General Instructions

Instead of filing Form 8453-PE, a general partner or limited liability company member manager filing a

TIP partnership’s return through an electronic return originator (ERO) can sign the return using a

personal identification number (PIN). For details, see Form 8879-PE, IRS e-file Signature Authorization for Form 1065.

Purpose of Form

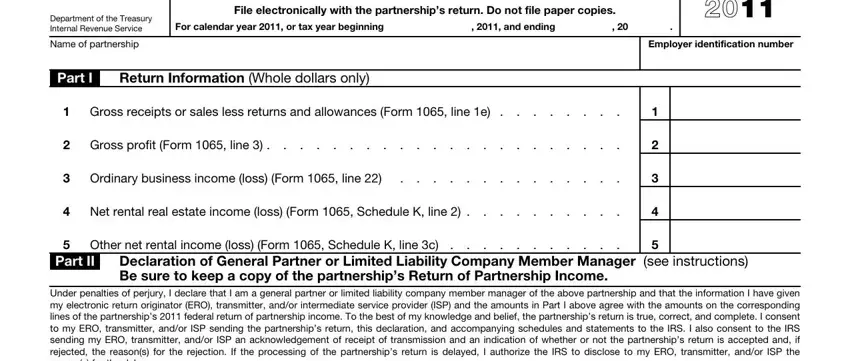

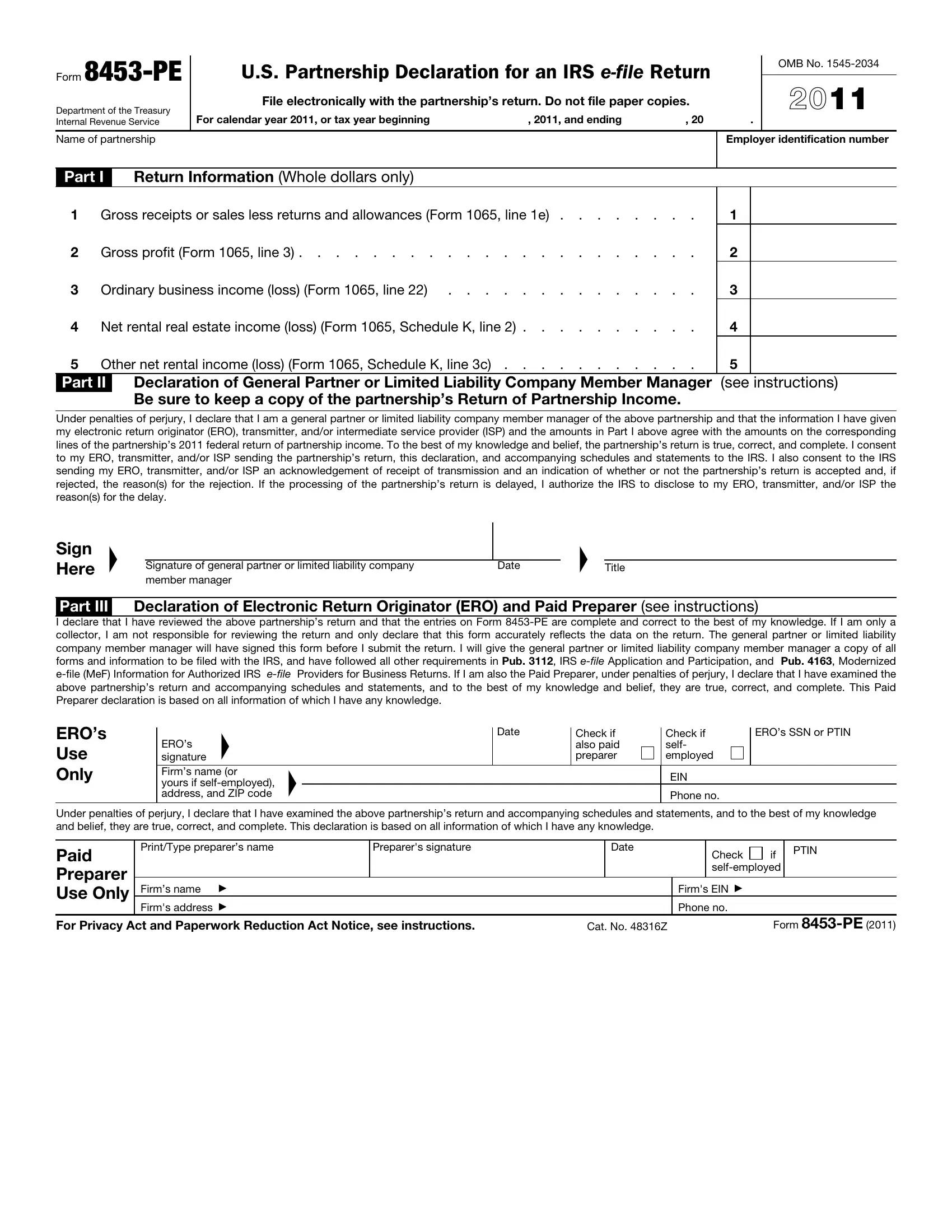

Use Form 8453-PE to:

•Authenticate an electronic Form 1065, U.S. Return of Partnership Income;

•Authorize the ERO, if any, to transmit via a third-party transmitter; and

•Authorize the intermediate service provider (ISP) to transmit via a third-party transmitter if you are filing online (not using an ERO).

