Working with PDF files online is actually very simple using our PDF tool. Anyone can fill in Form 8865 Schedule O here without trouble. Our expert team is constantly working to develop the tool and insure that it is much faster for people with its many functions. Benefit from today's innovative prospects, and discover a myriad of new experiences! For anyone who is seeking to start, here's what it's going to take:

Step 1: Hit the orange "Get Form" button above. It'll open up our editor so you can begin filling in your form.

Step 2: Using our state-of-the-art PDF tool, it is possible to do more than just fill in blank fields. Try each of the features and make your documents appear faultless with customized text added in, or adjust the file's original input to perfection - all comes along with an ability to add stunning photos and sign the document off.

It is actually an easy task to fill out the form with our practical guide! This is what you need to do:

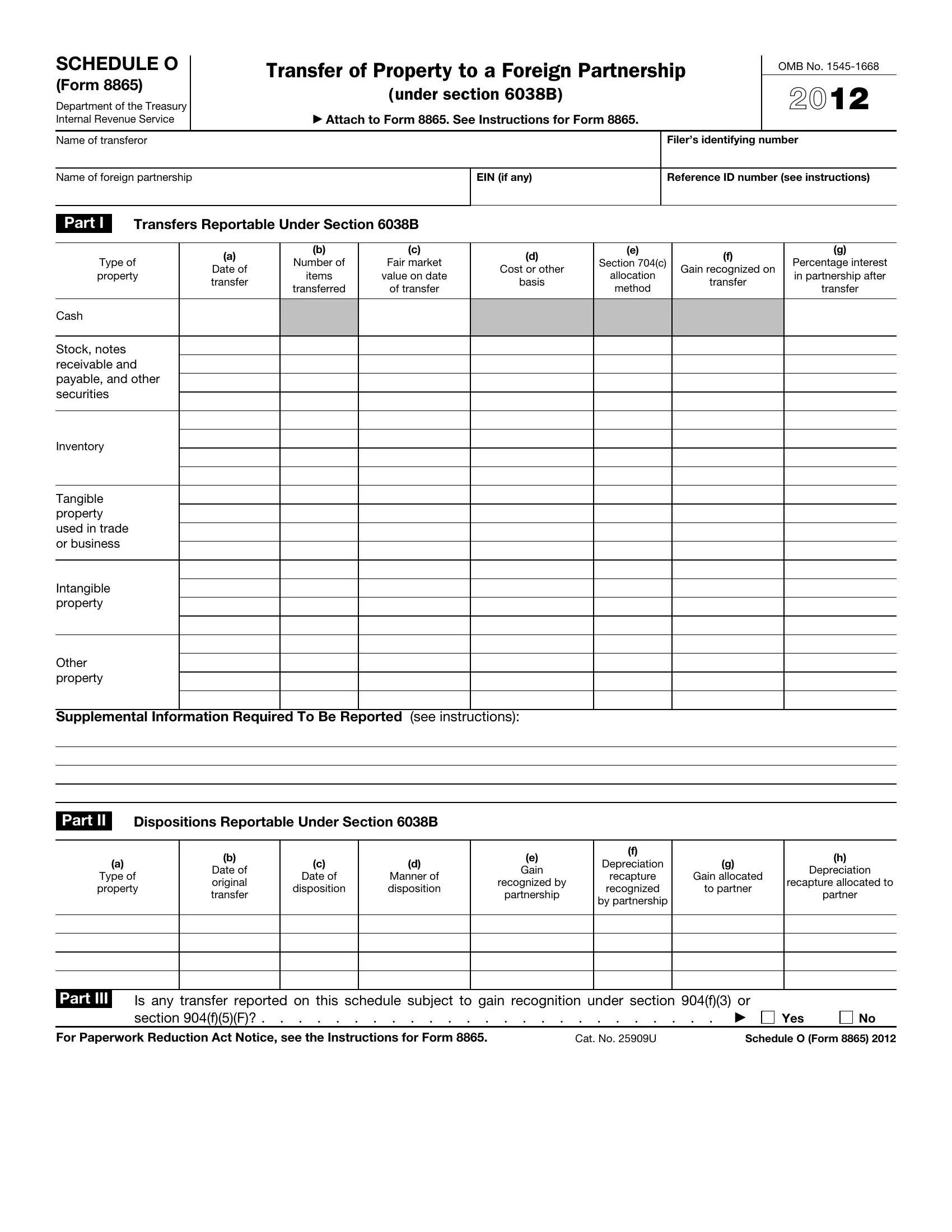

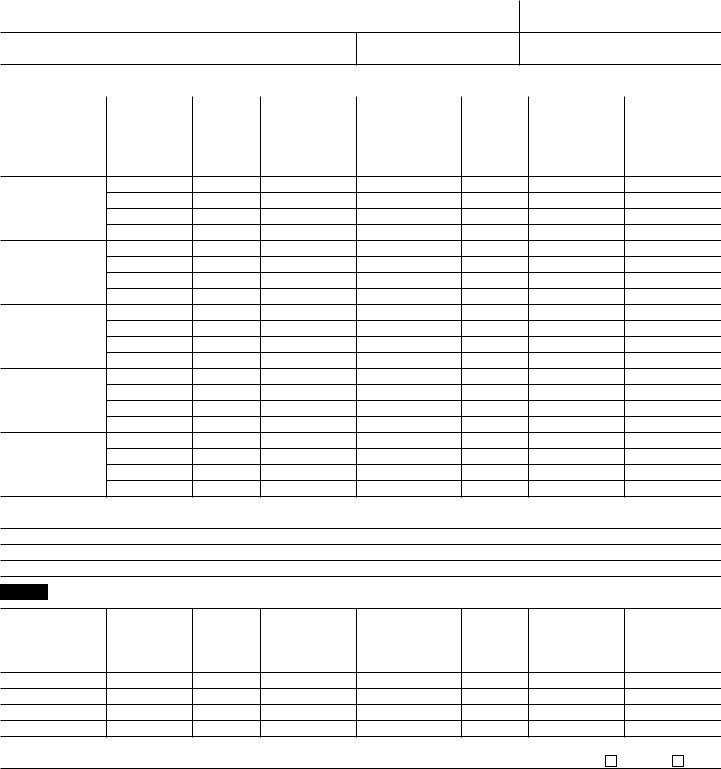

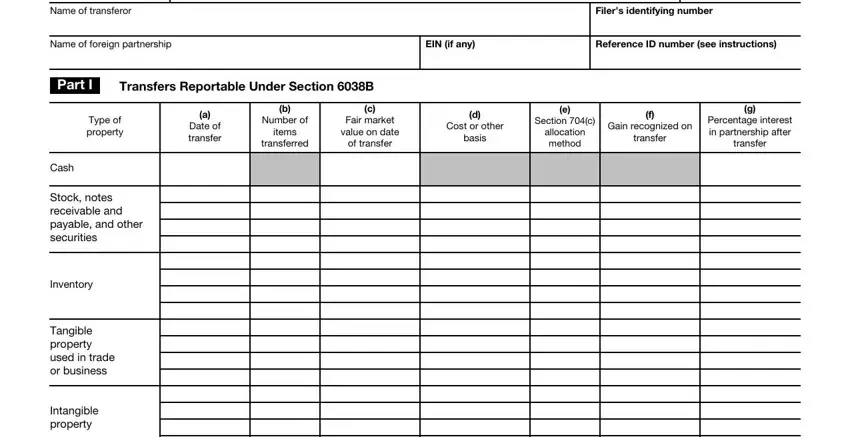

