Navigating the intricacies of Health Savings Accounts (HSAs) requires a solid understanding of Form 8889, a critical document provided by the Department of the Treasury Internal Revenue Service. This form serves as the key to reporting HSA contributions, distributions, and deductions on an individual's tax return. Whether contributing to an HSA, taking distributions, or simply managing year-end tax implications, understanding the details embedded in Form 8889's three parts is essential. The form meticulously outlines everything from individual and family contributions to the potential tax implications of distributions not used for qualified medical expenses. For those with High Deductible Health Plans (HDHPs), Form 8889 becomes an indispensable tool in maximizing the benefits of HSAs, navigating contributions including those made by employers or through cafeteria plans, and avoiding penalties associated with improper use. Furthermore, it addresses the nuances of filing jointly with separate HSAs and the additional scrutiny required for individuals aged 55 or older. The form also contains sections that detail how to rectify issues of excess contributions or distributions, all while providing clear pathways for legally minimizing tax liabilities associated with these accounts. Instructions accompanying Form 8889 offer guidance, but the form itself is a powerful testament to the complexity and flexibility afforded to individuals managing their health care expenses through these tax-advantaged accounts.

| Question | Answer |

|---|---|

| Form Name | Form 8889 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | HDHP, 1040NR, f8889 instructions, distributions |

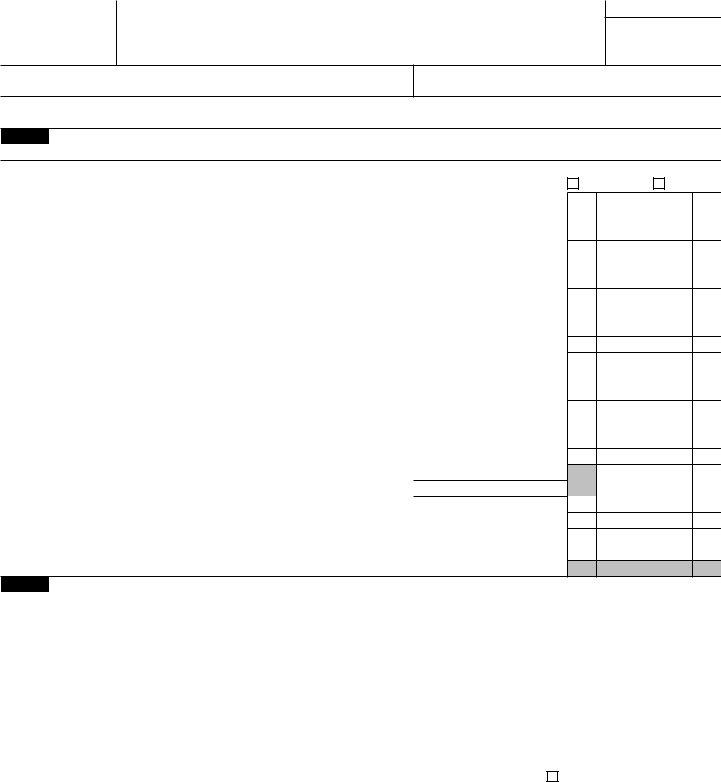

Form 8889

Department of the Treasury Internal Revenue Service

Health Savings Accounts (HSAs)

▶Information about Form 8889 and its separate instructions is available at www.irs.gov/form8889.

▶Attach to Form 1040 or Form 1040NR.

OMB No.

2012

Attachment Sequence No. 53

Name(s) shown on Form 1040 or Form 1040NR

Social security number of HSA beneficiary. If both spouses have HSAs, see instructions ▶

Before you begin: Complete Form 8853, Archer MSAs and

Part I HSA Contributions and Deduction. See the instructions before completing this part. If you are filing jointly and both you and your spouse each have separate HSAs, complete a separate Part I for each spouse.

1Check the box to indicate your coverage under a

2012 (see instructions). . . . . . . . . . . . . . . . . . . . . . . . ▶

2HSA contributions you made for 2012 (or those made on your behalf), including those made from January 1, 2013, through April 15, 2013, that were for 2012. Do not include employer contributions, contributions through a cafeteria plan, or rollovers (see instructions) . . . . .

3If you were under age 55 at the end of 2012, and on the first day of every month during 2012,

you were, or were considered, an eligible individual with the same coverage, enter $3,100 ($6,250 for family coverage). All others, see the instructions for the amount to enter . . . .

