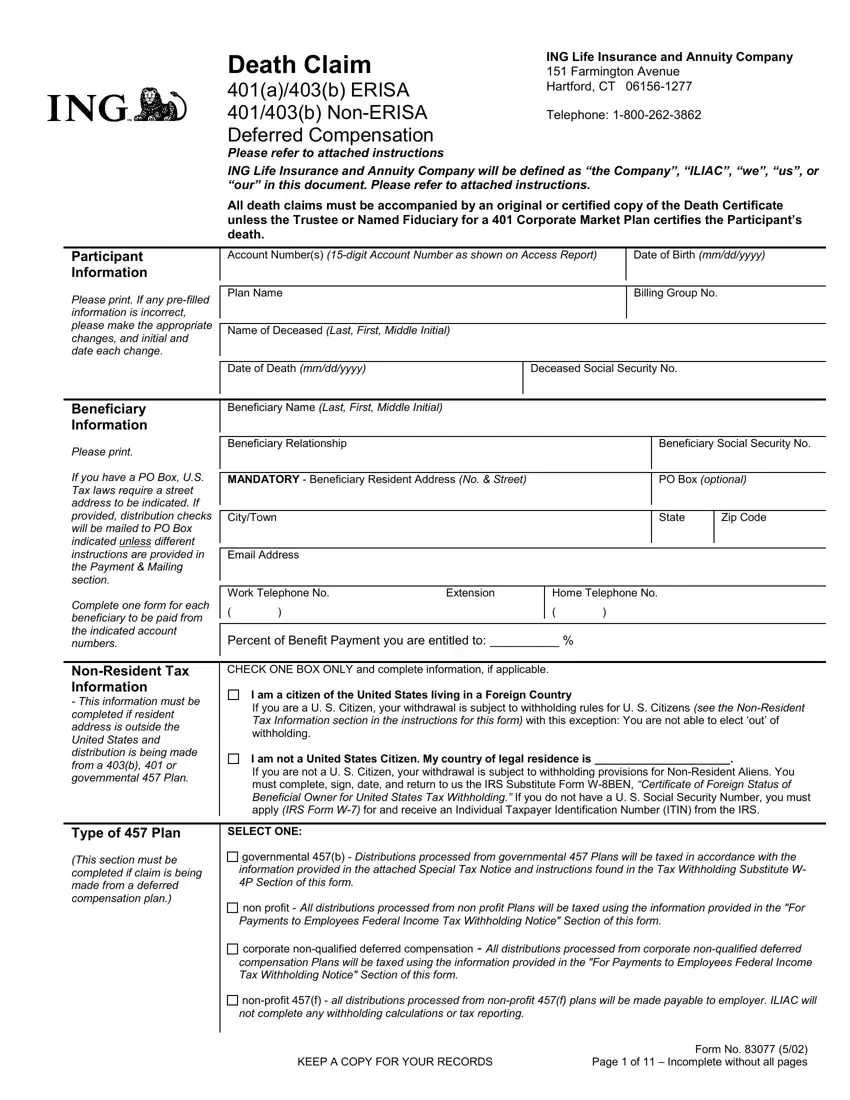

The following sections will create the PDF document that you will be filling out:

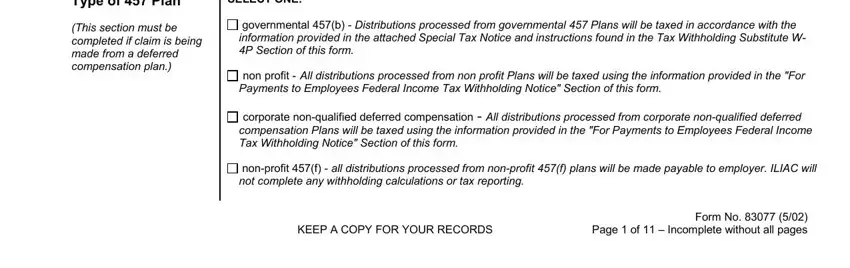

Type in the requested details in the space Type of Plan, SELECT ONE, This section must be completed if, governmental b Distributions, non profit All distributions, corporate nonqualified deferred, nonprofit f all distributions, KEEP A COPY FOR YOUR RECORDS, and Form No Page of Incomplete.

