You can fill out Aggregate effortlessly with our PDF editor online. To have our tool on the cutting edge of efficiency, we strive to put into action user-oriented capabilities and improvements regularly. We're at all times grateful for any suggestions - help us with revolutionizing PDF editing. By taking some basic steps, you may start your PDF editing:

Step 1: Open the PDF form inside our tool by pressing the "Get Form Button" above on this page.

Step 2: Using our handy PDF file editor, you can do more than merely fill in forms. Edit away and make your documents appear high-quality with customized text incorporated, or adjust the file's original input to perfection - all that accompanied by an ability to incorporate just about any pictures and sign the document off.

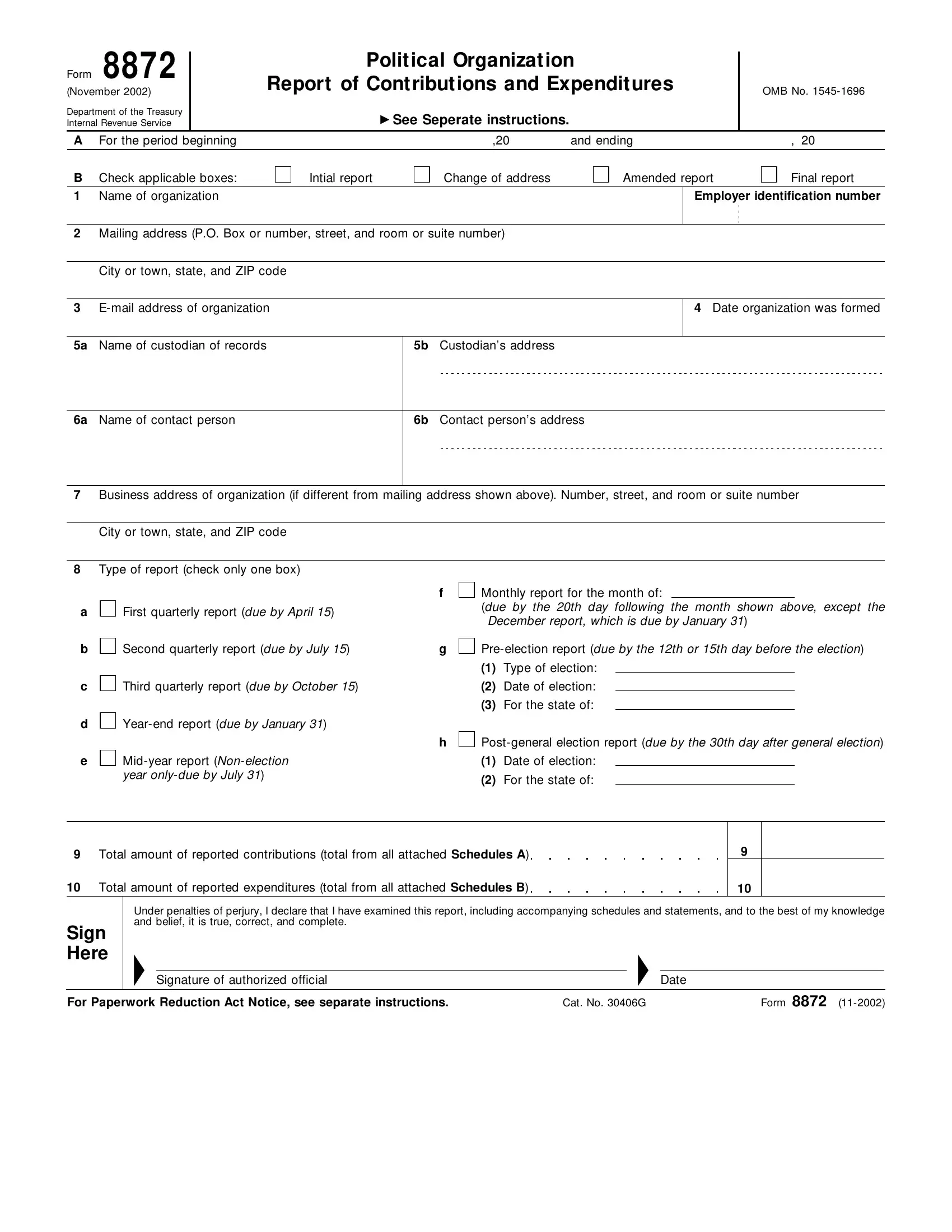

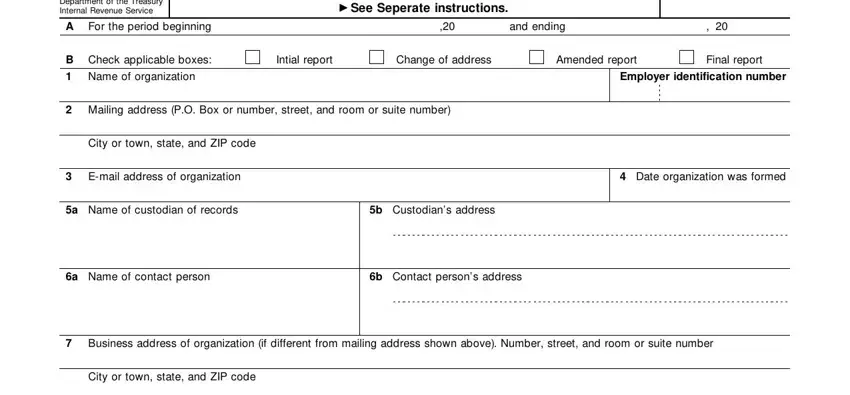

In order to finalize this form, be sure to enter the necessary information in every single field:

