|

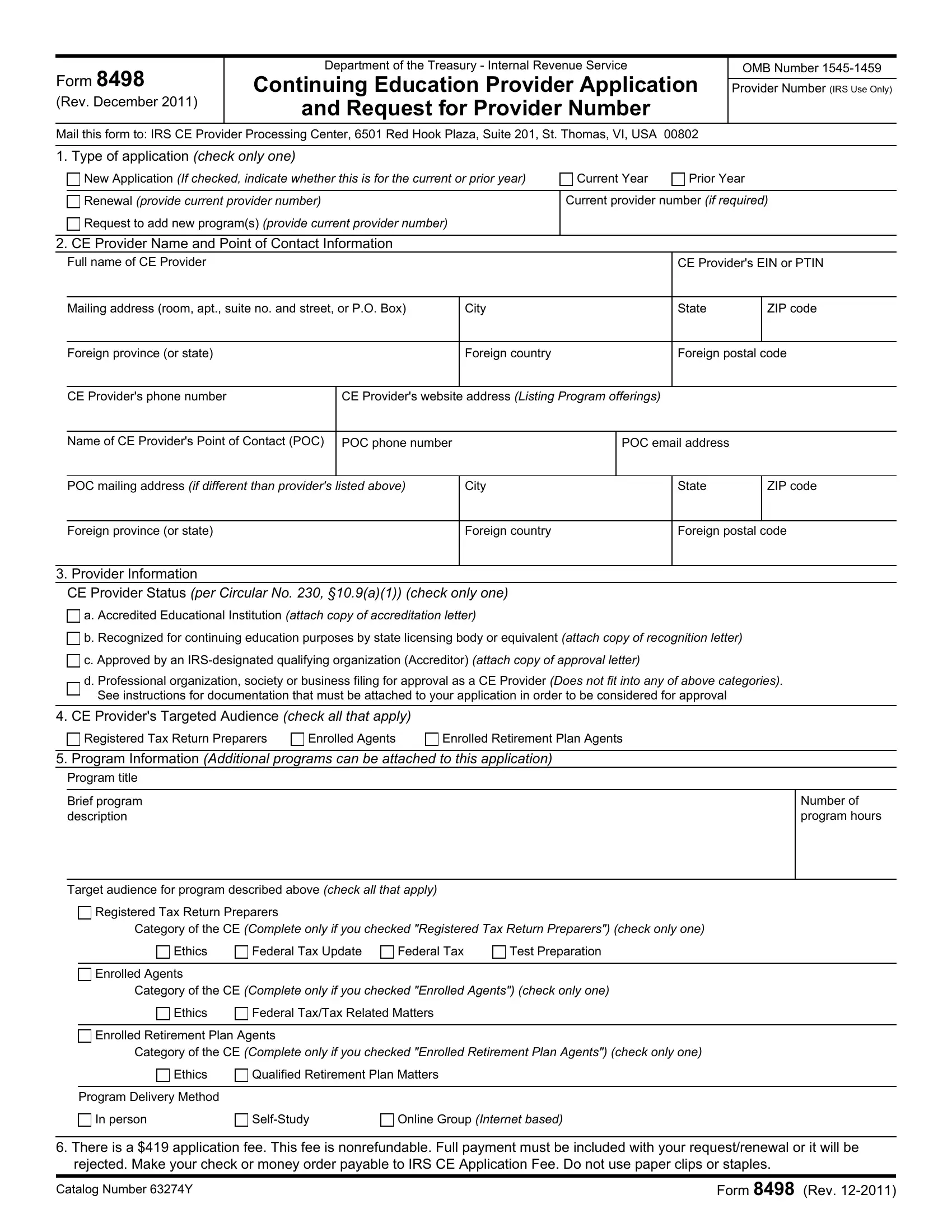

Form 8498 |

Department of the Treasury - Internal Revenue Service |

|

OMB Number 1545-1459 |

|

Continuing Education Provider Application |

|

|

Provider Number (IRS Use Only) |

|

(Rev. December 2011) |

|

and Request for Provider Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail this form to: IRS CE Provider Processing Center, 6501 Red Hook Plaza, Suite 201, St. Thomas, VI, USA 00802 |

