The Form 8803, known as the "Limit on Alternative Minimum Tax for Children Under Age 14," is a crucial document for taxpayers needing to adjust the alternative minimum tax (AMT) for eligible children. This form plays a vital role by enabling a possible reduction in the AMT for children who were under the specified age limit on January 1, 1993. It is attached exclusively to the child’s Form 1040 or Form 1040NR, following detailed instructions to ensure accurate completion. The necessity for Form 8803 arises after the completion of Form 6251, as it incorporates data such as the tentative minimum tax and income tax from the child’s as well as the parent's Form 6251. Specifically, it considers not just the individual child's financial situation but also integrates the tentative and total income taxes of the parents and any other eligible children under 14, fostering a comprehensive familial tax assessment. The adjustments and calculations made using Form 8803 can significantly impact the AMT owed by the child, making understanding and correctly applying this form essential for taxpayers. Furthermore, adjustments to parents' or siblings' taxes necessitate revisiting Form 8803, showcasing its ongoing relevance throughout the tax filing process. Hence, the meticulous process laid out in Form 8803 emphasizes both the complexity and importance of accurately determining a child's alternative minimum tax liability, necessitating careful attention to the form’s specifics to secure potential tax benefits effectively.

| Question | Answer |

|---|---|

| Form Name | Form 8803 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 1040X, 1040NR, 1040EZ, AMT |

Form 8803 |

|

Limit on Alternative Minimum Tax for |

|

OMB No. |

|

|

|

|

|

|

|

Children Under Age 14 |

|

|

|

|

|

|

|

Department of the Treasury |

|

▶ See instructions below and on back. |

|

Attachment |

|

▶ Attach ONLY to the child’s Form 1040 or Form 1040NR. |

|

||

Internal Revenue Service |

|

|

Sequence No. 56 |

|

Child’s name shown on return |

|

Child’s social security number |

||

A Parent’s name (first, initial, and last). Caution: See instructions on back before completing.

B Parent’s social security number

Caution: Read Purpose of Form on back before completing. |

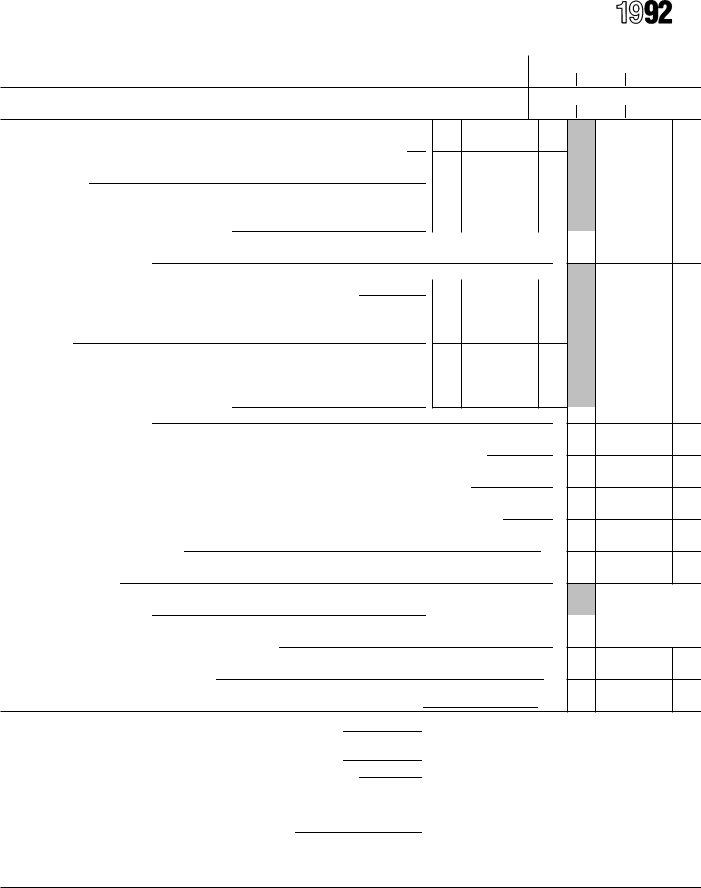

1 |

1 Enter the tentative minimum tax from line 20 of the child’s Form 6251 |

2Enter the tentative minimum tax, if any, from line 20 of the parent’s

Form 6251 |

2 |

3Enter the total tentative minimum tax, if any, from line 20 of Form 6251 of all other children under age 14 of the parent. Do not include the amount