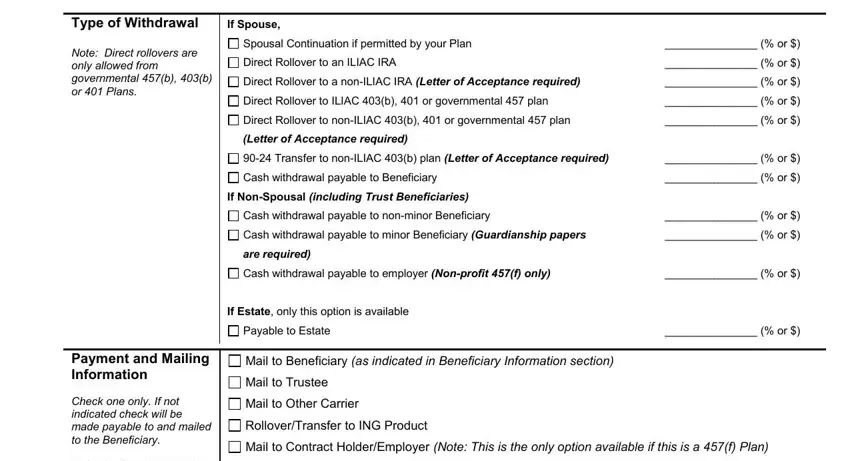

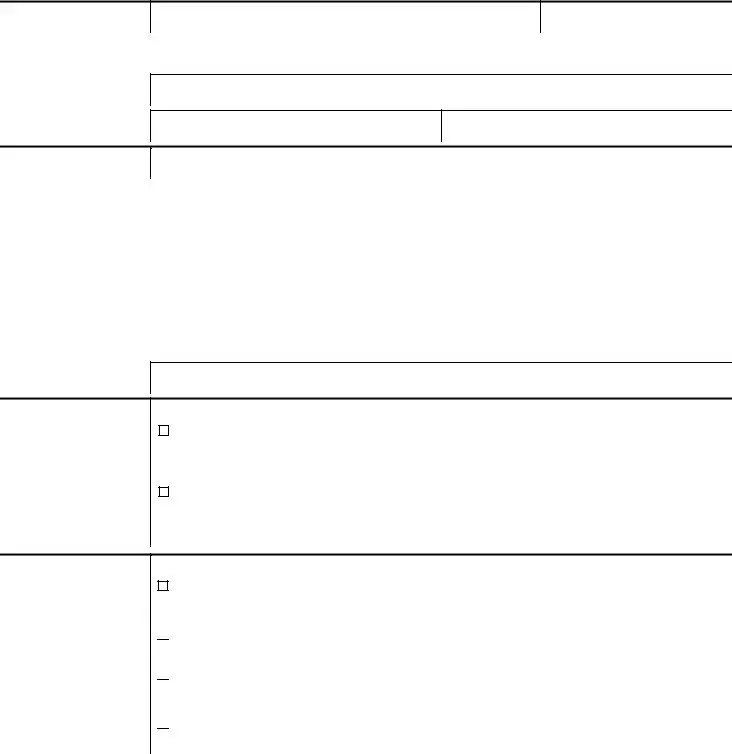

You're going to be instructed to type in the information to help the application complete the part Type of Withdrawal, If Spouse, Note Direct rollovers are only, Spousal Continuation if permitted, Direct Rollover to an ILIAC IRA, Direct Rollover to a nonILIAC IRA, Direct Rollover to ILIAC b or, Direct Rollover to nonILIAC b or, Letter of Acceptance required, Transfer to nonILIAC b plan, Cash withdrawal payable to, If NonSpousal including Trust, Cash withdrawal payable to, Cash withdrawal payable to minor, and are required.

