what is form 870 can be filled in in no time. Just open FormsPal PDF editing tool to get the job done in a timely fashion. The tool is constantly improved by our team, receiving handy features and growing to be greater. To begin your journey, take these simple steps:

Step 1: Access the form in our editor by hitting the "Get Form Button" at the top of this webpage.

Step 2: As you launch the editor, you will see the form prepared to be filled out. Aside from filling in different blanks, you may as well perform many other actions with the PDF, including writing custom textual content, modifying the initial text, inserting illustrations or photos, placing your signature to the document, and more.

This PDF form will involve specific information; to ensure consistency, don't hesitate to heed the next tips:

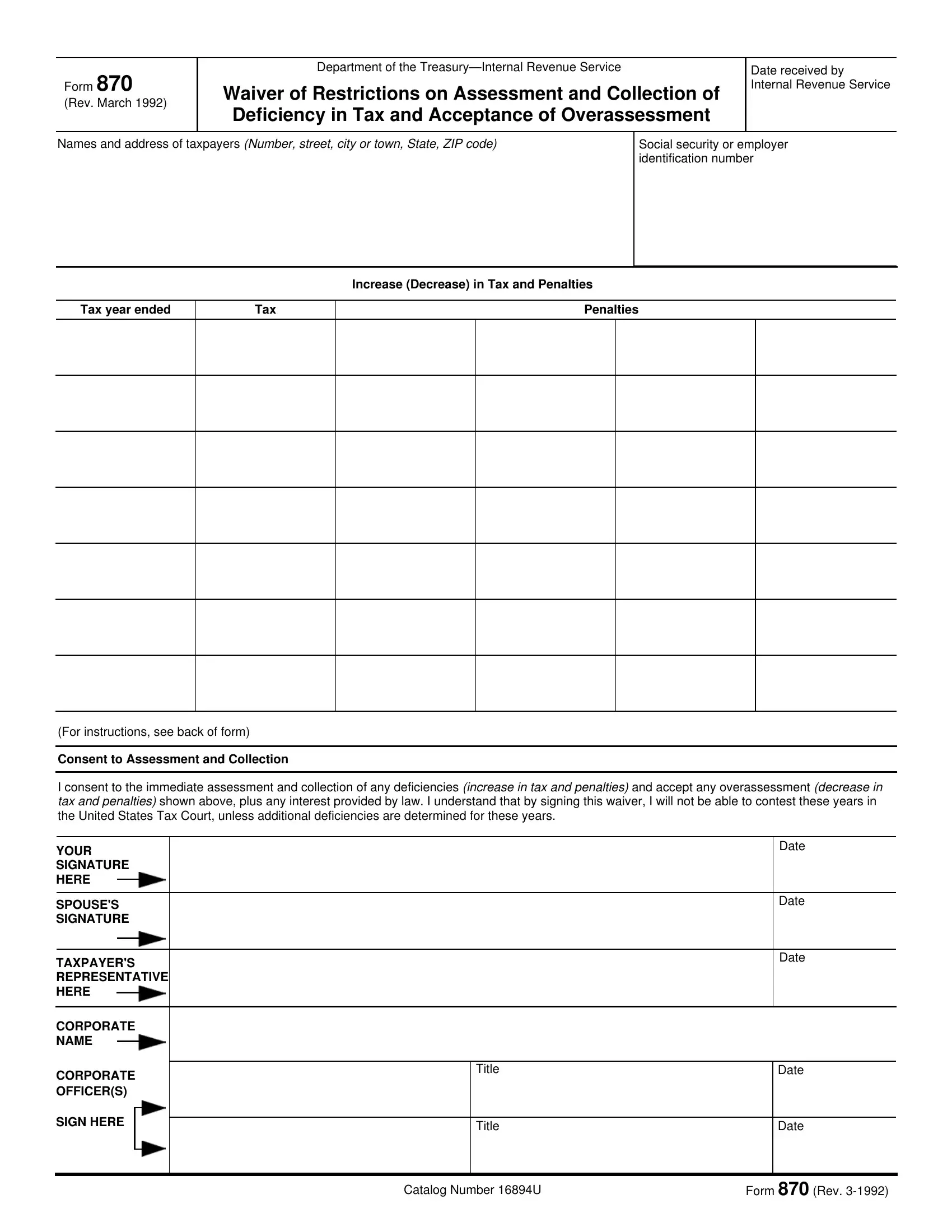

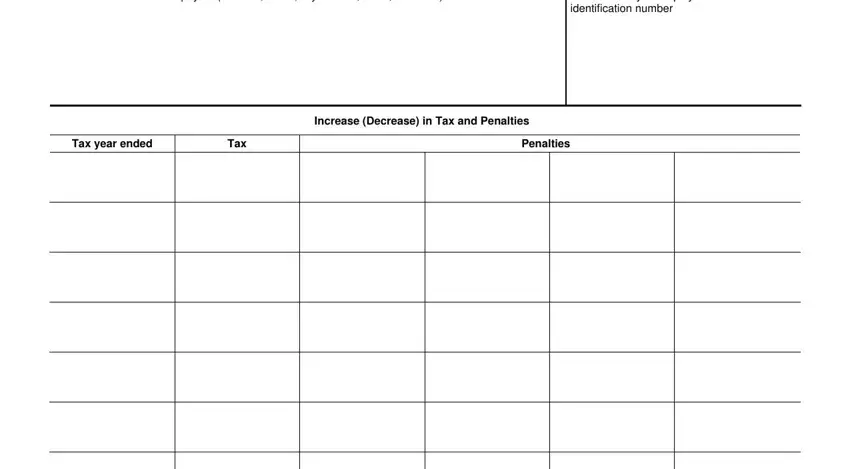

1. The what is form 870 usually requires specific details to be entered. Make certain the following fields are completed:

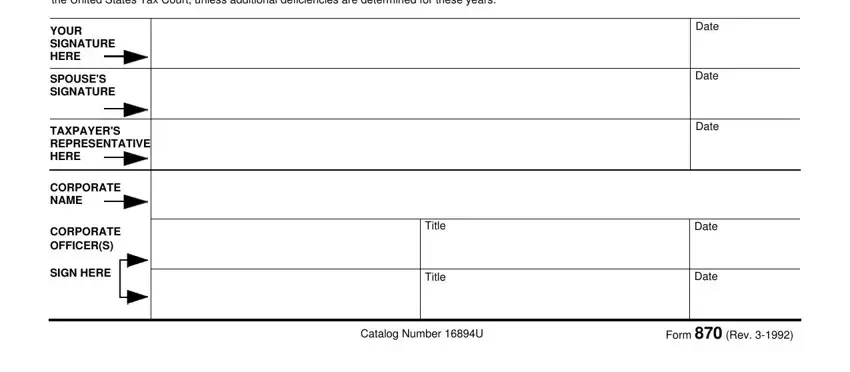

2. Once your current task is complete, take the next step – fill out all of these fields - I consent to the immediate, YOUR SIGNATURE HERE, SPOUSES SIGNATURE, TAXPAYERS REPRESENTATIVE HERE, CORPORATE NAME, CORPORATE OFFICERS, SIGN HERE, Date, Date, Date, Date, Date, Title, Title, and Catalog Number U with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

3. Completing Name of Taxpayer, Identification Number, Form page, General Information, Instructions, If you consent to the assessment, We have agreements with State tax, We will consider this waiver a, Who Must Sign, and If you filed jointly both you and is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Concerning We will consider this waiver a and Identification Number, make certain you get them right in this section. Both of these are the most significant fields in this file.

Step 3: Reread the details you have typed into the blanks and then click on the "Done" button. Sign up with FormsPal now and immediately obtain what is form 870, ready for downloading. All modifications made by you are kept , which means you can change the document later on when necessary. FormsPal ensures your information privacy by having a secure system that never records or distributes any kind of personal data involved in the process. Be assured knowing your files are kept confidential each time you use our tools!