|

|

|

|

|

|

|

|

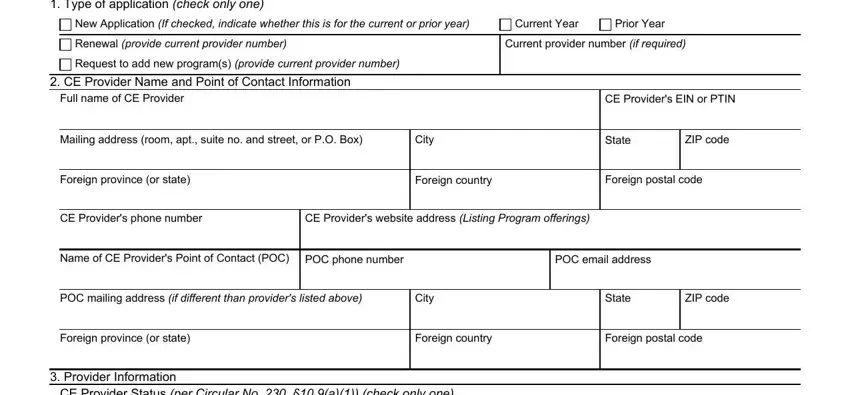

1. Type of application (check only one) |

|

|

|

|

|

New Application (If checked, indicate whether this is for the current or prior year) |

Current Year |

Prior Year |

|

|

|

|

|

|

Renewal (provide current provider number) |

Current provider number (if required) |

|

|

Request to add new program(s) (provide current provider number) |

|

|

|

|

|

|

|

|

|

|

2. CE Provider Name and Point of Contact Information |

|

|

|

CE Provider's EIN or PTIN

Mailing address (room, apt., suite no. and street, or P.O. Box)

Foreign province (or state)

|

CE Provider's phone number |

CE Provider's website address (Listing Program offerings) |

|

|

|

|

|

|

|

|

|

Name of CE Provider's Point of Contact (POC) |

POC phone number |

|

POC email address |

|

|

|

|

|

|

|

|

|

POC mailing address (if different than provider's listed above) |

City |

|

State |

ZIP code |

|

|

|

|

|

|

|

|

Foreign province (or state) |

|

Foreign country |

|

Foreign postal code |

|

|

|

|

|

|

|

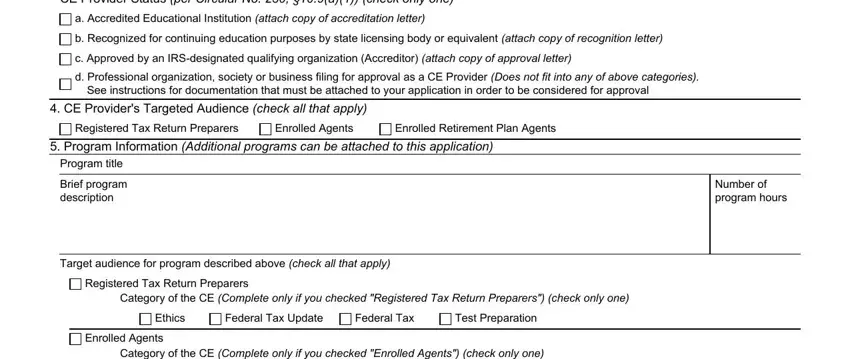

3. Provider Information

CE Provider Status (per Circular No. 230, §10.9(a)(1)) (check only one)

a. Accredited Educational Institution (attach copy of accreditation letter)

b. Recognized for continuing education purposes by state licensing body or equivalent (attach copy of recognition letter)

c. Approved by an IRS-designated qualifying organization (Accreditor) (attach copy of approval letter)

d. Professional organization, society or business filing for approval as a CE Provider (Does not fit into any of above categories). See instructions for documentation that must be attached to your application in order to be considered for approval

