The Form 8884, known officially as the "New York Liberty Zone Business Employee Credit," stands as a critical instrument for businesses operating within the New York Liberty Zone, facilitating the claim of tax credits against wages paid to eligible employees. Enacted to support and encourage economic recovery in areas affected by the events of September 11, 2001, this form enables qualifying businesses to receive a credit of 40% for qualified wages (up to $6,000) for employees working more than 400 hours, and 25% for those working between 120 and 400 hours, during the tax year. Besides the primary qualification criteria, the form accommodates various business structures, including pass-through entities like S corporations, partnerships, and cooperatives, by allowing them to allocate the credit among shareholders, partners, or patrons. Due to specific restrictions, such as limits on the number of employees and a cap on qualified wages, not all businesses will qualify for the credit. Additionally, the credit forms part of the Work Opportunity Credit and adheres to a unique set of rules and procedures, outlined comprehensively in the form's instructions and accompanying notices. Applications for the credit cover work performed after December 31, 2001, by employees in the defined Liberty Zone or, under certain conditions, in other parts of New York City if the business was displaced by the attacks. The detailed guidance provided for calculating and reporting the credit underscores the IRS's effort to bolster the economic vitality of this historically significant area while ensuring compliance with the tax code.

| Question | Answer |

|---|---|

| Form Name | Form 8884 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | 13a, 8582-CR, 2002, Carryback |

Form 8 8 8 4 |

New York Liberty Z one |

|

OMB No. |

|

|

|

|

||

|

200 1 |

|

||

|

Business Employee Credit |

|

|

|

Department of the Treasury |

Attach to your tax return. |

|

Attachment |

132 |

Internal Revenue Service |

|

Sequence No. |

||

Name(s) shown on return |

|

Identifying number |

|

|

|

|

|

|

|

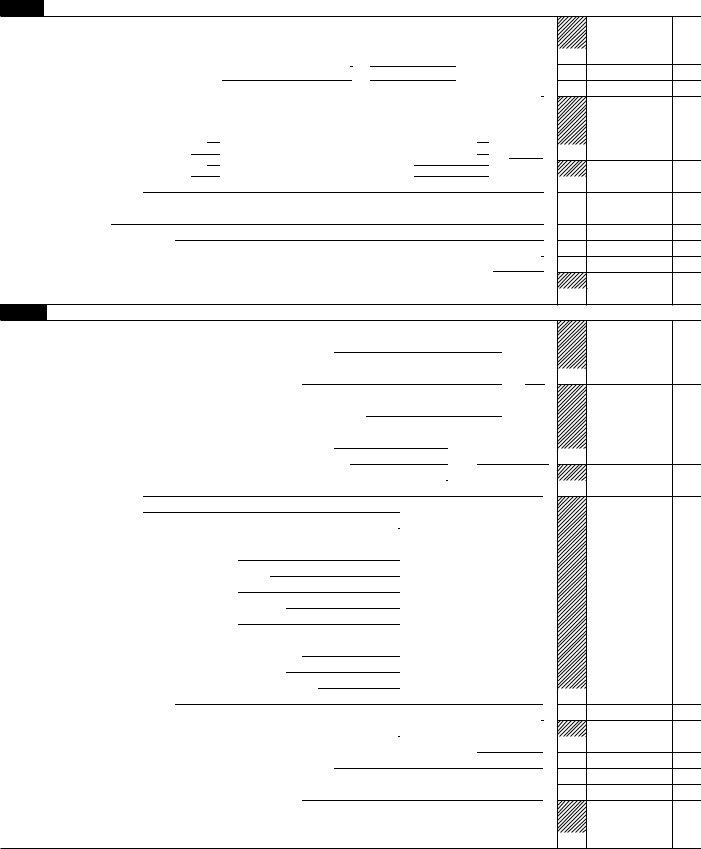

Part I Current Year Credit (Members of a controlled group, see instructions.)

