You are able to work with Overpayment easily with the help of our online PDF editor. To maintain our tool on the leading edge of practicality, we work to implement user-driven features and improvements on a regular basis. We are routinely glad to receive suggestions - join us in revolutionizing how you work with PDF documents. All it requires is a couple of basic steps:

Step 1: Click on the orange "Get Form" button above. It's going to open up our editor so that you can start completing your form.

Step 2: As you access the PDF editor, you will get the form prepared to be completed. Besides filling in various blank fields, you may also do some other actions with the Document, particularly putting on your own textual content, editing the initial textual content, inserting images, affixing your signature to the PDF, and much more.

Completing this PDF needs focus on details. Make sure that every field is completed accurately.

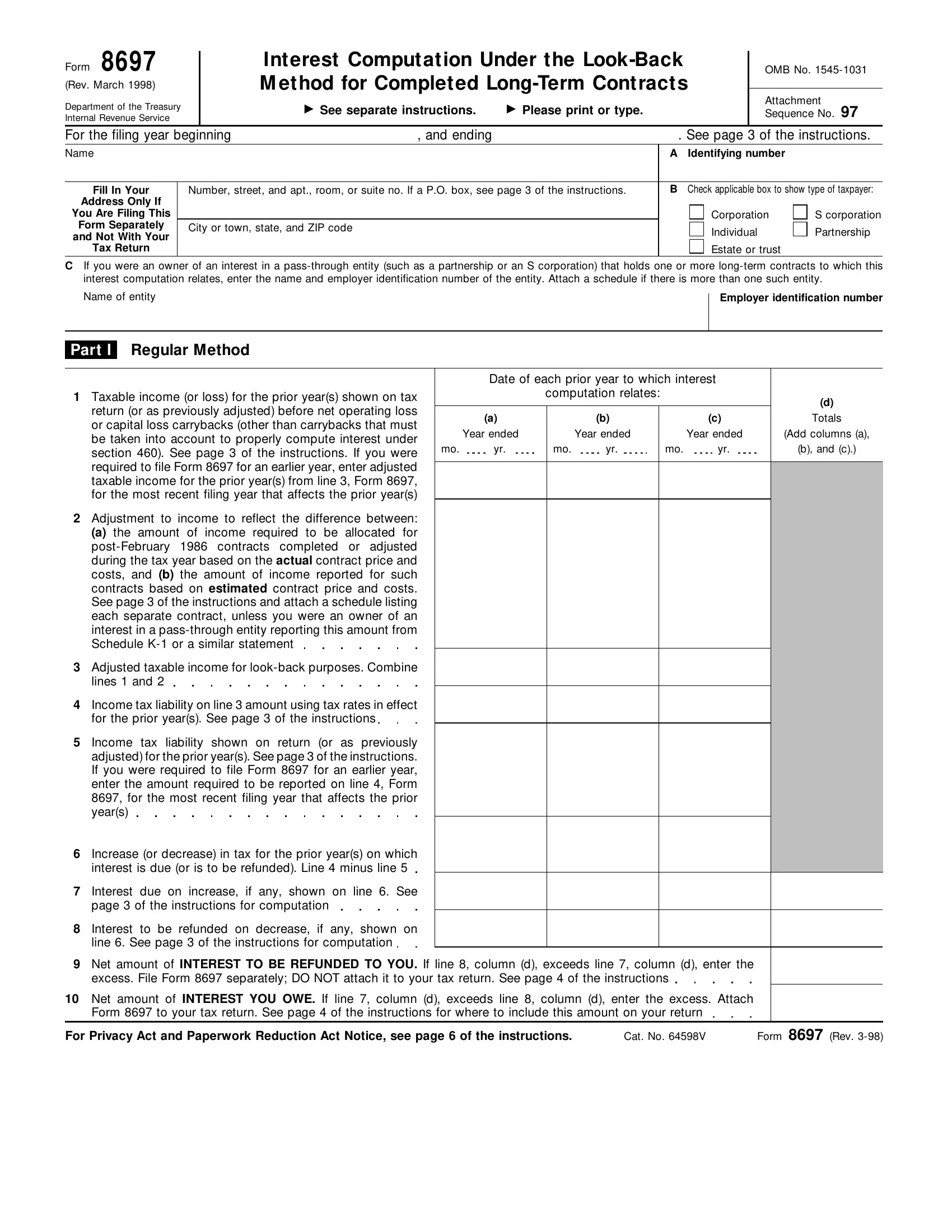