1. It's essential to fill out the Aggregate properly, hence take care when filling out the parts including these specific fields:

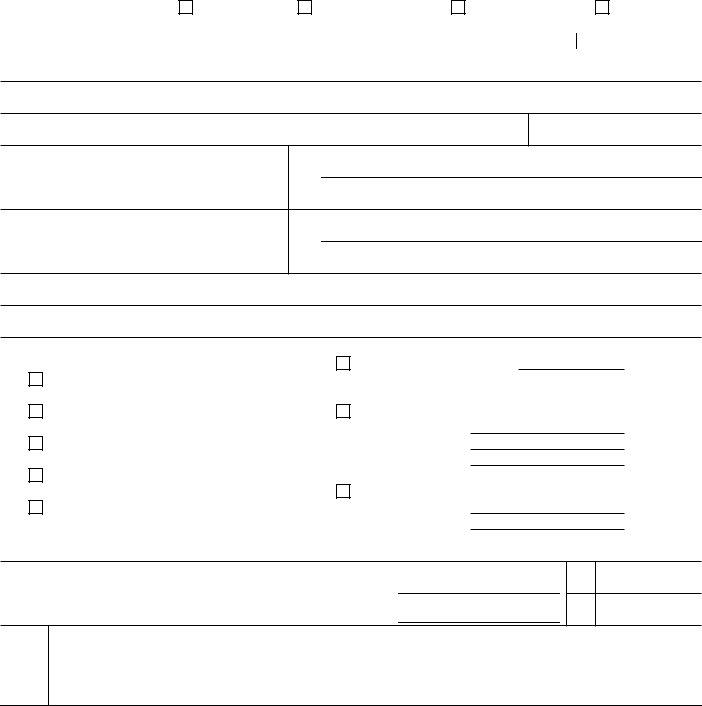

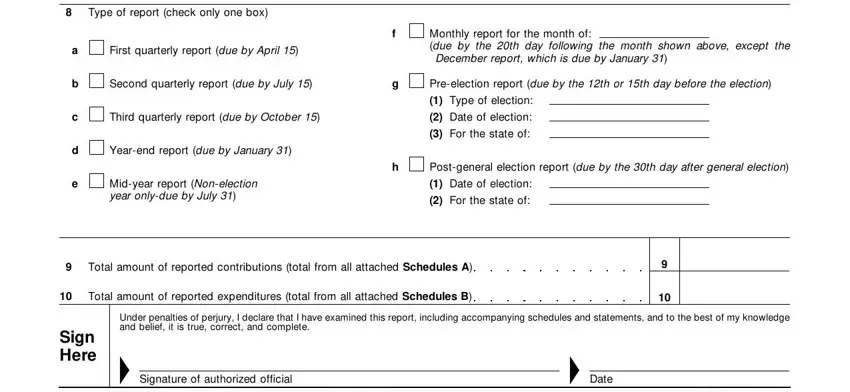

2. When the last section is completed, you have to insert the necessary details in Type of report check only one box, First quarterly report due by, Second quarterly report due by, Third quarterly report due by, Yearend report due by January, Midyear report Nonelection year, Monthly report for the month of, December report which is due by, Preelection report due by the th, Type of election, Date of election, For the state of, Postgeneral election report due by, Date of election, and For the state of so you're able to move on to the 3rd stage.