4. CE Provider's Targeted Audience (check all that apply)

Registered Tax Return Preparers

Enrolled Retirement Plan Agents

5.Program Information (Additional programs can be attached to this application)

Program title

Brief program description

Target audience for program described above (check all that apply)

Registered Tax Return Preparers

Category of the CE (Complete only if you checked "Registered Tax Return Preparers") (check only one)

Ethics |

Federal Tax Update |

Federal Tax |

Test Preparation |

Enrolled Agents

Category of the CE (Complete only if you checked "Enrolled Agents") (check only one)

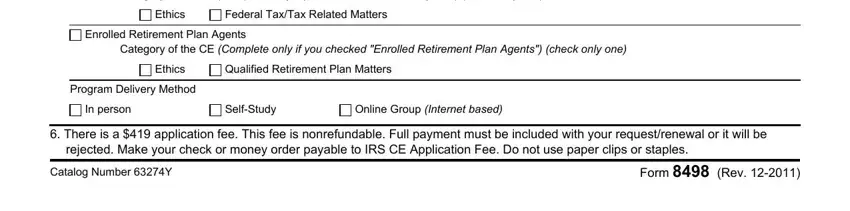

Federal Tax/Tax Related Matters

Enrolled Retirement Plan Agents

Category of the CE (Complete only if you checked "Enrolled Retirement Plan Agents") (check only one)

Qualified Retirement Plan Matters

Program Delivery Method

In person

Online Group (Internet based)

6.There is a $419 application fee. This fee is nonrefundable. Full payment must be included with your request/renewal or it will be rejected. Make your check or money order payable to IRS CE Application Fee. Do not use paper clips or staples.

Catalog Number 63274Y |

Form 8498 (Rev. 12-2011) |

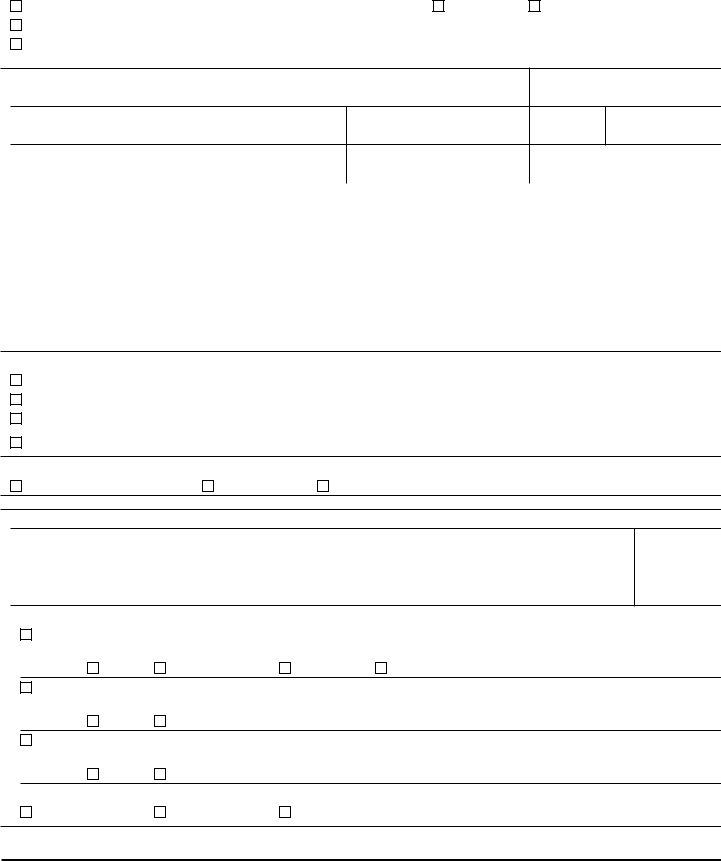

Continuing Education Provider Application and Request for Provider Number

(1)I (We) hereby certify that I (We) plan to offer continuing education programs compliant with the continuing education regulations for registered tax return preparers, enrolled agents, enrolled retirement plan agents (31 CFR, Part 10 reprinted as Treasury Department Circular No. 230).

