In the aftermath of Hurricane Katrina, a natural catastrophe that left untold devastation across multiple states, the Internal Revenue Service introduced Form 8914, a critical document designed to provide tax relief to those who opened their homes to individuals displaced by this unprecedented disaster. At its core, Form 8914, titled "Exemption Amount for Taxpayers Housing Individuals Displaced by Hurricane Katrina," offers a financial incentive in the form of an additional exemption amount for taxpayers who provided housing to displaced individuals in their main home for a minimum of 60 consecutive days. This provision underlines the government's commitment to supporting both the victims of the disaster and those who extended their generosity and resources to accommodate them. The form sets out clear guidelines regarding eligibility and the calculation of the exemption amount, capped at $2,000 ($1,000 if married filing separately), with adjustments based on the number of individuals housed and conditions established to ensure that only genuine cases are rewarded. Further unique stipulations include restrictions on claiming these exemptions for dependents or spouses and allowances for shared housing situations, making it essential for taxpayers to navigate the specifics of Form 8914 with great care. This initiative not only demonstrates a structured approach to post-disaster recovery but also fosters a culture of community support and resilience, amplifying the role of individual citizens in the nation's collective response to emergency situations.

| Question | Answer |

|---|---|

| Form Name | Form 8914 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | f8914 2006 irs form 8914 |

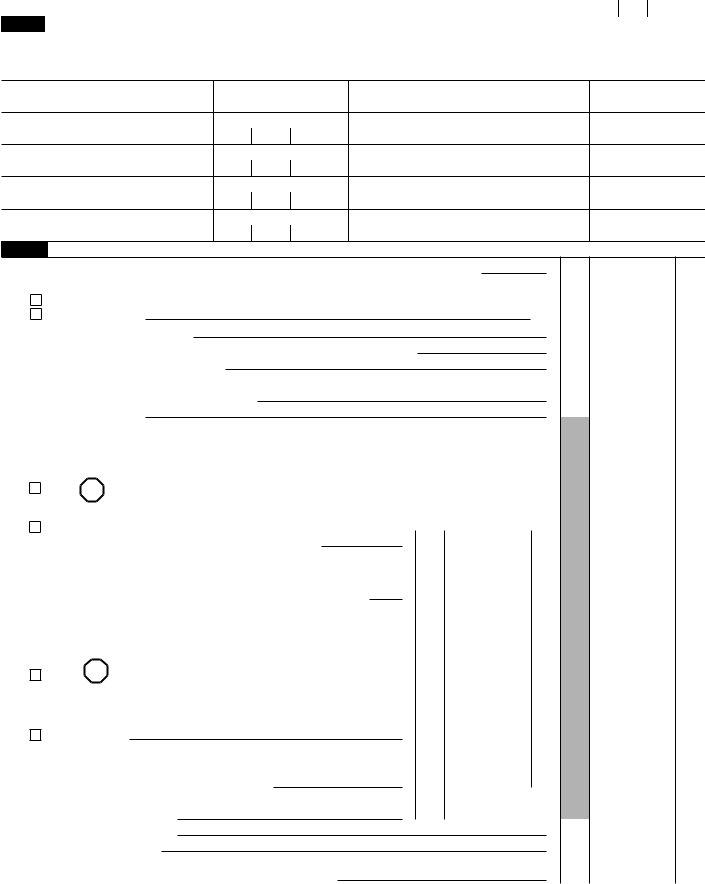

Form 8914 |

|

Exemption Amount for Taxpayers Housing |

|

OMB No. |

|

|

|

|

|

|

|

|

|

|

Department of the Treasury |

|

Individuals Displaced by Hurricane Katrina |

|

2006 |

|

▶ Attach to Form 1040, Form 1040A, or Form 1040NR |

|

Attachment |

|

Internal Revenue Service |

|

|

Sequence No. 55 |

|

|

|

|

||

Name(s) shown on your return |

|

Your social security number |

||

|

|

|

|

|

Part I Information on Individuals Displaced by Hurricane Katrina for Whom You Provided Housing in Your Main Home for at Least 60 Consecutive Days

Do not enter information for more than four individuals, for anyone included on line 6d of Form 1040 or 1040A (line 7d of Form 1040NR), or for anyone included on a Form 8914 you filed for 2005.

