Understanding the multifaceted nature of Form 8807 is crucial for retailers, manufacturers, and importers engaged in transactions subject to federal excise taxes. Instituted by the Internal Revenue Service (IRS), this form serves as an essential tool for calculating and reporting excise taxes on a wide spectrum of goods ranging from heavy vehicles to luxury passenger vehicles. Specifically, Form 8807 is divided into two main parts: Part I focuses on the computation of tax for items including trucks, trailers, semitrailers, fishing equipment, and archery products, aligning with the tax rates designated for each category. Part II, alternatively, is dedicated to the luxury tax applicable to passenger vehicles exceeding the set sales price threshold. Furthermore, this form takes into account various scenarios such as exemptions for vehicles utilized by individuals with disabilities, adjustments for parts or accessories added post-sale, and specific tax implications for imported vehicles. To facilitate compliance, this form is designed to be attached to Form 720, the Quarterly Federal Excise Tax Return, making it a critical document for ensuring accurate tax reporting and adherence to evolving tax laws, including the nuanced changes affecting luxury taxes post-December 1992 and considerations for exported vehicles. Such intricate details underscore the significance of thorough comprehension and accurate completion of Form 8807 in the realm of excise tax obligations.

| Question | Answer |

|---|---|

| Form Name | Form 8807 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | irs form 8807, semitrailer, form 8807 pdf, installer |

Form 8 8 0 7 |

|

Certain M anufacturers and Retailers |

|

|

|

|

|

(Rev. July 1993) |

|

Excise Taxes |

|

|

OMB No. |

|

|

|

|

|

|

|

|

|

|

Department of the Treasury |

|

▶ Attach to Form 720. |

|

|

Expires |

|

|

|

|

|

|

|

|||

Internal Revenue Service |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Name (as shown on Form 720) |

|

Quarter ending |

|

Employer identification number |

|||

|

|

|

|

|

|

||

A Are you required to file Form 2290, Heavy Vehicle Use Tax Return? |

|

|

Yes |

No |

|||

B Are you registered on Form 637, Application for Registration? |

|

|

Yes |

No |

|||

If “Yes,” please enter your registration number here |

▶ |

|

|||||

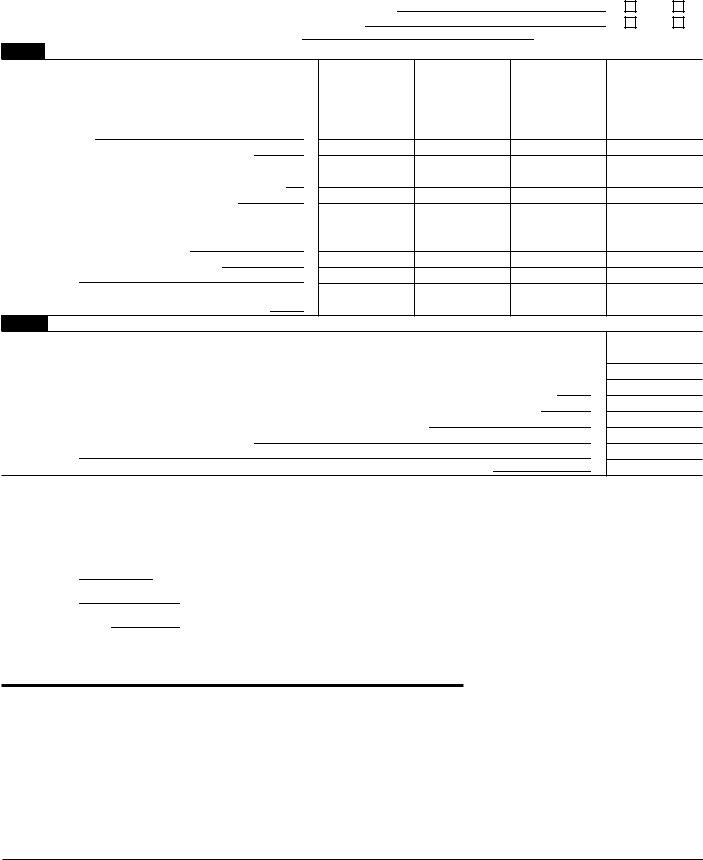

Part I Computation of Tax on All Items Except Passenger Vehicles

1Total sales

2Sales included on line 1 from imports

3Subtractions from sales. Include

4Net taxable sales (line 1 less line 3)

5Credits or adjustments. Include delivery expenses, tire credits,

6Taxable amount (line 4 less line 5)

7 Tax rate

8Amount of tax (multiply line 6 by line 7). Enter the amount of tax on Form 720 on the line for the IRS No.

