In navigating the complexities of international taxation, entities often encounter the challenge of currency fluctuations, which can significantly impact financial reporting and tax obligations. Form 8819, developed by the Department of the Treasury's Internal Revenue Service, serves as a vital tool in this context by allowing a U.S. person or entity to elect the U.S. dollar as the functional currency for a qualified business unit (QBU) operating in foreign jurisdictions. This election, permissible under Section 985 of the Internal Revenue Code, is particularly relevant for U.S. businesses with operations overseas, as well as for foreign corporations and partnerships with business activities in the United States. By filing Form 8819, these entities can stabilize their financial reporting and tax calculations, mitigating the risk posed by exchange rate volatility. The form caters to various filers, including U.S. persons making elections for their foreign QBUs, partnerships, trusts, estates, and foreign corporations, each with specific filing requirements and deadlines. Detailed instructions provided with the form guide filers through the process, ensuring compliance with U.S. tax laws while enabling a more predictable financial environment for international operations.

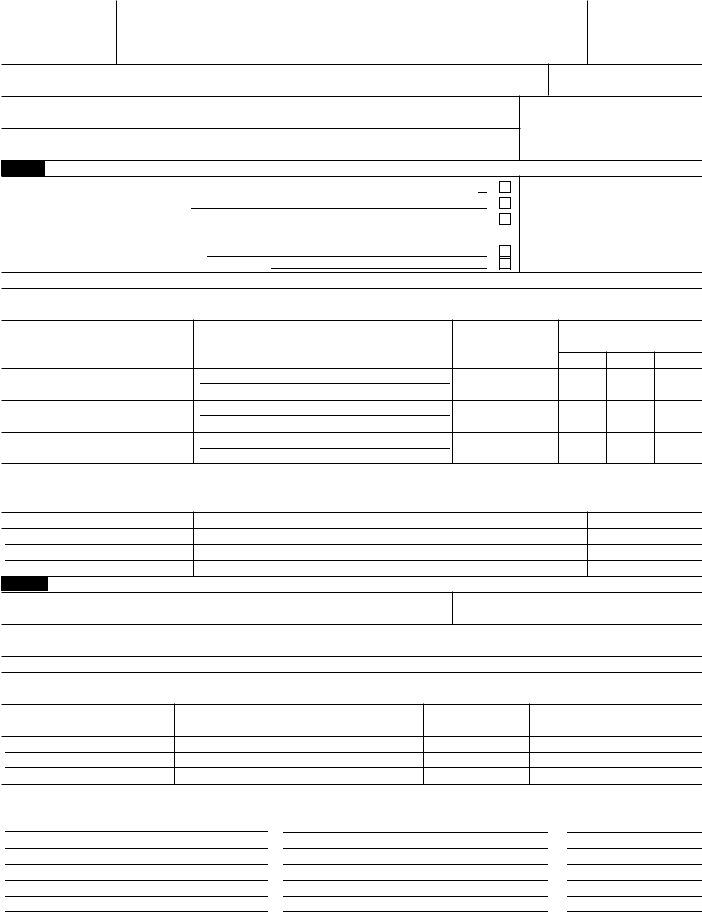

| Question | Answer |

|---|---|

| Form Name | Form 8819 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | f8819 1991 form 8819 irs |

Form 8 8 1 9

(May 1991)

Department of the Treasury Internal Revenue Service

Dollar Election Under Section 9 8 5

OMB No.

Expires

Name of Person Making Election

Identifying number

Number, street, and room or suite no. (If a P.O. box, see instructions on page 2.)

Enter tax year for which dollar election is effective

City or town, state, and ZIP code

Part I Entity for which the election is made

1U.S. person m aking election for its foreign QBU (other than a partnership, trust, or estate)

2 Partnership, trust, or estate

3 Controlling U.S. shareholders (within the m eaning of Regulations section 1.985- 2(c)(2)) for a corporation

4Majority domestic corporate shareholders (within the meaning of Regulations section

5Foreign person making election for a QBU

6Country where the principal place of business of the eligible QBU is located and country of each of its eligible QBU branches. See Regs. secs.