1(a) First and last name

(b)Social security number (see instructions)

(c)Former address in disaster area

(number and street, city or town, state, and ZIP code)

(d)Number of

consecutive days housed

in your main home

Part II Exemption Amount

2 Maximum exemption amount. Enter $2,000 ($1,000 if married filing separately) |

2 |

3Did you file Form 8914 for 2005?

|

Yes. Enter the amount from your 2005 Form 8914, line 2 |

|

|

No. Enter |

3 |

4 |

Subtract line 3 from line 2 |

4 |

5 |

Multiply $500 by the total number of individuals listed in Part I above |

5 |

6 |

Enter the smaller of line 4 or line 5 |

6 |

7 |

Multiply $3,300 by the total number of exemptions claimed on line 6d of Form 1040 or |

|

|

Form 1040A (line 7d of Form 1040NR) |

7 |

8 |

Add lines 6 and 7 |

8 |

9Is the amount on Form 1040, line 38 (Form 1040A, line 22; or Form 1040NR, line 36), more than the amount shown on line 10 below for your filing status?

|

No. STOP Enter the amount from line 8 above on Form 1040, |

|

||

|

line 42 (Form 1040A, line 26; or Form 1040NR, line 39) |

|

|

|

|

Yes. Enter on line 9 the amount from Form 1040, line 38 |

|

||

|

(Form 1040A, line 22; or Form 1040NR, line 36) |

|

9 |

|

10 Enter the amount shown below for your filing status. |

|

|

||

● |

% |

|

||

● Married filing jointly or Qualifying |

10 |

|||

● |

Married filing |

|||

|

||||

● |

Head of |

|

||

11Subtract line 10 from line 9. Is the result more than $122,500 ($61,250 if married filing separately)?

Yes. |

STOP |

Multiply $2,200 by the total number of exemptions |

|

|

|||

claimed on line 6d of Form 1040 or Form 1040A (line 7d of Form |

|||

1040NR). Subtract this amount from line 8 and enter the result on |

|||

Form 1040, line 42 (Form 1040A, line 26; or Form 1040NR, line 39) |

|||

No. Continue |

|

11 |

|

12Divide line 11 by $2,500 ($1,250 if married filing separately). If the result is not a whole number, increase it to the next higher whole

number (for example, increase 0.0004 to 1) |

12 |

13Multiply line 12 by 2% (.02) and enter the result as a decimal rounded

|

to at least three places |

13 |

. |

|

|

14 |

Multiply line 7 by line 13 |

|

|

14 |

|

15 |

Divide line 14 by 1.5 |

|

|

15 |

|

16Exemption amount. Subtract line 15 from line 8. Enter the result here and on Form 1040,

line 42; Form 1040A, line 26; or Form 1040NR, line 39 |

|

16 |

For Paperwork Reduction Act Notice, see back of form. |

Cat. No. 37724X |

Form 8914 (2006) |

Form 8914 (2006) |

Page 2 |

|

|

General Instructions

Purpose of Form

Use Form 8914 to claim your personal exemptions, exemptions for dependents, and the additional exemption amount for providing housing in your main home to one or more individuals displaced by Hurricane Katrina.

Additional Exemption Amount

You can claim an additional exemption amount of $500 for each displaced individual (defined below). You can claim an additional exemption amount only one time for a specific individual. If you claimed an additional exemption amount for that individual in 2005, you cannot claim that amount again in 2006. The maximum additional exemption amount you can claim for all displaced individuals is $2,000 ($1,000 if married filing separately). Any additional exemption amount you claimed for displaced individuals in 2005 will reduce the $2,000 maximum for 2006. If two or more taxpayers share the same main home, only one taxpayer in that main home can claim the additional exemption amount for a specific displaced individual. If married filing separately, only one spouse can claim the additional exemption amount for a specific displaced individual. In order for you to be considered to have provided housing, you must have a legal interest in the main home (that is, own or rent the home).

