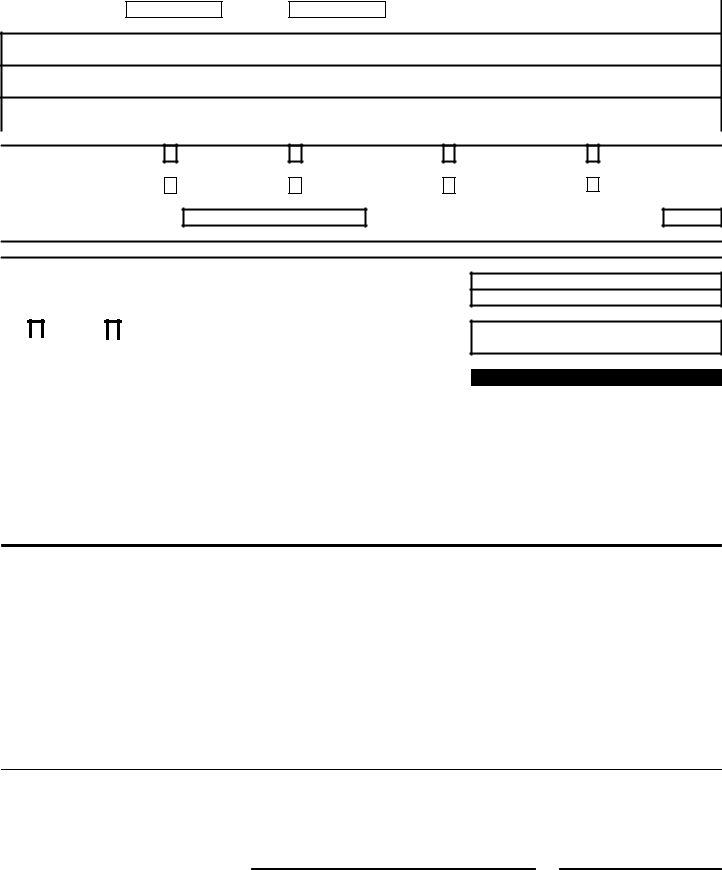

Navigating the complexities of state tax obligations can be daunting, especially for S-Corporations operating within Mississippi. The Form 85-105-99-8-1-000, a critical document revised in December 1999, serves as the Mississippi S-Corporation Income and Franchise Tax Return, catering specifically to the fiscal year starting in 1999. This form encompasses a comprehensive structure for these entities to report their income and calculate both income and franchise taxes due to the state. It addresses various filing statuses, including options for final, amended, and short year returns, while also facilitating declarations for multistate operations through direct accounting or apportioning methods. Notably, the form queries the S-Corporation's eligibility as a Qualified Subchapter S Subsidiary and prompts for details regarding the parent corporation if applicable. Beyond mere tax calculations, the form requests data on overpayments and estimated tax payments, guiding corporations through the process of rectifying any balance due or claiming refunds. Integral to ensuring accurate and compliant tax reporting, this document also entails a secondary page targeting more nuanced aspects of the S-Corporation's profile, such as business activities, product or service focus, and amendments triggered by federal tax return adjustments. Every section of this form, right down to the list of officers and the declaration of perjury, underscores the meticulous reporting standards imposed by the Mississippi State Tax Commission, making it an indispensable tool for S-Corporations navigating their fiscal responsibilities within the state.

| Question | Answer |

|---|---|

| Form Name | Form 85 105 99 8 1 000 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 85105993 mississippi s corporation income and franchise tax return form |

Form |

Mississippi |

For Fiscal Year Beginning

1999

and Ending

Page 1

▲ |

FEIN |

|

|

|

|

Name of Corporation

Mailing Address (PO Box or Street Including Rural Route)

City |

State |

ZIP + 4 |

County Code |

|

|

|

|

|

FILING STATUS |

|

(See Instructions) |

|

|

|

Check All That Apply:

Check All That Apply:

Final Return

(File Form

100% Mississippi

Amended Return

Multistate Direct

Accounting

Short Year Return

Multistate Apportioning

Address Change

Composite Return

Date of Election as an

Number of Shareholders at End of Tax year:

FRANCHISE AND INCOME TAX

1. Taxable Capital (From Form |

1 |

▲ |

2.Franchise Tax Due (From Form

3.Is this

|

|

Yes |

|

No |

If YES, enter Name and FEIN of the parent |

5 |

▲ |

|

|

|

|

|

|

|

corporation. |

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

||

FEIN

4.Mississippi Net Taxable Income (If Loss Enter Zero)(From Form

5.Total Income Tax (See Instructions)

6.Credits: a. Ad Valorem Tax Credit (From Form

7.Balance of Income Tax Due (Line 5 Minus Line 6a and Line 6b.)

