debarment certification can be filled out without difficulty. Just make use of FormsPal PDF editor to accomplish the job in a timely fashion. Our editor is continually developing to deliver the very best user experience achievable, and that's due to our commitment to continuous development and listening closely to comments from users. Starting is simple! All that you should do is adhere to the following easy steps down below:

Step 1: Just click the "Get Form Button" above on this site to see our form editor. Here you will find all that is needed to work with your file.

Step 2: The tool grants the ability to change nearly all PDF documents in many different ways. Improve it by adding personalized text, adjust what is originally in the file, and place in a signature - all within the reach of several clicks!

It will be easy to complete the pdf adhering to our helpful guide! This is what you want to do:

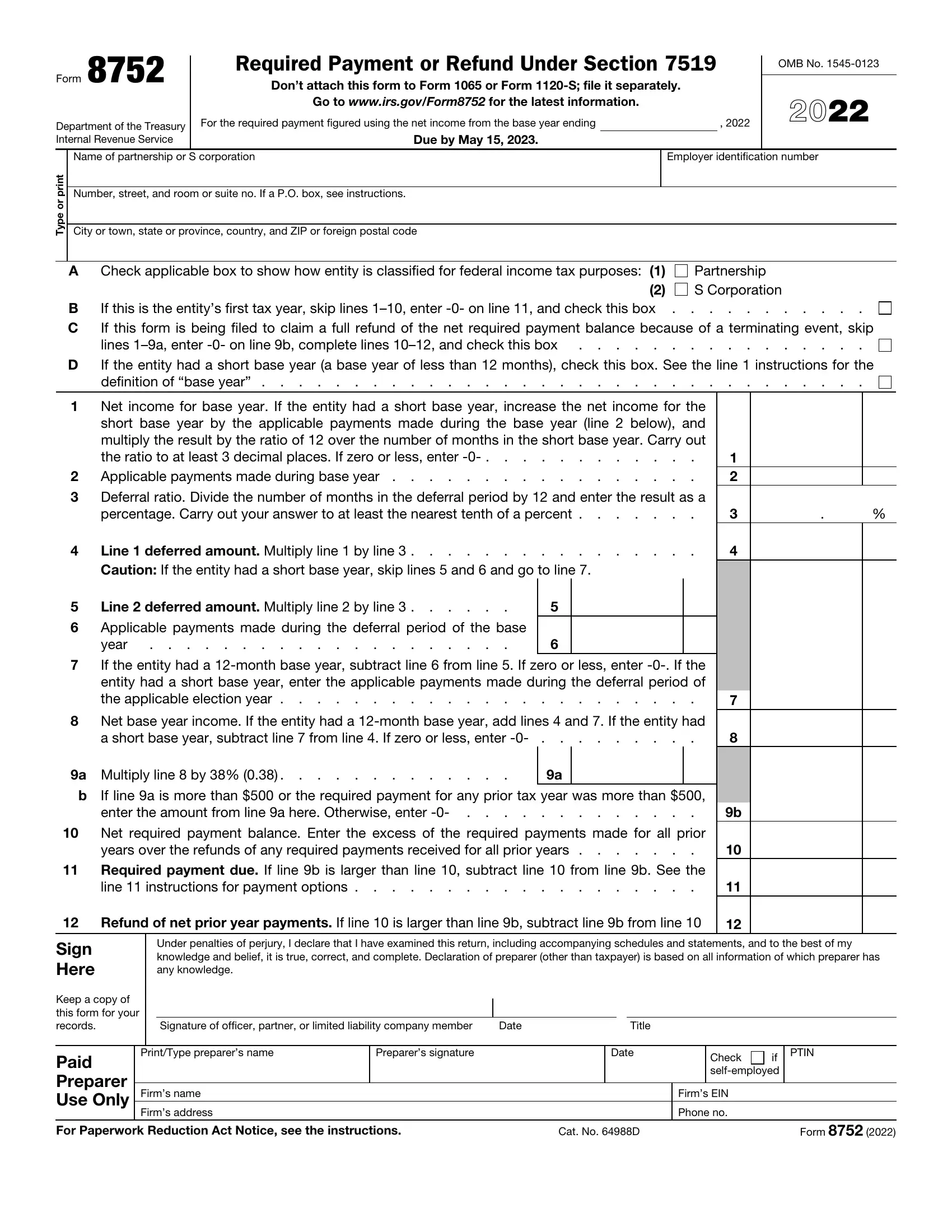

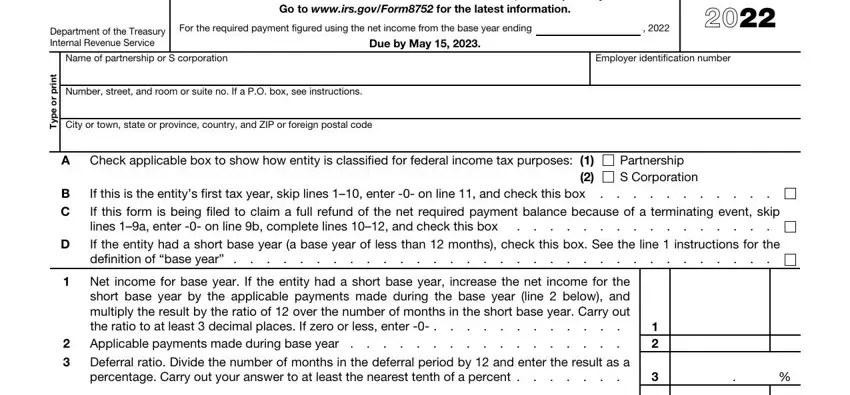

1. When filling out the debarment certification, make certain to incorporate all necessary blanks in their corresponding area. This will help to speed up the process, which allows your details to be processed fast and correctly.

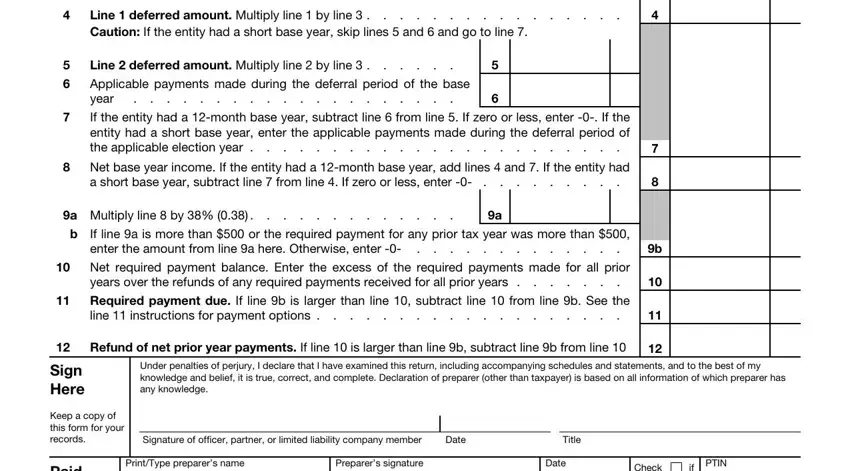