(a) |

(b) |

(c) |

(d) |

|

Truck, trailer, and |

Electric outboard |

|||

Sport |

||||

Bows and arrows |

||||

semitrailer chassis and |

motors and sonar |

|||

fishing equipment |

||||

|

||||

bodies, and tractors |

devices |

|

||

|

|

|||

|

|

|

|

|

IRS No. 33 |

IRS No. 41 |

IRS No. 42 |

IRS No. 44 |

|

$ |

$ |

$ |

$ |

.12 |

.1 |

.03 |

.11 |

Part II Computation of Luxury Tax on Passenger Vehicles

1Taxable adjusted sales price of first retail sales of passenger vehicles, from line 7 of Worksheet I

2 Taxable amount of subsequent additions to passenger vehicles, from line 7 of Worksheet II 3 Taxable fair market value (FMV) on changes in use of passenger vehicles

4 Taxable amount (add lines 1, 2, and 3)

5 Tax rate

6 Tax (multiply line 4 by line 5). Enter the tax on Form 720 on the line for IRS No. 92

(a)

Passenger vehicles

IRS No. 92

$

.1

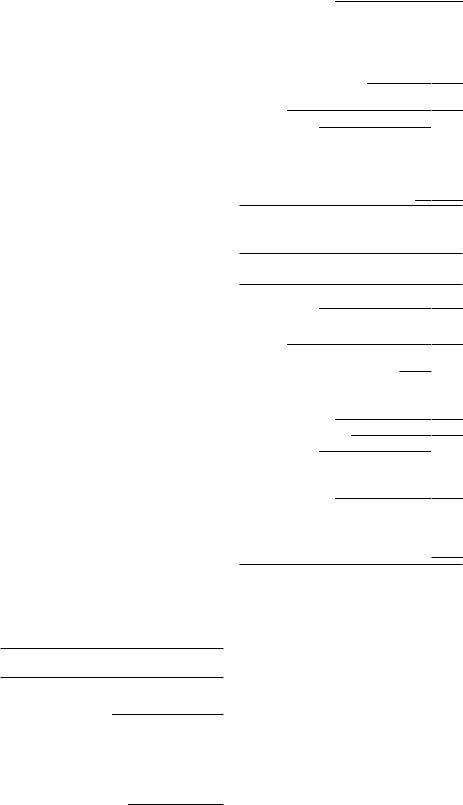

Paperwork Reduction Act

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

|

8807 Part I |

8807 Part II |

Worksheet I |

Worksheet II |

Recordkeeping |

3 hr., 7 min. |

2 hr., 38 min. |

1 hr., 26 min. |

1 hr., 40 min. |

Learning about the |

|

|

|

|

law or the form |

6 min. |

6 min. |

|

|

Preparing and sending |

|

|

|

|

the form to the IRS |

9 min. |

9 min. |

1 min. |

2 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form more simple, we would be happy to hear from you. You can write to both the IRS and the Office of Management and Budget at the addresses listed in the Instructions for Form 720, Quarterly Federal Excise Tax Return.

4.Taxpayers who claimed exemption from the aircraft luxury tax because the aircraft is used 80% or more in any trade or business must attach a statement to his or her income tax return for the 2 taxable years ending after the date the aircraft was placed in service documenting the 80% business use. If this statement is not attached, the luxury tax will apply. See the Instructions for Form 720 and Form 4562, Depreciation, for more information.

General Instructions

SECTION REFERENCES ARE TO THE INTER NAL REVENUE CODE UNLESS OTHERWISE NOTED.

Purpose of

Changes To Note

1.The luxury tax has been repealed on aircraft, boats, furs, and jewelry for sales after December 31, 1992. As of January 1, 1993, the luxury tax applies only to passenger vehicles with an adjusted sales price exceeding $30,000. See the Instructions for Form 720 for information on claiming a refund of the luxury taxes paid on aircraft, boats, furs, and jewelry from January 1, 1993, to June 30, 1993.