8.Total Franchise and Income Tax Due. (Line 2 Plus Line 7.)

9.Interest & Penalty on Underestimated Income Tax Payments. (Attach Form

10.Total of Lines 8 and 9.

Whole Dollars Only

6 |

▲ |

|

22 |

▲ |

|

|

||

26 |

▲ |

|

|

||

|

||

|

||

|

|

|

|

PAYMENTS and TAX DUE |

|

|

|

|

11. |

Overpayments from Prior Year. |

|

|

|

|

|

|

|

|

||

12. |

Estimated Tax Payments and Payments with Extensions. |

|

|

|

|

13. |

Total Payments (Line 11 Plus Line 12.) |

|

|

|

|

14. |

If Line 10 is Larger than Line 13, Enter Balance Due. (Line 10 Minus Line 13.) |

|

|

|

|

15. |

Late Payments - Interest @ 1% Per Month and Penalty @ 1/2% Per Month. |

|

▲ |

|

|

|

(See Instructions) |

|

29 |

|

|

16. |

Amount Paid with this Return. (Line 14 plus Line 15) |

|

|

▲ |

|

Attach Payment for Total Due to: State Tax Commission. |

AMOUNT PAID |

31 |

|

||

17. |

If Line 13 is Larger than Line 10, Enter Amount of Overpayment. (Line 13 minus Line 10.) |

▲ |

|

||

18. |

Amount of Overpayment (Line 17) to be Refunded. |

REFUND |

33 |

|

|

19. |

Amount of Overpayment (Line 17) to be Credited to Next Year. |

34 |

▲ |

|

|

I declare, under the penalties of perjury, that this return (including any accompanying schedules) has been examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

Check To: |

State Tax Commission |

|

|

|

Mail To: |

P.O. Box 23050 |

|

|

|

|

Jackson, MS |

|

|

|

|

Officer's Signature |

Date |

||

|

|

|||

( )

Officer's Title |

Tax Department Phone |

Form

Mississippi

1999

Page 2

1. DBA |

2. County locations in Mississippi |

3.Principal business activity in Mississippi

5.Principal product or service in Mississippi

7.Contact person for this return

9. If amended return, check reason:

Mississippi |

|

Amended Federal Form |

correction only |

|

1120S (attach copy) |

|

4.Principal business activity everywhere

6.Principal product or service everywhere

8.Contact person's location and phone

( )

Federal RAR

(attach applicable Other: copies)

10. If final return, check reason and enter date effective: |

Date |

Dissolving Mississippi Corporation

Sold

Merged

Other :

If you checked Sold or Merged, provide the following:

New company or owner's name and address

FEIN

Phone (

Former owner's forwarding address

Phone (

11.Is this corporation a partner in a partnership, LLP or LLC doing business in Mississippi? If Yes, attach MS Forms

12.Are you a parent of a QSSS? If yes, list on a separate schedule the Name and FEIN of the QSSS(s).

13.Has the corporation filed amended federal returns in the last three years? If Yes, list years

14.Has the IRS made any changes to your taxable income in the last three years? If Yes, list years

15.If Line 13 and/or Line 14 was checked "Yes", has the corporation filed Mississippi amended returns for all years for which amended Federal return(s) were filed or changes to taxable income were made by the IRS?

)

)

Yes

Yes

Yes

Yes

Yes

No

No

No

No

No

List of Officers - This schedule MUST be completed

|

President: Name and Home Address |

Social Security Number |

|

|

Ownership Percentage |

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

Salary |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vice President: Name and Home Address |

Social Security Number |

|

|

Ownership Percentage |

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

Salary |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Treasurer: Name and Home Address |

Social Security Number |

|

|

Ownership Percentage |

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

Salary |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secretary: Name and Home Address |

Social Security Number |

|

|

Ownership Percentage |

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

Salary |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid Preparer's Signature

Paid Firm's Identification Number or PTIN

OR

Date |

Paid Preparer's Address |

|

|

|

|

|

|

|

|||

Paid Preparer's Social Security Number or PTIN |

|

Preparer's Phone |

|||

|

|

|

( |

) |

|