(2)I (We) agree to comply with the requirements of Circular 230 relative to each continuing education program offered, including but not limited to the following:

a.Program(s) will be designed to enhance professional knowledge in Federal taxation, Federal tax related matters, including ethics, consistent with the Internal Revenue Code and principles of effective tax administration.

b.Program(s) will be developed by individual(s) qualified in the subject matter.

c.Program(s) will utilize material specifically developed for instructional use. General professional literature and IRS publications will be used only to supplement specific program materials.

d.Program(s) will comply with topic requirements for relevant audience (e.g., continuing education programs for enrolled retirement plan agents must be designed to enhance professional knowledge in qualified retirement plan matters).

e.Content of program(s) will be accurate and current. I (We) will review and update program(s), at least annually, to ensure accuracy and consistency with current accepted standards relating to program(s)' subject matter.

f.Instructor(s), discussion leader(s), and/or speaker(s) will be qualified with respect to program content and will possess demonstrable teaching and communication skills.

g.Program(s) will include some means for evaluation of attendees' successful absorption of program content.

h.Program(s) will be measured in contact hours (50 minutes constituting one contact hour), with credit granted only for a full contact hour.

i.Certificates of completion bearing a qualified continuing education program number issued by the IRS will be issued to each individual who successfully completes the program(s).

j.Records will be maintained to verify participants who attended and completed each program for a period of four years following completion of the program. (For continuous conferences, conventions, and the like, records will be maintained to verify completion of the program and attendance by each participant at each segment of the program.)

(3)I (We) agree to submit CE program participation data by PTIN holder to the IRS using the format, timing and instructions prescribed by the Return Preparer Office.

(4)I (We) understand and agree that the above program(s) and related records will be subject to review by the Return Preparer Office and that additional documentation may be requested at the discretion of the IRS.

(5)I (We) agree to renew our status as an IRS-approved continuing education provider on an annual basis for each year that we intend to offer IRS continuing education programs, using forms and guidance prescribed by the IRS.

(6)I (We) understand and agree that if we fail to comply with this agreement or fail to meet acceptable standards in our programs, the IRS may revoke my (our) status as a provider of IRS approved continuing education. Notice of such revocation may be given by the Director of the Return Preparer Office to all individuals who practice before the Internal Revenue Service and are required to complete IRS approved continuing education.

Under penalty of perjury, I declare that I have examined this application and read all accompanying information, and to the best of my knowledge and belief, the information provided is true, correct and complete. I understand any false or misleading information may result in criminal penalties and/or the denial or revocation of my (our) status as a provider of IRS approved continuing education.

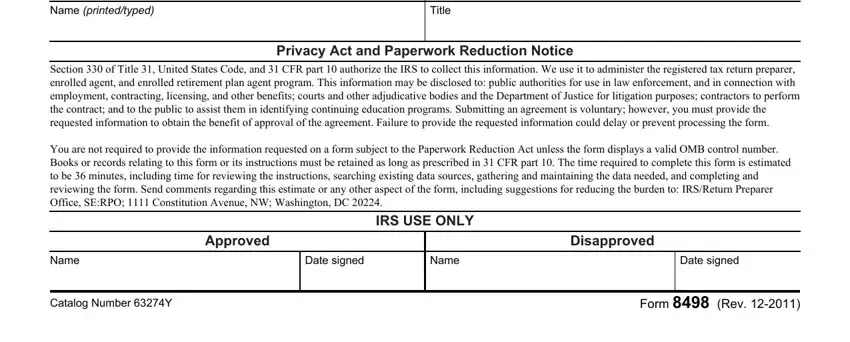

Privacy Act and Paperwork Reduction Notice

Section 330 of Title 31, United States Code, and 31 CFR part 10 authorize the IRS to collect this information. We use it to administer the registered tax return preparer, enrolled agent, and enrolled retirement plan agent program. This information may be disclosed to: public authorities for use in law enforcement, and in connection with employment, contracting, licensing, and other benefits; courts and other adjudicative bodies and the Department of Justice for litigation purposes; contractors to perform the contract; and to the public to assist them in identifying continuing education programs. Submitting an agreement is voluntary; however, you must provide the requested information to obtain the benefit of approval of the agreement. Failure to provide the requested information could delay or prevent processing the form.

