Working with PDF documents online is actually a piece of cake with our PDF editor. You can fill out Form 8903 here within minutes. To make our tool better and easier to use, we constantly work on new features, with our users' suggestions in mind. By taking a few basic steps, you may begin your PDF editing:

Step 1: Access the PDF in our editor by pressing the "Get Form Button" at the top of this page.

Step 2: As soon as you access the editor, you will get the form made ready to be filled in. Other than filling in different blank fields, you might also do other things with the form, particularly adding custom text, changing the initial textual content, adding images, affixing your signature to the form, and a lot more.

It is actually easy to finish the document with our detailed guide! This is what you should do:

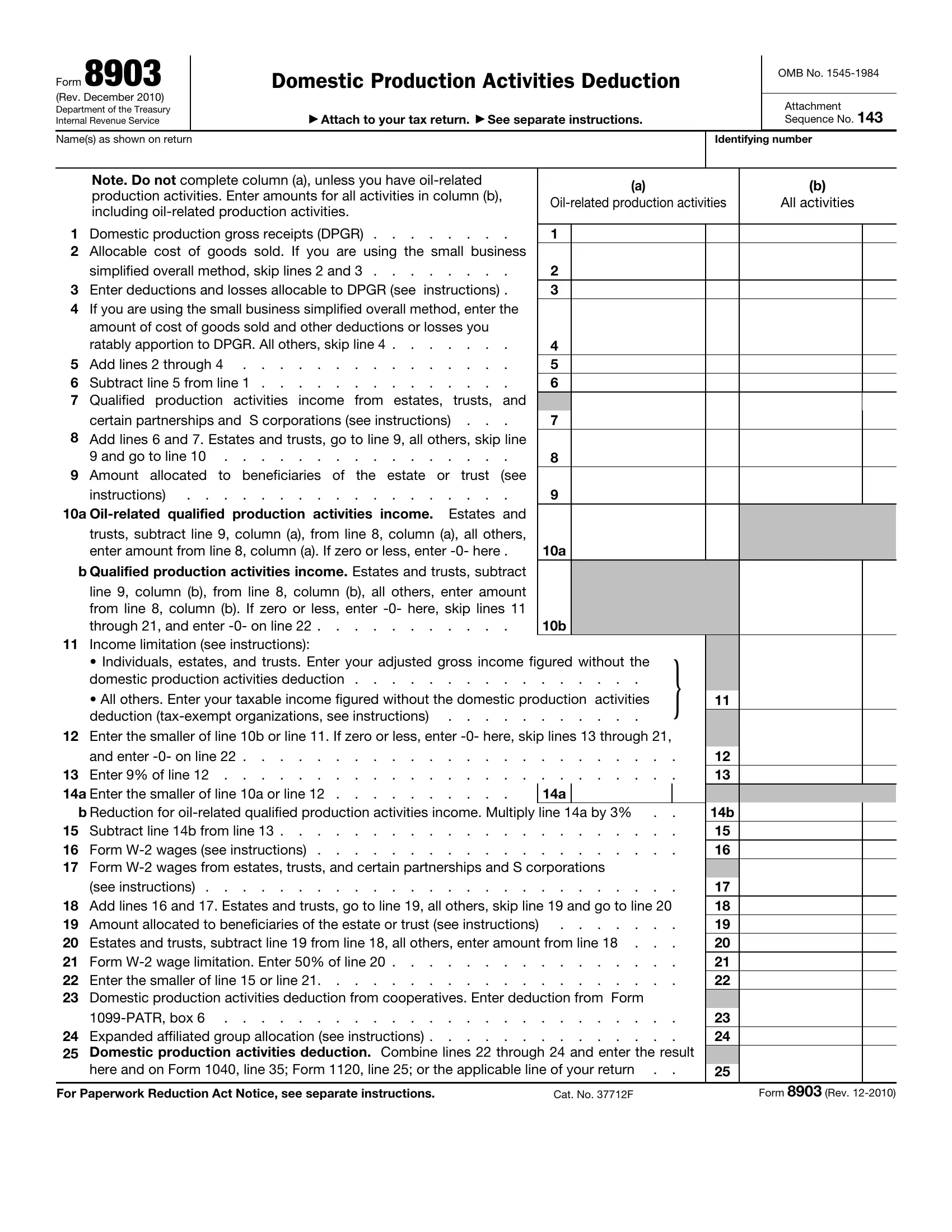

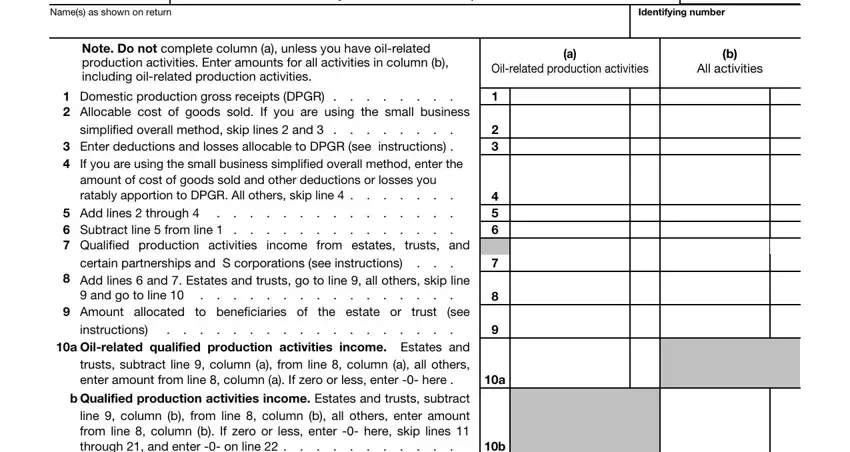

1. Start filling out your Form 8903 with a selection of essential blanks. Note all of the necessary information and make certain absolutely nothing is forgotten!

