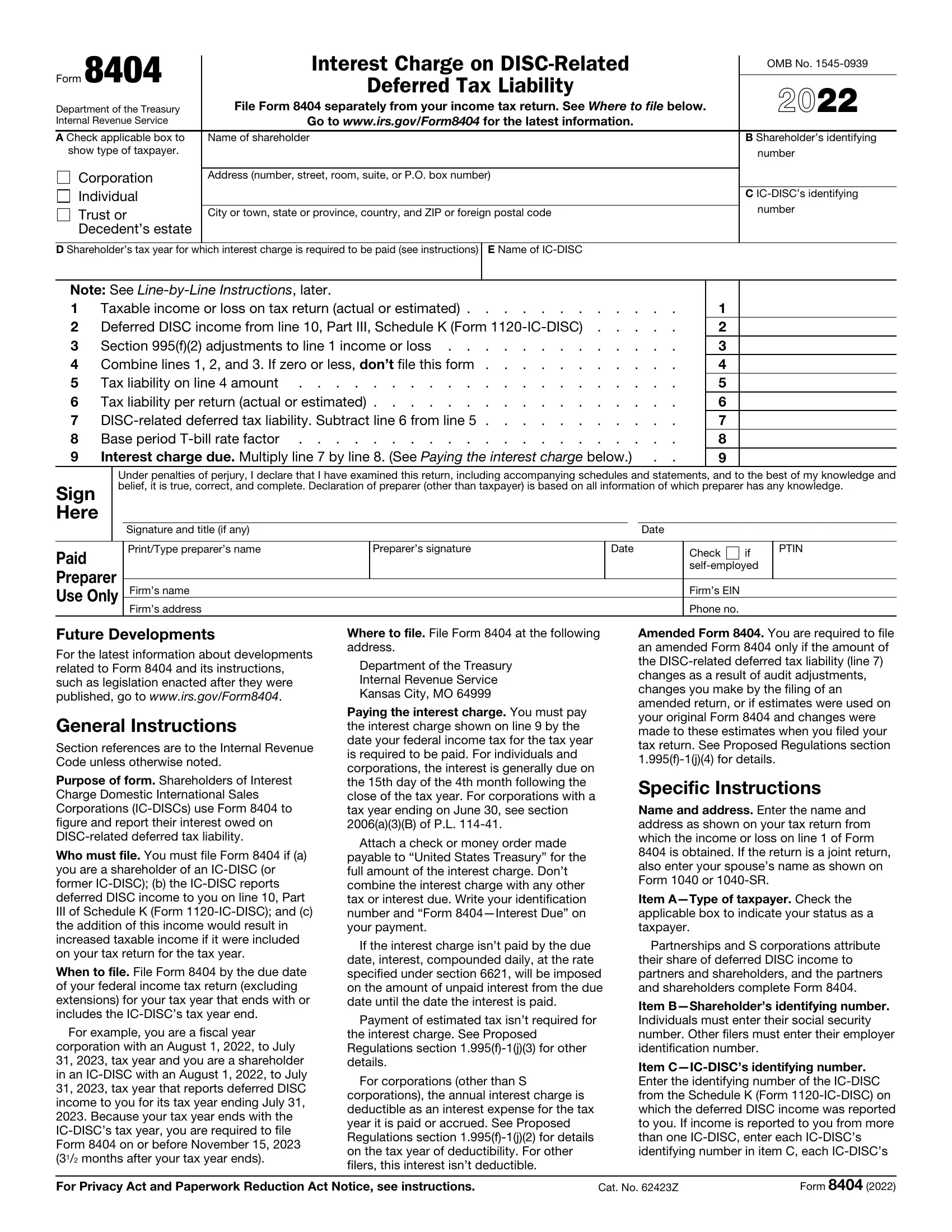

name in item E, and report the combined income on line 2.

Item D—Tax year. Enter in item D the calendar year or the beginning and ending dates of the tax year shown on your tax return for which the interest charge is figured.

Special Computation Rules

Carrybacks. The determination of the shareholder’s DISC-related deferred tax liability on lines 1 through 7 shall be made without taking into account any capital loss carryback or credit carryback to the tax year.

Carryovers. The determination of the shareholder’s tax liability (line 5) for the tax year is made by disregarding any loss, deduction, or credit to the extent that such loss, deduction, or credit may be carried forward by the shareholder to any other tax year.

Note: If the tax year is the last tax year to which the amount of carryforward (of loss, deduction, or credit) may be carried, the line 3 adjustments and line 5 tax shall be figured with regard to the full amount of such carryforward.

For example, a shareholder had an NOL carryover (originating before 2018) to 2022 of $12,000; $10,000 income to which $10,000 of the NOL can be applied; $2,000 allowable NOL carryover to 2023; and $5,000 deferred DISC income for 2022. In this case, for purposes of figuring line 5, the allowed NOL is $10,000. Note: If 2022 was the last tax year to which the $12,000 NOL (originating before 2018) could be carried, the full $12,000 NOL would be allowed for purposes of figuring line 5 tax liability. The additional $2,000 loss would be entered on line 3.

Other adjustments. In figuring line 3 adjustments, take into account any income and expense adjustments that don’t result in amounts that may be carried back or forward to other tax years. For example, in the case of an IC-DISC shareholder who is an individual, the amount of medical expenses allowable as a deduction under section 213 must be redetermined for purposes of line 3 adjustments. However, the amount allowable as a charitable deduction under section 170 isn’t redetermined because this adjustment could result in a carryback or carryover.

See Proposed Regulations section 1.995(f)-1(d) for other details regarding these and other special computation rules.

