irs 8869 can be filled out online without difficulty. Simply open FormsPal PDF tool to finish the job fast. In order to make our editor better and less complicated to utilize, we constantly implement new features, considering feedback coming from our users. Here's what you would have to do to get going:

Step 1: Click the "Get Form" button at the top of this page to get into our tool.

Step 2: When you open the PDF editor, you will see the document prepared to be completed. Aside from filling in various fields, it's also possible to perform other things with the Document, specifically writing custom textual content, modifying the original textual content, adding images, placing your signature to the document, and more.

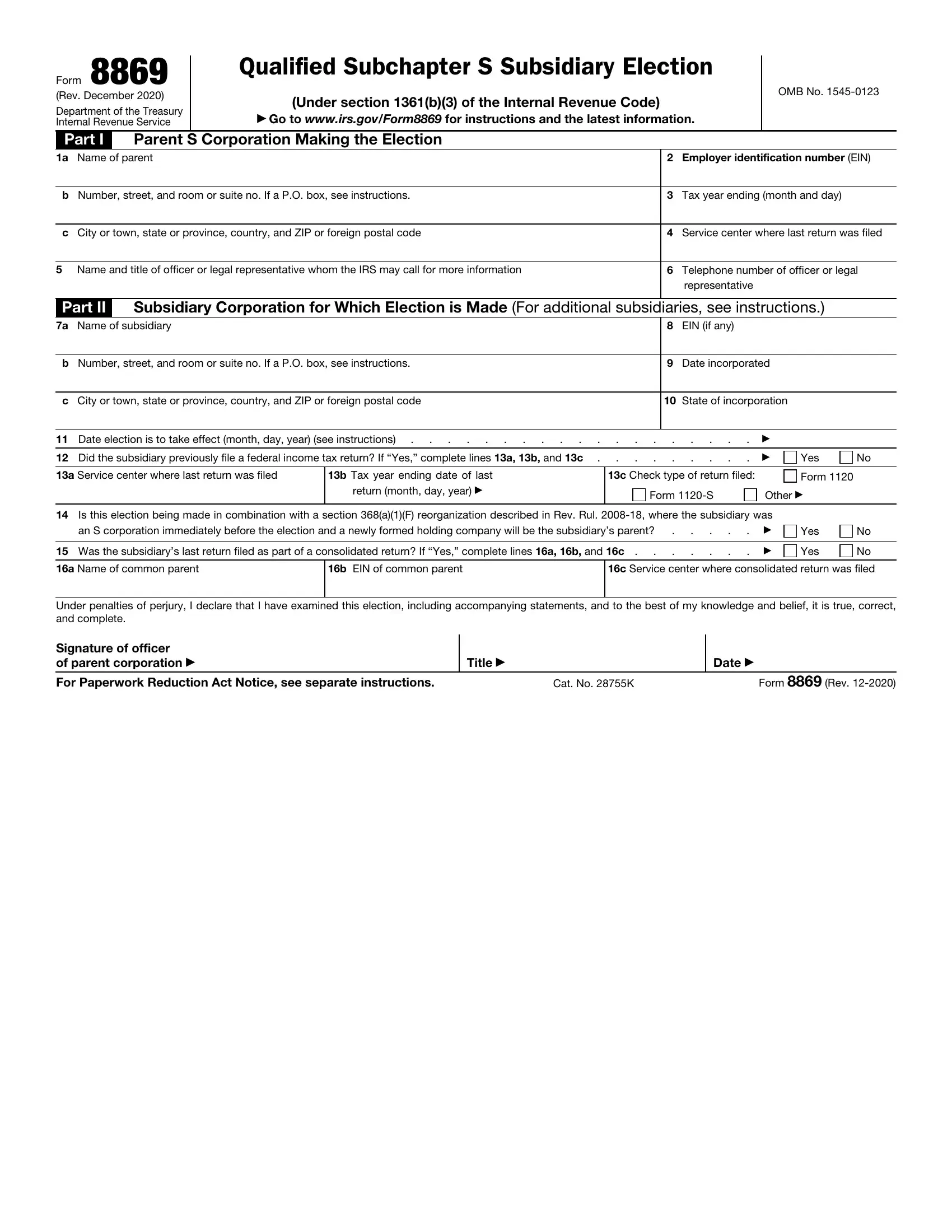

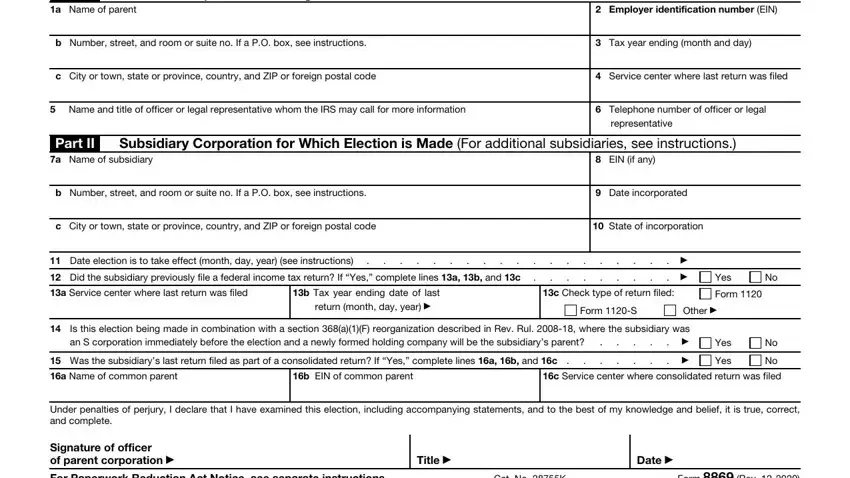

In an effort to fill out this document, make sure you type in the information you need in every single blank:

1. To get started, while completing the irs 8869, begin with the section that has the following blanks:

Step 3: Revise the details you have inserted in the form fields and then click on the "Done" button. Sign up with us right now and instantly get access to irs 8869, set for downloading. All adjustments you make are preserved , which enables you to customize the form at a later point when necessary. With FormsPal, you'll be able to fill out forms without stressing about information incidents or data entries being shared. Our protected software ensures that your personal information is stored safe.