Handling PDF documents online is actually a breeze using our PDF editor. You can fill out complete form 8825 here painlessly. Our editor is consistently evolving to provide the best user experience achievable, and that is because of our commitment to constant enhancement and listening closely to customer opinions. Here's what you'll want to do to get started:

Step 1: Simply hit the "Get Form Button" at the top of this site to access our form editing tool. There you'll find all that is necessary to work with your document.

Step 2: With the help of this online PDF editor, you're able to do more than just complete forms. Try each of the functions and make your forms seem faultless with customized text incorporated, or optimize the file's original content to perfection - all that backed up by the capability to incorporate any photos and sign the file off.

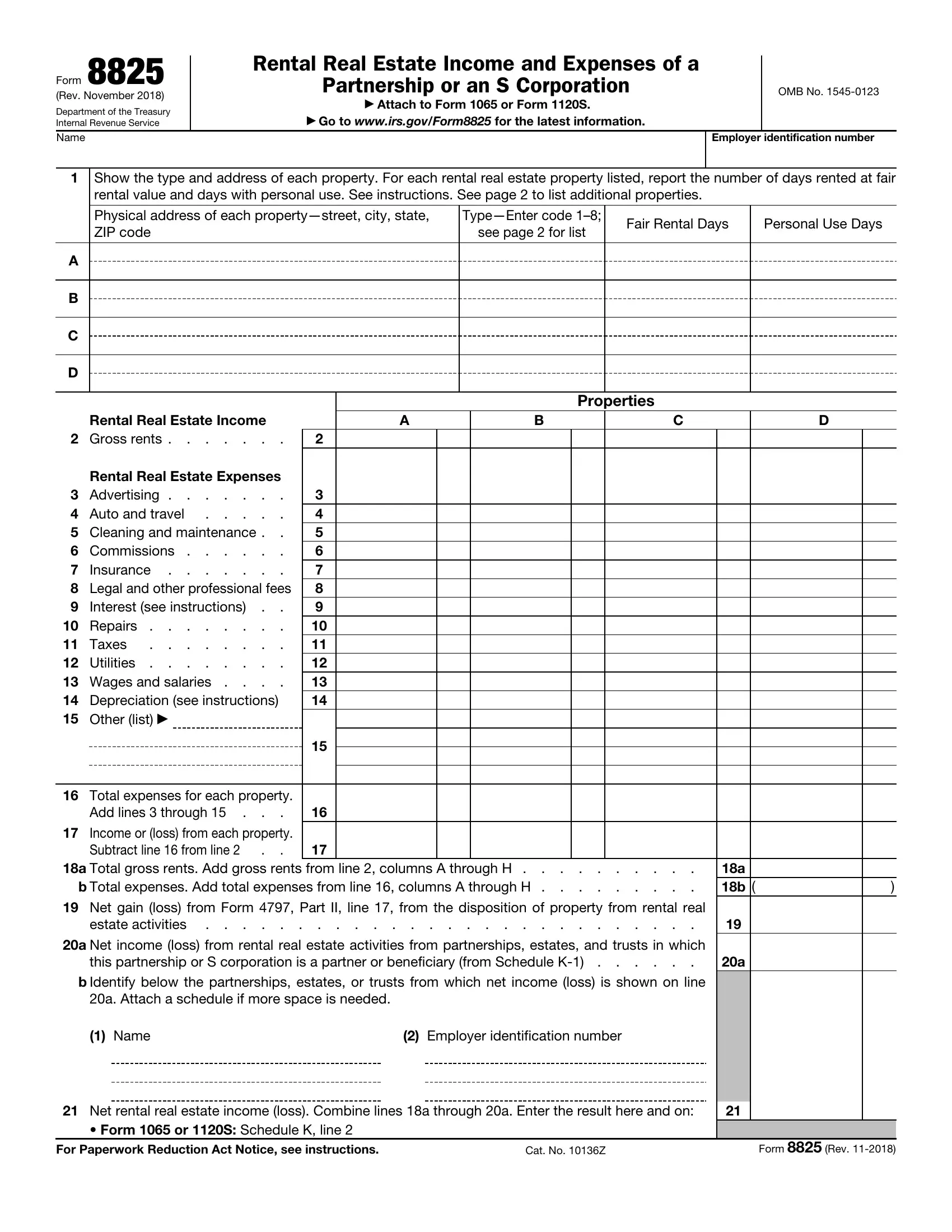

As for the blank fields of this particular document, here is what you should know:

1. To start off, while completing the complete form 8825, beging with the area containing following fields:

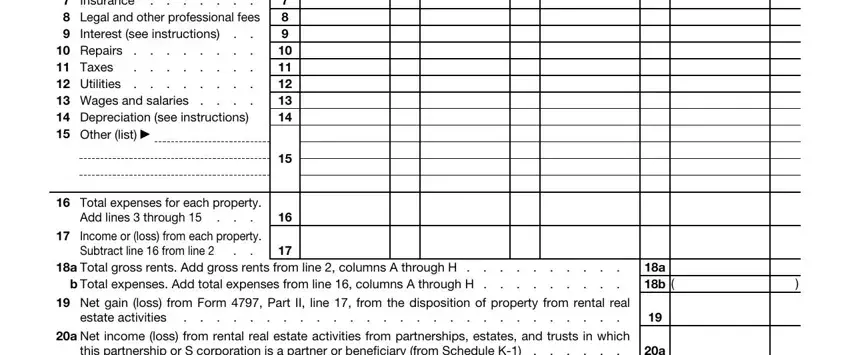

2. After the previous part is finished, you should include the needed specifics in Rental Real Estate Expenses, Advertising Auto and travel, Repairs Taxes Utilities, Total expenses for each property, Add lines through, Income or loss from each property, Subtract line from line, a Total gross rents Add gross, b Total expenses Add total, a b, Net gain loss from Form Part II, estate activities, a Net income loss from rental, and this partnership or S corporation in order to move on further.

