In navigating the complex landscape of the American tax system, understanding specific forms and their implications is crucial for both individuals and organizations involved in financial transactions. Among these, Form 8329, issued by the Department of the Treasury and the Internal Revenue Service (IRS), serves as a critical document for lenders in the realm of Mortgage Credit Certificates (MCCs). Revised in April 1993, this form captures detailed information about the issuance of MCCs for a calendar year, highlighting the interaction between lending institutions and the tax benefits extended to homeowners. The form is divided into sections that collect data starting from the lender's identification details to the recipients of the MCCs, as well as the computation of the total amount of MCCs issued. Not only does this form facilitate a lender's obligation to report on certified indebtedness loans, but it also aims to streamline the process and ensure compliance with Section 25 of the Internal Revenue Code. The necessity for lenders to maintain meticulous records and file Form 8329 by January 31 following the calendar year of issuing loans underscores the form's role in the broader context of housing finance and tax law. Additionally, the penalties for non-compliance emphasize the importance of accuracy and timeliness in submission. Through capturing a snapshot of mortgage credit activities within a given year, Form 8329 contributes to the execution of tax laws and aids in the administration of housing-related financial benefits, thus demonstrating the interconnectedness of tax policy, housing finance, and individual homeownership in the United States.

| Question | Answer |

|---|---|

| Form Name | Form 8329 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | preparer, 1992, irs form 8329 fillable, Issuers |

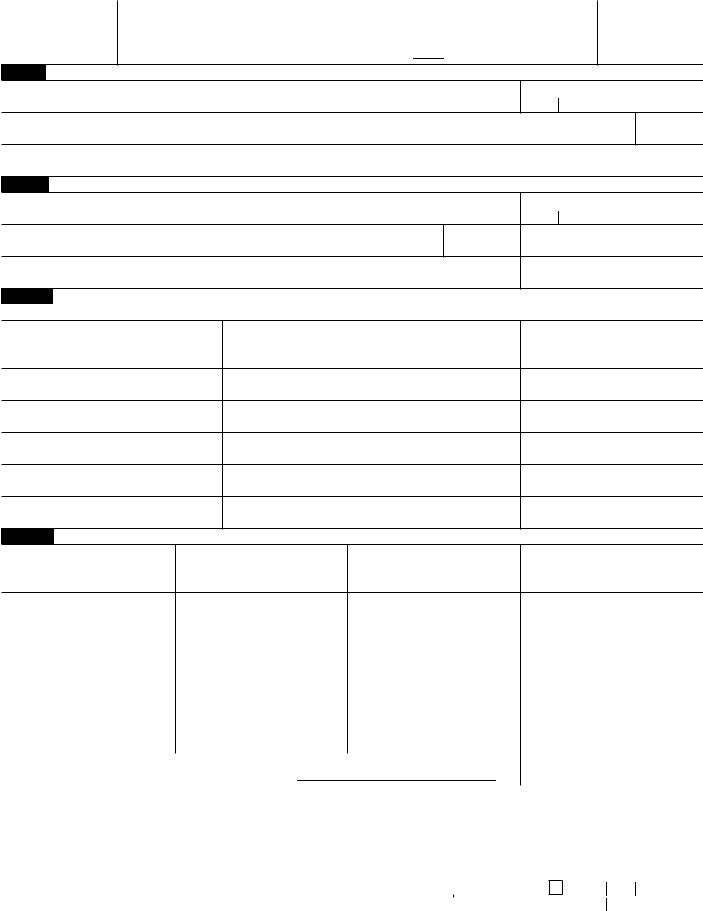

Form 8329

(Rev. April 1993)

Department of the Treasury Internal Revenue Service

Lender’s Information Return for M ortgage Credit Certificates (M CCs)

For calendar year ending 19

OMB No.

Expires

Part I Reporting Authority

Lender’s name

Employer identification number

Lender’s address (number, street, or P.O. box no., if mail is not delivered to street address)

Room/suite

City, state, and ZIP code

Part II Issuing Authority

Issuer’s name

Employer identification number

Issuer’s address (number, street, or P.O. box no., if mail is not delivered to street address)

Room/suite

Election date

City, state, and ZIP code

Nonissued bond amount

Part III Recipients of Mortgage Credit Certificates (Note: Match the infor mation entered on each line with infor mation entered on each corresponding line in Part IV. )

(a)

Name(s)

(b)

Address

Do not use a P.O. box number.

(c)

Social Security Number(s)

1

2

3

4

5

Part IV Computation of the Total Amount of Mortgage Credit Certificates

(a)

Date of Issue of MCC

(b)

Certified Indebtedness Amount

of Each MCC Issued

(c)

Certificate Credit Rate

(d)

Amount of MCC Issued

(Column (b) column (c))

