When you intend to fill out Form 8938, you won't need to download any sort of software - just make use of our online tool. The tool is constantly updated by our staff, getting new awesome functions and becoming better. All it requires is a few easy steps:

Step 1: Simply press the "Get Form Button" at the top of this site to launch our pdf editing tool. This way, you will find all that is necessary to work with your document.

Step 2: With the help of our state-of-the-art PDF editing tool, you can actually accomplish more than simply fill in blanks. Edit away and make your documents appear professional with custom text added, or fine-tune the original input to excellence - all that comes with an ability to incorporate any photos and sign it off.

Filling out this document requires focus on details. Make certain every blank field is done properly.

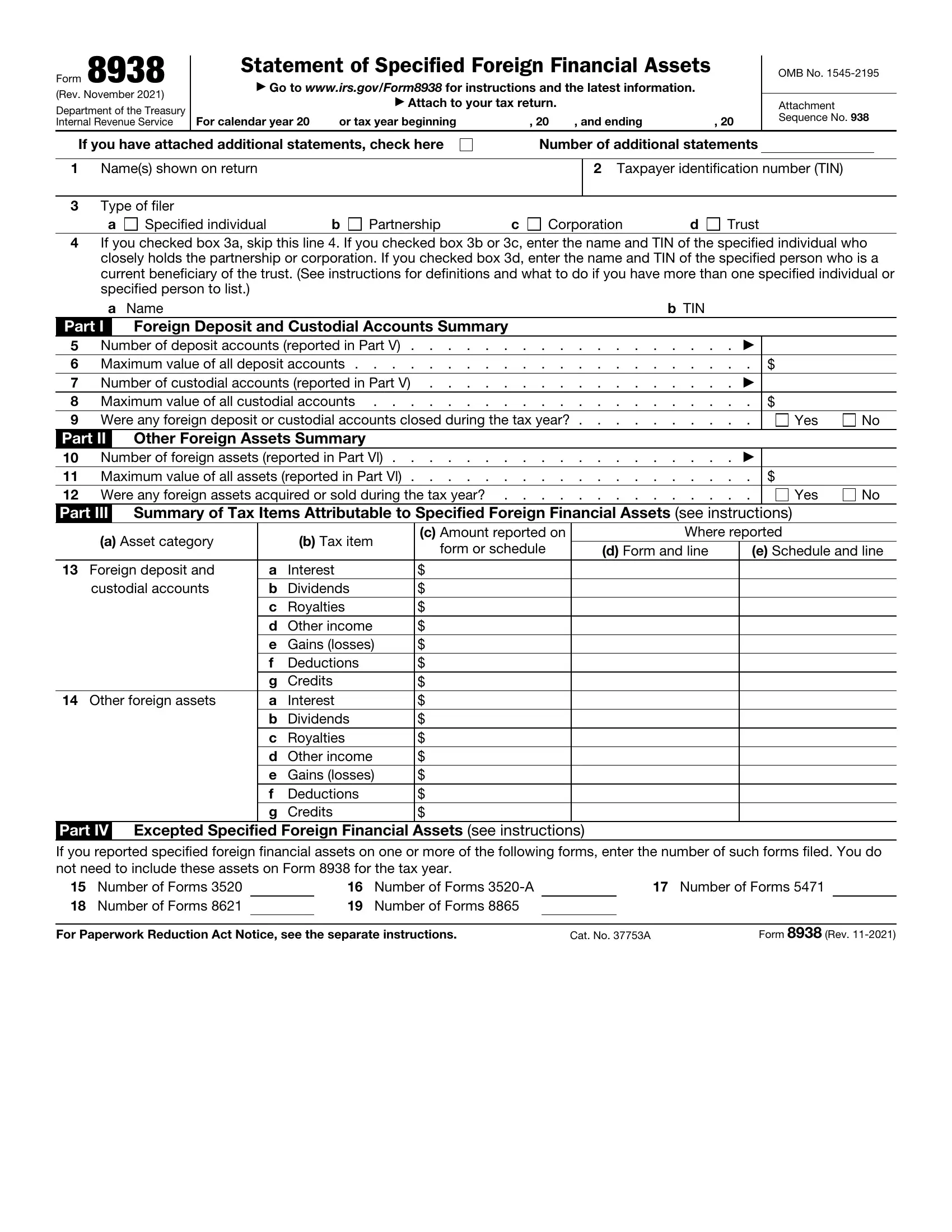

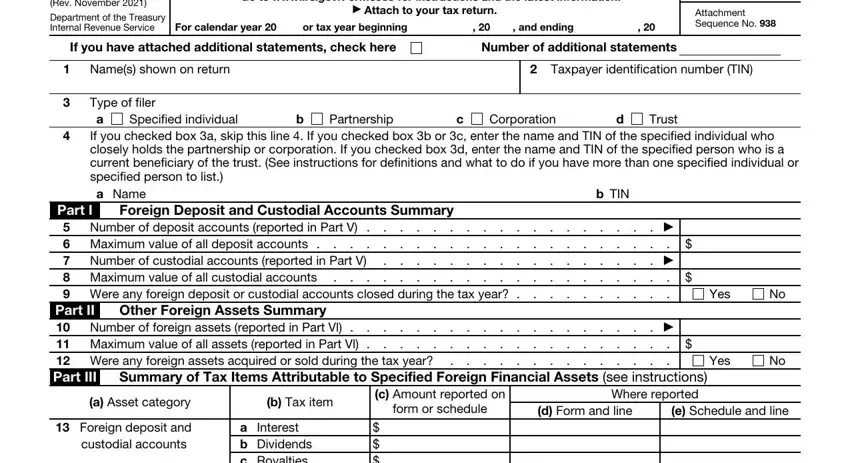

1. While completing the Form 8938, make sure to include all of the important blanks in the associated area. This will help facilitate the work, which allows your details to be processed without delay and properly.

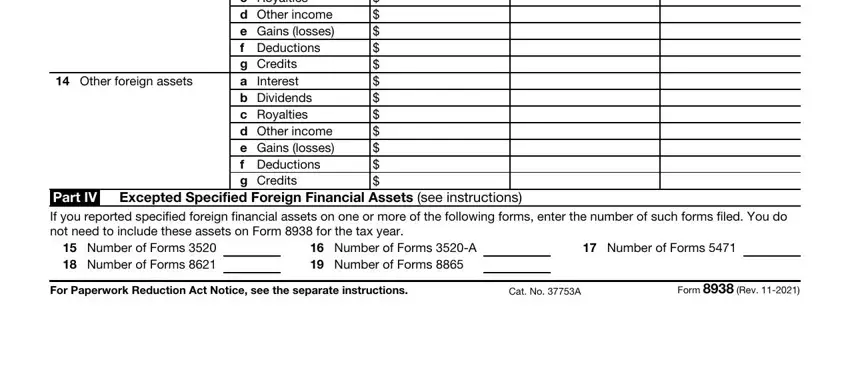

2. When the previous part is finished, you need to add the necessary details in a Interest b Dividends c Royalties, Other foreign assets Part IV If, Excepted Specified Foreign, Number of Forms Number of Forms, Number of Forms A Number of, Number of Forms, For Paperwork Reduction Act Notice, Cat No A, and Form Rev allowing you to move forward to the third stage.