You are not required to provide the information requested on a form subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to this form or its instructions must be retained as long as prescribed in 31 CFR part 10. The time required to complete this form is estimated to be 36 minutes, including time for reviewing the instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the form. Send comments regarding this estimate or any other aspect of the form, including suggestions for reducing the burden to: IRS/Return Preparer Office, SE:RPO; 1111 Constitution Avenue, NW; Washington, DC 20224.

IRS USE ONLY

Approved |

|

|

Disapproved |

|

|

|

|

|

Name |

Date signed |

Name |

|

Date signed |

|

|

|

|

|

Catalog Number 63274Y |

Form 8498 (Rev. 12-2011) |

Instructions for Form 8498, Continuing Education Provider Application and Request for Provider Number

What's New

The Return Preparer Office is responsible for registering, renewing, and overseeing continuing education providers who offer continuing educational programs to enrolled agents, enrolled retirement plan agents, and registered tax return preparers.

The IRS uses a vendor to process all requests to register, renew or add new programs as an IRS approved continuing education provider. The registration and renewal fee is the same: $419.00 per year. Check should be made payable to “IRS CE Application Fee”. This fee is non-refundable.

General Instructions

Purpose of Form

Use Form 8498 to: 1) register as a new provider of continuing educational programs being offered to IRS enrolled or registered tax professionals; 2) annually renew your status as an IRS-approved continuing educational provider; and 3) add new programs to an existing IRS-approved provider continuing education curriculum.

Who Must Register

Anyone who wishes to advertise, and grant continuing education credits, for programs which are approved by the IRS for enrolled or registered tax professionals. A continuing education provider must be one of the following:

oAn accredited educational institution;

oRecognized for continuing education purposes by the licensing body of any State, territory, or possession of the United States, including a Commonwealth, or the District of Columbia;

oRecognized and approved by a qualifying organization as a provider of continuing education on subject matters relating to Federal taxation, ethics or professional conduct; or

oRecognized by the IRS as a professional organization, society, or business whose programs include offering professional education opportunities in subject matters relating to Federal taxation, ethics, or professional conduct.

How to Register

Form 8498 may be filed electronically or by regular mail. The fastest and easiest way to have your registration processed is to electronically submit it to the vendor. If you must file Form 8498 by paper, the processing time will be 6-8 weeks. To find more information about applying to be a CE provider, visit: www.irs.gov/taxpros/ce.

If mailing Form 8498, send to:

IRS CE Provider Processing Center

6501 Red Hook Plaza, Suite 201

St. Thomas, VI USA 00802

What to File

File Form 8498 with all required documentation. A list of attachments can be found under the “Provider Information” section of these instructions. Note: Processing of this form may be delayed if the required documentation is not attached.

When to File

To be Registered as an approved Continuing Education Provider for the entire 2012 year, file Form 8498 on or before December 31, 2011. For each subsequent calendar year, you must renew by filing Form 8498 before December 31st of the previous year. All currently OPR-approved continuing education providers must submit a "new application," containing all the required documentation, on or before December 31, 2011, if they plan to offer CE to RTRPs by January 1, 2012.

Who Must Sign

Form 8498 must be signed by the owner, officer, or an individual who is authorized to sign on behalf of the applicant and who is knowledgeable about the applicant's continuing education processes and programs.

Catalog Number 63274Y |

Form 8498 (Rev. 12-2011) |

Instructions for Form 8498, Continuing Education Provider Application and Request for Provider Number (CONT.)

Specific Instructions

1.Type of Application

•New Application. All continuing education providers seeking authorization to offer continuing education credit must register as "new", including existing providers who were previously approved by the Office of Professional Responsibility (OPR). Previously approved providers must enter their OPR approval number in the "Current Provider Number" column. If you are applying during the open period for enrollment, please designate what year for which you are requesting approval (current or prior year). Current year would reflect the upcoming calendar year and prior year would be for the year currently applying in.

