In case you need to fill out Nonpatronage, you don't have to install any sort of software - just try our PDF editor. FormsPal team is constantly endeavoring to develop the tool and insure that it is much better for clients with its many features. Unlock an endlessly revolutionary experience now - check out and discover new possibilities along the way! To get the process started, take these simple steps:

Step 1: Firstly, open the tool by pressing the "Get Form Button" at the top of this page.

Step 2: The editor allows you to change most PDF documents in a variety of ways. Modify it with personalized text, adjust original content, and put in a signature - all at your fingertips!

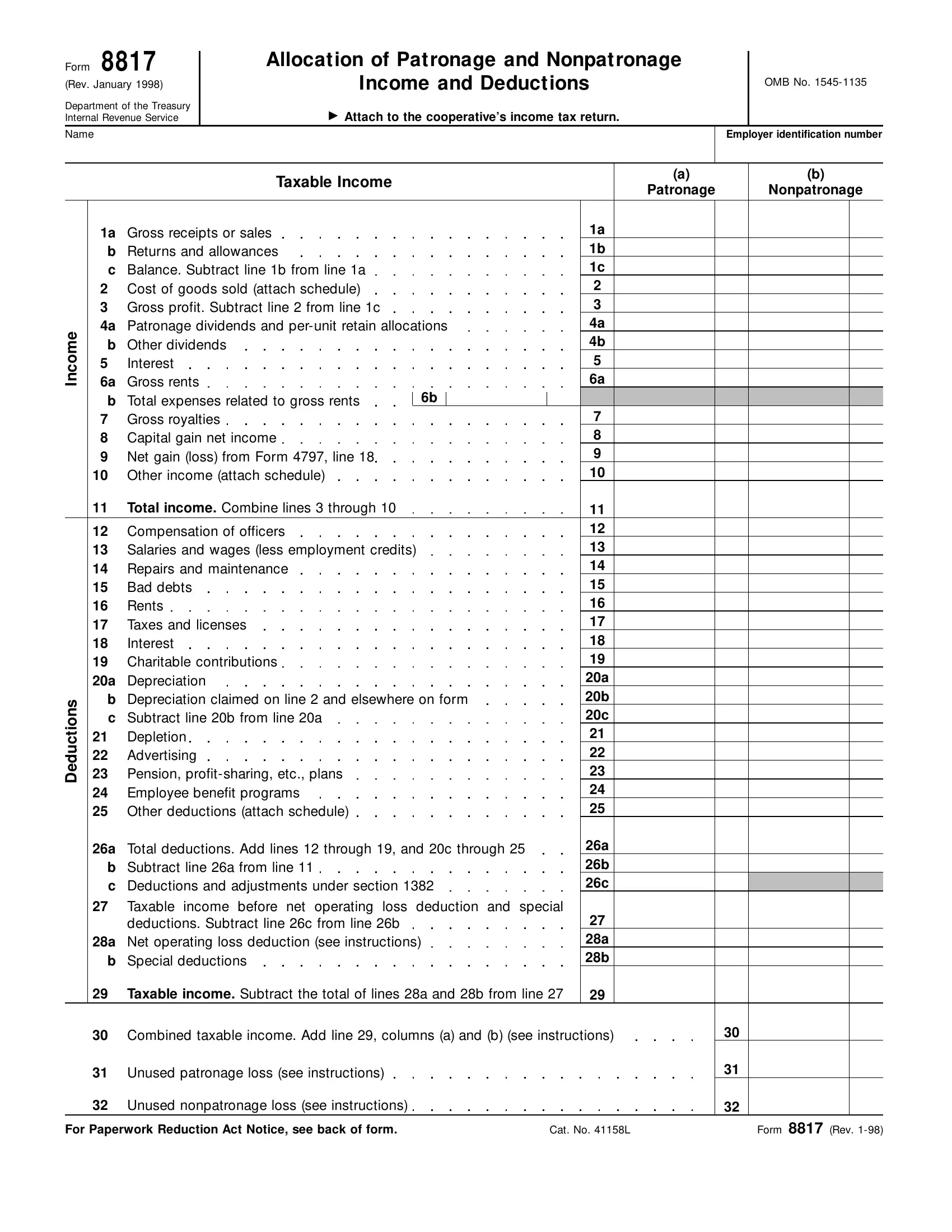

In an effort to finalize this PDF document, be sure you enter the necessary details in every field:

1. The Nonpatronage usually requires specific information to be inserted. Make certain the following fields are completed:

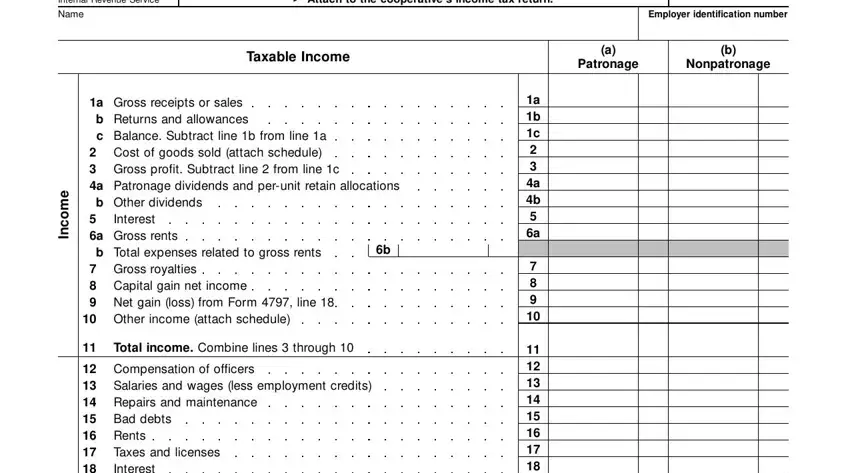

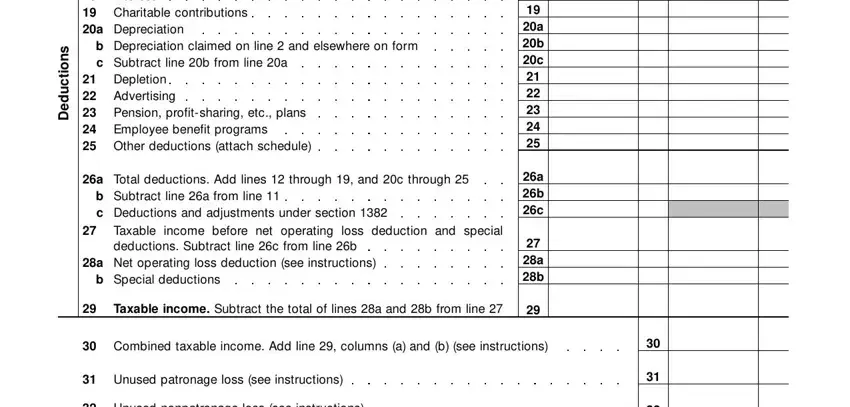

2. Once your current task is complete, take the next step – fill out all of these fields - s n o i t c u d e D, Compensation of officers, Taxes and licenses Interest, b Depreciation claimed on line, Subtract line b from line a, Depletion Other deductions, Advertising Pension profitsharing, Total deductions Add lines, b Subtract line a from line c, Deductions and adjustments under, a b, Taxable income Subtract the total, a b c, a b c, and a b with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Be really attentive when filling in s n o i t c u d e D and a b, because this is where a lot of people make some mistakes.

Step 3: Immediately after proofreading your entries, click "Done" and you are all set! Find the Nonpatronage as soon as you join for a free trial. Instantly gain access to the document in your FormsPal cabinet, with any modifications and changes being automatically kept! When using FormsPal, you can certainly fill out documents without being concerned about database breaches or data entries being shared. Our secure platform ensures that your personal details are kept safe.