1. When filling out the Form 8865 Schedule O, make certain to complete all of the essential blank fields in the corresponding part. It will help to hasten the process, allowing for your details to be processed efficiently and appropriately.

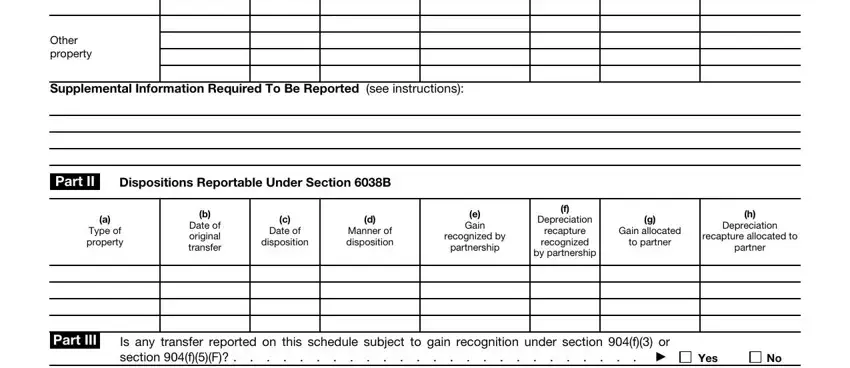

2. Now that this array of fields is completed, you should insert the required details in Other property, Supplemental Information Required, Part II, Dispositions Reportable Under, Type of property, Date of original transfer, Date of, disposition, Manner of disposition, e Gain, recognized by, partnership, Depreciation, recapture recognized, and by partnership in order to go further.

In terms of Supplemental Information Required and Manner of disposition, make sure that you don't make any errors here. Both of these could be the most significant ones in this file.

Step 3: You should make sure your information is accurate and then simply click "Done" to finish the task. Get the Form 8865 Schedule O once you join for a 7-day free trial. Readily access the pdf file in your FormsPal account, together with any modifications and changes conveniently kept! FormsPal is invested in the personal privacy of our users; we make sure that all personal data used in our system is confidential.