1Enter the total qualified wages paid or incurred during the tax year to New York (NY) Liberty Zone business employees for work performed during 2002 who have:

a Worked for you at least 120 hours but fewer than 400 hours |

$ |

25% |

(.25) = |

b Worked for you at least 400 hours |

$ |

40% |

(.40) = |

2Add lines 1a and 1b. You must subtract this amount from your deduction for salaries and wages

3 NY Liberty Zone |

If you are a— |

|

Then enter the NY Liberty Zone business employee credits from— |

||

|

|

|

|

|

|

business |

a Shareholder |

|

Schedule |

(Form 1120S), lines 12d, 12e, or 13 |

|

employee credits |

b Partner |

|

Schedule |

(Form 1065), lines 12c, 12d, or 13 |

|

from |

c Beneficiary |

|

Schedule |

(Form 1041), line 14 |

|

entities |

d Patron |

|

Written statement from cooperative |

||

|

|||||

4Add lines 2 and 3

5NY Liberty Zone business employee credit included on line 4 from passive activities (see instructions)

6Subtract line 5 from line 4

7NY Liberty Zone business employee passive activity credit allowed for 2001 (see instructions)

8Carryback of NY Liberty Zone business employee credit from 2002 (see instructions)

9Current year credit. Add lines 6 through 8. (S corporations, partnerships, estates, trusts, cooperatives, regulated investment companies, and real estate investment trusts, see instructions.)

1a

1b

2

3

4

5

6

7

8

9

Part II Allowable Credit

10Regular tax before credits:

● Individuals. Enter the amount from Form 1040, line 40 |

||

● |

Corporations. Enter the amount from Form 1120, Schedule J, line 3; Form |

|

|

Part I, line 1; or the applicable line of your return |

|

● |

Estates and trusts. Enter the sum of the amounts from Form 1041, Schedule G, lines 1a |

|

|

and 1b, or the amount from the applicable line of your return |

|

11Alternative minimum tax:

● |

Individuals. Enter the amount from Form 6251, line 28 |

|

||

● |

Corporations. Enter the amount from Form 4626, line 15 |

|

||

● |

Estates and trusts. Enter the amount from Form 1041, Schedule I, line 39 |

|||

12 |

Add lines 10 and 11 |

|

|

|

13a |

Foreign tax credit |

13a |

|

|

b |

Credit for child and dependent care expenses (Form 2441, line 9) |

13b |

|

|

c |

Credit for the elderly or the disabled (Schedule R (Form 1040), line 20) |

13c |

|

|

d |

Education credits (Form 8863, line 18) |

13d |

|

|

e |

Rate reduction credit (Form 1040, line 47) |

13e |

|

|

f |

Child tax credit (Form 1040, line 48) |

13f |

|

|

g |

Mortgage interest credit (Form 8396, line 11) |

13g |

|

|

h |

Adoption credit (Form 8839, line 14) |

13h |

|

|

i |

District of Columbia |

13i |

|

|

j |

Possessions tax credit (Form 5735, line 17 or 27) |

13j |

|

|

k |

Credit for fuel from a nonconventional source |

13k |

|

|

l |

Qualified electric vehicle credit (Form 8834, line 20) |

13l |

|

|

m |

Add lines 13a through 13l |

|

|

|

14Net income tax. Subtract line 13m from line 12. If zero, skip lines 15 through 18 and enter

15 Net regular tax. Subtract line 13m from line 10. If zero or less, enter |

15 |

|

|

16Enter 25% (.25) of the excess, if any, of line 15 over $25,000 (see instructions)

17Subtract line 16 from line 14. If zero or less, enter

18General business credit (including any empowerment zone employment credit) (see instructions)

19Subtract line 18 from line 17. If zero or less, enter

20Credit allowed for the current year. Enter the smaller of line 9 or line 19 here and on Form 1040, line 50; Form 1120, Schedule J, line 6d; Form

10

11

12

13m

14

16

17

18

19

20

For Paperwork Reduction Act Notice, see page 3. |

Cat. No. 33946Z |

Form 8884 (2001) |

Form 8884 (2001) |

Page 2 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Purpose of Form

A New York Liberty Zone business uses Form 8884 to claim the New York Liberty Zone business employee credit. For tax years that include January 1, 2002, the credit is 40% (25% for employees who worked for you fewer than 400 hours) of the qualified wages (up to $6,000) paid or incurred during the tax year, for work performed after December 31, 2001, to each New York Liberty Zone business employee.

You may claim or elect not to claim the credit any time within

3 years from the due date of your tax return (excluding extensions) on either your original or an amended return.

The New York Liberty Zone business employee credit is treated as a part of the work opportunity credit, and New York Liberty Zone business employees are considered members of a targeted group under the work opportunity credit. However, unlike the other targeted groups, New York Liberty Zone business employees do not require certification for their wages to qualify for the credit. Also, because of the special tax liability limit that applies to the credit for these employees, use only Form 8884 to figure the credit. Do not use Form 3800, General Business Credit, or Form 5884, Work Opportunity Credit, for this credit.