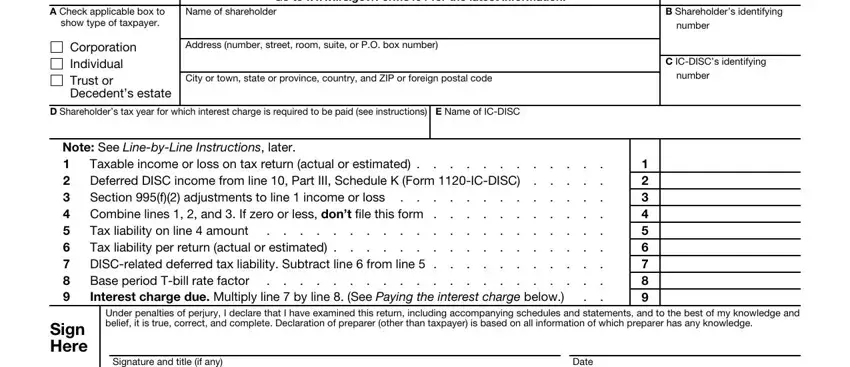

Line-by-Line Instructions

Line 1. Enter on line 1 the taxable income or loss from your federal income tax return for your tax year that ends with or includes the IC-DISC’s tax year end. If you haven’t yet filed your tax return, estimate your income or loss based on all information available to you. See Amended Form 8404, earlier.

Line 2. Enter the deferred DISC income from line 10, Part III of Schedule K (Form

1120-IC-DISC), for the IC-DISC tax year that ends with or within your tax year.

Line 3. Enter the net amount of all section 995(f)(2) adjustments to taxable income. See Special Computation Rules, earlier, for details on the income (loss) and expense adjustments to be made. If more than one adjustment is involved, attach a statement listing each item and show the computation of the net amount.

Lines 5 and 6. “Tax liability” on lines 5 and 6 (with and without the deferred DISC income) means the amount of tax imposed on the IC-DISC shareholder for the tax year by chapter 1 of the Internal Revenue Code (other than taxes listed below) reduced by credits allowable against such tax (other than credits listed below).

See Special Computation Rules, earlier, for rules for carrybacks and carryovers. These rules may affect the line 5 computation.

The following taxes aren’t taken into account.

•Alternative minimum tax (individuals only).

•Any other provisions described in section 26(b)(2) (relating to certain other taxes treated as not imposed by chapter 1).

The following credits aren’t taken into account.

•Section 31 (taxes withheld on wages).

•Section 32 (earned income credit).

•Section 34 (fuels credit).

For 2021, a Form 1040 or 1040-SR filer or a Form 1120 filer using the above rules will generally figure their line 6 tax liability using the following items shown on the following lines of those forms. All other filers should use the corresponding lines of other income tax returns. If you haven’t yet filed your return, estimate the line 6 tax liability based on all information available to you.

|

|

2021 |

2021 |

|

|

Form 1040 |

|

|

Form 1120 |

|

|

or 1040-SR |

|

|

Line |

Line |

|

|

|

Tax less nonrefundable |

|

|

|

credits |

. |

22 |

7, Sch. J |

Plus: (1) Recapture taxes |

|

* |

* |

(2) Prior year minimum |

|

|

tax credit . . |

. |

6b, Sch. 3 |

5d, Sch. J |

Less: (1) Alternative minimum |

|

|

tax . . . . |

. |

1, Sch. 2 |

|

(2) Refundable or |

|

|

|

additional child tax |

|

|

|

credit . . . |

. |

28 |

|

(3) American |

|

|

|

opportunity credit |

. |

29 |

|

(4) Premium tax credit |

|

|

|

(Form 8962) . . |

9, Sch. 3 |

|

(5) Credit for tax paid |

|

|

|

on undistributed |

|

|

|

capital gains (Form |

|

|

|

2439) . . . |

. 13a, Sch. 3 |

20a, Sch. J |

(6) Health insurance |

|

|

|

credit for eligible |

|

|

|

recipients (Form |

|

|

|

8885) . . . |

. 13c, Sch. 3 |

|

*Caution: Only use the portion of Form 1040 or 1040-SR, line 24, or Form 1120, Schedule J, line 10, attributable to recapture of credits allowable against taxes treated as imposed under chapter 1 (for example, recapture of investment tax and low-income housing credits). See section 26(b)(2) for a list of recapture taxes to exclude.

Line 8. The base period T-bill rate is defined in section 995(f)(4). The base period T-bill rate is compounded daily based on the number of days in the shareholder’s tax year to determine the base period T-bill rate factor.

The base period T-bill rate factor for 2021 is 0.000800319 for a 365-day tax year. Enter the appropriate factor on line 8 of Form 8404. See Rev. Rul. 2021-22, 2021-47 I.R.B. 736, for a short tax year or a 52-53-week tax year.

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. We need it to figure and collect the right amount of tax. Section 995(f) requires taxpayers to pay over to the IRS interest on DISC-Related Deferred Tax Liability. This form is used to determine the amount of tax that you owe. Sections 6001 and 6011 require you to provide the requested information if the tax applies to you. Section 6109 requires you to provide your identifying number. Routine uses of this information include disclosing it to the Department of Justice for civil and criminal litigation and to other federal agencies, as provided by law. We may disclose the information to cities, states, the District of Columbia, and U.S. commonwealths or possessions to administer their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. If you don’t provide this information or provide incomplete or fraudulent information, you may be subject to penalties.

You aren’t required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for business taxpayers filing this form is approved under OMB control number 1545-0123.

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/FormComments. Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Don’t send the form to this office. Instead, see Where to file, earlier.