Dealing with PDF forms online is certainly quite easy with our PDF editor. Anyone can fill out form 8689 2020 here effortlessly. To keep our editor on the cutting edge of practicality, we work to put into action user-driven capabilities and improvements regularly. We're routinely looking for feedback - play a pivotal part in revolutionizing the way you work with PDF forms. To start your journey, take these easy steps:

Step 1: Click the orange "Get Form" button above. It'll open our editor so that you could begin filling out your form.

Step 2: Once you start the PDF editor, you'll notice the form prepared to be completed. Aside from filling out different blanks, you may as well perform several other things with the Document, specifically putting on custom words, editing the original text, inserting illustrations or photos, placing your signature to the form, and a lot more.

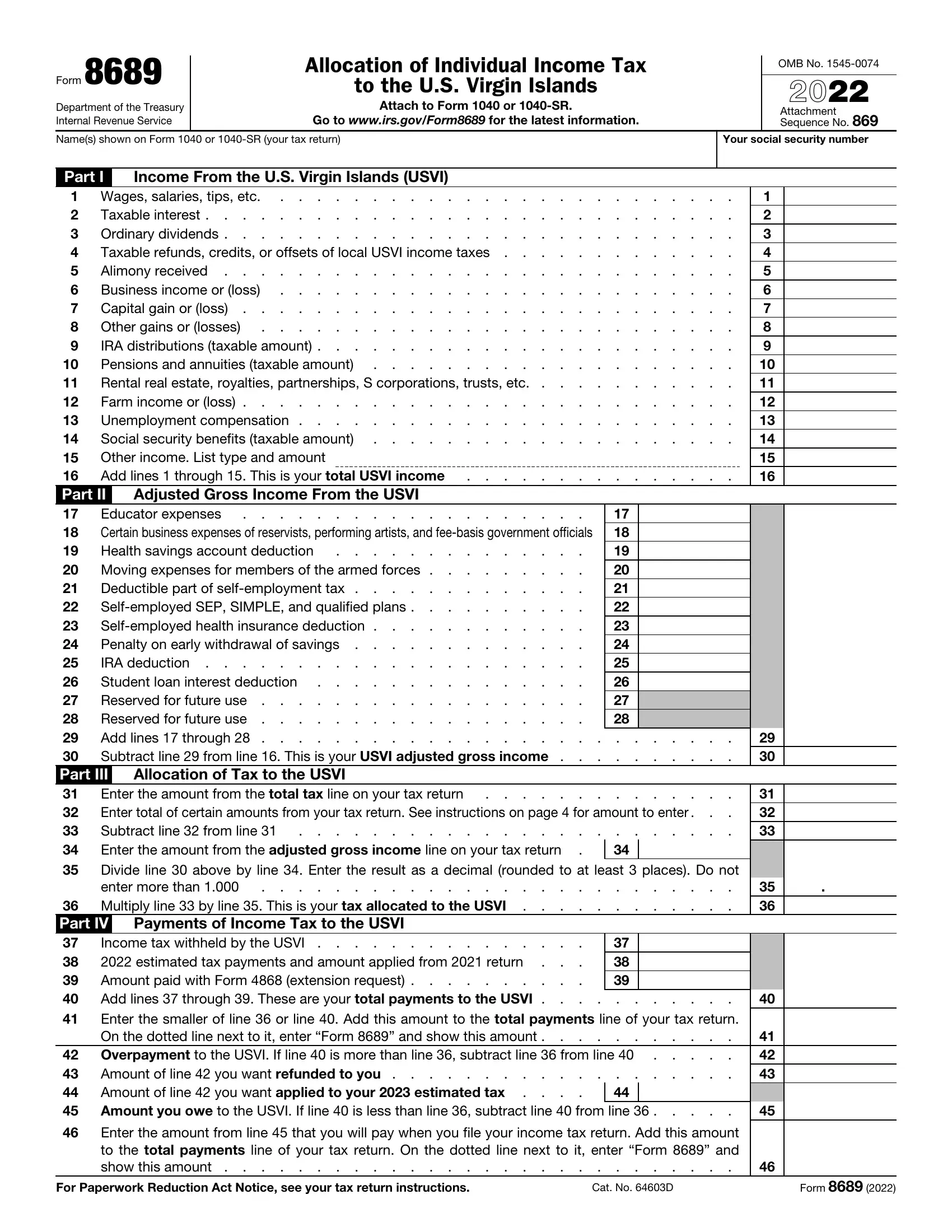

This document requires particular info to be entered, hence be sure you take some time to type in what's requested:

1. While submitting the form 8689 2020, make certain to complete all of the important blanks in their relevant section. This will help speed up the process, making it possible for your details to be handled without delay and appropriately.