For more details, see Notice

Definitions

New York Liberty Zone Business

A New York Liberty Zone business is any business that is located:

●In the New York Liberty Zone (see below) or

●In the city of New York, New York, outside the New York Liberty Zone, as a result of the physical destruction or damage of its place of business by the September 11, 2001, terrorist attack.

Exception. A business is not considered a New York Liberty Zone business for any tax year for which it employed an average of more than 200 employees on business days during the tax year. A business day is any day on which your business is open to the public or you regularly conduct business. You can use any reasonable method of calculating the average number of employees on business days during the tax year. For example, you may count employees on each business day and average the numbers, or count employees on the last day of each pay period and average those numbers. If you use different pay periods for different groups of employees, you may calculate the average number of employees in the groups separately, and then add the averages. You may count each

New York Liberty Zone

The New York Liberty Zone is the area located on or south of Canal Street, East Broadway (east of its intersection with Canal Street), or Grand Street (east of its intersection with East Broadway) in the borough of Manhattan in the city of New York, New York.

New York Liberty Zone Business Employee

A New York Liberty Zone business employee is, for any period, any employee of a New York Liberty Zone business if 80% or more of the services of the employee during the period are performed for the business:

1.In the New York Liberty Zone or

2.In the city of New York, New York, outside the New York Liberty Zone, for a New York Liberty Zone business located outside the New York Liberty Zone as a result of the physical destruction or damage of its place of business by the September 11, 2001, terrorist attack.

Limit on Number of Employees Located Outside the New York Liberty Zone

The number of employees described in 2 above that are treated as New York Liberty Zone business employees on any day is limited to the excess of:

●The number of employees of the business on September 11, 2001, in the New York Liberty Zone over

●The number of New York Liberty Zone business employees (determined without regard to employees described in 2 above) of the business on the day to which the limit is being applied.

Example 1. Elm is a New York Liberty Zone business that had two places of business in the New York Liberty Zone on September 11, 2001. One place of business remained in the New York Liberty Zone. Due to damage incurred on September 11, 2001, Elm relocated the other place of business to a location outside the New York Liberty Zone but within New York City. On September 11, 2001, Elm had 60 employees in the New York Liberty Zone. On each business day in 2002, 40 employees performed services at the place of business inside the New York Liberty Zone, and 30 employees performed services at the place of business outside the New York Liberty Zone. Elm did not exceed the

Example 2. The facts are the same as in Example 1, except that on each business day in 2002, 70 employees performed services at the place of business inside the New York Liberty Zone, and 20 employees performed services at the place of business outside the New York Liberty Zone. Elm can claim the credit on the basis of the qualified wages it paid to all 70 employees inside the New York Liberty Zone. Elm cannot claim the credit on the basis of the qualified wages it paid to any of the employees outside the New York Liberty Zone.

Members of a controlled group, see sections 52 and 1400L(a)(2)(D)(ii).

Qualified Wages

Qualified wages are wages paid or incurred by the employer during the tax year to New York Liberty Zone business employees for work performed in calendar year 2002 or 2003. The amount of qualified wages that may be taken into account for any employee is limited to $6,000 per calendar year. Wages qualifying for the credit generally have the same meaning as wages subject to the Federal Unemployment Tax Act (FUTA) (for a special rule that applies to railroad employees, see section 51(h)(1)(B)). Qualified wages for any employee must be reduced by the amount of any work supplementation payments you received under the Social Security Act.

The amount of qualified wages for any employee is zero if:

●The employee worked for you fewer than 120 hours,

●The employee is your dependent,

●The employee is related to you (see section 51(i)(1)),

●50% or less of the wages the employee received from you were for working in your trade or business, or

●You use any of the employee’s wages to figure the

Qualified wages do not include:

●Wages paid to any employee during any period for which you received payment for the employee from a federally funded

●Wages for services of replacement workers during a strike or lockout.

Form 8884 (2001) |

Page 3 |

Example. XYZ Company, a cash basis New York Liberty Zone business, had 90 employees from January 1, 2002, through June 30, 2002, the end of its fiscal year. Of those 90 employees, 89 were paid more than $6,000 for work performed in calendar year 2002. The other employee, Marie Maple, was paid $5,000 for work performed in calendar year 2002. The amount of XYZ’s qualified wages for its fiscal year beginning July 1, 2001, is $539,000 ($6,000 x 89 plus $5,000).