1. To get started, once filling out the Overpayment, beging with the area that features the subsequent blanks:

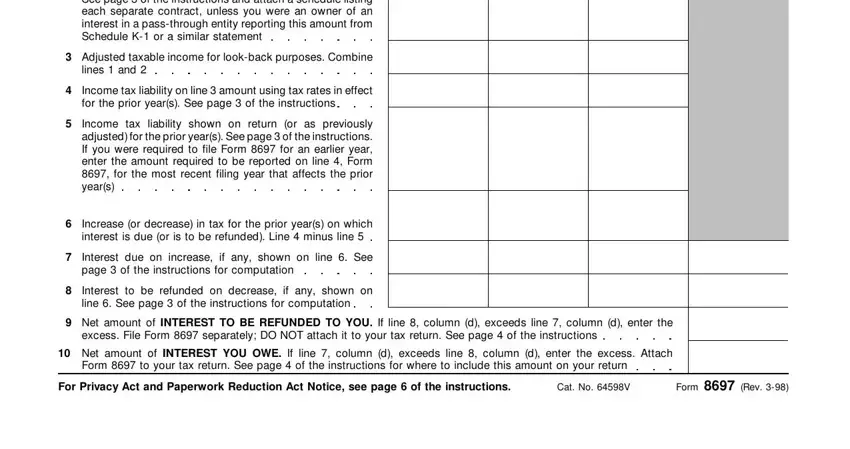

2. Once your current task is complete, take the next step – fill out all of these fields - Adjustment to income to reflect, Adjusted taxable income for, Income tax liability on line, Income tax liability shown on, Increase or decrease in tax for, Interest due on increase if any, Interest to be refunded on, Net amount of INTEREST TO BE, Net amount of INTEREST YOU OWE If, For Privacy Act and Paperwork, Cat No V, and Form Rev with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

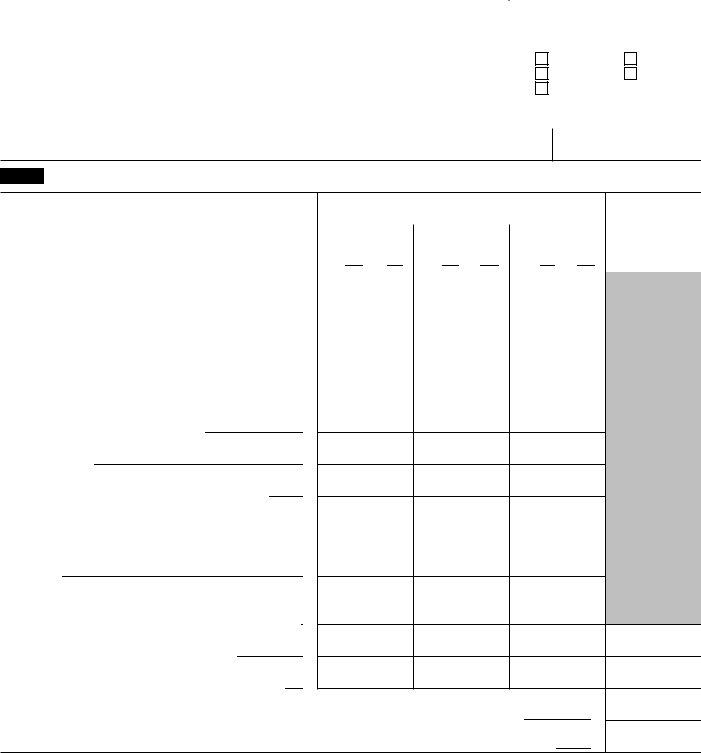

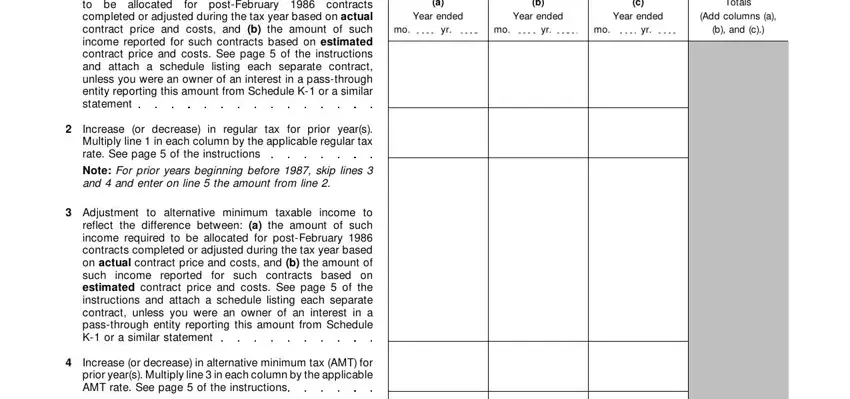

3. This next step is relatively straightforward, Totals, Year ended, Year ended, Year ended, Add columns a, b and c, Adjustment to regular taxable, Increase or decrease in regular, Note For prior years beginning, Adjustment to alternative minimum, and Increase or decrease in - all of these empty fields will have to be filled out here.