•Renewal. All continuing education providers must renew annually to maintain their status as a continuing education provider. When renewing, the prior year's authorization number must be entered in the "Current Provider Number" box on Form 8498. Failure to enter a current provider number will result in the application being processed as a new submission.

•Request to add new program(s). A continuing education provider who has had its educational curriculum approved in a prior year, may add any new programs to its education curriculum by submitting a Form 8498 any time during the year. Programs must be assigned program numbers prior to the program being offered in the marketplace.

2.CE Provider Name and Point of Contact Information

•Full Name of Continuing Education Provider. List the organizational name that will appear on the certificate of completion provided to the students at the completion of each program.

•Continuing Education Provider's EIN or PTIN. Business entities should enter an Employer Identification Number (EIN), if applicable. A Preparer Taxpayer Number (PTIN) may be used for sole proprietors with no EIN.

•Provider's Point of Contact (POC). The provider's POC should be the person primarily responsible for the provider's relationship with the IRS. This must be someone who is knowledgeable about the company's continuing education processes and programs. When an email address is given for the POC, communication will be sent to the POC's email address alerting them to log in to their secure email box within the CE Provider Registration System.

3.Provider Information

•a. Accredited Educational Institution. Attach a copy of the accreditation letter from a national or state accrediting body.

•b. Recognized for continuing education purposes by state licensing body or equivalent. Attach a copy of the recognition letter or other acknowledgment received from the licensing body of a state, territory or District of Columbia.

•c. Approved by an IRS-designated qualifying organization (Accreditor). Attach a copy of your approval letter received from an IRS approved Accreditor. A list of approved IRS approved Accreditors can be found at www.irs.gov/taxpro/ce.

•d. Professional organization, society or business filing for approval as a continuing education provider. Attach approval letter received from OPR, if applicable. If you are a professional organization, society, or business registering as a "new" CE Provider (not a, b, c, or d with approval from OPR), you must submit the following with Form 8498 for ONE program from each category offering below in #5: program material, program syllabus, program instructor biography, program examination (if required), evaluation form, and sample certificate of completion.

4.Continuing Education Provider Targeted Audience

Select all applicable targeted audiences for all programs that will be offered. For example, if a continuing educational program will be offered to Registered Tax Return Preparers and Enrolled Agents, check both boxes.

5. Program Information - the information requested below must be provided for each program submitted. If more than one program is being offered, include all of the following information for each program in an attachment. An incomplete submission will result in delay processing your application.

•Program Title. Include a descriptor to the specific program content in the program title.

•Program Description. Succinctly describe the major elements or contents of each program offered in a manner that provides sufficient information for the reviewer to make a determination that the program covers appropriate subject matter (federal tax, federal tax-related, qualified retirement plan matters, or ethics). Also include the manner in which the program will be delivered, e.g. speaker or panel; lecture or panel discussion; webinar; self study with test; on-line interactive; etc. If the presenter(s) is prominent in the subject area, include that name.

For additional information about program descriptions visit www.irs.gov/taxpros/ce.

•Targeted Audience for Program and Category of Continuing Education. Select each applicable target audience and each applicable category for which you seek authorization for each program. For example, if the continuing educational program offered to Registered Tax Return Preparers will include both ethics and federal tax, check both boxes. A program on federal tax which contains ethics material (or vice-versa), must be apportioned for credit hour purposes between federal tax and ethics based on the percentage of the program devoted to each topic. A program whose content is at least 60% ethics/standards of practice focus may be treated as a full hour of ethics.

•Program Delivery Method. Select all methods that will be used to deliver program content. For example, if program will be available as a self study and online group program, check both boxes.

For more information and details regarding CE Providers and Accreditors, visit www.irs.gov/taxpros/ce.

Catalog Number 63274Y |

Form 8498 (Rev. 12-2011) |