For its fiscal year beginning July 1, 2002, the first $1,000 of wages paid to Marie Maple for work performed in calendar year 2002 will be qualified wages. No amounts paid to the other employees for calendar year 2002 will be qualified wages. The first $6,000 of wages paid to each of the 90 employees for calendar year 2003 (during the tax year) will also be qualified wages for that tax year.

Controlled group members. The group member proportionately contributing the most qualified wages figures the group credit in Part I and skips Part II. See sections 52(a) and 1563. On separate Forms 8884, that member and every other member of the group should skip lines 1a and 1b and enter its share of the group credit on line 2. Each member then completes the rest of its separate form. Each member must attach to its Form 8884 a schedule showing how the group credit was allocated among the members. The members share the credit in the same proportion that they contributed qualified wages.

Specific Instructions

Note: If you only have a credit allocated to you from a

Lines 1a and 1b

For employees who have worked for you at least 120 hours but fewer than 400 hours, the credit rate is 25% . For employees who have worked for you at least 400 hours, the credit rate is 40% . Enter on the applicable line the total qualified wages paid (or incurred) to employees during the tax year for work performed during calendar year 2002. Multiply the wages you enter by the percentage shown.

Line 2

In general, you must reduce your deduction for salaries and wages by the amount on line 2. This is required even if you cannot take the full credit this year and must carry part of it back or forward. However, the following exceptions to this rule apply.

●You capitalized any salaries and wages on which you figured the credit. In this case, reduce your depreciable basis by the amount of the credit on those salaries and wages.

●You used the full absorption method of inventory costing, which required you to reduce your basis in inventory for the credit.

If either of the above exceptions applies, attach a statement explaining why the amount on line 2 differs from the amount by which you reduced your deduction.

Line 3

Enter the amount of credit that was allocated to you as a shareholder, partner, beneficiary, or patron of a cooperative.

Line 5

Enter the amount included on line 4 that is from a passive activity. Generally, a passive activity is a trade or business in which you did not materially participate. Rental activities are generally considered passive activities, whether or not you materially participate. For details, see Form 8582- CR, Passive Activity Credit Limitations (for individuals, trusts, and estates), or Form 8810, Corporate Passive Activity Loss and Credit Limitations (for corporations).

Line 7

Enter the passive activity credit allowed for the 2001 New York Liberty Zone business employee credit from Form

Line 8

Use only if you amend your 2001 return to carry back an unused New York Liberty Zone business employee credit from 2002.

Line 9

If line 9 is zero, skip Part II.

S corporations and partnerships. Allocate the credit among the shareholders or partners. Attach Form 8884 to the return and on Schedule

Electing large partnerships, include this credit in “ general credits.”

Estates and trusts. The credit is allocated between the estate or trust and the beneficiaries in proportion to the income allocable to each. On the dotted line next to line 9, the estate or trust should enter its part of the total credit. Label it “ 1041 Portion” and use this amount in Part II to figure the allowable credit to claim on Form 1041.

Cooperatives. Most

Regulated investment companies and real estate investment

trusts. Reduce the allowable credit to the company’s or trust’s ratable share of the credit. For details, see Regulations section

Line 16

See section 38(c)(4) for special rules that apply to married couples filing separate returns, controlled corporate groups, regulated investment companies, real estate investment trusts, and estates and trusts.

Line 18

Enter the amount of all other allowed credits for the current year included in the general business credit (GBC). If you are filing a single separate general business credit form, enter the amount from the last line of that form (line 55 of Form 6765). If you are filing Form 3800, enter the amount from line 18b of that form (plus any amount from Form 8844, line 24). If you are filing Form 8844 and another general business credit form (other than Form 3800), enter the sum of Form 8844, line 24, plus the last line of the other general business credit form (line 55 of Form 6765).

Line 20

If you cannot use part of the credit because of the tax liability limit (line 19 is smaller than line 9), carry the unused part back 1 year then forward up to 20 years. To carry back an unused credit, file an amended income tax return (Form 1040X, Form 1120X, or other amended return) for the prior tax year or an application for tentative refund (Form 1045, Application for Tentative Refund, or Form 1139, Corporation Application for Tentative Refund). If you file an application for tentative refund, it generally must be filed within 12 months after the end of the tax year in which the credit arose. Include any carryback of an excess credit on line 7 of the 2000 Form 3800 and any remaining carryforward of an excess credit on the carryforward line in Part I of the 2002 Form 8884.

Form 8884 (2001) |

Page 4 |

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

9 hr., 34 min. |

Learning about the law or the form |

47 min. |

Preparing and sending the form to the IRS |

59 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. See the instructions for the tax return with which this form is filed.