Foreign Corporation, Partnership, Trust or Estate

7If line 2, 3, 4, or 5 is checked, enter the information required by the instructions in the appropriate lines below. Attach additional sheets if necessary.

(a)Name of shareholder, partner, or beneficiary

(b)Address (street no., P.O. box, city, state, and ZIP code)

(c)Identifying number

(d)Percent of stock owned in each class

Common Preferred 1Preferred 2

8List names, addresses, and identifying number of all persons that are related to the electing QBU within the meaning of Regulations section

Name

Address

Identifying number

Part II If election is made by or for a foreign corporation, show the following information:

9a Name of foreign corporation (do not complete if foreign corporation is the filer)

b Country of organization or creation

cPrincipal place of business for each eligible QBU

(Attach additional sheets if necessary)

10Enter the nam e, address, and identifying num ber of every U.S. person notified of the dollar election pursuant to Regulations section 1.985- 2(c)(2)(ii) . Also, enter the country w here the principal place of business of the eligible QBU is located. Attach additional sheets if necessary.

Name

Address

Identifying number

Country where the principal place of business of the eligible QBU is located.

Under penalties of perjury, I declare that I have examined this form and to the best of my knowledge and belief, it is true, correct, and complete.

Signature |

(Title, if any) |

Date |

|

|

|

For Paperwork Reduction Act Notice, see page 2. |

Cat. No. 10850K |

Form 8819 |

Form 8819 |

Page 2 |

Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us this information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

2 hrs., 52 min. |

Learning about the |

|

law or the form |

24 min. |

Preparing and sending |

|

the form to IRS |

28 min. |

If you have comments concerning the accuracy of this time estimate or suggestions for making the form more simple, we would be happy to hear from you. You can write to both the Internal Revenue Service, Washington, DC 20224, Attention: IRS Reports Clearance Officer, T:FP, and the Office of Management and Budget, Paperwork Reduction Project

General Instructions

(SECTION REFERENCES ARE TO THE INTERNAL REVENUE CODE UNLESS OTHERWISE NOTED.)

Purpose of Form

Form 8819 is filed by a U.S. qualified business unit (QBU)

Who Must File

If the election is made by a U.S. person on behalf of a foreign branch of that person, Form 8819 must be filed by the U.S. person.

If the election is made on behalf of a controlled foreign corporation (CFC) or a branch of a CFC, Form 8819 must be filed by the CFC’s controlling U.S. shareholders as defined in Regulations section

If the election is made on behalf of a noncontrolled foreign corporation or branch of a noncontrolled foreign corporation, Form 8819 must be filed by each of the foreign corporation’s majority U.S. shareholders as defined in Regulations section

If an election is made by a foreign corporation, Form 8819 must be filed by an authorized officer or director of the foreign corporation.

If an election is made by a partnership, trust, or estate, Form 8819 must be filed as follows:

In the case of a partnership, the election must be made by the partnership. See section 703(b). In the case of a trust, the election must be made by the trustee. In the case of an estate, the election must be made by the executor or executrix.

When and Where To File

A U.S. person electing on behalf of a foreign branch must file Form 8819 with that U.S. person’s timely filed Federal income tax return (including extensions) for the tax year the election is made.

If the election has been made in a previous tax year under the provisions of Regulations section

All others must file Form 8819 within 180 days after the end of the tax year for which the dollar election is made. File Form 8819 with the Internal Revenue Service Center, Philadelphia, PA 19255.

Specific Instructions

Line

Line

If line 3 or 4 is checked, enter on line 7 the name, address, identifying number of, and the percent of stock owned (within the meaning of section 958(a)) in each class of stock for each U.S. shareholder (as defined in section 951(b)) making the election.

If line 5 is checked by a controlled foreign corporation (CFC), enter on line 7 the name, address, identifying number of, and percent of stock owned in each class of stock for each U.S. shareholder (as defined in section 951(b)) who is known by the foreign corporation to own stock in the foreign corporation. See section 958(a) for a definition of stock ownership.

If line 5 is checked by a noncontrolled foreign corporation, enter on line 7 the name, address, identifying number, and percent of stock owned (as defined in section 902(b)) in each class of stock for each domestic corporate shareholder.