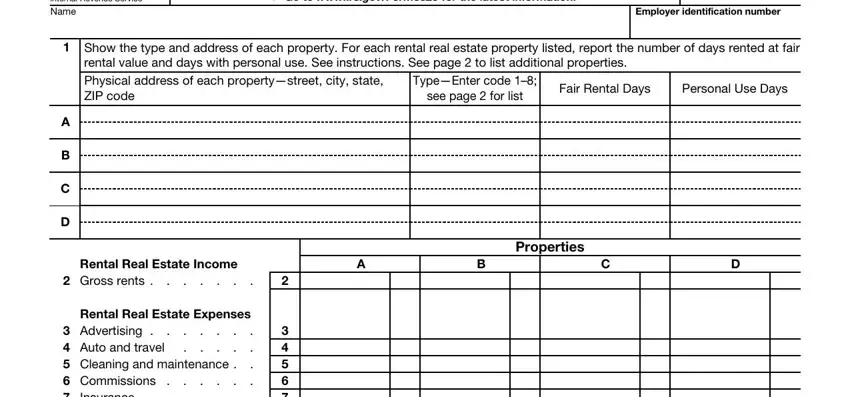

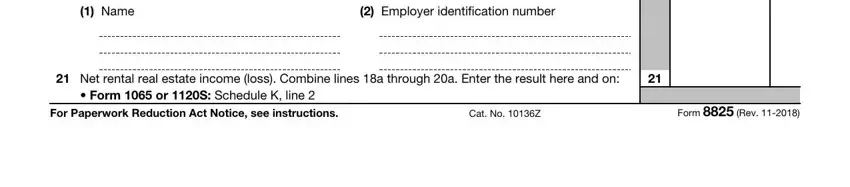

3. Through this part, check out Name, Employer identification number, Net rental real estate income, Form or S Schedule K line, For Paperwork Reduction Act Notice, Cat No Z, and Form Rev. All of these are required to be filled in with highest accuracy.

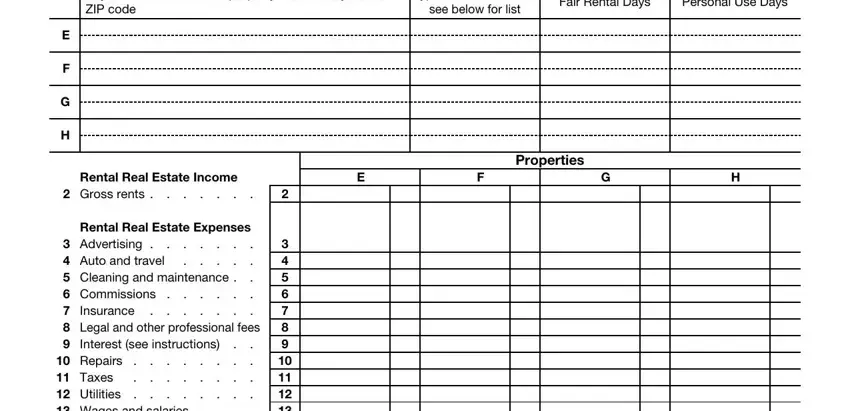

4. This fourth section comes next with the next few blanks to focus on: Physical address of each, TypeEnter code, see below for list, Fair Rental Days, Personal Use Days, Rental Real Estate Income, Gross rents, Properties, Rental Real Estate Expenses, Advertising Auto and travel, and Repairs Taxes Utilities.

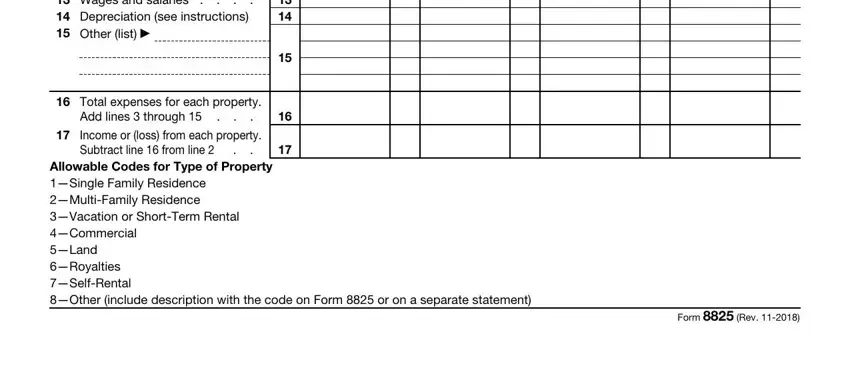

5. This last notch to finalize this document is critical. Make sure you fill in the displayed form fields, for example Advertising Auto and travel, Repairs Taxes Utilities, Total expenses for each property, Add lines through, Income or loss from each property, Subtract line from line, Allowable Codes for Type of, and Form Rev, prior to finalizing. Failing to do it could end up in an incomplete and potentially invalid document!

As for Allowable Codes for Type of and Form Rev, be certain that you don't make any errors in this section. Both of these are the most important fields in the page.

Step 3: Proofread what you've entered into the blank fields and hit the "Done" button. Acquire your complete form 8825 when you join for a 7-day free trial. Quickly access the pdf within your personal account page, with any edits and adjustments being all kept! FormsPal guarantees secure form editor with no personal data recording or sharing. Rest assured that your information is secure here!