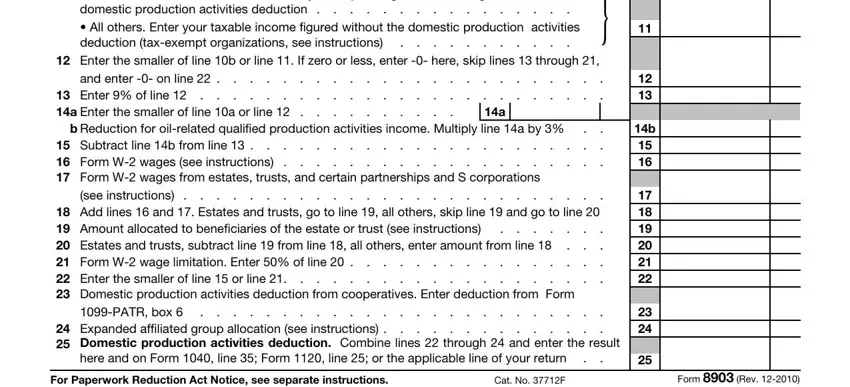

2. Once your current task is complete, take the next step – fill out all of these fields - Individuals estates and trusts, All others Enter your taxable, Enter the smaller of line b or, and enter on line, Enter of line a Enter the, b Reduction for oilrelated, Subtract line b from line, see instructions, Add lines and Estates and, PATR box, Expanded affiliated group, here and on Form line Form line, For Paperwork Reduction Act Notice, Cat No F, and Form Rev with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

As to Individuals estates and trusts and Add lines and Estates and, make certain you review things here. Both of these are definitely the key fields in the PDF.

Step 3: After going through your fields and details, hit "Done" and you are done and dusted! Sign up with us now and instantly get access to Form 8903, prepared for downloading. All adjustments you make are saved , meaning you can change the file at a later point anytime. Here at FormsPal.com, we do our utmost to make sure your information is maintained secure.