Who Must File

If you are filing a 2011 Form 1065 through an ISP and/or transmitter and you are not using an ERO, you must file Form 8453-PE with your electronically filed return. An ERO can use either Form 8453- PE or Form 8879-PE to obtain authorization to file the partnership’s Form 1065.

When and Where To File

File Form 8453-PE with the partnership’s electronically filed return. Use a scanner to create a Portable Document File (PDF) file of the completed form. Your tax preparation software will allow you to transmit this PDF file with the return.

Specific Instructions

Name. Print or type the partnership’s name in the space provided.

Employer identification number (EIN). Enter the partnership’s EIN in the space provided.

Part II—Declaration of General Partner or Limited Liability Company Member Manager

An electronically transmitted return will not be considered complete, and therefore filed, unless either:

•Form 8453-PE is signed by a general partner or limited liability company member manager, scanned into a PDF file, and transmitted with the return, or

•The return is filed through an ERO and Form 8879-PE is used to select a PIN that is used to electronically sign the return.

The general partner or limited liability company member manager’s signature allows the IRS to disclose to the ERO, transmitter, and/or ISP:

•An acknowledgement that the IRS has accepted the partnership’s electronically filed return, and

•The reason(s) for any delay in processing the return.

The declaration of general partner or limited liability company member manager must be signed and dated by:

•The president, vice president, treasurer, assistant treasurer, chief accounting officer, or

•Any other general partner or limited liability company member manager (such as tax officer) authorized to sign the partnership’s return.

If the ERO makes changes to the electronic return after Form 8453-PE has been signed by the general partner or limited liability company member manager, whether it was before it was

transmitted or if the return was rejected after transmission, the ERO must have the general partner or limited liability company member manager complete and sign a corrected Form 8453-PE if either:

•The total income (loss) on Form 1065, line 8 differs from the amount on the electronic return by more than $150, or

•The ordinary business income (loss) on Form 1065, line 22 differs from the amount on the electronic return by more than $100.

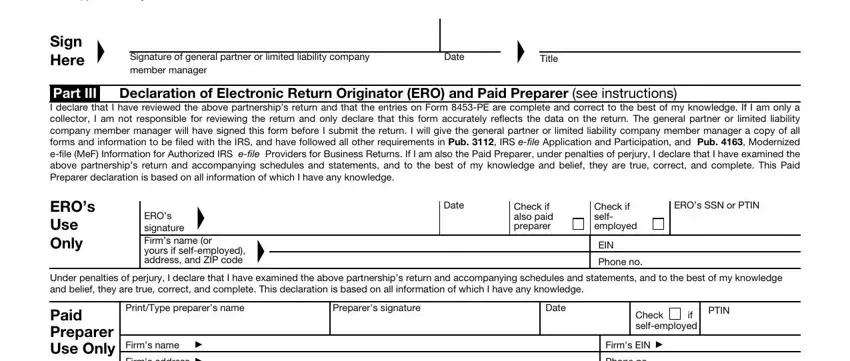

Part III—Declaration of Electronic Return Originator (ERO) and Paid Preparer

Note. If the return is filed online through an ISP and/or transmitter (not using an ERO), do not complete Part III.

If the partnership’s return is filed through an ERO, the IRS requires the ERO’s signature. A paid preparer, if any, must sign Form 8453-PE in the space for Paid Preparer Use Only. But if the paid preparer is also the ERO, do not complete the paid preparer section. Instead, check the box labeled “Check if also paid preparer.”

Use of PTIN

Paid Preparers. Anyone who is paid to prepare the partnership's return must enter their PTIN in Part III. The PTIN entered must have been issued after September 27, 2010. For information on applying for and receiving a PTIN, see Form W-12, IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal, or visit www.irs.gov/ptin.

EROs who are not paid preparers. Only EROs who are not also the paid preparer of the return have the option to enter their PTIN or their social security number in the "ERO's Use Only" section of Part

III.If the PTIN is entered, it must have been issued after September 27, 2010. For information on applying for and receiving a PTIN, see Form W-12, IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal, or visit www.irs.gov/ptin.

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information.

We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax. Section 6109 requires EROs to provide their identifying numbers on the return.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

. . . . |

. |

2 hr., 52 min. |

Learning about the law or the form |

. . . . |

. |

. |

. |

12 min. |

Preparing the form, copying, |

|

|

|

|

|

assembling, and sending |

|

|

|

|

|

the form to the IRS |

. . . . |

. |

. |

. |

15 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:M:S, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Do not send the form to this address. Instead, see When and Where To File on this page.