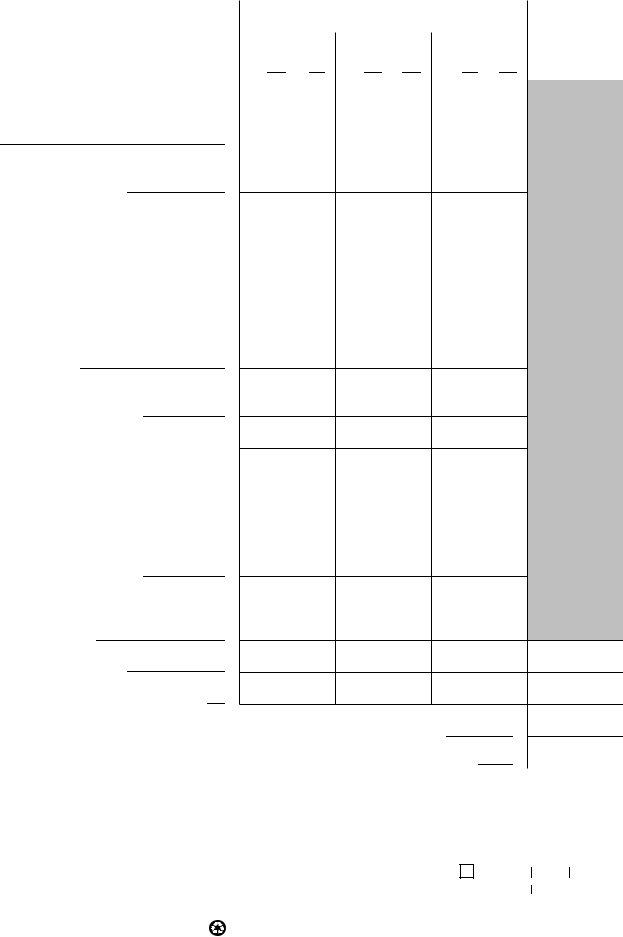

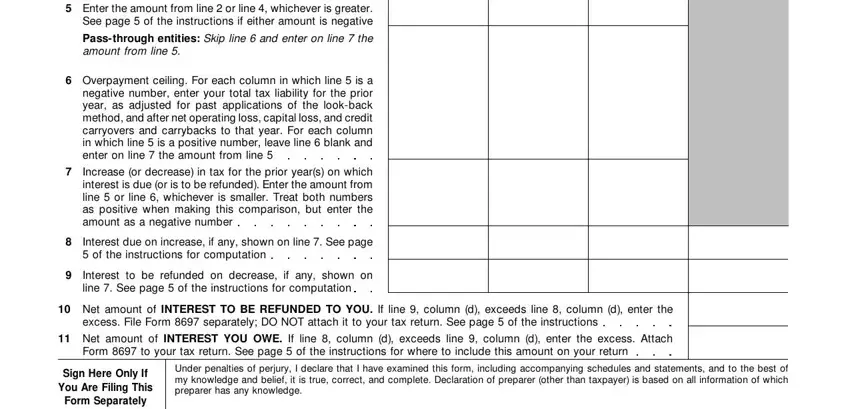

4. To go ahead, your next stage will require completing a few form blanks. These include Enter the amount from line or, Passthrough entities Skip line, Overpayment ceiling For each, Increase or decrease in tax for, Interest due on increase if any, of the instructions for, Interest to be refunded on, line See page of the, Net amount of INTEREST TO BE, excess File Form separately DO, Net amount of INTEREST YOU OWE If, Form to your tax return See page, Sign Here Only If You Are Filing, Form Separately and Not With Your, and Under penalties of perjury I, which are fundamental to moving forward with this form.

You can certainly make errors when completing the Interest to be refunded on, for that reason make sure to take another look before you finalize the form.

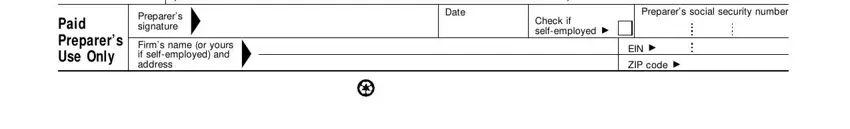

5. Because you draw near to the finalization of the document, you will find just a few extra requirements that must be fulfilled. Specifically, Paid Preparers Use Only, Preparers signature, Firms name or yours if, Date, Preparers social security number, Check if selfemployed, EIN, and ZIP code must be filled in.

Step 3: Confirm that your information is right and then simply click "Done" to conclude the task. Find the Overpayment the instant you sign up for a free trial. Readily gain access to the pdf file from your personal account page, together with any edits and changes all preserved! FormsPal offers secure form editor without personal data record-keeping or sharing. Feel safe knowing that your information is secure with us!