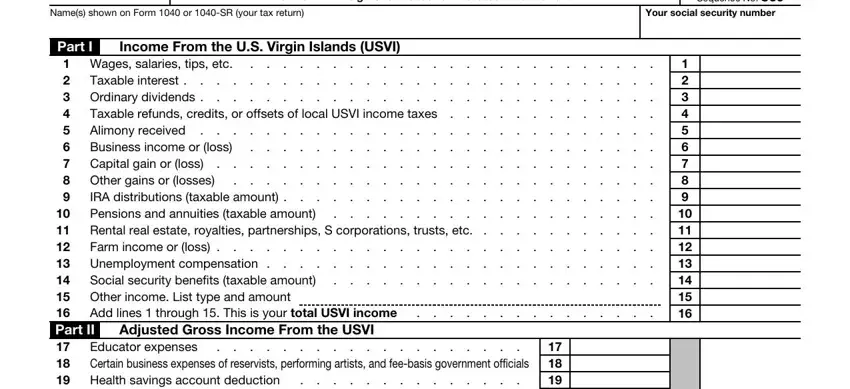

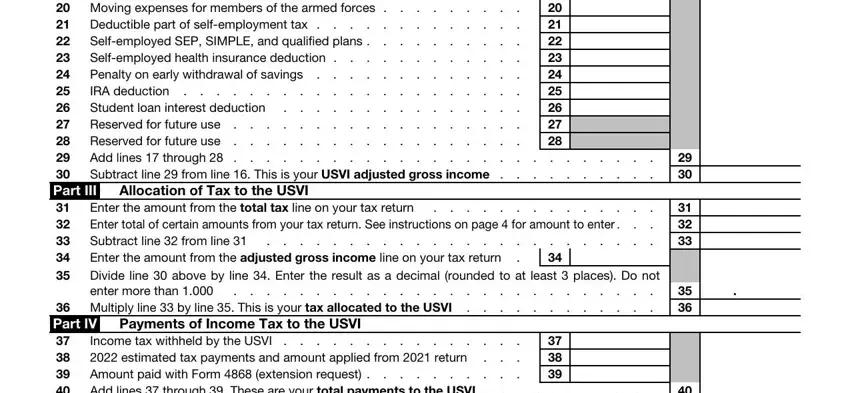

2. After this part is complete, you're ready put in the necessary specifics in Part I Wages salaries tips etc, Selfemployed SEP SIMPLE and, Enter the amount from the total, enter more than, Multiply line by line This is, and Income tax withheld by the USVI in order to progress further.

A lot of people often make some errors while filling out enter more than in this section. Be sure to go over what you enter right here.

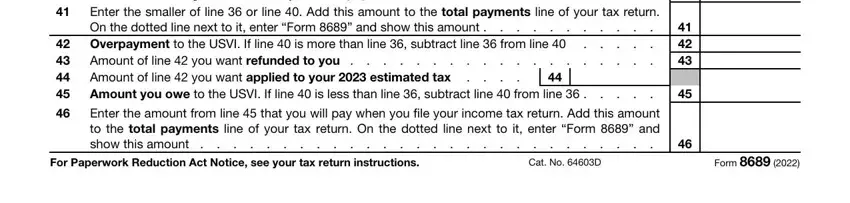

3. In this particular step, review Multiply line by line This is, Income tax withheld by the USVI, Overpayment to the USVI If line, Amount of line you want refunded, Enter the amount from line that, For Paperwork Reduction Act Notice, Cat No D, and Form. Every one of these have to be filled out with greatest precision.

Step 3: When you have looked again at the information in the blanks, simply click "Done" to complete your document generation. Create a free trial plan with us and obtain immediate access to form 8689 2020 - readily available inside your personal account. When you work with FormsPal, you can certainly fill out forms without needing to be concerned about personal data breaches or entries being shared. Our protected system helps to ensure that your private data is maintained safe.