Displaced Individual

For you to claim the additional exemption amount, a displaced individual must meet all of the following conditions.

●The individual must have had his or her main home in the Hurricane Katrina disaster area (for this purpose, the states of Alabama, Florida, Louisiana, and Mississippi) on August 28, 2005, and he or she must have been displaced from that home. If the individual’s main home was located outside the core disaster area (defined below), that home must have been damaged by Hurricane Katrina or the individual must have been evacuated from that home because of Hurricane Katrina.

●The individual must have been provided housing in your main home free of charge for a period of at least 60 consecutive days ending in 2006. See Compensation for Housing on this page.

●He or she cannot be your spouse or dependent.

Core Disaster Area

The following areas in three states are within the core disaster area.

Alabama. The counties of Baldwin, Choctaw, Clarke, Greene, Hale, Marengo, Mobile, Pickens, Sumter, Tuscaloosa, and Washington.

Louisiana. The parishes of Acadia, Ascension, Assumption, Calcasieu, Cameron, East Baton Rouge, East Feliciana, Iberia, Iberville, Jefferson, Jefferson Davis, Lafayette, Lafourche, Livingston, Orleans, Plaquemines, Pointe Coupee, St. Bernard, St. Charles, St. Helena, St. James, St. John the Baptist, St. Martin, St. Mary, St. Tammany, Tangipahoa, Terrebonne, Vermilion, Washington, West Baton Rouge, and West Feliciana.

Mississippi. The counties of Adams, Amite, Attala, Choctaw, Claiborne, Clarke, Copiah, Covington, Forrest, Franklin, George, Greene, Hancock, Harrison, Hinds, Holmes, Humphreys, Jackson, Jasper, Jefferson, Jefferson Davis, Jones, Kemper, Lamar, Lauderdale, Lawrence, Leake, Lincoln, Lowndes, Madison, Marion, Neshoba, Newton, Noxubee, Oktibbeha, Pearl River, Perry, Pike, Rankin, Scott, Simpson, Smith, Stone, Walthall, Warren, Wayne, Wilkinson, Winston, and Yazoo.

Compensation for Housing

You cannot claim the additional exemption amount if you received rent (or any other amount) from any source for providing the housing. You are permitted to receive payments or reimbursements that do not relate to normal housing costs, including the following.

●Food, clothing, or personal items consumed or used by the displaced individual.

●Reimbursement for the cost of any long distance telephone calls made by the displaced individual.

●Reimbursement for the cost of gasoline for the displaced individual’s use of your vehicle.

However, you cannot claim the additional exemption amount if you received any reimbursement for the extra costs of heat, electricity, or water used by the displaced individual.

Specific Instructions

Line 1, Column (a)

Enter the first and last names of up to four individuals displaced by Hurricane Katrina who were provided housing in your main home for a period of at least 60 consecutive days ending in 2006. If less than 60 consecutive days, you cannot claim an additional exemption amount for this individual.

Do not enter the name of any individual you included on a Form 8914 you filed for 2005.

Line 1, Column (b)

Enter the displaced individual’s social security number (SSN) or individual taxpayer identification number (ITIN). You must provide this information in column (b) to claim an exemption amount. You may use Form

Line 1, Column (c)

Enter the street address where the displaced individual’s main home was located on August 28, 2005. That home must have been located in the Hurricane Katrina disaster area on that date. Include the number and street, city or town, state, and ZIP code.

Line 1, Column (d)

Enter the number of consecutive days the displaced individual was provided housing in your main home free of charge.

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section 6103.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For the estimated averages, see the instructions for your income tax return.

If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return.

Printed on recycled paper