1 |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

6 Total amount of MCCs issued. (See instructions.) |

|

|

|

|

▶ |

|

|

|||||

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge |

|||||||||||

Please |

and belief it is true, correct, and complete. Declaration of preparer (other than representative of lender) is based on all information of which preparer has |

|||||||||||

any knowledge. |

|

|

|

|

|

|

|

|

|

|

||

Sign |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Here |

▶ |

|

|

|

|

|

|

▶ |

|

|

|

|

|

Signature of authorized representative of lender |

Date |

|

Title |

|

|

||||||

|

Preparer’s |

|

|

|

Date |

|

|

Check if |

Preparer’s social security no. |

|||

Pai d |

signature ▶ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

Preparer’ s |

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name (or |

|

|

|

|

|

|

|

E.I. No. ▶ |

|

|

||

Use Only |

|

|

|

|

|

|

|

|

|

|||

yours if |

|

|

|

|

|

|

|

|

|

|

||

▶ |

|

|

|

|

|

ZIP code ▶ |

|

|

||||

|

and address |

|

|

|

|

|

|

|

||||

For Paperwork Reduction Act Notice, see back of form. |

|

|

Cat. No. 13902F |

Form 8329 (Rev. |

||||||||

Form 8329 (Rev. |

Page 2 |

|

|

Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

3 hr., 35 min. |

Learning about the |

|

law or the form |

53 min. |

Preparing and sending |

|

the form to the IRS |

59 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form more simple, we would be happy to hear from you. You can write to both the Internal Revenue Service, Attention: Reports Clearance Officer, T:FP, Washington, DC 20224; and the Office of Management and Budget, Paperwork Reduction Project

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Any person who makes a loan that is a “certified indebtedness amount” on any mortgage credit certificate (MCC) must maintain books and records of such activity and file Form 8329. (See Regulations section

A separate Form 8329 must be filed for each issue of MCCs for which the lender made mortgage loans during the calendar year. Each issue of MCCs corresponds to the MCC program relating to the nonissued bond amount that was the subject of the election made on the election date. Both the nonissued bond amount and the election date are to be provided in Part II of this Form 8329.

Caution: After June 30, 1992, issuers (states and political subdivisions) cannot elect to convert their right to issue qualified mortgage bonds for the right to issue qualified mortgage credit certificates. However, lenders must still file a Form 8329 to report on mortgage credit certificates issued under a

Purpose of Form

Form 8329 is used by lenders of certified indebtedness amounts to provide the IRS with information regarding the issuance of MCCs under section 25.

The MCC must be issued under a program that meets the residence requirements of section 143(c). Under these requirements, the residence must: (1) be a

Who Must File

Any person who makes a loan that is a certified indebtedness amount on any MCC must file Form 8329.

When To File

File Form 8329 by January 31 following the close of the calendar year in which the lender made certified indebtedness loans.

The IRS may grant an extension of time to file Form 8329 if there is reasonable cause for not filing on time.

Where To File

File Form 8329 with the Internal Revenue Service Center, Philadelphia, PA 19255.

Penalty

Any person required to file Form 8329 may be subject to a $200 penalty for each form that is not filed by the due date.

Definitions

A mortgage credit certificate is a certificate issued under a “qualified mortgage credit certificate program” by the state or political subdivision having the authority to issue qualified mortgage bonds to provide financing for the acquisition, qualified rehabilitation, or qualified home improvement of a taxpayer’s principal residence. For more information, see section 25(c)(1).

A qualified mortgage credit certificate program is a program established for any calendar year by a state or political subdivision that is authorized to issue qualified mortgage bonds under section 143 (and for which there has been an appropriate allocation of state volume cap for that calendar year under section 146) but elected instead to issue mortgage credit certificates. (See section 25(c)(2) for additional requirements.) The aggregate amount of all mortgage credit certificates issued under any single MCC program may not exceed 25% of the nonissued bond amount for which the election was made. See section 25(d)(2).

The certified indebtedness amount is the amount of indebtedness specified in the MCC and incurred by a taxpayer:

a. To acquire his or her principal residence,

b. To make qualified home improvements on that residence, or

c. To make a qualified rehabilitation of that residence.

The certificate credit rate is the rate specified by the issuer on the MCC. However, the rate cannot be less than 10% nor more than 50% . For other limitations, see Regulations section

Specific Instructions

Part

Provide information about the mortgage lender.

Part

Provide information about the mortgage credit certificate issuer.

Election

Nonissued bond

Part

Column

Column

Column

Part

Amount of Mortgage Credit

Certificates

Column

Column

Column

Line

Note for Parts III and IV: The information on each line in Part IV must match the information entered on each corresponding line in Part III. For example, the MCC listed on line 1 of Part IV should be the MCC that was issued to the individual(s) listed on line 1 of Part III.

If the lender must report on more than 5 mortgage credit certificates, it should report these additional certificates on an attachment formatted like Form 8329.

Instead of formatting its own attachment, the lender may use one Form 8329 as a transmittal document and use additional Forms 8329 as attachments. In such a case, draw an “X” across the 5 lines of Parts III and IV of the Form 8329 used as a transmitting document. Complete the remaining lines of this Form 8329, making certain that all mortgage credit certificate amounts reported in all the attachments in Part IV, column (d) are totaled for line 6 of the transmittal document. Sign only the transmittal Form 8329 and indicate in the top margin the number of Forms 8329 attached to this Form 8329.

On the attached Forms 8329, show the lender’s name and employer identification number in Part I and enter mortgage credit certificate information on the 5 lines of Parts III and IV.

Signature

Form 8329 must be signed by an authorized representative of the lender.

Leave the paid preparer’s space blank if the return was prepared by a regular employee of the lender. Otherwise, anyone who is paid to prepare the return must sign it in the Paid Preparer’s Use Only area.

The paid preparer must complete the required preparer information and:

●Sign the return, by hand, in the space provided for the preparer’s signature (signature stamps and labels are not acceptable).

●Give a copy of the return to the lender.