4Enter the amount you and your employer contributed to your Archer MSAs for 2012 from Form 8853, lines 1 and 2. If you or your spouse had family coverage under an HDHP at any time during 2012, also include any amount contributed to your spouse’s Archer MSAs . . . . .

5 |

Subtract line 4 from line 3. If zero or less, enter |

6Enter the amount from line 5. But if you and your spouse each have separate HSAs and had

family coverage under an HDHP at any time during 2012, see the instructions for the amount to enter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7If you were age 55 or older at the end of 2012, married, and you or your spouse had family

|

coverage under an HDHP at any time during 2012, enter your additional contribution amount |

|||

|

(see instructions) |

|||

8 |

Add lines 6 and 7 |

|||

9 |

Employer contributions made to your HSAs for 2012 . . . . |

9 |

|

|

10 |

Qualified HSA funding distributions |

10 |

|

|

11 |

Add lines 9 and 10 |

|||

12 |

Subtract line 11 from line 8. If zero or less, enter |

|||

13HSA deduction. Enter the smaller of line 2 or line 12 here and on Form 1040, line 25, or Form 1040NR, line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . .

Caution: If line 2 is more than line 13, you may have to pay an additional tax (see instructions).

2

3

4

5

6

7

8

11

12

13

Part II HSA Distributions. If you are filing jointly and both you and your spouse each have separate HSAs, complete a separate Part II for each spouse.

14a |

Total distributions you received in 2012 from all HSAs (see instructions) |

. |

. . |

14a |

|

|

b Distributions included on line 14a that you rolled over to another HSA. Also include any excess |

|

|

|

|||

|

contributions (and the earnings on those excess contributions) included on line 14a that were |

|

|

|

||

|

withdrawn by the due date of your return (see instructions) |

. |

. . |

14b |

|

|

c |

Subtract line 14b from line 14a |

. |

. . |

14c |

|

|

15 |

Unreimbursed qualified medical expenses (see instructions) |

. |

. . |

15 |

|

|

16 |

Taxable HSA distributions. Subtract line 15 from line 14c. If zero or less, enter |

|

|

|

||

|

include this amount in the total on Form 1040, line 21, or Form 1040NR, line 21. On the dotted |

|

|

|

||

|

line next to line 21, enter “HSA” and the amount |

. |

. . |

16 |

|

|

17a |

If any of the distributions included on line 16 meet any of the Exceptions to the Additional |

|

|

|

||

|

20% Tax (see instructions), check here |

. |

▶ |

|

|

|

b Additional 20% tax (see instructions). Enter 20% (.20) of the distributions included |

on line 16 |

|

|

|

||

|

that are subject to the additional 20% tax. Also include this amount in the total on Form 1040, |

|

|

|

||

|

line 60, or Form 1040NR, line 59. On the dotted line next to Form 1040, line 60, or Form |

|

|

|

||

|

1040NR, line 59, enter “HSA” and the amount |

. |

. . |

17b |

|

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 37621P |

Form 8889 (2012) |

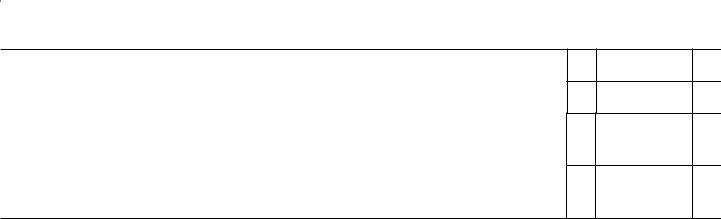

Form 8889 (2012) |

Page 2 |

|

|

|

|

Part III |

Income and Additional Tax for Failure To Maintain HDHP Coverage. See the instructions |

before |

completing this part. If you are filing jointly and both you and your spouse each have separate HSAs, complete a separate Part III for each spouse.

18

19 Qualified HSA funding distribution . . . . . . . . . . . . . . . . . . . . .

20Total income. Add lines 18 and 19. Include this amount on Form 1040, line 21, or Form

1040NR, line 21. On the dotted line next to Form 1040, line 21, or Form 1040NR, line 21, enter “HSA” and the amount . . . . . . . . . . . . . . . . . . . . . . . .

21Additional tax. Multiply line 20 by 10% (.10). Include this amount in the total on Form 1040, line 60, or Form 1040NR, line 59. On the dotted line next to Form 1040, line 60, or Form 1040NR,

line 59, enter “HDHP” and the amount . . . . . . . . . . . . . . . . . . .

18

19

20

21

Form 8889 (2012)