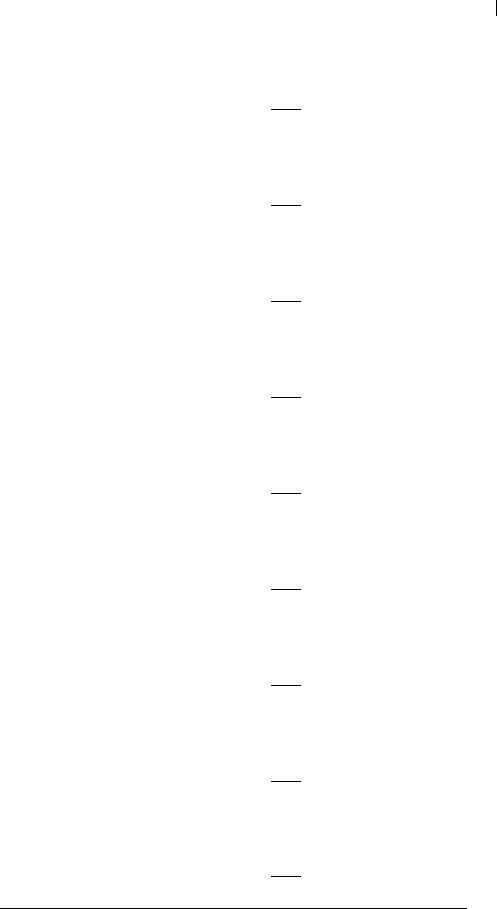

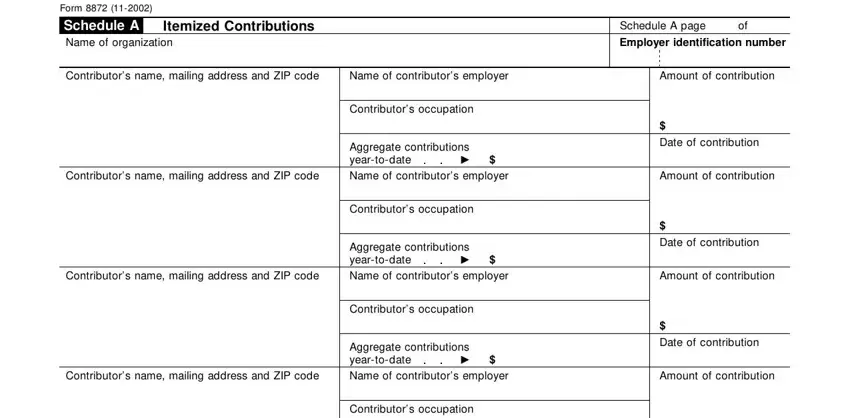

3. Completing Form Schedule A Name of, Itemized Contributions, Schedule A page Employer, Contributors name mailing address, Name of contributors employer, Amount of contribution, Contributors name mailing address, Name of contributors employer, Amount of contribution, Contributors occupation, Aggregate contributions yeartodate, Date of contribution, Contributors occupation, Aggregate contributions yeartodate, and Date of contribution is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

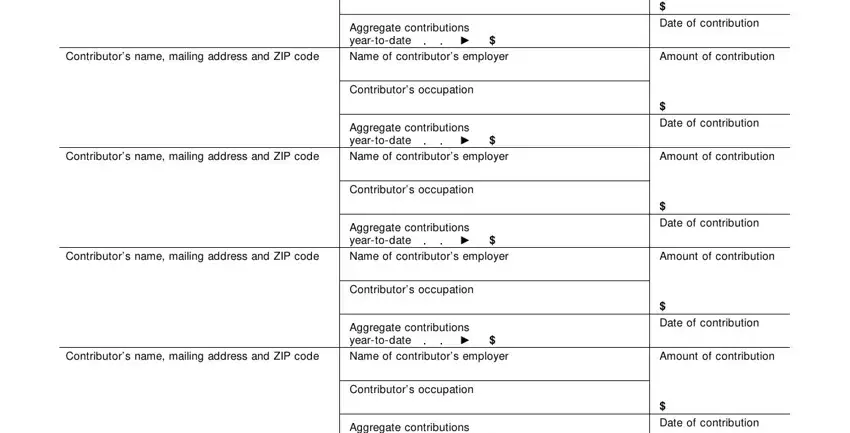

4. This next section requires some additional information. Ensure you complete all the necessary fields - Contributors name mailing address, Name of contributors employer, Amount of contribution, Aggregate contributions yeartodate, Date of contribution, Contributors occupation, Aggregate contributions yeartodate, Date of contribution, Contributors name mailing address, Name of contributors employer, Amount of contribution, Contributors name mailing address, Name of contributors employer, Amount of contribution, and Contributors occupation - to proceed further in your process!

As for Aggregate contributions yeartodate and Amount of contribution, make sure you don't make any mistakes in this current part. These are certainly the most significant fields in the form.

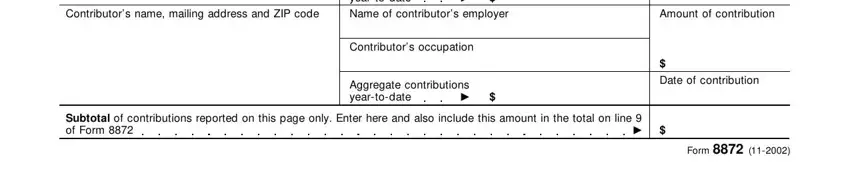

5. Finally, the following last portion is precisely what you'll want to complete prior to closing the document. The blank fields in this instance are the next: Contributors name mailing address, Name of contributors employer, Amount of contribution, Aggregate contributions yeartodate, Contributors occupation, Aggregate contributions yeartodate, Date of contribution, Subtotal of contributions reported, and Form.

Step 3: Make sure the information is accurate and simply click "Done" to progress further. Go for a 7-day free trial account with us and acquire immediate access to Aggregate - which you are able to then make use of as you would like in your FormsPal cabinet. When you use FormsPal, you can easily complete forms without stressing about data incidents or data entries getting distributed. Our protected platform makes sure that your private information is maintained safely.