Using the online editor for PDFs by FormsPal, you are able to fill out or alter form 886 h eic here. To maintain our tool on the forefront of efficiency, we strive to put into operation user-driven features and improvements regularly. We're routinely looking for suggestions - join us in revolutionizing PDF editing. It just takes several simple steps:

Step 1: Press the "Get Form" button in the top area of this page to access our PDF tool.

Step 2: This editor will let you modify PDF documents in a range of ways. Enhance it by writing customized text, correct existing content, and include a signature - all close at hand!

It is simple to complete the form with our detailed tutorial! Here's what you have to do:

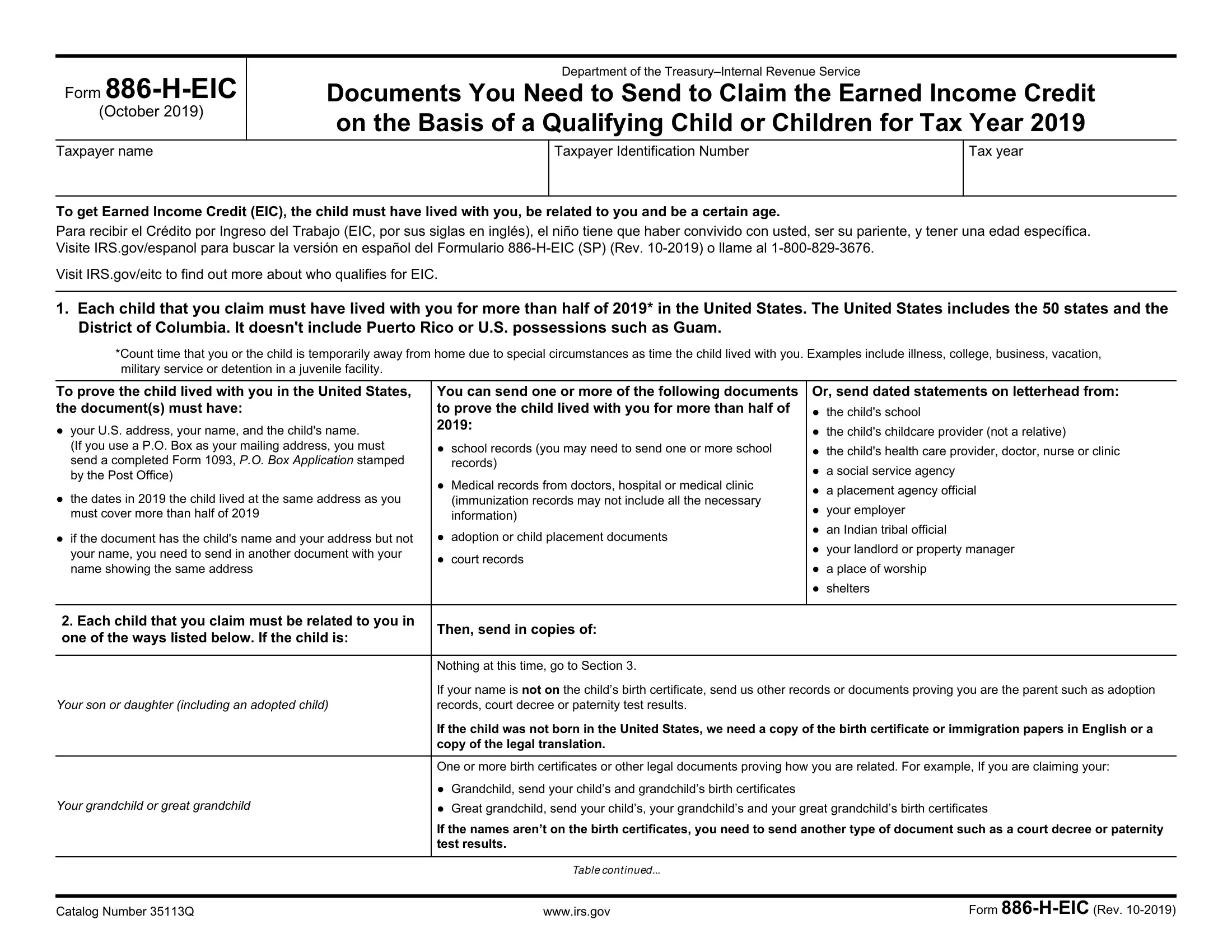

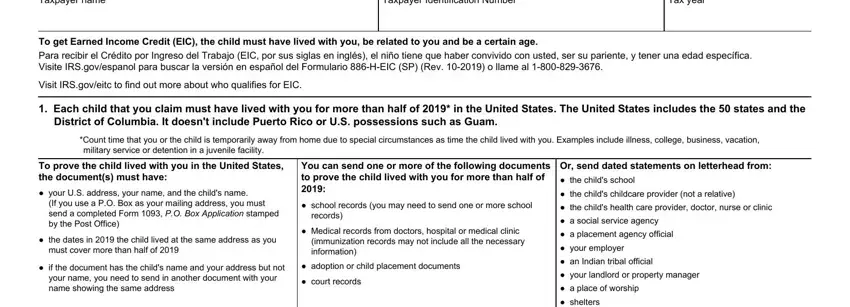

1. To begin with, while filling out the form 886 h eic, start with the page that features the next blanks:

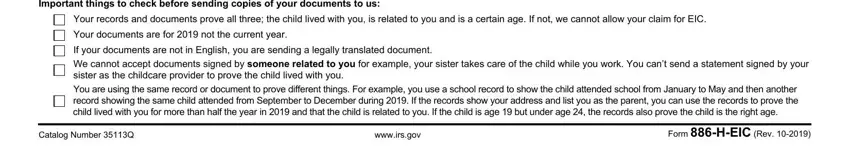

2. When the last part is filled out, go on to enter the relevant details in all these - Important things to check before, Your records and documents prove, Your documents are for not the, If your documents are not in, You are using the same record or, Catalog Number Q, wwwirsgov, and Form HEIC Rev.

You can potentially make an error while completing the Your records and documents prove, hence you'll want to go through it again prior to when you submit it.

Step 3: Before moving forward, check that blank fields were filled out correctly. As soon as you’re satisfied with it, click “Done." Right after creating afree trial account here, it will be possible to download form 886 h eic or send it through email directly. The document will also be at your disposal from your personal cabinet with all your changes. FormsPal guarantees safe document tools without data recording or sharing. Rest assured that your details are in good hands with us!