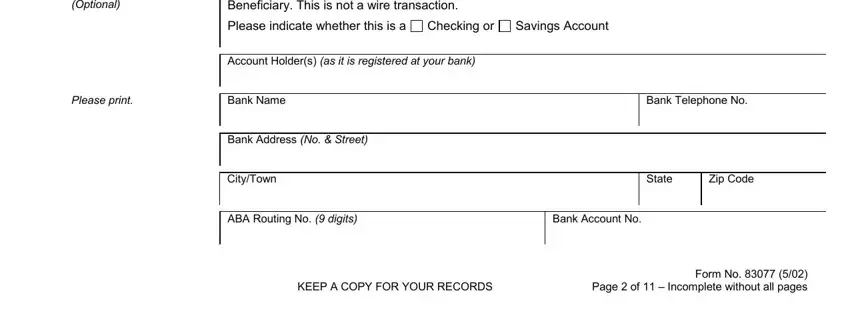

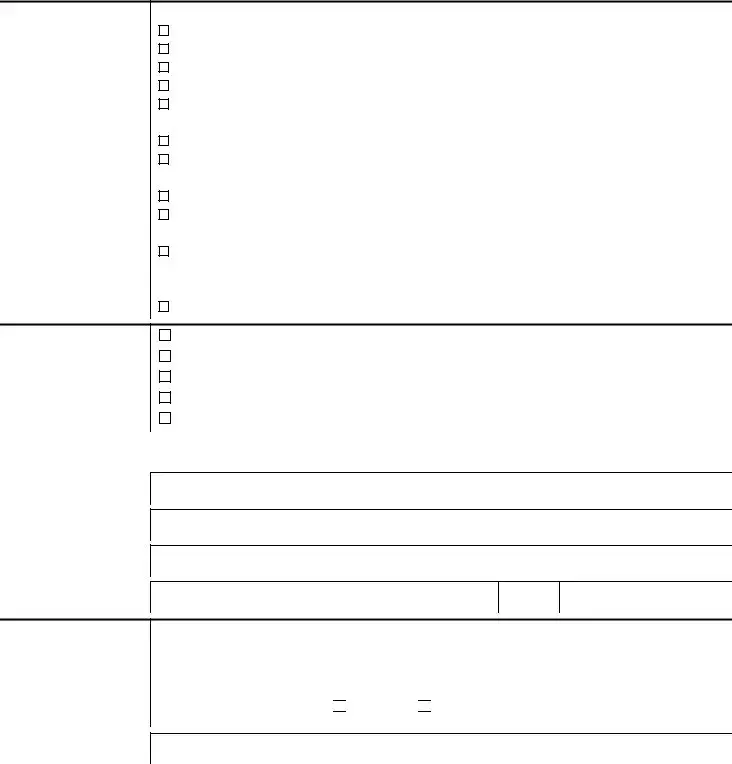

The Optional, If you would like us to, Please indicate whether this is a, Checking or, Savings Account, Account Holders as it is, Please print, Bank Name, Bank Telephone No, Bank Address No Street, CityTown, State, Zip Code, ABA Routing No digits, and Bank Account No box is where all parties can place their rights and obligations.

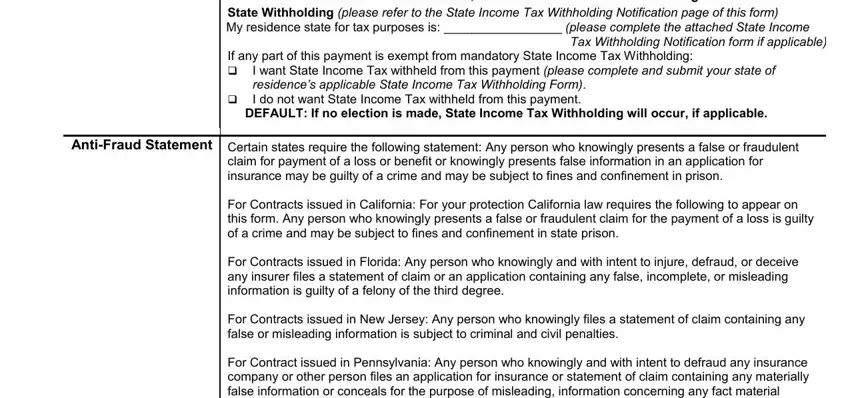

Terminate by taking a look at the following fields and preparing them correspondingly: DEFAULT If no election is made, State Withholding please refer to, Tax Withholding Notification form, If any part of this payment is, I want State Income Tax withheld, cid, DEFAULT If no election is made, AntiFraud Statement Certain states, claim for payment of a loss or, For Contracts issued in California, For Contracts issued in Florida, For Contracts issued in New Jersey, and For Contract issued in.

Step 3: Select the "Done" button. Then, you can transfer the PDF file - download it to your device or deliver it via electronic mail.

Step 4: It may be simpler to create copies of your form. You can rest easy that we are not going to disclose or view your particulars.

corporate

corporate

Checking or

Checking or

Savings Account

Savings Account