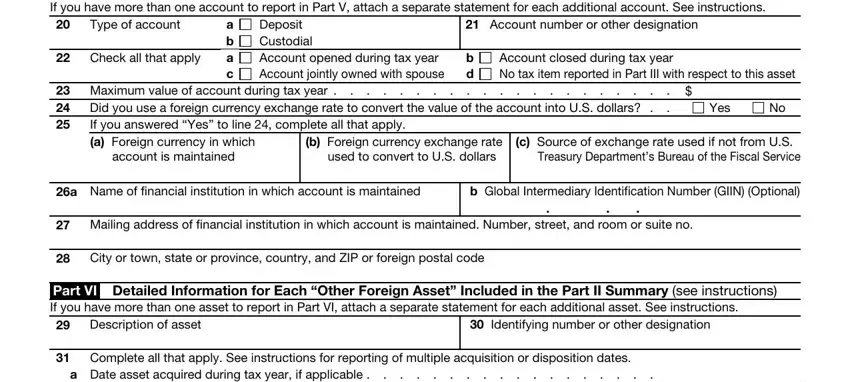

3. This 3rd section should also be fairly simple, If you have more than one account, Account number or other, Type of account, Check all that apply, a b a c, Deposit Custodial Account opened, Maximum value of account during, Did you use a foreign currency, b Foreign currency exchange rate, account is maintained, used to convert to US dollars, c Source of exchange rate used if, Yes, b d, and Account closed during tax year No - each one of these blanks needs to be filled in here.

Concerning b d and Yes, be sure that you review things in this current part. Those two are considered the most important ones in the page.

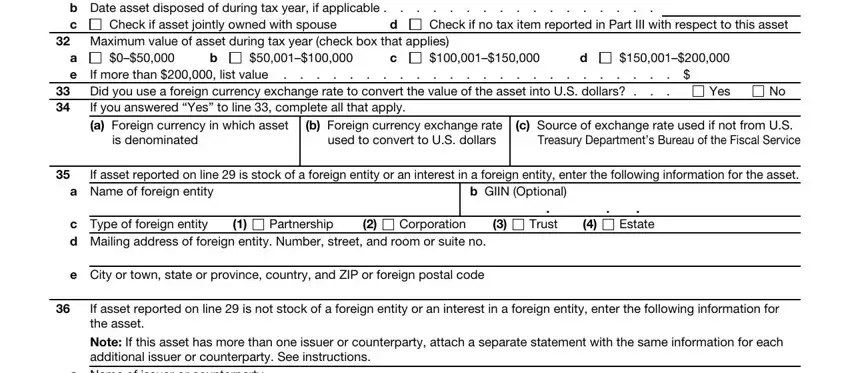

4. You're ready to proceed to this next part! Here you've got all these a Date asset acquired during tax, Check if asset jointly owned with, Check if no tax item reported in, Maximum value of asset during tax, a e If more than list value, Did you use a foreign currency, b Foreign currency exchange rate, Yes, c Source of exchange rate used if, is denominated, used to convert to US dollars, If asset reported on line is, a Name of foreign entity, b GIIN Optional, and c Type of foreign entity d Mailing form blanks to do.

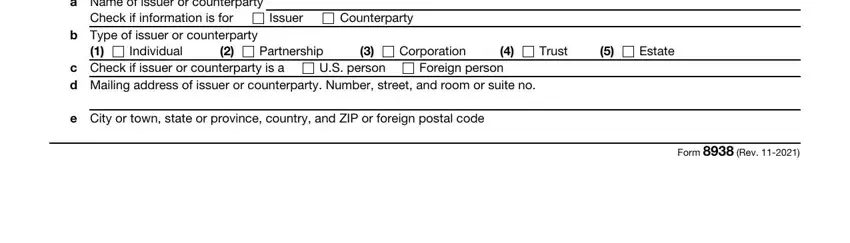

5. When you get close to the conclusion of this form, there are several more requirements that need to be satisfied. Particularly, a Name of issuer or counterparty, Check if information is for, Issuer, Counterparty, b Type of issuer or counterparty, Individual, Partnership, Corporation, Trust, Estate, c Check if issuer or counterparty, Foreign person, US person, e City or town state or province, and Form Rev should be filled out.

Step 3: Prior to finalizing this file, make sure that all blanks have been filled in the right way. When you think it is all good, click on “Done." After starting a7-day free trial account with us, it will be possible to download Form 8938 or send it through email without delay. The PDF form will also be readily available through your personal cabinet with all of your edits. We don't share any information that you use whenever completing forms at our site.