2. After this segment is completed, you need to include the essential particulars in Line deferred amount Multiply, Line deferred amount Multiply, Net base year income If the, a short base year subtract line, a Multiply line by, If line a is more than or the, years over the refunds of any, Required payment due If line b is, line instructions for payment, Refund of net prior year payments, Under penalties of perjury I, Sign Here, Keep a copy of this form for your, Signature of officer partner or, and Date so you're able to move on to the next step.

Always be very careful when filling out a short base year subtract line and Net base year income If the, as this is where a lot of people make mistakes.

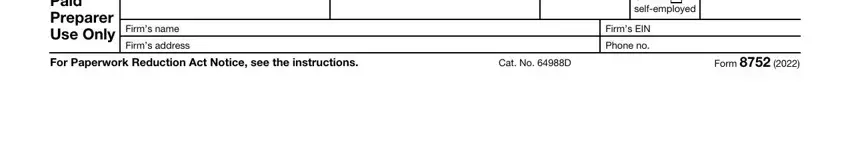

3. Through this stage, look at Paid Preparer Use Only, Firms name, Firms address, Check if selfemployed, Firms EIN, Phone no, For Paperwork Reduction Act Notice, Cat No D, and Form. Every one of these should be taken care of with utmost precision.

Step 3: Proofread the information you've entered into the blanks and then click on the "Done" button. After creating afree trial account here, it will be possible to download debarment certification or email it right off. The PDF form will also be easily accessible from your personal account menu with your each and every edit. FormsPal ensures your data privacy by using a protected system that in no way saves or shares any type of personal data involved. Feel safe knowing your documents are kept protected when you work with our services!