2.The base amount not subject to tax for passenger vehicles has not changed and will remain at $30,000.

3.Parts or accessories installed on a vehicle to enable or assist an individual with a disability to operate the vehicle or to enter or exit the vehicle will be exempt from the luxury tax. This change is effective as of January 1, 1991. See the Instructions for Form 720 for information on claiming a refund of the luxury tax paid from January 1, 1991, to June 30, 1993.

the sale of truck, trailer, and semitrailer chassis and bodies, and tractors. Part I is also used by manufacturers, producers, and importers to figure and report excise tax on the sale of fishing equipment and bows and arrows. Part II is used by retailers to compute the luxury tax on passenger vehicles. Attach this form to Form 720. See Pub. 510, Excise Taxes for 1993, for more information on each item reported on this form. See the separate instructions for Form 720 for information on when and where to file this form.

Cat. No. 10090M |

Form 8807 (Rev. |

Form 8807 (Rev. |

Page 2 |

|

|

Part I

Truck, Trailer, and Semitrailer Chassis and Bodies, and Tractors (IRS No. 33).—

The tax on truck, trailer, and semitrailer chassis and bodies, and tractors is 12% (.12) of the sales price of the first retail sale of the item. The sales price of a vehicle includes certain related parts and accessories sold on or in connection with the sale of the vehicle. It applies to vehicles designed for highway transportation that have a gross vehicle weight (GVW) over 33,000 pounds. It also applies to truck, trailer, and semitrailer chassis and bodies for use with a trailer or semitrailer with a GVW over 26,000 pounds. Tractors of the kind mainly used for highway transportation with a trailer or semitrailer are taxable.

Fishing Equipment (IRS Nos. 41 and

The tax on electric outboard motors and sonar devices for finding fish (IRS No. 42) is 3% (.03) of the sales price. The tax is limited to $30 for each sonar device.

A sonar device for finding fish does not include graph recorders, digital types, meter readouts, or combination graph recorders or combination meter readouts.

Bows and Arrows (IRS No.

Part II

Use Part II of this form for the luxury tax on passenger vehicles. They are taxable if the adjusted sales price exceeds $30,000. The tax is 10% of the amount by which the adjusted sales price exceeds the base amount.

Taxable

1.First Retail

2.Subsequent

3.Change in

First Retail

Adjusted Sales

Imported

Passenger Vehicles (IRS No.

Line

Worksheet

(keep for your records)

1.Enter the retail price of the vehicle. Price includes cash, cash equivalents, goods, services, and the wholesale fair market value of any

2.Additions to the retail price. Enter the amounts for the following items if they are stated separately and not included in the retail price on line 1: delivery charges, packaging, dealer preparation, parts and accessories sold on or in connection with the article, taxes (except the luxury tax), commissions, warranties, and any other charges not listed above

3.Add lines 1 and 2

4.Subtractions from the sales price. Enter the amounts for the following items if they are stated separately and included in line

3:state and local sales taxes, title and registration charges, optional warranty charges, rebates and price adjustments paid, and the value of used components supplied by the purchaser

5.Adjusted sales price. Subtract line 4 from line 3

6. Base amount |

30,000 |

7.Taxable adjusted sales price. Subtract line 6 from line 5. If line 6 is greater than line 5, make no entry; the luxury tax does not apply to the vehicle. Add the amounts on line 7 of all Worksheets I for each passenger vehicle. Enter the total in Part II, line 1, of Form 8807 in column (a)

Line

Worksheet

(keep for your records)

1.The price (including installation) of a part or accessory

2a. Aggregate price (including installation) of all other parts and accessories previously added

2b. Add lines 1 and 2a. If $200 or less, do not complete this worksheet

3.Adjusted sales price of the taxable vehicle (from line 5 of Worksheet I). If you did not complete Worksheet I for the vehicle, complete it now

4.Add lines 1, 2a, and 3

5. Base amount |

30,000 |

6.Subtract line 5 from line 4. If this amount is zero or less, there is no luxury tax on this vehicle and you do not have to complete line 7

7.Taxable amount of subsequent addition. Enter the smaller of line 1 or line 6. Add the amounts on line 7 of all Worksheets II for each passenger vehicle. Enter the total in Part II, line 2, column (a) of Form 8807

Line 3, Taxable FMV on the Change in Use of Passenger