from line 1 above. See instructions |

3 |

4Add lines 1, 2, and 3

5 Enter the income tax from line 21 of the child’s Form 6251 |

5 |

6Enter the income tax, if any, from line 21 of the parent’s Form 6251. If Form

6251 was not completed for the parent, see the instructions for the amount |

6 |

to enter |

7Enter the total income tax, if any, from line 21 of Form 6251 of all other

children under age 14 of the parent. Do not include the amount from line |

|

5 above. If Form 6251 was not completed for all of these children, see the |

7 |

instructions for the amount to enter |

8Add lines 5, 6, and 7

9Subtract line 8 from line 4. If the result is zero or less, enter

10Enter the alternative minimum tax, if any, from line 22 of the parent’s Form 6251

11Subtract line 10 from line 9. If the result is zero or less, enter

12 Subtract line 5 from line 1 |

▶ |

13Enter the total alternative minimum tax, if any, of all other children under age 14 of the parent. See instructions

14 Add lines 12 and 13 |

14 |

|

|

15Divide line 12 by line 14 and enter the result as a decimal (rounded to two places). If the amounts on lines 12 and 14 are the same, enter “1.00”

16 Multiply line 11 above by line 15 |

▶ |

17Child’s alternative minimum tax. Enter the smaller of line 12 or line 16 here and on the child’s

Form 6251, line 22. In the space to the left of line 22, write “Form 8803” |

▶ |

4

8

9

10

11

12

13

15

16

17

x.

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

The time needed to complete and file this form will vary depending on individ- ual circumstances. The estimated aver- age time is:

Recordkeeping

Learning about the law or the form

Preparing the form

Copying, assembling, and sending the form to the IRS

13 min. |

If you have comments concerning the |

|

|

accuracy of these time estimates or |

|

5 min. |

suggestions for making this form more |

|

simple, we would be happy to hear from |

||

26 min. |

||

you. You can write to both the IRS and |

||

|

||

|

the Office of Management and Budget |

|

|

at the addresses listed in the instruc- |

|

17 min. |

tions of the tax return with which this |

|

form is filed. |

||

|

(continued on back) |

Cat. No. 10038U |

Form 8803 (1992) |

Form 8803 (1992) |

Page 2 |

General Instructions

Purpose of Form

A child who was under age 14 on January 1, 1993, may be able to reduce the amount of his or her alternative minimum tax (AMT). Use Form 8803 to see if the child’s AMT can be reduced and, if so, to figure the amount to enter on line 22 of the child’s Form 6251, Alternative Minimum

Before Form 8803 can be completed, the child’s Form 6251 must be completed through line 21. If applicable, Form 6251 must be completed for the parent and each of the parent’s other children who were under age 14 on January 1, 1993.

Do not use Form 8803 if the amount on line 21 of the child’s Form 6251 is equal to or more than the amount on line 20 of that form. Also, do not use this form if neither of the child’s parents was alive on December 31, 1992.

Amended Return

If, after the child’s return is filed, the parent’s tax liability is changed or the tax liability of any of the parent’s other children under age 14 is changed, the child’s alternative minimum tax must be refigured on Form 8803 using the adjusted amounts. If the child’s alternative minimum tax changes as a result of the adjustment(s), file Form 1040X, Amended U.S. Individual Income Tax Return, to correct the child’s tax.

Specific Instructions

Lines A and B

If the child’s parents were married to each other and filed a joint return, enter the name and social security number (SSN) of the parent who is listed first on the joint return. For example, if the father’s name is listed first on the return and his SSN is entered in the block labeled “Your social security number,” enter his name on line A and his SSN on line B.

If the parents were married to each other but filed separate returns, enter the name and SSN of the parent who had the higher taxable income. If you do not know which parent had the higher taxable income, get Pub. 929, Tax Rules for Children and Dependents.

If the parents were unmarried, treated as unmarried for Federal income tax purposes, or separated either by a divorce or separate maintenance decree, enter the name and SSN of the parent who had custody of the child for most of the year (the custodial parent).

Exception. If the custodial parent remarried and filed a joint return with his or her new spouse, enter the name and SSN of the person who is listed first on the joint return, even if that person is not the child’s parent. If the custodial parent and his or her new spouse filed separate returns, enter the name and SSN of the person with the higher taxable income, even if that person is not the child’s parent.

Note: If the parents were unmarried but lived together during the year with the child, enter the name and SSN of the parent who had the higher taxable income.

Line 3

If Form 6251 was completed for any of the parent’s other children who were under age 14, add the amounts, if any, from line 20 on each of their Forms 6251 and enter the total on line 3.

Line 6

If Form 6251 was not required to be completed for the parent, use the following instructions to find the amount to enter on line 6.

If the parent filed:

Form 1040. Add the amount from line 38 of the parent’s Form 1040 to any tax from Form 4970 entered on line 39 of that Form 1040. Subtract from that total any foreign tax credit entered on line 43 of the parent’s Form 1040. Enter the result on line 6 of Form 8803.

Form 1040A. Enter on line 6 the amount from line 23 of the parent’s Form 1040A.

Form 1040EZ. Enter on line 6 the amount from line 7 of the parent’s Form 1040EZ.

Form 1040NR. Add the amount from line 36 of the parent’s Form 1040NR to any tax from Form 4970 entered on line 37 of that Form 1040NR. Subtract from that total any foreign tax credit entered on line 40 of the parent’s Form 1040NR. Enter the result on line 6 of Form 8803.

Line 7

If Form 6251 was not required to be completed for all of the parent’s other children who were under age 14, figure the amount to enter on line 7 as follows. First, if Form 6251 was completed for some of these children, add the amounts from line 21 on each of their Forms 6251. To that total add the amounts figured below for each of the children for whom Form 6251 was not completed. Enter the total on line 7.

If the parent’s other child filed:

Form 1040. Add the amount from line 38 of the child’s Form 1040 to any tax from Form 4970 entered on line 39 of that Form 1040. Subtract from that total any foreign tax credit entered on line 43 of the child’s Form 1040. The result is the child’s income tax.

Form 1040A. The child’s income tax is the amount entered on line 23 of Form 1040A.

Form 1040EZ. The child’s income tax is the amount entered on line 7 of Form 1040EZ.

Form 1040NR. Add the amount from line 36 of the child’s Form 1040NR to any tax from Form 4970 entered on line 37 of that Form 1040NR. Subtract from that total any foreign tax credit entered on line 40 of the child’s Form 1040NR. The result is the child’s income tax.

Line 13

Figure the AMT of each of the parent’s other children under age 14 for whom Form 6251 was completed. To do this, subtract the amount shown on line 21 of each child’s Form 6251 from the amount shown on line 20 of that form. If the result is zero or less, that child does not owe AMT.

Example. The parent of the child for whom this form is being completed had two other children (Mary and John) who were under age 14. The amount on line 20 of Mary’s Form 6251 is $10,000 and the amount on line 21 is $3,000. Mary’s AMT is $7,000 ($10,000 – $3,000). John has $2,500 on line 20 of his Form 6251 and $3,000 on line 21. John’s AMT is zero. The amount to enter on line 13 of Form 8803 is $7,000 ($7,000 0).